Hurricane Ike Costs Biggest Impact on Results SAN ANTONIO, Oct. 22

/PRNewswire-FirstCall/ -- Cullen/Frost Bankers, Inc. (NYSE:CFR)

today reported earnings for the third quarter of 2008 of $49.0

million, compared to the $56.5 million reported for the same period

in 2007. On a per-share basis, net income for the quarter was $.82

per diluted common share, compared to the $.95 per diluted common

share reported a year earlier. Approximately $10 million of the

provision for possible loan losses or $.11 on an after-tax

per-share basis was related to the projected impact of Hurricane

Ike on the Corporation's operations in the Houston and Galveston

markets. Return on average assets and return on average equity for

the third quarter of 2008 were 1.44 percent and 12.39 percent,

respectively, compared to 1.72 percent and 16.44 percent for the

same quarter in 2007. For the third quarter of 2008, net interest

income on a tax-equivalent basis was $139.7 million, a 3.7 percent

increase compared to the $134.7 million for the same quarter of

2007. Average loans for the third quarter of 2008 rose 13.4

percent, to $8.4 billion, compared to the $7.4 billion reported for

the third quarter a year earlier. Average deposits for the quarter

increased to $10.4 billion, up 1.5 percent over the $10.3 billion

reported for the third quarter of 2007. "Cullen/Frost continues to

generate positive results in the midst of a financial storm that

has taken many banks with it," said Dick Evans, chairman and CEO.

"But the storm that affected us the most this quarter was Hurricane

Ike -- a Texas-sized natural disaster that slammed the Texas coast

at Galveston and Houston. Thanks to extraordinary planning and

execution, most of our Houston locations were up and running within

a week, and Galveston locations were operational two weeks later.

"We generated solid growth in non-interest income, including an

11.3 percent increase in trust income. I was pleased to see loans

rise by over 13 percent, as deposits were up about 2 percent. It

was also good to see the net interest margin up six basis points

over the previous quarter to 4.74 percent. In the first few weeks

of the fourth quarter, we are seeing an increase in deposits as

consumers and businesses alike, considering Frost a safe haven,

move money and relationships to our company. "This quarter we

opened new financial centers in Houston and San Antonio, including

our first on a college campus at the University of Texas at San

Antonio, with additional locations opening in the coming months. We

are fortunate to operate only in the state of Texas, in some of the

top markets in the country. With a senior management team on board

who helped us survive the 1980s, we have a proven track record of

managing through challenging financial times. Our exceptional staff

continues to perform at a high level, and that was never more

evident than during the hurricane, when many employees went above

and beyond to make sure we took care of our customers as well as

fellow employees. I am deeply grateful for their dedication." For

the first nine months of 2008, earnings were $154.3 million, or

$2.61 per diluted common share, compared to $157.4 million, or

$2.62 per diluted common share, for the same period in 2007.

Returns on average assets and equity for the first nine months of

2008 were 1.53 percent and 13.23 percent respectively, compared to

1.62 percent and 15.21 percent for the same period a year earlier.

