0000928054FALSE00009280542024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 7, 2024

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-13270 | 90-0023731 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

5775 N. Sam Houston Parkway W., Suite 400 Houston, TX, 77086

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock, $0.0001 par value | FTK | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition |

On May 7, 2024, Flotek Industries, Inc. (the “Company”) issued a press release providing its financial results for the quarter ended March 31, 2024 and announcing that it will hold a conference call to discuss its operating results. The press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K and in Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

Item 7.01 | Regulation FD Disclosure |

On May 7, 2024, the Company provided on its website a presentation containing information relating to its current operations and financial results. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on 8-K and in Exhibit 99.2 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

d) Exhibits.

| | | | | | | | |

| | |

Exhibit Number | | Description |

| |

| 99.1 | | |

| |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FLOTEK INDUSTRIES, INC. |

Date: May 7, 2024 | /s/ Bond Clement |

| Name: | Bond Clement |

| Title: | Chief Financial Officer |

Exhibit 99.1

Flotek Announces First Quarter 2024 Results Reflecting Improved Profitability

HOUSTON, May 7, 2024 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced operational and financial results for the quarter ended March 31, 2024, highlighted by significant improvement in profitability metrics as compared to the first quarter of 2023.

Financial Summary (in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31, | | |

| | | | | 2024 | | 2023 | | % Change |

| | | | | | | | | |

| Total Revenues | | | | | $ | 40,374 | | | $ | 48,007 | | | (16)% |

| Gross Profit | | | | | $ | 8,821 | | | $ | 1,880 | | | 369% |

Adjusted Gross Profit (1) | | | | | $ | 10,075 | | | $ | 2,647 | | | 281% |

| Net Income | | | | | $ | 1,562 | | | $ | 21,343 | | | (93)% |

| Diluted Income (Loss) Per Share | | | | | $ | 0.05 | | | $ | (0.12) | | | n/a |

Adjusted EBITDA (1) | | | | | $ | 4,026 | | | $ | (3,851) | | | n/a |

First Quarter 2024 Highlights

•Reported net income of $1.6 million compared to net income of $21.3 million for the first quarter of 2023. Net income for the first quarter of 2023 benefited from $30.6 million in non-cash gains. Excluding these non-cash gains, first quarter 2024 net income improved by $10.8 million.

•Delivered significant year-over-year improvements in gross profit, adjusted gross profit(1) and adjusted EBITDA(1) of $6.9 million, $7.4 million and $7.9 million, respectively.

•Realized gross profit margin and adjusted gross profit margin(1) of 22% and 25%, respectively.

•Achieved the 3rd consecutive quarter of net income and 11th consecutive quarter of improvement in adjusted EBITDA(1) as a percentage of revenue.

•Reduced borrowings outstanding under the Asset Based Loan by 58% (or $4.4 million) compared to year-end 2023.

Full Year 2024 Profitability Outlook

As a result of the numerous cost reductions and efficiency gains implemented throughout 2023, the Company expects a substantial increase in margins compared to 2023. In 2023, our gross margin was 13% and our net income was $24.7 million. Flotek expects 2024 adjusted gross profit margin(2) to range between 18% and 22%, as compared to 2023 adjusted gross profit margin(1) of 15%. The Company expects 2024 adjusted EBITDA(2) to range between $10 million and $16 million as compared to $1.5 million in 2023(1).

Management Commentary

Chief Executive Officer Dr. Ryan Ezell commented, “Our first quarter results continue the positive financial and operational trends that began during 2022. We achieved our third consecutive quarter of net income. Adjusted EBITDA(1) during the quarter exceeded the entire year of 2023. Using the mid-point of our guidance, we expect a nearly 800% increase in annual adjusted EBITDA(2) versus 2023(1).

During the quarter we realized 19% sequential growth in our ProFrac related revenue while our data analytics segment revenues increased 18% from the fourth quarter of 2023. While our first quarter external chemistry customer sales realized 27% year over year growth, they declined sequentially, which is consistent with the first quarter in each of the last three years. We expect these revenues will show a substantial increase during the second quarter and we anticipate annual growth in external chemistry customer sales for 2024.

