Newmont Sees Lower Production - Analyst Blog

October 17 2012 - 1:04PM

Zacks

Mining company Newmont Mining Corporation (NEM)

reported preliminary third quarter 2012 attributable gold and

copper production of 1.24 million ounces and 35 million pounds,

respectively compared with gold and copper production of 1.3

million ounces and 58 million pounds respectively reported in the

third quarter of 2011.

Lower mill availability and recoveries at Boddington, and lower

ore tons and grade mined at Tanami in Australia were the primary

reasons cited by the company for lower production.

Newmont reported attributable gold and copper sales of 1.21 million

ounces and 38 million pounds, respectively, for the quarter. The

company also announced that it expects to incur a $27 million

charge related to Hope Bay care and maintenance, and another charge

of $50 million for restructuring severance and other related costs

for the quarter.

Newmont released its second quarter 2012 financial results in

July 2012. The company’s second quarter-2012 adjusted earnings of

59 cents a share significantly lagged last year’s earnings of 90

cents, and missed the Zacks Consensus Estimate of 94 cents by a

huge margin.

Reported profits plunged 47% to $279 million, or 56 cents per

share, in the quarter, from $523 million or $1.06 per share in the

prior-year quarter. Revenues went down 6% year over year to $2.2

billion and trailed the Zacks Consensus Estimate of $2.4

billion.

Newmont’s attributable gold and copper production declined 3%

and 10%, respectively, from last year to 1.18 million ounces and 38

million pounds in the quarter. On a year-over-year basis,

attributable gold and copper sales also dropped 6% and 35%,

respectively, to 1.14 million ounces and 29 million pounds.

Based in Colorado, Newmont is one of the world's largest

producers of gold with several active mines in Nevada, Peru,

Australia/New Zealand, Indonesia and Ghana. It competes with the

likes of AngloGold Ashanti Ltd. (AU),

Barrick Gold Corporation (ABX) and Gold

Fields Ltd. (GFI).

Newmont is well-positioned to gain from the rising price of

gold. But the company’s direct mining costs are increasing due to

declining grades, increased royalties and other costs.

The stock retains a Zacks #3 Rank, indicating a short-term (1 to

3 months) Hold rating. We currently have a long-term (more than 6

months) Underperform recommendation on the shares of Newmont.

BARRICK GOLD CP (ABX): Free Stock Analysis Report

ANGLOGOLD LTD (AU): Free Stock Analysis Report

GOLD FIELDS-ADR (GFI): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

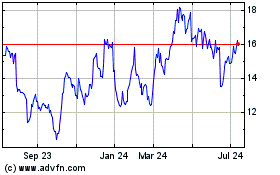

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

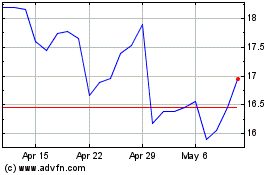

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jul 2023 to Jul 2024