Fresenius Completes IDC Buy - Analyst Blog

July 05 2011 - 10:15AM

Zacks

Fresenius Medical

Care (FMS), the largest provider of dialysis products and

services on the planet, has wrapped up its acquisition of Euromedic

International’s (“Euromedic”) dialysis service division

International Dialysis Centers (“IDC”) for €485 million (roughly

$648 million). This follows the regulatory approvals of the deal

(announced in January 2011) by the anti-trust authorities.

IDC provides treatment to over

8,200 hemodialysis patients mainly in Central and Eastern Europe

and runs 70 clinics in nine nations. The acquisition enables

Fresenius to expand its role in the dialysis care business, mainly

in the fast-growing Eastern European markets, where IDC has a major

presence. For its part, Euromedic will focus on cancer treatment

and diagnostic arenas.

The newly acquired business

is expected to contribute about $180 million in annual

revenues for Fresenius. Moreover, the acquisition is expected to be

accretive to its earnings in the very first year following the

transaction closure. Fresenius financed the acquisition with its

internal cash flows and available borrowing capacity.

Fresenius operates a network of

about 2,769 dialysis clinics across North America and overseas

markets to provide dialysis treatment to 216,942 patients

worldwide. Dialysis treatment is required by victims of chronic

kidney failure, a condition that affects over 2 million people

globally each year. Fresenius’ principal competitor in the U.S. is

DaVita Inc. (DVA), which provides dialysis

services for patients suffering from chronic kidney failure or

end-stage renal disease.

Fresenius’ first-quarter 2011

profit rose 4.5% year over year on the back of higher sales which

climbed roughly 5%. Its international sales were boosted by higher

dialysis services revenues while domestic sales were hit by the

unfavorable impact of the implementation of the new Medicare

end-stage renal disease prospective payment system (the “bundled

rate” system), which resulted in a cap in reimbursement.

During the quarter the company

provided roughly 8.17 million dialysis treatments globally.

Encouraged by its reasonably healthy first quarter results and

factoring in the favorable impact of Medicare’s elimination of fees

related to the new bundled system, Fresenius has raised its

revenues and earnings guidance for fiscal 2011.

DAVITA INC (DVA): Free Stock Analysis Report

FRESENIUS MED (FMS): Free Stock Analysis Report

Zacks Investment Research

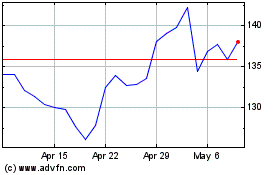

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

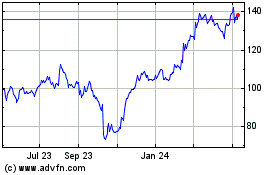

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024