Our numerous financial improvements continue to validate the initiatives executed over the past 18 months aimed at building a resilient business that can sustain profitability through the volatility inherent in our industry.”

First Quarter 2024 Financial Results

•Revenue: Flotek reported total revenues of $40.4 million for the first quarter 2024, which was a decrease of $7.6 million, or 16%, compared to total revenues of $48.0 million for the first quarter 2023. The decline in revenue compared to the first quarter 2023 was the result of lower related party activity that was partially offset by a 13% increase in revenue from external customers.

Revenue from external chemistry customers during the first quarter 2024 declined by approximately $6.0 million as compared to the fourth quarter 2023 due primarily to normal seasonal declines. The Company anticipates external chemistry customer revenues to increase significantly in the second quarter 2024.

Revenue associated with the Company’s data analytics segment increased to $1.7 million, an 18% improvement as compared to the fourth quarter 2023. Revenues from data analytics totaled $2.5 million during the first quarter 2023.

•Gross Profit: The Company generated gross profit of $8.8 million during the first quarter 2024 as compared to gross profit of $1.9 million for the first quarter 2023. The improvement in first quarter 2024 gross profit was the result of successful initiatives to drive cost improvements with respect to freight, logistics and materials, and revenue attributable to the estimated annual minimum chemistry purchase requirements contained in the ProFrac supply agreement. The measurement period during 2023 for annual minimum chemistry purchase requirements was June 1, 2023 through December 31, 2023.

•Adjusted Gross Profit (Non-GAAP)(1): Flotek generated adjusted gross profit of $10.1 million during the first quarter 2024 compared to adjusted gross profit of $2.6 million for the first quarter 2023. Adjusted gross profit excludes non-cash items, primarily amortization of contract assets.

•Selling, General and Administrative (“SG&A”) Expense: SG&A expense totaled $6.1 million for the first quarter 2024 compared to $6.5 million for the first quarter 2023. The improvement was the result of lower personnel costs and professional fees during the 2024 period.

•Net Income and EPS: Flotek reported net income of $1.6 million, or $0.05 per diluted share, for the first quarter 2024. This compares to net income of $21.3 million, or $(0.12) per diluted share, for the first quarter 2023. Net income for the first quarter 2023 benefited from a $26.1 million non-cash gain related to the fair value adjustment of the Company’s convertible notes, as well as a $4.5 million gain from the partial forgiveness of the Company’s PPP loan.

•Adjusted EBITDA (Non-GAAP)(1): Adjusted EBITDA was $4.0 million in the first quarter 2024 as compared to negative $3.9 million in the first quarter 2023.

(1)A non-GAAP financial measure. See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures.

(2)A non-GAAP financial measure. See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures. We are unable to reconcile this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure, including, among other items, the future amortization of our contract assets, certain stock-based compensation costs and the impact of the revaluation of certain liabilities, which is based upon our future stock price. These items do not impact the non-GAAP financial measure.

Conference Call Details

Flotek will host a conference call on May 8, 2024, at 9:00 a.m. CT (10:00 a.m. ET) to discuss its first quarter 2024 results. Participants may access the call through Flotek’s website at www.flotekind.com under “News” within the Investor Relations section or by telephone toll free at 1-800-836-8184 (international toll: 1-646-357-8785) approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website.

An updated corporate presentation that will be referenced on the call will be posted to the Investor Relations section of Flotek’s website at www.flotekind.com prior to the start of the earnings conference call.

About Flotek Industries, Inc.

Flotek Industries, Inc. is an advanced technology-driven, green chemical and data analytics company providing unique and innovative completion solutions that have a proven, positive impact on sustainability and reducing the overall environmental impact of energy on air, land, water and people. Flotek has an intellectual property portfolio of over 170 patents and a global presence in more than 59 countries throughout North America, Latin America, the Middle East and North Africa. Flotek has established collaborative partnerships focused on sustainable and optimized chemistry and data solutions which improve well performance and allow its customers to generate higher returns on invested capital.

Flotek is based in Houston, Texas and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK”. For additional information, please visit www.flotekind.com.

