DaVita Upgraded to Outperform - Analyst Blog

January 25 2012 - 11:00AM

Zacks

We have upgraded our recommendation on DaVita

Inc. (DVA) to Outperform from Neutral based on the

company’s strong cash flows and strategic acquisitions. The bundled

ESRD payment system is also expected to be a long-term

positive.

DaVita reported third-quarter 2011 operating earnings of $138.2

million or $1.45 per share, exceeding the Zacks Consensus Estimate

by a penny. Results were also higher than the $119.5 million or

$1.15 per share earned in the comparable quarter of 2010.

DaVita has been generating strong operating cash flow accruing

from improved earnings and robust cash collections, leading to a

4-year CAGR (2007–2010) of 13.1%. Higher-than-expected cash flow

during the first three quarters of 2011 also allowed the company to

raise its 2011 operating cash flow guidance to $1.02–1.10 billion

from $900–980 million. The company projects similar growth in the

future and believes that it will be able to meet its capital

expenditures, as well as repurchase shares and spend on

acquisitions.

In addition to improving its operating performance, DaVita

constantly seeks to generate cost efficiencies. The recent

long-term Epogen purchase deal with Amgen

Inc. (AMGN) is expected to significantly reduce

the company’s expenditure on Epogen, a medicine used for increasing

red blood cells in kidney patients.

Moreover, DaVita is regularly expanding via acquisitions. In

January 2012, the company’s subsidiary – Paladina Health LLC –

announced the acquisition of ModernMed, which operates clinics and

physician practices in 12 states across the U.S.

However, DaVita is facing multiple investigations for

over-billing of Medicare and over-use of Epogen. If the charges are

found to be true, the company will not only suffer substantial

reduction in goodwill, but will also face several lawsuits and

might be heavily fined, weighing on the financials.

Moreover, a significant portion of DaVita’s dialysis and related

lab services revenues are generated from patients who have

commercial payors as the primary payor. However, unemployment may

result in the shifting of people from commercial insurance schemes

to more affordable government schemes.

Moreover, the shift will be harmful as the Medicaid was reduced

by many states in 2011 and many others are considering the

possibility of reducing the rate. Furthermore, almost 87% of

DaVita’s patients already use Medicare or Medicaid programs,

thereby leading to additional pressure on the company, as

inadequacy of government reimbursements will substantially affect

profitability.

The Zacks Consensus Estimate for DaVita’s fourth-quarter

earnings is currently $1.48 per share, up about 31% year over year.

None of the 12 firms covering the stock revised their estimates in

the last 30 days. For 2011, earnings are expected to be about $5.05

per share, climbing about 15% year over year.

DaVita currently caries a Zacks #1 Rank, implying a short-term

‘Strong Buy’ rating.

AMGEN INC (AMGN): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

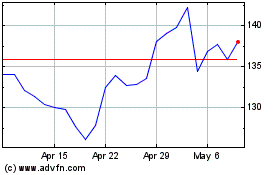

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

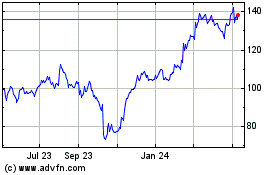

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024