Fresenius' 4Q EPS Meets, Sales Miss - Analyst Blog

February 22 2012 - 4:15AM

Zacks

Fresenius Medical

Care (FMS), the world's largest dialysis company, posted

fourth-quarter 2011 earnings per share of $1.02, in line with the

Zacks Consensus Estimate while exceeding the year-ago earnings of

90 cents. Net income (attributable to the company) shot up 14% year

over year to $310 million on the back of higher revenues.

For the year, earnings of $3.54 a

share missed the Zacks Consensus Estimate by a penny while

surpassing the year-ago earnings of $3.25. Profit (attributable to

the company) climbed 9% year over year to $1,071 million.

Revenue

Analysis

Net revenues rose 5% (up 6% at

constant currency) year over year to $3,323 million, but missed the

Zacks Consensus Estimate of $3,382 million. Organic revenue growth

was 3% on a global basis. For the full year, revenues rose 6% year

over year to $12,795 million, also below the Zacks Consensus

Estimate of $12,871 million.

Geographically, revenues from the

North American markets crept up 1% to $2,096 million in the fourth

quarter while overseas revenues jumped 12% (up 14% at constant

currency) to $1,223 million.

International sales were boosted by

double-digit growth in dialysis product and services revenues while

domestic revenues were hurt by the negative impact of the

implementation of the new Medicare end-stage renal disease

prospective payment system (the “bundled rate” system), which

resulted in lower reimbursement.

Dialysis services revenues nudged

up 3% year over year to $2,435 million with domestic and

international sales rising 1% and 13%, respectively, to $1,882

million and $553 million. Average revenue per treatment for

domestic clinics declined to $351 from $355 a year ago, impacted by

reduced Medicare reimbursement.

Consolidated dialysis product

revenues spiked 9% year over year to $888 million. Dialysis product

sales in domestic markets grew just 2% to $214 million as higher

sales of hemodialysis products were, in part, neutralized by

pricing cuts on renal drugs.

International dialysis product

sales jumped 11% to $669 million, boosted by higher sales of

peritoneal dialysis products, dialyzers, dialysis machines and

products for acute care treatments.

Operating

Statistics

Fresenius operated a network of

2,898 dialysis clinics (up 6% year over year) across North America

and the overseas markets at the end of 2011. It has provided

dialysis treatment to 233,156 patients (up 9% year over year)

worldwide as of December 31, 2011. During the year, the company

provided roughly 34.39 million dialysis treatments globally, up 9%

year over year.

Margins

Operating margin rose to 17.7% from

17% a year ago. In North America, operating margin climbed to 19.1%

from 17.9% driven by favorable pharma costs. Operating margin for

overseas markets increased to 18.7% from 18% helped by favorable

currency exchange movements and growth in Asia-Pacific.

Cash Flows

Fresenius generated operating cash

flows of $497 million (roughly 15% of sales) in the fourth quarter,

a 46% year-over-year surge. The company spent $191 million on

capital expenditure in the quarter. Free cash flows (prior to

acquisitions) soared 77% year over year to $306 million. Fresenius

spent $1,775 million on acquisitions in 2011.

Acquisitions

Fresenius, on October 1, 2011,

closed its acquisition of U.S. based American Access Care Holdings

for $385 million. American Access runs outpatient clinics, which

serve the vascular access needs of dialysis patients. The

acquisition is expected to contribute roughly $175 million in

annual sales. Fresenius is also on track to close its $1.7

billion acquisition (expected in first-quarter 2012) of leading

dialysis company Liberty Dialysis Holdings Inc.

Guidance

Moving ahead, Fresenius envisions

sales of roughly $14 billion for 2012, taking into account certain

accounting changes. This represents a roughly 11% increase from the

comparable sales of 2011. The current Zacks Consensus Estimate for

2012 is $14,359 million.

Net income for the year is expected

at $1.3 billion and net income (attributable to shareholders) is

pegged at $1.14 billion. Operating margin is expected to be around

16.9%. The company expects capital expenditure of roughly $700

million and expects to spend around $1.8 billion on

acquisitions.

Fresenius Medical, which employs

79,159 people globally, is the largest provider of products and

services for patients undergoing dialysis treatment on the planet.

The company’s principal competitor in the U.S. is DaVita

Inc. (DVA), which provides dialysis services for patients

suffering from chronic kidney failure or end stage renal

disease.

DAVITA INC (DVA): Free Stock Analysis Report

FRESENIUS MED (FMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

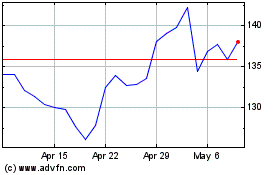

DaVita (NYSE:DVA)

Historical Stock Chart

From Apr 2024 to May 2024

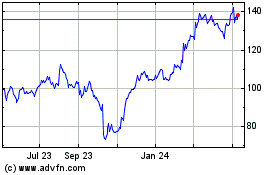

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2023 to May 2024