Forward-Looking Statements

Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the “Risk Factors” section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this press release.

Investor contact:

Mike Critelli

Director of Finance

E: ir@flotekind.com

P: (713) 726-5322

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 5,219 | | | $ | 5,851 | |

| Restricted cash | 100 | | | 102 | |

Accounts receivable, net of allowance for credit losses of $374 and $745 at March 31, 2024 and December 31, 2023, respectively | 10,718 | | | 13,687 | |

Accounts receivable, related party, net of allowance for credit losses of $0 at each March 31, 2024 and December 31, 2023 | 38,655 | | | 34,569 | |

| Inventories, net | 13,871 | | | 12,838 | |

| | | |

| | | |

| Other current assets | 2,686 | | | 3,564 | |

| Current contract asset | 7,019 | | | 5,836 | |

| Total current assets | 78,268 | | | 76,447 | |

| Long-term contract assets | 66,369 | | | 68,820 | |

| Property and equipment, net | 5,061 | | | 5,129 | |

| Operating lease right-of-use assets | 4,336 | | | 5,030 | |

| Deferred tax assets, net | 91 | | | 300 | |

| Other long-term assets | 1,725 | | | 1,787 | |

| TOTAL ASSETS | $ | 155,850 | | | $ | 157,513 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 35,952 | | | $ | 31,705 | |

| Accrued liabilities | 3,365 | | | 5,890 | |

| Income taxes payable | 78 | | | 45 | |

| | | |

| Current portion of operating lease liabilities | 2,083 | | | 2,449 | |

| Current portion of finance lease liabilities | 13 | | | 22 | |

| Asset-based loan | 3,111 | | | 7,492 | |

| Current portion of long-term debt | 179 | | | 179 | |

| | | |

| | | |

| Total current liabilities | 44,781 | | | 47,782 | |

| Deferred revenue, long-term | 35 | | | 35 | |

| Long-term operating lease liabilities | 7,121 | | | 7,676 | |

| | | |

| Long-term debt | 15 | | | 60 | |

| | | |

| TOTAL LIABILITIES | 51,952 | | | 55,553 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding | — | | | — | |

| Common stock, $0.0001 par value, 240,000,000 shares authorized; 30,772,837 shares issued and 29,661,130 shares outstanding at March 31, 2024; 30,772,837 shares issued and 29,664,130 shares outstanding at December 31, 2023 | 3 | | | 3 | |

| Additional paid-in capital | 463,484 | | | 463,140 | |

| Accumulated other comprehensive income | 169 | | | 127 | |

| Accumulated deficit | (325,244) | | | (326,806) | |

| Treasury stock, at cost; 1,111,707 and 1,108,707 shares at March 31, 2024 and December 31, 2023, respectively | (34,514) | | | (34,504) | |

| Total stockholders’ equity | 103,898 | | | 101,960 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 155,850 | | | $ | 157,513 | |

FLOTEK INDUSTRIES, INC.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, | | |

| | | | | | 2024 | | 2023 | | | | |

| Revenue: | | | | | | | | | | | |

| Revenue from external customers | | | | | $ | 13,180 | | | $ | 11,652 | | | | | |

| Revenue from related party | | | | | 27,194 | | | 36,355 | | | | | |

| Total revenues | | | | | 40,374 | | | 48,007 | | | | | |

| Cost of goods sold | | | | | 31,553 | | | 46,127 | | | | | |

| Gross profit | | | | | 8,821 | | | 1,880 | | | | | |

| Operating costs and expenses: | | | | | | | | | | | |

| Selling, general, and administrative | | | | | 6,084 | | | 6,451 | | | | | |

| Depreciation | | | | | 220 | | | 176 | | | | | |

| Research and development | | | | | 406 | | | 614 | | | | | |

| Severance costs | | | | | 3 | | | 2,223 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Gain in fair value of Contract Consideration Convertible Notes Payable | | | | | — | | | (26,095) | | | | | |

