Buffett's Berkshire Reports New Stakes In DaVita, Liberty Media

February 14 2012 - 6:33PM

Dow Jones News

Warren Buffett's Berkshire Hathaway Inc. (BRKA, BRKB) revealed

new investments in DaVita Inc. (DVA) and Liberty Media, though both

holdings were small enough to suggest they may not have been made

by the company's famed leader.

Berkshire held 2.68 million shares of DaVita, one of the largest

U.S. providers of dialysis services, as of Dec. 31, according to a

regulatory filing released Tuesday. The stake was worth $203

million.

The 1.7 million Liberty Media shares were valued at $132 million

at the end of the year. The company is a media conglomerate

controlled by John Malone.

Buffett's company also reported additional shares of Intel Corp.

(INTC), Visa Inc. (V), General Dynamics Corp. (GD), CVS Caremark

Corp. (CVS) and DirecTV Group Inc. (DTV). Berkshire had first

reported owning stakes in these companies earlier this year. All

but the DirecTV stake were worth less than $300 million at

year-end, and because of their size, many Buffett watchers have

concluded they were likely the work of Todd Combs, a relatively new

Berkshire investment manager.

The company also reported increased holdings in a long-held

position in Wells Fargo & Co. (WFC), a Buffett favorite.

Berkshire reported smaller stakes in Kraft Foods Inc. (KFT) and

Johnson & Johnson (JNJ), according to the filing. It also

appeared to have exited a position in Exxon Mobil Corp. (XOM).

The changes in Berkshire's equity portfolio were made in the

last three months of 2011, when the benchmark Standard & Poor's

500 Stock Index rose 11%. Buffett, one of the world's richest

people, wrote on Fortune magazine's website last week that

investing in stocks or buying "first-class businesses" outright are

far better options over the long term than bonds or gold, two

assets that "enjoy maximum popularity at peaks of fear."

Berkshire's total U.S. stock investments were worth $66.2

billion as of Dec. 31, up from the $59.1 billion Berkshire reported

a quarter earlier. Buffett's company, like other firms that control

an investment portfolio of more than $100 million, is required to

report its U.S. stock holdings 45 days after the end of a given

quarter.

News about Berkshire's stock picks has the power to move the

market. Some money managers use the disclosure to mimic the

investment success of the "Oracle of Omaha."

Buffett, 81, has long warned that not all the moves in the

investment portfolio are his. A portion of the portfolio was long

managed by Lou Simpson, the investment manager at Berkshire-owned

car insurer Geico Corp. He stepped down a year ago and Buffett has

named two new money managers: Combs and Ted Weschler, who was to

join Berkshire early this year after winding down his hedge fund,

Peninsula Capital Advisors LLC.

Each of the two men has about $3 billion to investment

initially, Buffett has said. But they will gradually get more of

Berkshire's money to invest over time and may be joined by a third

investment manager. Upon Buffett's eventual departure from the

company, the managers would take over Berkshire's entire stock and

debt portfolio.

Berkshire also showed a stake of 63.9 million shares of

International Business Machines Corp. (IBM), up from 57.3 million

at the end of the third quarter. Buffett had disclosed that

position on CNBC in November.

-By Erik Holm, Dow Jones Newswires; 212-416-2892;

erik.holm@dowjones.com

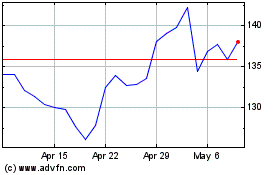

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

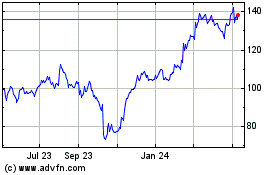

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024