BOK Financial's Outlook Positive - Analyst Blog

August 04 2011 - 1:13PM

Zacks

The long-term Issuer Default Ratings (IDR) of BOK

Financial Corp. (BOKF) and its lead bank subsidiary, BOKF,

NA was affirmed by Fitch Ratings at 'A-'. However, the rating

outlook has been revised to Positive from Stable.

The rating affirmation of BOK Financial can be attributed to

strong and consistent performance amidst a tough credit cycle as

opposed to dividend cuts or bailout relief. To the company’s

credit, its steady performance aided it in maintaining a solid

capital position.

BOK Financial has adhered to conservative underwriting standards

and this resulted in sturdy asset quality with very low charge-off

levels, which in turn bolstered its performance. Besides, its

diverse revenue mix as well as favorable geographic footprint has

backed its growth.

Offsetting the positives are an elevated level of nonperforming

assets (NPAs) and a $500 million exposure to sub investment grade

private-label mortgage-backed securities. Higher NPA levels reflect

the company’s slow asset disposition process rather than poor asset

quality. These raise the company’s future credit loss risk. The

company also possesses a highly liquid balance sheet that weighs on

its interest margin. Yet, the company saw a steady margin as it is

managed well.

The revision in outlook to positive stems form the rating

agency’s view that BOK Financial’s persistent and solid operating

performance coupled with a reduction in NPA levels as well as

private-label mortgage-backed securities without incurring

substantial credit impairments, could lead to BOK's IDR

upgrade.

BOK Financial’s growth strategy has involved comparatively

smaller footprint acquisitions and this has helped the company to

garner a larger share of the market. If prospects arise, this

strategy could continue in the near to intermediate term. However,

if the company alters its growth strategy, making larger

acquisition or moving out of its current footprint, its ratings may

come under pressure.

BOK Financial’s second quarter 2011 earnings came in at $69.0

million or $1.00 per share, which were above the Zacks Consensus

Estimate of 98 cents. The results also compare favorably with the

prior-quarter earnings of $64.8 million or 94 cents and prior-year

earnings of $63.5 million or 93 cents.

Results primarily reflect a decrease in loan loss provisions and

improved credit quality. Increases in fees and commissions revenue

also supported top-line growth.

Our Take

Strategic expansions and local-leadership based business model

of BOK Financial, which has peers such as Cullen/Frost

Bankers Inc. (CFR) and First Financial Bankshares

Inc. (FFIN), have aided its expansion into a leading

financial service provider from a small bank in Oklahoma.

A diverse revenue stream, sturdy capital position and expense

control initiatives augur well. A dividend hike is encouraging. Yet

a slow economic recovery and regulatory issues remain headwinds to

the company.

BOK Financial shares are maintaining a Zacks #3 Rank, which

translates into a short-term Hold recommendation.

BOK FINL CORP (BOKF): Free Stock Analysis Report

CULLEN FROST BK (CFR): Free Stock Analysis Report

FIRST FIN BK-TX (FFIN): Free Stock Analysis Report

Zacks Investment Research

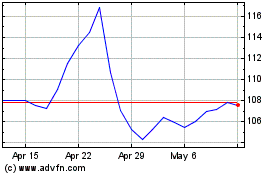

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Aug 2024 to Sep 2024

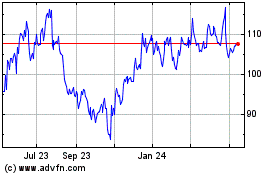

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Sep 2023 to Sep 2024