Noted financial data for the third quarter of 2008 follows. -- Tier

1 and Total Risk-Based Capital Ratios for the Corporation at the

end of the third quarter of 2008 were 10.3 percent and 12.7

percent, respectively. These same ratios for Frost Bank were 10.4

percent and 11.9 percent, respectively. These capital ratios for

the Corporation and Frost Bank are well in excess of the levels

necessary to be considered well-capitalized. -- Net-interest income

on a taxable equivalent basis for the third quarter totaled $139.7

million, an increase of 3.7 percent compared to $134.7 million for

the same period a year ago. This increase primarily resulted from

an increase in the average volume of earning assets and an increase

in the net interest margin. The net interest margin was 4.74

percent for the third quarter of 2008, an increase of five basis

points compared to 4.69 percent for the third quarter of 2007, and

up six basis points from 4.68 percent for the second quarter of

2008. -- Non-interest income for the third quarter of 2008 totaled

$77.3 million, a 9.3 percent increase from $70.8 million reported

for the third quarter of 2007. Trust income rose $2.0 million to

$19.7 million, an 11.3 percent increase from a year earlier,

primarily from increases in oil and gas trust management fees, up

$1.3 million, and investment fees, up $629 thousand. Service

charges on deposit accounts were $22.6 million, up $1.9 million or

9.4 percent, compared to $20.7 million for the third quarter of

2007. Impacting this rise was a $2.1 million increase in service

charges on commercial accounts, resulting from higher treasury

management fees. A drop in the earnings credit rate for commercial

accounts, compared to a year earlier, impacted treasury management

fees. When interest rates are lower, customers earn less credit for

their deposit balances, and this, in turn, increases the amount of

service charges to be paid for through fees. Other non-interest

income was $15.9 million, a 14.6 percent increase over the $13.8

million reported the same quarter a year earlier. Insurance

commissions and fees were $8.3 million, compared to $7.7 million

reported the same quarter a year earlier. -- Non-interest expense

was $123.0 million for the quarter, up $9.4 million, or 8.3

percent, from the $113.6 million reported a year earlier. Total

salaries and wages and related employee benefits rose to $68.5

million, up 7.5 percent, compared to the third quarter of 2007.

This increase was impacted by normal annual merit increases,

combined with increases in the number of employees and increases in

incentive compensation. Net occupancy expense was $10.3 million, an

increase of $833 thousand from the third quarter last year due

mainly to increases in utilities and building maintenance.

Furniture and equipment was $9.7 million, which was up $864

thousand from the same quarter last year. This increase occurred

due to increases in service contracts expense, depreciation expense

related to furniture and fixtures and software maintenance expense.

Other expenses rose $3.2 million, from the third quarter last year.

Significant components of this increase included FDIC insurance

expense, up $1.6 million, and sundry expense from various

miscellaneous items, up $1.4 million. Included in the sundry

expense increase was a $1.0 million for costs related to the impact

on operations in Houston and Galveston from Hurricane Ike. -- For

the third quarter of 2008, the provision for possible loan losses

was $18.9 million, compared to net charge-offs of $6.4 million. For

the third quarter of 2007, the provision for possible loan losses

was $5.8 million, compared to net charge-offs of $9.6 million.

Approximately $10 million of the provision for possible loan losses

was related to Hurricane Ike, which impacted the Corporation's

operations in Houston and Galveston during the third quarter of

2008. The allowance for possible loan losses as a percentage of

total loans was 1.25 percent at September 30, 2008, compared to

1.24 percent at the end of the third quarter last year and 1.13

percent at the end of the second quarter of 2008. In light of the

national financial crisis and the enactment of the Emergency

Economic Stabilization Act of 2008, U.S. government agencies are

taking various actions in an attempt to enhance financial

stability. These include the U.S. Treasury Department's Troubled

Asset Relief Program Capital Purchase Program, which offers to all

U.S. banking organizations the opportunity to issue and sell

preferred stock, along with warrants to purchase common stock, to

the U.S. Treasury on what may be considered attractive terms. In

addition, the FDIC has initiated the Temporary Liquidity Guarantee

Program that will provide a 100 percent guarantee for a limited

period of time to newly issued senior unsecured debt and

non-interest bearing transaction deposits. Coverage under the

Temporary Liquidity Guarantee Program is available for 30 days

without charge and thereafter at a cost of 75 basis points per

annum for senior unsecured debt and 10 basis points per annum for

non-interest bearing transaction deposits. Although Cullen/Frost's

and Frost Bank's capital ratios remain well above the minimum

levels required for well capitalized status and have not been

adversely affected in any significant respect by the national

financial crisis, Cullen/Frost is assessing its participation in

both programs but has not yet made a definitive decision as to

whether it will participate. Cullen/Frost Bankers, Inc. will host a

conference call on Wednesday, October 22, 2008, at 10:00 a.m.

Central Time (CT) to discuss the results for the quarter. The media

and other interested parties are invited to access the call in a

"listen only" mode at 1-800-944-6430. Digital playback of the

conference call will be available after 2:00 p.m. CT until midnight

Sunday, October 26, 2008 at 800-642-1687 with Conference ID # of

68273995. The call will also be available by webcast at the URL

listed below and available for playback after 2:00 p.m. CT. After

entering the Web site, http://www.frostbank.com/, go to "About

Frost" on the top navigation bar, then click on Investor Relations.

