Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 24 2024 - 1:16PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

May, 2024

Commission File Number 1-15182

DR.

REDDY’S LABORATORIES LIMITED

(Translation of registrant’s name into English)

8-2-337, Road No. 3, Banjara Hills

Hyderabad, Telangana 500 034, India

+91-40-49002900

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨ No x

If “Yes” is marked, indicate below the file number assigned

to registrant in connection with Rule 12g3-2(b): 82-________.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized

| |

DR. REDDY’S LABORATORIES LIMITED

(Registrant) |

| |

|

|

| Date: May 24, 2024 |

By: |

/s/ K Randhir Singh |

| |

|

Name: |

K Randhir Singh |

| |

|

Title: |

Company Secretary |

Exhibit 99.1

|

Dr.

Reddy’s Laboratories Ltd.

8-2-337,

Road No. 3, Banjara Hills,

Hyderabad

- 500 034, Telangana,

India.

CIN

: L85195TG1984PLC004507

Tel

: +91 40 4900 2900

Fax :

+91 40 4900 2999

Email

: mail@drreddys.com

www.drreddys.com |

May 24, 2024

National Stock Exchange of India Ltd. (Scrip Code: DRREDDY-EQ)

BSE Limited (Scrip Code: 500124)

New York Stock Exchange Inc. (Stock Code: RDY)

NSE IFSC Ltd (Stock Code: DRREDDY)

Dear Sir/Madam,

| Sub: | Disclosure pursuant to Regulation 30 of the SEBI (Listing Obligations

and Disclosure Requirements) Regulations, 2015 |

This is in furtherance to our intimation dated

January 30, 2024, wherein we have informed that the Board has approved the fund infusion by way of investment in equity shares of Aurigene

Oncology Limited (“AOL”) (formerly, Aurigene Discovery Technologies Limited), a wholly-owned subsidiary of the Company, upto

an amount of Rs. 6,500 million, and AOL will make similar investment in equity shares of Aurigene Pharmaceutical Services Limited (“APSL”),

a wholly-owned subsidiary of AOL and a step-down wholly-owned subsidiary of the Company.

In this connection, we further inform that the

Company has made an investment of Rs. 649,99,98,032/- and AOL has allotted 9,70,14,896 equity shares of Rs.10 each at a premium of Rs.

57/- to the Company on May 23, 2024.

The details required under Regulation 30 of the

SEBI Listing Regulations, read with SEBI Circular No. SEBI/HO/CFD/CFD-PoD-1/P/CIR/2023/123 dated July 13, 2023, with respect to the above

fund infusion is given in Annexure enclosed herewith.

This is for your information and records.

Thanking you.

Yours faithfully,

For Dr. Reddy’s Laboratories Limited

K Randhir Singh

Company Secretary, Compliance Officer and Head-CSR

Encl: as above

Annexure

Disclosure under Part A Para A(i) of Schedule

III read with Regulation 30 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015

|

Sl.

No |

Particulars |

Description |

| 1 |

Name of the target entity, details in brief

such as size, turnover etc. |

Aurigene Oncology Limited (“AOL”) (formerly, Aurigene Discovery Technologies Limited), a wholly-owned subsidiary of the Company. The fund infused by the Company into AOL will be further invested in Aurigene Pharmaceutical Services Limited (“APSL”), a wholly-owned subsidiary of AOL, to support the capex and working capital requirements of APSL. The turnover of AOL for FY2024 was Rs.372 crores. |

| 2 |

Whether the acquisition would fall within related party transaction(s) and whether the promoter/ promoter group/ group companies have any interest in the entity being acquired? If yes, nature of interest and details thereof and whether the same is done at “arms-length” |

The investment in AOL is a related party transaction, as AOL is a wholly owned subsidiary and accordingly a related party to the Company. The investment is done based on valuation report of an Independent Valuer and on arm’s length basis. Except as stated above, the promoter/ promoter group/ group companies have no interest in AOL. |

| 3 |

Industry to which the entity being acquired

belongs |

AOL is a drug discovery and clinical stage biotech company, committed to bringing novel and effective therapeutics for the treatment of cancer. |

| 4 |

Objects and effects of acquisition (including but not limited to, disclosure of reasons for acquisition of target entity, if its business is outside the main line of business of the listed entity) |

The fund infused by the Company into AOL will be further invested in Aurigene Pharmaceutical Services Limited (“APSL”), a wholly-owned subsidiary of AOL and step down wholly owned subsidiary of the Company, to support the capex and working capital requirements of APSL. |

| 5 |

Brief details of any governmental or regulatory approvals required for the acquisition |

Not applicable. |

| 6 |

Indicative time period for completion of

the acquisition |

AOL has allotted 9,70,14,896 Equity shares of Rs.10 each at a premium of Rs. 57/- to the Company on May 23, 2024. |

| 7 |

Nature of consideration- whether cash consideration or share swap and details of the same |

Cash consideration |

| 8 |

Cost of acquisition or the price at which

the shares are acquired |

Cash consideration of Rs. 649,99,98,032/- towards subscription of equity shares of 9,70,14,896 equity shares of Rs.10 each at a premium of Rs. 57/- |

| 9 |

Percentage of shareholding / control acquired and / or number of shares acquired |

AOL is a wholly owned subsidiary of the Company. |

| 10 |

Brief background about the entity acquired in terms of products/line of business acquired, date of incorporation, history of last 3 years turnover, country in which the acquired entity has presence and any other significant information (in brief) |

AOL is a drug discovery and clinical stage biotech committed to bringing novel and effective therapeutics for the treatment of cancer. The company was incorporated on 10th of August 2001. The turnover of the company for the previous 3 years is shown in below table: |

| |

|

FY 2024 |

Rs.372 Cr |

|

| |

|

FY 2023 |

Rs.265 Cr |

|

| |

|

FY 2022 |

Rs.290 Cr |

|

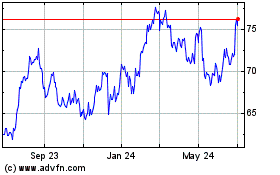

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

From May 2024 to Jun 2024

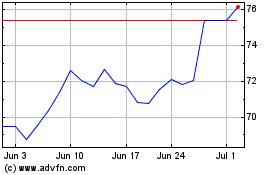

Dr Reddys Laboratories (NYSE:RDY)

Historical Stock Chart

From Jun 2023 to Jun 2024