DaVita Inc. (DVA) reported fourth-quarter

income from continuing operations of $1.58 per share, which

surpassed the Zacks Consensus Estimate of $1.48 and prior-year

quarter earnings of $1.13. Operating income amounted to $149.4

million, compared with $111.9 million in the fourth quarter of

2010.

Including an after-tax debt refinancing and redemption charge of

$42.9 million or 43 cents per share, the prior-year quarter’s

operating income amounted to $68.9 million or 70 cents per

share.

Net income was $148.1 million or $1.56 per share, almost double

from $69.0 million or 70 cents per share in the year-ago quarter.

The increased income was attributable to better-than-expected

revenue, which was partly offset by higher expenses and loss from

discontinued operations.

Net operating revenues for the reported quarter climbed to $1.86

billion, surpassing the year-ago revenue of $1.65 billion. Total

operating expenses and charges also climbed to $1.53 billion from

$1.39 billion in the fourth quarter of 2010.

Segment wise, revenues from the Dialysis and related

Lab Services segment for the quarter came in at $1.72

billion, against $1.54 billion in the prior-year quarter.

Operating income for the segment increased to $353 million in

the reported quarter from $332 million in the year-ago quarter.

Ancillary services and strategic

initiatives generated revenues of $148 million,

increasing from $137 million in the year-ago quarter. However, the

segment recorded operating loss of $13 million in the reported

quarter, far wider than $3 million in the year-ago quarter.

Loss from discontinued operations in the reported quarter was

$0.239 million, declining from an income of $0.093 million in the

year-ago quarter. The company also recorded a loss of $1.07 million

on disposal of discontinued operations in the fourth quarter of

2011.

DaVita provided administrative services across 1,809 outpatient

dialysis centers in the US, serving approximately 142,000 patients

in 2011. Additionally, the company provided administrative services

in 11 outpatient dialysis centers in three non-US countries.

However, only 1,784 centers, including 8 centers outside the US,

were consolidated in the financial statements.

DaVita acquired and opened a total of 45 centers during the

reported quarter. Additionally, the company divested 2 centers in

order to complete the DSI acquisition.

Total US treatments for the reported quarter came in at

approximately 5.23 million. This represents a per day increase of

12.4% over the year-ago quarter. The growth of non-acquired

treatment in the quarter stood at 4.4%.

The company's effective tax rate was 34.1% in the reported

quarter. The third party owners’ income attributable to non-tax

paying entities impacted the effective tax rate. The effective tax

rate attributable to DaVita in the reported quarter was 38.0%.

Full-Year 2011 Highlights

For 2011, DaVita reported operating income per share of $5.14,

which surpassed the Zacks Consensus Estimate of $5.05 and

prior-year earnings of $4.37. Operating income amounted to $496.2

million, compared with $450.8 million in 2010.

Operating income excludes an after-tax non-cash goodwill

impairment charge of $14.4 million or 15 cents per share in 2011

and an after-tax debt refinancing and redemption charge of $45.4

million or 44 cents per share in 2010. Including the charges,

income from continuing operations amounted to $481.8 million or

$4.99 per share in 2011 and $405.4 million or $3.93 per share in

2010.

Reported net income came in at $478.0 million against $405.7

million in 2010. Net operating revenue was $6.98 billion,

increasing from $6.44 billion in 2010, while total operating

expenses and charges increased to $5.85 billion from $5.44

billion.

Financial Update

In 2011, operating cash flow was $1.18 billion, reflecting a

jump from $839.7 million in the prior-year quarter.

Total assets at the end of 2011 were $8.89 billion, up from $

8.11 billion on December 31, 2010, while long-term debt as of

December 31, 2011 increased to $4.42 billion from $4.23 billion as

of December 31, 2010.

Shareholders’ equity at the end of 2011 amounted to $2.14

billion, up from $1.98 billion at 2010-end.

Outlook

DaVita affirmed its previously disclosed operating income

guidance of $1.2–1.3 billion for 2012. Additionally, the company

revealed its operating cash flow guidance of $0.95–1.05

billion.

The company expects the effective tax rate attributable to

DaVita to be in the range of 40–41% for fiscal 2012.

Our Take

DaVita is showing revenue upsides in both its business segments,

which is driving the top line. Moreover, the company also has

strong cash flows and a sturdy balance sheet. We expect the cash

flows to remain strong in the upcoming quarters as well, based on

higher-than-expected cash flow during all the four quarters of

2011.

The strong financial position of DaVita provides the potential

for meaningful mergers and acquisitions, which convinces us that

the company will continue its growth story. Moreover, the long-term

Epogen purchase deal with Amgen

Inc. (AMGN) is expected to reduce the company’s

expenditure on the drug by a substantial amount. Thus, we are

optimistic about the company’s growth potential.

The shares of DaVita currently carry a Zacks #2 Rank, implying a

short-term ‘Buy’ rating. We are also maintaining a long-term

‘Outperform’ recommendation on the shares.

AMGEN INC (AMGN): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

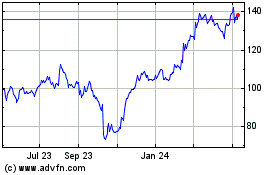

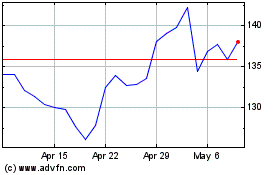

DaVita (NYSE:DVA)

Historical Stock Chart

From Apr 2024 to May 2024

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2023 to May 2024