| | | | | | | | | | | |

| Total operating costs and expenses | | | | | 6,713 | | | (16,631) | | | | | |

| Income from operations | | | | | 2,108 | | | 18,511 | | | | | |

| Other income (expense): | | | | | | | | | | | |

| Paycheck protection plan loan forgiveness | | | | | — | | | 4,522 | | | | | |

| Interest expense | | | | | (278) | | | (1,672) | | | | | |

| Other expense, net | | | | | (26) | | | (9) | | | | | |

| Total other income (expense), net | | | | | (304) | | | 2,841 | | | | | |

| Income before income taxes | | | | | 1,804 | | | 21,352 | | | | | |

| Income tax expense | | | | | (242) | | | (9) | | | | | |

| Net income | | | | | $ | 1,562 | | | $ | 21,343 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income (loss) per common share: | | | | | | | | | | |

| Basic | | | | | $ | 0.05 | | | $ | 1.30 | | | | | |

| Diluted | | | | | $ | 0.05 | | | $ | (0.12) | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | |

| Weighted average common shares used in computing basic income (loss) per common share | | | | | 29,431 | | | 16,468 | | | | | |

| Weighted average common shares used in computing diluted income (loss) per common share | | | | | 30,316 | | | 26,462 | | | | | |

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 1,562 | | | $ | 21,343 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Change in fair value of contingent consideration | (26) | | | (359) | |

| Change in fair value of Contract Consideration Convertible Notes Payable | — | | | (26,095) | |

| Amortization of convertible note issuance costs | — | | | 83 | |

| Payment-in-kind interest expense | — | | | 1,571 | |

| Amortization of contract assets | 1,267 | | | 1,251 | |

| Depreciation and amortization | 220 | | | 176 | |

| Amortization of asset-based loan origination costs | 85 | | | — | |

| Provision for credit losses, net of recoveries | 32 | | | 23 | |

| Provision for excess and obsolete inventory | 285 | | | 258 | |

| | | |

| | | |

| Non-cash lease expense | 694 | | | 977 | |

| Stock compensation expense | 311 | | | (1,112) | |

| Deferred income tax expense (benefit) | 209 | | | (6) | |

| Paycheck protection plan loan forgiveness | — | | | (4,522) | |

| Changes in current assets and liabilities: | | | |

| Accounts receivable | 2,937 | | | 3,504 | |

| Accounts receivable, related party | (4,086) | | | (3,546) | |

| Inventories | (1,318) | | | (441) | |

| | | |

| Other assets | 856 | | | (470) | |

| | | |

| Accounts payable | 4,246 | | | 8,554 | |

| Accrued liabilities | (2,499) | | | 1,236 | |

| Operating lease liabilities | (921) | | | (1,190) | |

| Income taxes payable | 33 | | | (87) | |

| Interest payable | — | | | (8) | |

| Net cash provided by operating activities | 3,887 | | | 1,140 | |

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(continued)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from investing activities: | | | |

| Capital expenditures | (152) | | | (157) | |

| | | |

| Net cash used in investing activities | (152) | | | (157) | |

| Cash flows from financing activities: | | | |

| Payment for forfeited stock options | — | | | (617) | |

| Payments on long term debt | (45) | | | (15) | |

| Proceeds from asset-based loan | 38,800 | | | — | |

| Payments on asset-based loan | (43,181) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payments to tax authorities for shares withheld from employees | (9) | | | (200) | |

| Proceeds from issuance of stock | 33 | | | 20 | |

| Payments for finance leases | (9) | | | (6) | |

| Net cash used in financing activities | (4,411) | | | (818) | |

| Effect of changes in exchange rates on cash and cash equivalents | 42 | | | (21) | |

| Net change in cash and cash equivalents and restricted cash | (634) | | | 144 | |

| Cash and cash equivalents at the beginning of period | 5,851 | | | 12,290 | |

| Restricted cash at the beginning of period | 102 | | | 100 | |

| Cash and cash equivalents and restricted cash at beginning of period | 5,953 | | | 12,390 | |

| Cash and cash equivalents at end of period | 5,219 | | | 12,433 | |

| Restricted cash at the end of period | 100 | | | 101 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 5,319 | | | $ | 12,534 | |

FLOTEK INDUSTRIES, INC.

Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, | | Twelve Months Ended December 31, | |

| | | | | | 2024 | | 2023 | | 2023 | | | |

| | | | | | | | | | | | |

| Gross profit | | | | | $ | 8,821 | | | $ | 1,880 | | | $ | 24,263 | | | | |

| Stock compensation expense | | | | | 4 | | | (140) | | | (132) | | | | |

| Severance and retirement | | | | | 9 | | | 15 | | | 29 | | | | |

| Contingent liability revaluation | | | | | (26) | | | (359) | | | (527) | | | | |

| | | | | | | | | | | | |

| Amortization of contract assets | | | | | 1,267 | | | 1,251 | | | 5,033 | | | | |

Adjusted Gross profit (Non-GAAP) (1) | | | | | $ | 10,075 | | | $ | 2,647 | | | $ | 28,666 | | | | |

| | | | | | | | | | | | |

| Net income | | | | | $ | 1,562 | | | $ | 21,343 | | | $ | 24,713 | | | | |

| Interest expense | | | | | 278 | | | 1,672 | | | 2,857 | | | | |

| Income tax expense | | | | | 242 | | | 9 | | | 149 | | | | |

| Depreciation and amortization | | | | | 220 | | | 176 | | | 734 | | | | |

EBITDA (Non-GAAP) (1) | | | | | $ | 2,302 | | | $ | 23,200 | | | $ | 28,453 | | | | |

| Stock compensation expense | | | | | 311 | | | (1,112) | | | (268) | | | | |

| Severance and retirement | | | | | 12 | | | 2,238 | | | (17) | | | | |

| Contingent liability revaluation | | | | | (26) | | | (359) | | | (527) | | | | |

| | | | | | | | | | | | |

| Gain on disposal of assets | | | | | — | | | — | | | (38) | | | | |

| | | | | | | | | | | | |

| PPP loan forgiveness | | | | | — | | | (4,522) | | | (4,522) | | | | |

| Contract Consideration Convertible Notes Payable revaluation adjustment | | | | | — | | | (26,095) | | | (29,969) | | | | |

| Amortization of contract assets | | | | | 1,267 | | | 1,251 | | | 5,033 | | | | |

| Non-Recurring professional fees | | | | | 160 | | | 1,548 | | | 3,343 | | | | |

Adjusted EBITDA (Non-GAAP) (1) | | | | | $ | 4,026 | | | $ | (3,851) | | | $ | 1,488 | | | | |

(1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the three months ended March 31, 2024, 2023, and 12 months ended December 31, 2023, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items.

Corporate Update May 2024

Forward-Looking Statements Certain statements set forth in this presentation constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this presentation. Although forward-looking statements in this presentation reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the "Risk Factors" section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this presentation. This presentation includes certain non-GAAP measures. Please refer to the reconciliations provided in the earnings press release and the appendix in this presentation for the nearest GAAP measure. // 2

Compelling Investment Opportunity // 3 Market leading Oil & Gas prescriptive chemistry solutions • Sustained growth in US and international O&G completion chemistry • Industry leading technology improving BOE uplift by +26% • Long-term contracted chemistry volumes mitigates impact of industry volatility Market disrupting real-time measurement technology • Data analytics segment expected to grow associated revenues over 50% in 2024 • Release of next generation analyzer provides scale and new market opportunities Leadership team with deep industry expertise to execute rapid growth strategy RETURN TO PROFITABILITY UNDERSCORES TURNAROUND EXECUTION

Company Overview // 4 Headquarters Field Office FTK Global Presence Founded: 1985 Employees: 143 Corporate Headquarters: Houston Countries with Clients: 59 Patents: >170 1Q 2024 Results: – Gross Profit Margin: 22% – Net Income ($MM): $1.6 – Adj. EBITDA* ($MM): $4.0 – Debt to Adj. EBITDA*: 0.3x * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the nearest GAAP measure.

