Earnings Preview: DaVita Inc. - Analyst Blog

February 14 2012 - 6:45AM

Zacks

A leading dialysis services provider in the U.S, DaVita

Inc. (DVA), is slated to release its fourth-quarter 2011

financial results after the market closes on February 16, 2012.

Currently, the Zacks Consensus Estimate for fourth quarter is

$1.48 per share, representing a 31% growth over the year-ago

quarter.

DaVita has been generating strong operating cash flow accruing

from improved earnings, robust cash collections and the timing of

payments for working capital expenditures. Moreover, the company’s

acquisition strategy has been accretive to earnings, while a strong

cash position expands the potential for further meaningful M&A.

However, the headwinds from debt refinancing and ongoing concerns

related to health care reform and payor mix cast an apprehensive

outlook.

Previous Quarter Performance

DaVita reported third-quarter income from continuing operations

of $1.45 per share, which exceeded the Zacks Consensus Estimate by

a penny. The earnings were also significantly higher than $1.15 in

the prior-year quarter. Operating income for the third quarter of

2011 came in at $138.2 million, showing a substantial improvement

from $119.5 million in the year-ago quarter.

Net income was $135.4 million or $1.42 per share, showing a hike

from $119.4 million or $1.15 per share in the year-ago quarter.

Net operating revenues for the quarter climbed to $1.81 billion,

surpassing $1.65 billion a year ago, while total operating expenses

and charges climbed to $1.49 billion from $1.39 billion in the

third quarter of 2010.

Agreement of Estimate Revisions

Ahead of the earnings release, we do not see any movement in the

analyst estimates. Over the last 30 days, none of the 12 analysts

covering the stock revised their estimates for the fourth quarter.

Moreover, for the full year, none of the 13 firms covering the

stock revised their estimates over the last 30 days. This implies

that the analysts do not foresee any significant directional

pressure on the earnings.

Magnitude of Estimate Revisions

There have been no estimate revisions over the last 90 days. As

a result, earnings per share guidance remained at $1.48 for the

fourth quarter of 2011 and $5.05 for full-year 2011.

Earnings Surprise

Going by past trends, we are slightly optimistic about DaVita

exceeding estimates. The company exceeded estimates in three of the

preceding four quarters. The average earnings surprise was a

positive 0.97%. This implies that the company has beaten the Zacks

Consensus Estimate by the same magnitude over the last four

quarters.

Conclusion

Acquisition of dialysis centers and businesses that own and

operate dialysis centers has been DaVita’s preferred business

strategy since years, generating substantial inorganic growth.

Since September 2011, the company completed the acquisition of DSI

Renal Inc. and announced the acquisition of ModernMed and ExtraCorp

AG. Moreover, the company is slowly but steadily moving into the

international markets. In January 2012, the company announced the

purchase of a majority stake in NephroLife, an India-based kidney

care company.

Additionally, DaVita has been generating strong operating cash

flow over the years. Higher-than-expected cash flow during the

first three quarters allowed the company to raise the 2011

operating cash flow guidance to $1.02–1.10 billion from the

previous guidance of $900–980 million.

Moreover, the long-term Epogen purchase deal with

Amgen Inc. (AMGN) is expected to

reduce the company’s expenditure on the drug by a substantial

amount. However, DaVita’s debt refinancing continues to keep the

company’s financial leverage at elevated levels, thereby limiting

its ability to refinance the debt or seek additional financing at

acceptable terms.

Additionally, the mix of treatments reimbursed by non-government

payors, as a percentage of total treatments, has been falling

consistently over the years. The trend is negatively impacting

DaVita as the company generates a sizeable portion of its revenues

from dialysis and related lab services from patients who have

commercial payors as the primary payor.

The shares of DaVita currently carry a Zacks #2 Rank, implying a

short-term ‘Buy’ rating. We are also maintaining a long-term

‘Outperform’ recommendation on the shares.

AMGEN INC (AMGN): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

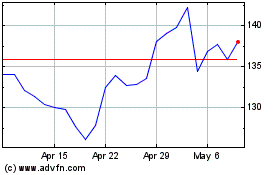

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

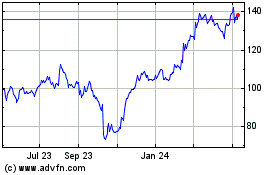

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024