Diversified industrial manufacturer Eaton Corporation (NYSE:ETN)

today announced net income per share of $0.83 for the first quarter

of 2011, an increase of 80 percent over the first quarter of 2010.

Sales in the quarter were $3.8 billion, 23 percent above the same

period in 2010. Net income was $287 million, up 85 percent over the

first quarter of 2010.

Net income in both periods included charges for integration of

acquisitions. Before acquisition integration charges, operating

earnings per share in the first quarter of 2011 was $0.84, an

increase of 75 percent over the first quarter of 2010. Operating

earnings for the first quarter of 2011 were $289 million, an

increase of 80 percent over 2010.

Alexander M. Cutler, Eaton chairman and chief executive officer,

said, “We had a strong first quarter, with earnings per share above

the high end of our increased earnings guidance provided at the end

of February. Our markets enjoyed strong growth during the first

quarter, increasing 14 percent compared to the first quarter of

2010. The sales growth in the first quarter of 23 percent consisted

of 19 percent organic growth, 2 percent from acquisitions, and 2

percent from higher foreign exchange rates.

“Our Electrical Americas, Hydraulics, and Truck markets grew

more strongly than anticipated and we are increasing our

expectations for the growth of these three markets in 2011,” said

Cutler. “As a result, we now anticipate our markets for all of 2011

will grow by 10 percent.

“We anticipate net income per share for the second quarter of

2011 to be between $0.89 and $0.95 and operating earnings per

share, which exclude charges to integrate our recent acquisitions,

to be between $0.90 and $0.96. As a result of our strong first

quarter and our slightly stronger market outlook for the year, we

are raising our full year guidance by $0.15 for net income per

share to between $3.66 and $3.96 and for operating earnings per

share to between $3.70 and $4.00.”

Business Segment Results

Sales for the Electrical Americas segment were $964 million, up

20 percent over 2010. The sales increase was made up of a 15

percent increase in core sales, 4 percent from acquisitions, and 1

percent from foreign exchange. Operating profits were $132 million.

Excluding acquisition integration charges of $3 million during the

quarter, operating profits were $135 million, up 27 percent over

the first quarter of 2010.

“End markets for our Electrical Americas segment grew 14 percent

in the first quarter,” said Cutler. “We saw solid growth in our

industrial markets, and we continue to believe nonresidential

construction activity is on track to begin recovering by the middle

of this year.

“Our bookings in the Electrical Americas segment were up 21

percent from the first quarter a year ago,” said Cutler. “We are

revising our estimate of the growth in 2011 of the Electrical

Americas markets to 7 percent, 1 percent higher than our prior

estimate.”

Sales for the Electrical Rest of World segment were $743

million, up 22 percent over the first quarter of 2010. Our

Electrical Rest of World markets grew 9 percent in the quarter. The

segment reported operating profits of $70 million, compared to

operating profits of $42 million in the first quarter of 2010.

Bookings in the quarter grew 9 percent over the first quarter of

2010.

“During the quarter, we reached agreement to acquire ACTOM (Pty)

Limited’s low-voltage electrical business in South Africa,” said

Cutler. “This acquisition provides us with a solid position in the

South African electrical market, as well as a platform for growth

in southern Africa.”

Hydraulics segment sales were $685 million, an increase of 40

percent compared to the first quarter of 2010. Global hydraulics

markets increased 27 percent in the quarter compared to the first

quarter of 2010. Operating profits in the first quarter were $106

million, an increase of 96 percent over the first quarter of

2010.

“The hydraulics markets in the first quarter continued their ‘V’

shape recovery from the sharp downturn of 2008-2009,” said Cutler.

“Bookings in the quarter grew 39 percent over the first quarter of

2010, establishing a new quarterly bookings record. For all of

2011, we now believe hydraulics markets are likely to grow by 18

percent, up from our prior estimate of 16 percent.

“We were particularly pleased with the record quarterly margin

of 15.5 percent,” said Cutler. “We believe this business is likely

to earn margins of this level for the full year.

“We completed the acquisition of Tuthill Couplings on January

1,” said Cutler. “This acquisition further expands our offerings of

hydraulic and pneumatic quick connect coupling solutions.

“We signed an agreement in March to acquire Internormen

Technology Group, a leader in hydraulic filtration and

instrumentation based in Germany,” said Cutler. “This acquisition

significantly expands our portfolio of filtration products and adds

additional presence in emerging markets.”

Aerospace segment sales were $389 million, up 3 percent over the

first quarter of 2010. Aerospace markets grew 2 percent compared to

the first quarter of 2010. Operating profits in the first quarter

were $45 million, a decline of 8 percent compared to a year

earlier.

