Adding substance to optimistic predictions

As investors swallowed a bunch of nauseating economic data this

week, we were also treated to a fresh dose of optimism in the form

of one Mr. James Altucher and his “Dow 20,000” prediction. Writing

for MarketWatch, Altucher outlined ten reasons why the market will

soar in the next 12 to 18 months, boosting the S&P 500 to 2,000

along the way.

Many of his arguments were similar to those I wrote in a piece for

TheStreet in May, “8 Reasons the S&P 500 is Going to 1,500.”

And that piece was based on an article I wrote for The Options News

Network in March of 2010, “7 Reasons the S&P 500 is Going to

1,300.”

While I agree with Altucher on several points -- and more

importantly on the overall theme of an extended bull market and

economic good times for the next few years -- I also want to

highlight where a few of them do little to support a 50% rise in

the broad averages before 2014. In other words, it’s a great start

with lots of potential. And probably more meaningful for investors

now than that “Dow 36K” book written a decade ago.

Where We Agree

In my original analysis from 15 months ago, the accelerated

earnings recovery was my #2 reason for continued bullishness.

Altucher cites corporate profits at record levels as his #7.

Obviously, we mean the same thing. In my amateur-economist penchant

for finding memorable ways to describe markets, I began calling the

forces driving the 2009 market launch “the V-Recovery Spread.”

What I was attempting to capture in this phrase was the fact that

off of a recession trough, institutional fund managers would

aggressively buy stocks as earnings recovered faster than P/E

multiples. In short, they were buying the spread of trough earnings

to close the gap with extended valuations.

When most doubted the “V-recovery” thesis in 2009, I explained why

it was actually working, especially with Steady Ben at the helm of

the Fed. When I recently became a student of the Zacks Rank stock

rating system and related investing methodologies, I discovered the

underlying mechanics of why it worked.

Altucher and I also both tout cash on the sidelines. When I wrote

in March of 2010, I was talking about $1 trillion on non-financial

balance sheets. That number has doubled as I noted last month when

I said, “cash on the sidelines is massive -- and still trash -- in

the era of extended QE.”

But I’m not just talking about the $2 trillion on corporate balance

sheets. I’m talking about the staggering bond fund inflows that

dwarfed equity fund inflows throughout 2009 and 2010 -- after the

credit crisis was over. According to data I just dug up from the

Investment Company Institute, in that two years, bond mutual funds,

both taxable and municipal, attracted $617.3 billion of inflows

versus equity mutual funds at minus $45.5 billion in net outflow!

With those kind of numbers, it’s a wonder the stock market went up

at all.

Altucher gives two of his ten reasons to “innovation” and “dirt

cheap” stocks. I don’t talk directly about innovation in my 8

reasons, but I have always been a big fan of this perpetual force

of motion in the American economy. It’s what makes us the most

dynamic and thriving economy on the planet. Technology and

productivity beget more of both and certainly add to GDP and

profits in ways I’m not qualified to talk about.

Regarding cheap stocks like

Apple (AAPL) and

Microsoft (MSFT), I also agree strongly. He cites

Apple trading for 12 times forward earnings when you back out the

$65 billion in cash it has with no debt. I think the stock is a buy

here not simply for its earnings momentum but also its must-have

gadget magic and productivity tools that create cult-like consumer

momentum.

My boss here, Steve Reitmeister, believes that Apple’s biggest

victories may be on the horizon as consumers who keep moving up the

product cycle—from iPod, to iPhone, to MacBook, as I just did—will

be more likely to buy an Apple desktop next. With single digit

desktop market share now, imagine the possibilities for the

company’s revenue and earnings if they double their

penetration.

Where We Part Company

Altucher opens with his #1 reason for Dow 20K as “QE2 has not

started.” He’s being clever, of course, but then his logic is

utterly flawed. He cites the old monetary policy tenet that

“Federal stimulus takes 6 to 18 months before even one dollar hits

the U.S. economy in a meaningful way.”

Talk about getting your apples and oranges mixed up. QE2 was a bond

buying market operation with immediate impact on yields and capital

flows. He somehow thinks we should “expect that $600 billion or

more to start hitting toward the end of 2011.” Ask any economist

and he or she will tell you that the QE2 string-pushing was so

January.

The remaining reasons for Dow 20K are a little hazy, if not

underwhelming. His #3 reason is the “multiplier effect.” Isn’t this

part of the Fed stimulus argument? And #6 on the employment picture

is a solid idea in of itself. But I’m not sure it belongs on a list

like this. Yes, temp worker hiring increases are historically

indicative of an encouraging jobs outlook down the road. But it’s

still part of any slow grind recovery and not a catalyst for excess

returns.

What got left out may be more important than anything. What’s

driving the stock market recovery—as much as, if not more than, any

extraordinary monetary policy— is emerging markets. Global growth

and demand from dozens of countries with emerging middle class

populations that want the lifestyles of the west have kept the

profits of companies like

Caterpillar (CAT) and

Eaton (ETN) brimming as infrastructure development

in the BRICs and beyond hiccupped during the US banking crisis and

then forged on.

And he closes with a curious reference to “major demographic

changes… that are going to affect stocks for the next 25 years.”

Not only does he not tell us what any of these changes are, he

doesn’t explain what the next 25 years has to do with his

prediction for the next 18 months.

Finally, James wraps up with a “see, I told you so” thumbed nose to

all his critics the last time he rolled out a similar wild

prediction. I feel his pain, especially the part about his kids

“Googling” their last name to find post after post insulting their

Dad. Refreshingly for them, he was vindicated for his last

predictions with a market 25% higher. I went through something

similar in the spring of 2010 after my call for S&P 1,300—right

before Deepwater Horizon and the “flash crash.”

My criticism of his work is with all due respect and more. I am

bullish on America too and I love big, macro, amateur-economist

think pieces like this. Because I would actually rather discuss the

economy and our country’s future with someone like him than any

economist on Wall Street. Good data and research are essential for

stock-picking as we prove here every week at Zacks, but vision and

analysis often make the big difference in long run investing

success.

And you don’t need a PhD in economics to figure out what the big

trends driving growth for the next few years will be. If you’re not

sure where to begin, just ask James or I. We’ll share all our

nearly-expert analysis.

Kevin Cook is a Senior Stock Strategist for Zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

EATON CORP (ETN): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

Zacks Investment Research

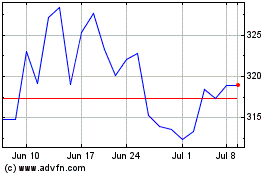

Eaton (NYSE:ETN)

Historical Stock Chart

From Jun 2024 to Jul 2024

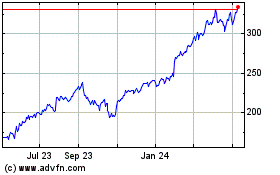

Eaton (NYSE:ETN)

Historical Stock Chart

From Jul 2023 to Jul 2024