A Purpose-Driven Company // 5 Our completion solutions have a positive impact on sustainability and reducing the overall environmental impact of energy on air, land, water and people Who We Are An advanced technology-driven, green chemical and data analytics company providing unique and innovative completion solutions Our Vision We strive to be the collaborative partner of choice for solutions that reduce the environmental impact of energy on air, water, land and people Value Proposition We collaborate and deliver sustainable, optimized chemistry and data solutions that maximize our customers’ value

Our Strategic Priorities // 6 Industry-Leading Innovation Track record of delivering fit-for-purpose optimized chemistry and data solutions Expand Global Footprint Sustainable growth in international revenues Environmental Leadership Focus on reducing impact of energy on air, land, water, and people Sustainable Revenue Growth 10-year contracted chemistry volumes with significant market expansion opportunities Enhanced Profitability Generated a $7.9 million improvement in Adj. EBITDA* 1Q 2024 over 1Q 2023 Strong Balance Sheet Debt to Adj. EBITDA* 0.3x * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the nearest GAAP measure.

1Q 2024 Highlights: Improvement in Performance // 7 Poised to deliver sustained growth and further market share gains through chemistry and emerging data analytics upstream market • Delivered year-over-year growth: • Net income*: $10.8 million • Gross profit: $6.9 million • Adj. gross profit**: $7.4 million • Adj. EBITDA**: $7.9 million • Realized gross profit margin and adj. gross profit margin** of 22% and 25%, respectively • 11th consecutive quarter of improvement in adj. EBITDA** as a percentage of revenue • Initiated full year 2024 guidance of adj. gross profit margin*** of 18% to 22% and adj. EBITDA*** of $10 million to $16 million • Borrowings under Asset Based Loan declined 58% compared to year-end 2023 Improved profitability with lower industry fleet counts * 1Q 2023 net income excludes $30.6 million in non-cash gains related to the fair value adjustment of the Company's convertible notes and the partial forgiveness of the Company's PPP loan ** Adjusted gross profit and adjusted EBITDA are non-GAAP measures. See the Appendix in this presentation for a reconciliation to the nearest GAAP measure *** We are unable to reconcile this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure

$81.6 $120.9 $38.9 $49.0 $59.0 $4.3 $5.5 $8.1 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 2021 2022 2023 ProFrac Chemistry External Chemistry Data Analytics Strong Revenue Performance // 8 Annual Segmented Total Revenue ($MM) * ProFrac Chemistry reflects ‘Chemistry Only’ revenues TRANSFORMATIVE YEAR WITH SIGNIFICANT GROWTH IN ALL PROFITABILITY METRICS $9.2 $11.7 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 1Q23 1Q24 External Chemistry Revenue Quarter 1 Comparison ($MM) External Chemistry

External Chemistry: Operator Seasonality // 9 The last three years have experienced seasonality impacts in 1Q: • Operator capital budgets have seen slow starts in the first quarter in each of the last 3 years • 27% improvement in Q1 2024 sales compared Q1 2023 with 18 fewer fleets • Expect a substantial revenue improvement in Q2 2024 $9.3 $12.1 $13.2 $14.1 $9.2 $15.5 $16.3 $18.0 $11.7 268 279 286 266 273 275 258 267 255 235 240 245 250 255 260 265 270 275 280 285 290 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 U S Fr ac F le et s* Ex te rn al C h em is tr y Sa le s External Chemistry Sales by Quarter External Chemistry US Frac Fleets ($MM) * US Average Frac Fleets according to The American Oil & Gas Reporter 1Q2 1Q23

Delivering Rapid Improvement in Gross Profit // 10 Quarterly Consolidated Gross Profit (Loss) ($2,500) $0 $2,500 $5,000 $7,500 $10,000 1Q22 1Q23 1Q24 • 1Q 2024 gross profit was positive for the fifth consecutive quarter despite impacts of 1Q seasonality • Delivered a $6.9 million increase in 1Q 2024 gross profit compared to 1Q 2023 • Long-term contracted chemistry volumes protects against lower frac fleet activity CONSISTENT GROWTH IN PROFITABILITY METRICS ($000’s)