“Our margins in Aerospace were impacted during the quarter by

increased expenses stemming from changes in scope, program delays,

and execution of new customer programs,” said Cutler. “We

anticipate that margins will likely improve by the second half of

the year.

“We were pleased to establish our new joint venture in China

with Shanghai Aircraft Manufacturing Co., Ltd., a subsidiary of

Commercial Aircraft Corporation of China (COMAC), to produce

products for the new COMAC C919 single-aisle passenger aircraft,”

said Cutler. “The joint venture will focus on the design and

manufacture of fuel and hydraulic conveyance systems.”

The Truck segment posted sales of $576 million, up 27 percent

compared to the first quarter of 2010. Truck markets increased by

20 percent in the first quarter. The segment reported operating

profits in the first quarter of $90 million, an increase of 96

percent over the first quarter of 2010.

“U.S. truck markets accelerated in the first quarter, growing 36

percent compared to the first quarter in 2010 and 16 percent over

the fourth quarter of 2010,” said Cutler. “Our non-U.S. markets

grew 9 percent.

“We were pleased with the 15.6 percent operating margin our

Truck segment posted in the first quarter,” said Cutler. “As the

NAFTA Class 8 market continues to expand over the course of this

year, we believe margins will improve even further.”

The Automotive segment posted first quarter sales of $446

million, up 19 percent from the first quarter of 2010. Global

automotive markets were up 13 percent. The segment reported

operating profits of $50 million, up 19 percent compared to the

first quarter of 2010.

“Global auto markets posted strong growth in the first quarter,”

said Cutler. “U.S. markets grew 17 percent while markets outside

the U.S. grew 12 percent.”

Eaton Corporation is a diversified power management company with

2010 sales of $13.7 billion. Celebrating its 100th anniversary in

2011, Eaton is a global technology leader in electrical components

and systems for power quality, distribution and control; hydraulics

components, systems and services for industrial and mobile

equipment; aerospace fuel, hydraulics and pneumatic systems for

commercial and military use; and truck and automotive drivetrain

and powertrain systems for performance, fuel economy and safety.

Eaton has approximately 70,000 employees and sells products to

customers in more than 150 countries. For more information, visit

www.eaton.com.

Notice of conference call: Eaton’s conference call to discuss

its first quarter results is available to all interested parties as

a live audio webcast today at 10 a.m. Eastern time via a link on

the center of Eaton’s home page. This news release can be accessed

under its headline on the home page. Also available on the website

prior to the call will be a presentation on first quarter results,

which will be covered during the call.

This news release contains forward-looking statements concerning

second quarter and full year 2011 net income per share and

operating earnings per share, and our worldwide markets. These

statements should be used with caution and are subject to various

risks and uncertainties, many of which are outside the company’s

control. The following factors could cause actual results to differ

materially from those in the forward-looking statements:

unanticipated changes in the markets for the company’s business

segments; unanticipated downturns in business relationships with

customers or their purchases from us; competitive pressures on

sales and pricing; increases in the cost of material and other

production costs, or unexpected costs that cannot be recouped in

product pricing; the introduction of competing technologies;

unexpected technical or marketing difficulties; unexpected claims,

charges, litigation or dispute resolutions; strikes or other labor

unrest; the impact of acquisitions and divestitures; unanticipated

difficulties integrating acquisitions; new laws and governmental

regulations; interest rate changes; stock market and currency

fluctuations; and unanticipated deterioration of economic and

financial conditions in the United States and around the world. We

do not assume any obligation to update these forward-looking

statements.

Financial Results

The company’s comparative financial results for the three months

ended March 31, 2011 are available on the company’s website,

www.eaton.com.

EATON CORPORATION CONSOLIDATED STATEMENTS OF

INCOME Three months ended (In millions except for per

share data) March 31 2011 2010

Net sales $ 3,803 $ 3,103

Cost of products sold 2,682 2,201 Selling and administrative

expense 665 587 Research and development expense 105 101 Interest

expense-net 32 35 Other income-net (16 ) (8 )

Income before income taxes 335 187 Income tax expense

49 31

Net income 286 156 Adjustment for

net income (loss) for noncontrolling interests 1

(1 )

Net income attributable to Eaton common

shareholders $ 287 $ 155

Net income per

common share Diluted $ 0.83 $ 0.46 Basic 0.84 0.46

Weighted-average number of common shares outstanding Diluted

345.7 339.2 Basic 340.1 334.2

Cash dividends paid per

common share $ 0.34 $ 0.25

Reconciliation of net

income attributable to Eaton common shareholders to

operating earnings Net income attributable to Eaton common

shareholders $ 287 $ 155 Excluding acquisition integration charges

(after-tax) 2 6

Operating

earnings $ 289 $ 161 Net income per common

share - diluted $ 0.83 $ 0.46 Excluding per share impact of

acquisition integration charges (after-tax) 0.01

0.02

Operating earnings per common share $

0.84 $ 0.48

Net income per common share,

weighted-average number of common shares outstanding, cash

dividends paid percommon share and operating earnings per common

share have been restated to give effect to the two-for-onestock

split. See the accompanying notes for additional information.

