The European Equity Fund, Inc. and The New Germany Fund, Inc. Announce Final Results of Tender Offers

August 28 2012 - 9:00AM

Business Wire

The European Equity Fund, Inc. (NYSE: EEA) (“EEA”) and

The New Germany Fund, Inc. (NYSE: GF) (“GF”) (each a

“Fund”) each announced today that, in accordance with its

respective tender offer for up to 5% of its issued and outstanding

shares of common stock, which offer expired at 5:00 p.m. Eastern

time on August 22, 2012, EEA has accepted 529,026, and GF has

accepted 863,598, properly tendered shares at a price per share

equal to 98% of each Fund’s respective net asset value (“NAV”) as

determined by each Fund on August 23, 2012. Each Fund normally

calculates its NAV per share at 11:30 a.m. New York time on each

day during which the New York Stock Exchange is open for trading.

5,314,744.107 shares of EEA’s common stock, or 50.23% of its common

stock outstanding, and 10,697,485.001 shares of GF’s common stock,

or 61.94% of its common stock outstanding, were tendered through

the stated expiration date. The tender offer for each Fund was

oversubscribed, meaning that pursuant to the terms of each tender

offer, not all shares that were tendered were accepted for payment

by the Funds. Under the final pro-ration calculations, 9.95% of

EEA’s shares, and 8.07% of GF’s shares, that were tendered have

been accepted for payment by the respective Fund. The shares

accepted for payment will receive cash at a repurchase offer price

of $7.08 for EEA and $15.85 for GF, each of which prices is equal

to 98% of the respective Fund’s NAV as determined by each Fund on

August 23, 2012. Those shares that were tendered but not accepted

for payment will continue to be held by their record owners.

For more information on EEA and GF, including the most recent

month-end performance, visit www.dws-investments.com or call (800)

349-4281.

The European Equity Fund, Inc. is a diversified, closed-end

investment company seeking long-term capital appreciation

through investment primarily (normally at least 80% of its

assets) in equity or equity-linked securities of companies

domiciled in European countries utilizing the Euro currency.

Investing in foreign securities presents certain

risks, such as currency fluctuations, political and economic

changes, and market risks. Any fund that concentrates in a

particular segment of the market will generally be more

volatile than a fund that invests more broadly.

The New Germany Fund, Inc. is a diversified, closed-end

investment company seeking capital appreciation primarily through

investment in equity or equity-linked securities of small and

mid-cap German companies. The Fund may invest up to 35% of its

assets in large cap German companies and up to 20% in other Western

European companies. Investing in foreign securities presents

certain risks, such as currency fluctuations, political and

economic changes, and market risks. Any fund that concentrates in a

particular segment of the market will generally be more volatile

than a fund that invests more broadly.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and, once

issued, shares of closed-end funds are bought and

sold in the open market through a stock exchange. Shares of

closed-end funds frequently trade at a discount to NAV. The

price of a fund’s shares is determined by a number of

factors, several of which are beyond the control of the

fund. Therefore, a fund cannot predict whether its shares will

trade at, below or above NAV.

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer

or solicitation or sale would be unlawful prior to

registration or qualification under the laws of such state or

jurisdiction.

Certain statements contained in this release may be

forward-looking in nature. These include all statements

relating to plans, expectations, and other statements that

are not historical facts and typically use words like “expect,”

“anticipate,” “believe,” “intend,” and similar expressions. Such

statements represent management’s current beliefs, based

upon information available at the time the statements are

made, with regard to the matters addressed. All

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such

statements. Management does not undertake any obligation to update

or revise any forward-looking statements, whether as a

result of new information, future events, or

otherwise.

NOT FDIC/NCUA INSURED • MAY LOSE VALUE • NO

BANK GUARANTEENOT A DEPOSIT • NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY

DWS Investments is part of Deutsche Bank’s Asset Management

division and, within the US, represents the retail asset management

activities of Deutsche Bank AG, Deutsche Bank Trust Company

Americas, Deutsche Investment Management Americas Inc. and DWS

Trust Company. R-20423-7 (8/12)

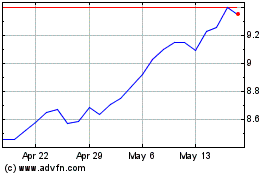

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2024 to Jul 2024

European Equity (NYSE:EEA)

Historical Stock Chart

From Jul 2023 to Jul 2024