BOK Financial Corporation’s (BOKF)

fourth-quarter 2011 earnings came in at 98 cents per share, below

the Zacks Consensus Estimate by 12 cents. Results were, however,

above 86 cents per share in the prior-year quarter, although it

missed the prior quarter's earnings of $1.24 per share.

The earnings results primarily reflect a decrease in net

interest revenue and lower fees and commissions sequentially,

thereby leading to reduced top-line growth. However, these

negatives were partially offset by decreased operating expenses.

Moreover, improved credit quality and growth in loans and deposits

were also positives for the quarter.

Net income in the reported quarter was $67.0 million compared

with $85.1 million in the prior quarter and $58.8 million in the

prior-year quarter.

For full-year 2011, net income was $285.9 million or $4.17 per

share, up 16% year over year (y/y). However, the reported full year

earnings lagged the Zacks Consensus Estimate of $4.32.

Performance in Detail

BOK Financial reported total revenue of $309.5 million in the

quarter, down 11.4% from $349.4 million in the prior quarter.

Moreover, revenue was also below the Zacks Consensus Estimate of

$313.0 million.

For full year, total revenue was $1.26 billion, up 2.4% from

$1.23 billion in the prior year. Moreover, revenue also exceeded

the Zacks Consensus Estimate of $1.22 billion.

Net interest revenue totaled $171.5 million in the reported

quarter, down 2.2% sequentially. Net interest margin also fell 14

basis points (bps) from the prior quarter to 3.20%. However, the

effect of lower interest rates on net interest revenue was

partially offset by earning asset growth, which increased $789

million during the quarter under review.

Fees and commissions revenue totaled $131.8 million, reflecting

a sequential downside of 9.7%. The decline was fueled by lower

brokerage and trading revenue, mortgage banking revenue and

transaction card revenue. Moreover, transaction card revenue

dropped mainly due to interchange fee regulations, which became

effective October 1, 2011. BOK Financial expects these regulations

to reduce annual interchange revenue by $20 million to $25

million.

Total operating expenses were $219.2 million, down 0.8%

sequentially. Excluding changes in the fair value of mortgage

servicing rights, operating expenses totaled $213.9 million, up

$17.9 million from the prior quarter. Nevertheless, the company

experienced increases in personnel expenses, though non-personnel

expenses remained flat sequentially. The rise in personnel expenses

was primarily due to increased incentive compensation expenses.

Credit Quality

The credit quality of BOK Financial’s loan portfolio produced

improved results. Nonperforming assets totaled $357 million or

3.13% of outstanding loans and repossessed assets as of December

31, 2011, down from $388 million or 3.45%, respectively, as of

September 30, 2011.

Net loans charged off edged down 6.9% to $9.5 million from $10.2

million in the prior quarter. Moreover, negative provision for

credit losses of $15 million was recorded in the fourth quarter of

2011, following no provision for credit losses in the prior

quarter.

Further, the combined allowance for credit losses totaled $263

million or 2.33% of outstanding loans as of December 31, 2011,

declining from $287 million or 2.58% of outstanding loans as of

September 30, 2011.

Capital Position

At December 31, 2011, armed with strong capital ratios, the

company and its subsidiary bank exceeded the regulatory definition

of well capitalized. As of December 31, 2011, Tier 1 and total

capital ratios were 13.27% and 16.49%, respectively, compared with

13.14% and 16.54%, respectively as of September 30, 2011. Moreover,

its tangible common equity ratio marginally declined to 9.56% from

9.65% as of September 30, 2011.

Outstanding loan balances at BOK Financial were $11.3 billion as

of December 31, 2011, up from $11.1 billion as of September 30,

2011. Growth in commercial loan and residential mortgage loan

balances was partially offset by lower consumer loans. Moreover,

period-end deposits totaled $18.8 billion as of December 31, 2011,

up from $18.4 billion as of September 30, 2011.

Share Repurchase and Dividend Update

During the reported quarter, the company repurchased 69,581

common shares at an average price of $51.44 per share, through a

previously-announced share repurchase program.

During the fourth quarter of 2011, the Board of Directors of BOK

Financial increased its quarterly cash dividend to 33 cents per

share, indicating quarterly cash dividend increase twice in

2011.

On January 31, 2012, the Board of Directors approved a quarterly

cash dividend of 33 cents per share. The dividend will be paid on

February 29, 2012 to shareholders of record as of February 15,

2012.

Our Take

The strategic expansions and local-leadership based business

model of BOK Financial, which has peers such as

Cullen/Frost Bankers Inc. (CFR) and First

Financial Bankshares Inc. (FFIN), have aided its expansion

into a leading financial service provider from a small bank in

Oklahoma.

The company’s diverse revenue stream, sturdy capital position

and expense control initiatives augur well for investors. The

dividend hike will also bode well and boost investors’

confidence.

Nevertheless, with a protracted economic recovery, we expect

revenue growth to be restricted. Furthermore, we remain concerned

about the regulatory issues and the margin pressure resulting from

a highly liquid balance sheet.

The shares of BOK Financial currently retain a Zacks #3 Rank,

which translates into a short-term ‘Hold’ rating. Considering the

company’s business model and fundamentals, we have a long-term

“Neutral” recommendation on the stock.

BOK FINL CORP (BOKF): Free Stock Analysis Report

CULLEN FROST BK (CFR): Free Stock Analysis Report

FIRST FIN BK-TX (FFIN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

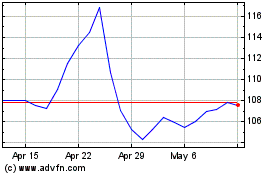

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jun 2024 to Jul 2024

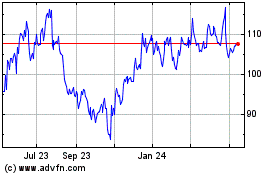

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jul 2023 to Jul 2024