See accompanying notes.

EATON CORPORATION

BUSINESS SEGMENT INFORMATION

Three months ended (In millions) March 31 2011 2010

Net

sales Electrical Americas $ 964 $ 802 Electrical Rest of World

743 608 Hydraulics 685 490 Aerospace 389 376 Truck 576 453

Automotive 446 374

Total net

sales $ 3,803 $ 3,103

Segment operating

profit Electrical Americas $ 132 $ 105 Electrical Rest of World

70 42 Hydraulics 106 54 Aerospace 45 49 Truck 90 46 Automotive

50 42

Total segment operating

profit 493 338

Corporate Amortization of

intangible assets (48 ) (45 ) Interest expense-net (32 ) (35 )

Pension and other postretirement benefits expense (33 ) (32 ) Other

corporate expense-net (45 ) (39 )

Income before

income taxes 335 187 Income tax expense 49

31

Net income 286 156 Adjustment for net income

(loss) for noncontrolling interests 1 (1 )

Net income attributable to Eaton common shareholders $ 287

$ 155 See accompanying notes.

EATON

CORPORATION CONDENSED CONSOLIDATED

BALANCE SHEETS March 31, December 31, (In

millions) 2011 2010

Assets Current assets Cash $ 201

$ 333 Short-term investments 496 838 Accounts receivable-net 2,466

2,239 Inventory 1,667 1,564 Other current assets 640

532 Total current assets 5,470 5,506 Property, plant and

equipment-net 2,523 2,477

Other noncurrent assets

Goodwill 5,569 5,454 Other intangible assets 2,304 2,272 Deferred

income taxes and other noncurrent assets 1,471 1,543

Total assets $ 17,337 $ 17,252

Liabilities and

shareholders' equity Current liabilities Short-term debt $ 93 $

72 Current portion of long-term debt 4 4 Accounts payable 1,456

1,408 Accrued compensation 300 465 Other current liabilities

1,348 1,284 Total current liabilities 3,201

3,233 Non-current liabilities Long-term debt 3,354 3,382

Pension liabilities 1,207 1,429 Other postretirement benefits

liabilities 741 743 Deferred income taxes and other long-term

liabilities 1,010 1,062 Total noncurrent liabilities

6,312 6,616 Shareholders' equity Eaton

shareholders' equity 7,783 7,362 Noncontrolling interests 41

41 Total equity 7,824 7,403 Total liabilities

and equity $ 17,337 $ 17,252 See accompanying notes.

EATON CORPORATION

NOTES TO THE FIRST QUARTER 2011 EARNINGS RELEASE

Amounts are in millions of dollars unless indicated otherwise

(per share data assume dilution).

On January 27, 2011, Eaton’s Board of Directors announced a

two-for-one stock split of the Company’s common shares effective in

the form of a 100% stock dividend. The record date for the stock

split was February 7, 2011, and the additional shares were

distributed on February 28, 2011. Accordingly, all per share

amounts and average shares outstanding presented in this earnings

release have been adjusted retroactively to reflect the stock

split.

This earnings release includes certain non-GAAP financial

measures. These financial measures include operating earnings,

operating earnings per common share, and operating profit before

acquisition integration charges for each business segment, each of

which excludes amounts that differ from the most directly

comparable measure calculated in accordance with generally accepted

accounting principles (GAAP). A reconciliation of each of these

financial measures to the most directly comparable GAAP measure is

included in this earnings release. Management believes that these

financial measures are useful to investors because they exclude

transactions of an unusual nature, allowing investors to more

easily compare Eaton's financial performance period to period.

Management uses this information in monitoring and evaluating the

on-going performance of Eaton and each business segment.

Note 1. ACQUISITIONS OF BUSINESSES

In 2011 and 2010, Eaton acquired businesses and entered into a

joint venture in separate transactions. The Consolidated Statements

of Income include the results of these businesses from the dates of

the transactions or formation. These transactions are summarized

below:

Acquired business

Date oftransaction

Businesssegment

Annual sales

Eaton-SAMC (Shanghai) Aircraft

ConveyanceSystem Manufacturing Co., Ltd.

March 8,2011

Aerospace

New jointventure

A 49%-owned joint venture in China

focusing onthe design, development, manufacturing andsupport of

fuel and hydraulic conveyancesystems for the global civil aviation

market.