Solid Financial Momentum Continues // 11 Quarterly Adjusted EBITDA*/Revenue * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the nearest GAAP measure ** Adjusted EBITDA is a non-GAAP metric. We are unable to reconcile this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure -80% -70% -60% -50% -40% -30% -20% -10% 0% 10% 20% 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 • 1Q 2024 adj. EBITDA* increased $7.9 million over 1Q 2023 • 1Q 2024 was the 11th consecutive quarter of improvement • Mid-point of 2024 guidance implies ~800% increase in annual adj. EBITDA** TREND OF PROFITABILITY IMPROVEMENT REACHES 11 CONSECUTIVE QUARTERS

• Global presence in 59 countries • Establishing collaborative partnerships with E&P operators and oil field service providers • Extensive experience with proven solutions in over 20,000 completed wells worldwide • Fit-for-purpose optimized chemistry and data solutions allow customers to maximize the value of their business • High margin data analytics segment driving revenue growth and increased profitability • Increasing market share across both segments Complementary Segments Drive Growth // 12 Sustainable chemistry solutions to maximize customer’s value chain while minimizing their environmental impact Transforming business through real-time data, monitoring and visualization across the energy value chain utilizing proprietary technologies Chemistry Technologies Data Analytics CHEMISTRY AS A COMMON VALUE CREATION PLATFORM

0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 0 5 10 15 20 C u m u la ti v e P ro d u c ti o n ( B O E ) Months Permian Basin Average Cumulative BOE Flotek PCM Non-Flotek 25 +26% Uplift Chemistry Technologies: Competitive Advantage // 13 • Prescriptive Chemistry Management (PCM)TM • Proprietary energy chemistry solutions • Dedicated chemistry management team • Customized solutions to each well’s geology • Data on over 20,000 wells to enable advanced AI driven analytics for maximized customer return • CnFTM is our proprietary reservoir technology utilized by PCM services • Leveraging over 170 active patents to design the best chemistry for each well • Strong well performance with 75,000 BOE uplift versus competition * Data derived from 2019-2023 Enverus Prism Platform (1,878 wells) ** Similar Results from all basins, example is highlighting the most productive basin in the U.S. (Permian) $- $3.0 $6.0 $9.0 $12.0 $15.0 $18.0 2022 2023 CnFTM Revenue Performance 75 MBOE } * DELIVERING THE BEST UPLIFT PERFORMANCE IN INDUSTRY 75% growth R e v e n u e s ($ i n M M ) $9.3 $16.3

Chemistry Technologies: New Markets // 14 DIVERSIFIES CUSTOMER BASE AND PROVIDES FUTURE GROWTH OPPORTUNITIES Industrial Geothermal Agricultural Solar Hydrogen As smart systems develop, so will the demand for green chemistry solutions Positioned to capitalize on proprietary patents, technology advancements and collaborative partnerships with customers

Data Analytics: Industry Applications Upstream • Realtime product measurement improves accuracy of payments to royalty owners and operators • Continuous BTU monitoring to facilitate field gas utilization in powering rigs and frac fleets • Flare monitoring and methane detection Midstream • Gas processing plant control and optimization • Pipeline batch detection to optimize pipeline transmix processes • Vapor pressure controls to achieve product specifications • Emerging market in carbon capture Downstream • Realtime measurement to optimize distillation tower efficiency • Crude feedstock blending • Chemical property and quality measurement in pipelines and terminals • Refined product specification measurement to optimize mix of products UTILIZING TECHNOLOGIES FOR EXPANSION INTO NEW MARKETS // 15

Data Analytics: “Measure More” Strategy // 16 Introduction of the new generation Cal-X JP3 Analyzer • Expected to unlock an estimated $700 million oil & gas upstream TAM* • 12x improvement in manufacturing/delivery time • Provides a 60% Data as a Service sales opportunity Expansion of product portfolio • Flare gas, H2, N2, CO2, H2S, Diesel and Jet Fuel hotspots • Raman analyzer unlocks the downstream and carbon capture markets that require hydrogen (H2) • New Two-channel Verax upgrades revenue opportunity on single point measurement and allows for validation Pictured above: The proprietary Cal-X spectrometer installed on an Eagleford wellsite DIVERSIFYING REAL-TIME DATA MONITORING ACROSS CHEMISTRY LANDSCAPE * Total Addressable Market

