Ecolab's 2Q EPS Meets, Ups View - Analyst Blog

July 27 2011 - 11:31AM

Zacks

Leading cleaning and sanitation products maker Ecolab

Inc’s (ECL) second-quarter fiscal 2011 adjusted (excluding

special gains/charges and tax-related adjustments) earnings of 64

cents a share matched the Zacks Consensus Estimate while surpassing

the year-ago adjusted earnings of 56 cents. The results met the top

end of the Minnesota-based company’s guidance of 62-64 cents.

Net income (attributable to Ecolab) for the quarter fell 2.6%

year over year to $125.9 million (or 53 cents a share), hurt by

roughly $30 million in charges associated with the company’s

European restructuring program, which offset a double-digit

expansion in the top line.

Net sales surged 11.7% year over year (up 8% in constant

currency) to $1,698.8 million, ahead of the Zacks Consensus

Estimate of $1,654 million. The results were powered by healthy

sales across the company’s core U.S. Cleaning & Sanitizing

business as well as Asia-Pacific and Latin American operations,

backed by acquisitions and favorable currency exchange

translation.

Segment Results

Revenues from Ecolab’s core U.S. Cleaning & Sanitizing

division jumped 9.2% year over year to $752.4 million, led by

Institutional, Food & Beverage and Kay sub-segments. The

U.S. Other Services segment revenues edged up 1.4% to $116.5

million. Sales (at constant currency) from the company’s

International operations rose 7.2% year over year to $781.1

million, boosted by the contributions from emerging markets.

Margins

Operating margin contracted to 11.7% from 13.4% a year-ago, as

revenue growth was more than offset by sizable restructuring

charges. Gross margin fell to 49.3% from 50.7% a year-ago as a

result of a 15% rise in cost of sales.

Gross margin was impacted by higher raw material costs

which are

expected to peak in the third quarter. Ecolab is employing

effective pricing strategies to offset the raw material

inflation.

Financial Condition

Ecolab ended the second quarter with cash and cash equivalents

of $163.2 million, up 34.5% year over year. Long-term debt

increased 10.4% year over year to $703.3 million. The company

repurchased 0.9 million shares during the quarter.

Guidance and Recommendation

Ecolab has lifted its adjusted earnings per share target for

fiscal 2011 to between $2.52 and $2.56 (a 13%-15% year over year

growth) from its earlier forecast of $2.49 and $2.53. The adjusted

earnings exclude charges associated with the company’s recently

announced $8 billion acquisition of Illinois-based water treatment

company Nalco Holding Company (NLC) as well as

European restructuring.

For the third quarter, Ecolab envisions adjusted earnings

between 73 cents and 75 cents a share. The forecast assumes a dilution of

roughly 5-6 cents a share, primarily associated with the company’s

restructuring activities but excludes the potential impact of the

Nalco buyout. The current Zacks Consensus Estimates for the third

quarter and fiscal 2011 are 76 cents and $2.53, respectively.

Adjusted gross margin for the third quarter is expected in the

band of 50%-51%. Moreover, Ecolab expects improved year-over-year

revenue growth in the quarter.

We are encouraged by Ecolab’s strong international exposure and

recovery across its end-markets. The recent move to buy Nalco

Holding is a strategic fit and highly complementary for the

company, enabling it to bolster its water management business.

However, Ecolab is faced with aggressive competition from the

likes of Clorox

(CLX) and

Church

& Dwight (CHD). Moreover, raw material

price hikes represent a headwind for the company and its

aggressive acquisition strategy has inherent integration risks. We

are currently Neutral on the stock.

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

NALCO HLDG CO (NLC): Free Stock Analysis Report

Zacks Investment Research

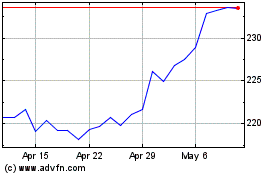

Ecolab (NYSE:ECL)

Historical Stock Chart

From May 2024 to Jun 2024

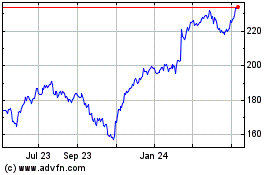

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jun 2023 to Jun 2024