Tuthill Coupling Group January 1, Hydraulics $35 for the

A United States and France-based

manufacturerof pneumatic and hydraulic quick couplingsolutions and

leak-free connectors used inindustrial, construction, mining,

defense, energyand power applications.

2011

year endedNovember 30,2010

Chloride Phoenixtec Electronics October 12, Electrical Rest

$25 for the

A China manufacturer of uninterruptible

powersupply (UPS) systems. Eaton acquired theremaining shares to

increase its ownership from50% to 100%.

2010 of World

year endedSeptember 30,2010

CopperLogic, Inc. October 1, Electrical $35 for the

A United States-based manufacturer

ofelectrical and electromechanical systems.

2010 Americas

year endedSeptember 30,2010

Wright Line Holding, Inc. August 25, Electrical $101 for the

A United States provider of

customizedenclosures, rack systems, and air-flowmanagement systems

to store, power, andsecure mission-critical IT data center

electronics.

2010 Americas

year endedJune 30, 2010

EMC Engineers, Inc. July 15, Electrical $24 for 2009

A United States energy engineering and

energyservices company that delivers energy efficiencysolutions for

a wide range of governmental,educational, commercial and industrial

facilities.

2010 Americas

On January 20, 2011, Eaton reached an agreement to acquire ACTOM

(Pty) Limited’s low-voltage electrical business in South

Africa. This business is a manufacturer and supplier of motor

control components, engineered electrical distribution systems, and

uninterruptible power supply systems and had sales of $58 for the

year ended December 31, 2010. The terms of the agreement are

subject to regulatory approvals and other customary closing

conditions. The acquisition is expected to close during the second

quarter of 2011. This business will be included in the

Electrical Rest of World segment.

On March 14, 2011, Eaton reached an agreement to acquire

Internormen Technology Group, a leading Germany-based manufacturer

of hydraulic filtration and instrumentation. This business had

sales of more than $55 in 2010 and has sales and distribution

subsidiaries in India, China, Brazil and the United States. The

terms of the agreement are subject to customary closing conditions.

The acquisition is expected to close during the second quarter of

2011. This business will be included in the Hydraulics segment.

Note 2. ACQUISITION INTEGRATION CHARGES

Eaton incurs charges related to the integration of acquired

businesses. A summary of these charges follows:

Three months ended March 31

Acquisitionintegrationcharges

Operating profitas reported

Operating profitexcluding

acquisitionintegration charges

2011 2010 2011 2010 2011 2010

Business

segment

Electrical Americas $ 3 $ 1 $ 132 $ 105 $ 135 $ 106 Electrical Rest

of World - 7 70 42 70 49 Hydraulics - - 106 54 106 54 Aerospace - 1

45 49 45 50 Truck - - 90 46 90 46 Automotive - -

50 42 50 42 Total before income taxes $

3 $ 9 $ 493 $ 338 $ 496 $ 347 After-tax integration charges $ 2 $ 6

Per common share $ 0.01 $ 0.02

Charges in 2011 were related primarily to CopperLogic, Wright

Line Holding and EMC Engineers. Charges in 2010 were related

primarily to Moeller and Phoenixtec. These charges were included in

Cost of products sold or Selling and administrative expense, as

appropriate. In Business Segment Information, the charges reduced

Operating profit of the related business segment.

Note 3. INCOME TAXES

The effective income tax rate for the first quarter of 2011 was

14.5% compared to 16.4% for the first quarter in 2010. The lower

tax rate in 2011 is primarily attributable to the absence of

certain unfavorable net nonrecurring items incurred in 2010,

including the impact of the Health Care Reform and Education

Reconciliation Act on taxation associated with Medicare Part D.

Additionally, contributing to the lower effective tax rate in 2011

is the favorable impact of the renewal of the U.S. Research and

Experimentation tax credit which was not signed into law until the

last quarter of 2010. Partially offsetting these favorable items

noted above for 2011 is increased tax expense associated with

higher tax rates in the United States and other jurisdictions due

to improved economic conditions.

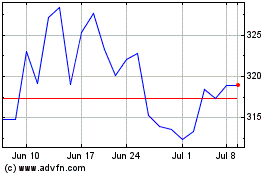

Eaton (NYSE:ETN)

Historical Stock Chart

From Jun 2024 to Jul 2024

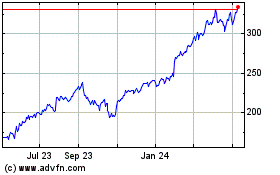

Eaton (NYSE:ETN)

Historical Stock Chart

From Jul 2023 to Jul 2024