EPA Regulation: • Requires hourly Net Heating Value measurement of the gas stream for 14 consecutive operating days. • Effective May 7th 2024 JP3 Technology: • Provides continuous and autonomous monitoring • JP3 Flare Analyzer allows for site to site mobility • Provides full service: sampling, reporting, and power • JP3 currently on customer field trials and seeking EPA regulatory approval Data Analytics: New Flare Market (OOOOb/c) // 17 Continuous and Autonomous Flare Monitoring JP3 installed on flare with customer trial

Complimentary Segments: Outlook // 18 Chemistry • Prescriptive chemistry management (PCM)TM and unique patented products unlocks maximum production uplift • Pursuing strategic opportunities within production and pipeline chemistry markets leveraging real-time measurement analytics • Contracted long-term volume agreements establish economy of scale and market pricing power Data Analytics • New JP3 analyzer expected to open a $700 million O&G upstream TAM* • “Measure More” strategy to improve product offering and market application of our units • Further integration of data analytics and chemistry segments will provide an autonomous solution to customers * Total Addressable Market THE NEXT PHASE OF TRANSFORMATION

Summary: Compelling Investment Opportunity // 19 Market leading Oil & Gas prescriptive chemistry solutions • Sustained growth in US and international O&G completion chemistry • Industry leading technology improving BOE uplift by +26% • Long-term contracted chemistry volumes mitigates impact of industry volatility Market disrupting real-time measurement technology • Data analytics segment expected to grow associated revenues over 50% in 2024 • Release of next generation analyzer provides scale and new market opportunities Leadership team with deep industry expertise to execute rapid growth strategy RETURN TO PROFITABILITY UNDERSCORES TURNAROUND EXECUTION

Appendix

Recent Financials Unaudited Condensed Consolidated Statement of Operations (in thousands, except share data) // 21

Unaudited Condensed Consolidated Balance Sheets (in thousands, except share data) // 22

Unaudited Condensed Consolidated Statements of Cash Flows (in thousands) // 23

Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings (in thousands)(1) // 24 (1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the three months ended March 31, 2024 and 2023 and 12 months ended December 31,2023, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items.

• JP3 field gas monitoring system allows frac fleets and drilling rigs to safely run on field gas displacing more expensive and higher carbon footprint diesel • Provides meaningful cost savings compared to gas chromatograph • A three-pad customer case study July - August 2023: • Achieved 70% field gas substitution rate • Eliminated 1.2 mm gallons of diesel usage • Realized 100% uptime Data Analytics: Upstream Field Gas Usage // 25 Delivered 70% Reduction in Diesel and CNG usage Frac Trailer Mounted System

Upstream Custody Transfer challenges: • Readings only taken every 3 to 6 weeks with gas chromatography (gc) • Revenue degradation on inconsistent readings impacted by temperature, timing, and conditions • Requires onsite personnel JP3 technology changes the market: • Accurate readings every 5 seconds • Stakeholders paid on more consistent hydrocarbon quality readings • A more valuable hydrocarbon stream • Autonomous measurement Data Analytics: Upstream Market Disruptor // 26 From 3 weeks to 5 Seconds! Local System Mobile App and SCADA Reporting Real-Time Wellsite Readings

Investor Contact Mike Critelli Director of Finance ir@flotekind.com

v3.24.1.u1

Cover

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

Flotek Industries, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13270

|

| Entity Tax Identification Number |

90-0023731

|

| Entity Address, Address Line One |

5775 N. Sam Houston Parkway W., Suite 400

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77086

|

| City Area Code |

(713)

|

| Local Phone Number |

849-9911

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

FTK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000928054

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| City Area Code |

(713)

|

| Local Phone Number |

849-9911

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

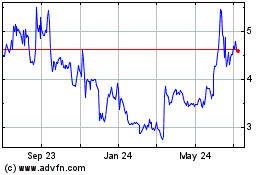

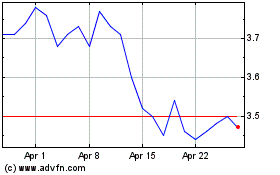

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2024 to May 2024

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From May 2023 to May 2024