Earnings Preview: Skechers - Analyst Blog

February 13 2012 - 5:30AM

Zacks

Skechers USA Inc.

(SKX), the designer, marketer and distributor of footwear, is

slated to report its fourth-quarter 2011 financial results on

February 15, 2012. The current Zacks Consensus Estimate for the

quarter reflects a loss of 23 cents per share, representing a sharp

decline from earnings of 7 cents in the prior-year quarter.

Revenue, as per the Zacks Consensus Estimate, is $324 million.

Third-Quarter

Synopsis

Skechers delivered earnings of 7

cents a share, down approximately 90% from the prior-year period as

weak top-line performance weighed upon its bottom-line results.

However, the quarterly earnings fared better than the Zacks

Consensus Estimate of one cent a share.

However, including one-time items,

Skechers delivered earnings of 17 cents a share.

Skechers, which competes with

Deckers Outdoor Corporation (DECK), reported a

25.7% year over year drop in total net sales to $412.2 million,

reflecting lower sales of high priced toning shoes and sluggish

performances across other footwear lines. Moreover, the reported

revenue also came below the Zacks Consensus Estimate of $465

million.

Agreement of Estimate

Revisions

Of the 5 analysts covering the

stock, 2 revised the estimates downward in the last 30 days, while

none moved in the opposite direction.

In the last 7 days, none of the

analysts revised the estimates in either direction.

Magnitude of Estimate

Revisions

Following the estimate revisions,

the Zacks Consensus estimate of loss per share widened by 5 cents

over the last 30 days.

The downward revisions support the

view that revenue growth will remain muted in the coming quarters

as there is lack of near-term catalysts to drive sales. Further,

the company’s aggressive inventory offloading stance in order to

right-size its inventory coupled with lower average selling price

is taking a toll on its margins.

Mixed Earnings Surprise

History

With respect to earnings surprises,

Skechers has topped as well as missed the Zacks Consensus Estimate

over the last four quarters in the range of negative 53.3% to a

positive 600%. The average remained at positive 133.9%, indicating

that the company has surpassed the Zacks Consensus Estimate by the

same magnitude in the trailing four quarters.

Our Take

The company is trying to reposition

itself to drive growth by focusing on inventory optimization and

cost-containment efforts. Moreover, in our opinion, the company’s

international business provides an enormous scope for growth.

Further, Skechers’ sustained focus

on new line of products, opening of new retail stores and

distribution channels, and the development of new international

distribution agreements (in India and Mexico), should drive

profitability.

However, we remain on the sidelines

considering the company’s weak top-line performances and continued

margin pressure through lower average selling price.

Currently, we have a long-term

‘Neutral’ rating on the stock. Moreover, Skechers has a Zacks #3

Rank, which translates into a short-term ‘Hold’ recommendation.

DECKERS OUTDOOR (DECK): Free Stock Analysis Report

SKECHERS USA-A (SKX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

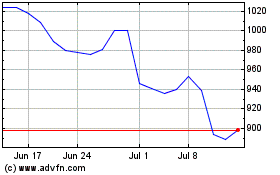

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From Apr 2024 to May 2024

Deckers Outdoor (NYSE:DECK)

Historical Stock Chart

From May 2023 to May 2024