Dominion Raises Offer for Owners of Its Midstream Unit

November 26 2018 - 5:32PM

Dow Jones News

By Micah Maidenberg

Dominion Energy Inc. boosted its buyout offer to owners of a

publicly traded subsidiary it formed several years ago to operate

natural-gas assets.

Dominion said in a statement Monday it will now offer unit

holders in Dominion Energy Midstream LP 0.2492 shares of Dominion

for each unit they hold in the partnership, higher than the

exchange ratio the utility offered in September of 0.2468.

Based on Dominion's closing price of $73.99 a share Monday, the

latest offer implies a valuation of $18.44 for Dominion Energy

Midstream units, which closed Monday at $18.28.

Dominion, a Richmond, Va.-based utility company, formed the

midstream partnership in 2014 to build up its natural-gas terminal,

processing, storage and transport assets, according to its latest

annual report.

Dominion owned about 61% of the midstream company as of Sept.

19, according to FactSet.

When it made the first offer, Dominion Chief Executive Thomas

Farrell cited weakness in capital markets for master limited

partnerships and a policy change implemented in March by the

Federal Energy Regulatory Commission as reasons the company was

pursuing the deal.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

November 26, 2018 17:17 ET (22:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

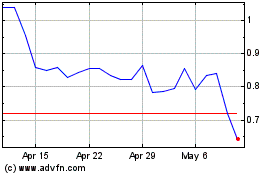

Desktop Metal (NYSE:DM)

Historical Stock Chart

From May 2024 to Jun 2024

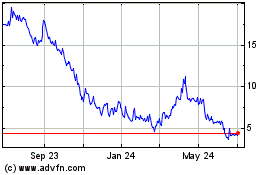

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Jun 2023 to Jun 2024