A.M. Best Affirms Ratings of Fidelity National Financial, Inc. and Its Title Insurance Subsidiaries

June 16 2011 - 3:05PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

of A- (Excellent) and issuer credit ratings (ICR) of “a-” of

Fidelity National Financial Group (Fidelity) and its four

title insurance members. A.M. Best also has affirmed the ICR of

“bbb-” of the parent holding company, Fidelity National

Financial, Inc. (FNF) (headquartered in Jacksonville, FL)

(NYSE: FNF). The outlook for all ratings is stable. (See below for

a complete list of the companies and ratings.)

The ratings reflect Fidelity’s adequate capitalization and

strong market profile as the largest title insurance group in the

United States. The stable outlook is based on Fidelity’s improved

trend of risk-adjusted capitalization, lower premium leverage and

the support it receives from FNF.

In 2009 and 2010, the group was able to reduce premium leverage

measures through organic surplus growth from improved operating

earnings, along with a moderate decline in premium writings. FNF’s

financial leverage measures, which had been elevated in recent

years primarily due to increased borrowings to support liquidity

levels, have been reduced mainly due to the issuance of over $300

million in new common stock in 2010, the proceeds of which were

used exclusively to pay down a portion of the company’s existing

debt.

These positive rating factors are somewhat offset by Fidelity’s

challenge to manage and sustain operating performance through the

current downswing in the real estate cycle. The significant

slowdown in the U.S. housing market in recent years has negatively

impacted the company’s profitability. However, Fidelity continues

to undertake aggressive efforts to achieve operating efficiencies,

which along with its flexible cost structure, have helped to

somewhat mitigate the effects of this down cycle.

The FSR of A- (Excellent) and ICR of “a-” have been affirmed for

Fidelity National Financial Group and its following

members:

- Alamo Title Insurance

- Chicago Title Insurance

Company

- Commonwealth Land Title Insurance

Company

- Fidelity National Title Insurance

Company

The principal methodology used in determining these ratings is

Best’s Credit Rating Methodology -- Global Life and Non-Life

Insurance Edition, which provides a comprehensive explanation of

A.M. Best’s rating process and highlights the different rating

criteria employed. Additional key criteria utilized include:

“Rating Members of Insurance Groups”; “Risk Management and the

Rating Process for Insurance Companies”; “A.M. Best’s Title

Insurance Rating Methodology”; “BCAR for Title Insurance

Companies”; “Catastrophe Risk Management Incorporated Within the

Rating Process”; and “A.M. Best’s Ratings & the Treatment of

Debt.” Methodologies can be found at

www.ambest.com/ratings/methodology..

Founded in 1899, A.M. Best Company is the world’s oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2011 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

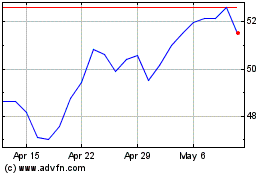

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jun 2024 to Jul 2024

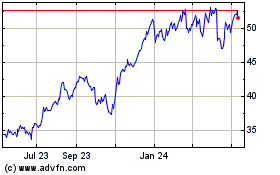

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jul 2023 to Jul 2024