Cullen/Frost Bankers, Inc. (NYSE:CFR) is a financial holding

company, headquartered in San Antonio, with assets of $14.1 billion

at September 30, 2008. The corporation provides a full range of

commercial and consumer banking products, investment and brokerage

services, insurance products and investment banking services. Frost

operates more than 100 financial centers across Texas in the

Austin, Corpus Christi, Dallas, Fort Worth, Houston, Rio Grande

Valley and San Antonio regions. Founded in 1868, Frost is the

largest Texas-based banking organization that operates only in

Texas, with a legacy of helping clients with their financial needs

during three centuries. Forward-looking statements involve risks

and uncertainties that may cause actual results to differ

materially from those in such statements. Factors that could cause

actual results to differ from those discussed in the

forward-looking statements include, but are not limited to: --

Local, regional, national and international economic conditions and

the impact they may have on the Corporation and its customers and

the Corporation's assessment of that impact. -- Volatility and

disruption in national and international financial markets. --

Government intervention in the U.S. financial system. -- Changes in

the level of non-performing assets and charge-offs. -- Changes in

estimates of future reserve requirements based upon the periodic

review thereof under relevant regulatory and accounting

requirements. -- The effects of and changes in trade and monetary

and fiscal policies and laws, including the interest rate policies

of the Federal Reserve Board. -- Inflation, interest rate,

securities market and monetary fluctuations. -- Political

instability. -- Acts of God or of war or terrorism. -- The timely

development and acceptance of new products and services and

perceived overall value of these products and services by users. --

Changes in consumer spending, borrowings and savings habits. --

Changes in the financial performance and/or condition of the

Corporation's borrowers. -- Technological changes. -- Acquisitions

and integration of acquired businesses. -- The ability to increase

market share and control expenses. -- Changes in the competitive

environment among financial holding companies and other financial

service providers. -- The effect of changes in laws and regulations

(including laws and regulations concerning taxes, banking,

securities and insurance) with which the Corporation and its

subsidiaries must comply. -- The effect of changes in accounting

policies and practices, as may be adopted by the regulatory

agencies, as well as the Public Company Accounting Oversight Board,

the Financial Accounting Standards Board and other accounting

standard setters. -- Changes in the Corporation's organization,

compensation and benefit plans. -- The costs and effects of legal

and regulatory developments including the resolution of legal

proceedings or regulatory or other governmental inquiries and the

results of regulatory examinations or reviews. -- Greater than

expected costs or difficulties related to the integration of new

products and lines of business. -- The Corporation's success at

managing the risks involved in the foregoing items. Forward-looking

statements speak only as of the date on which such statements are

made. The Corporation undertakes no obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which such statement is made, or to reflect the

occurrence of unanticipated events. Cullen/Frost Bankers, Inc.

CONSOLIDATED FINANCIAL SUMMARY (UNAUDITED) (In thousands, except

per share amounts) 2008 2007 ---------------------------

------------------- 3rd Qtr 2nd Qtr 1st Qtr 4th Qtr 3rd Qtr -------

------- ------- --------- ------- CONDENSED INCOME STATEMENTS

------------ Net interest income $134,736 $131,328 $129,880

$130,760 $130,624 Net interest income(1) 139,655 136,223 134,767

135,269 134,704 Provision for possible loan losses 18,940 6,328

4,005 3,576 5,784 Non-interest income: Trust fees 19,749 19,040

18,282 18,009 17,749 Service charges on deposit accounts 22,642

21,634 19,593 21,044 20,696 Insurance commissions and fees 8,261

7,015 11,158 5,979 7,695 Other charges, commissions and fees 10,723

9,496 6,931 7,949 10,772 Net gain (loss) on securities transactions

78 (56) (48) 15 -- Other 15,862 13,452 14,312 13,387 13,844 ------

------ ------ ------ ------ Total non- interest income 77,315

70,581 70,228 66,383 70,756 Non-interest expense: Salaries and

wages 57,803 54,534 55,138 54,069 52,996 Employee benefits 10,677

11,912 14,113 9,945 10,727 Net occupancy 10,342 10,091 9,647 10,198

9,509 Furniture and equipment 9,657 9,182 8,950 8,870 8,793

Intangible amortization 1,976 1,955 2,046 2,162 2,184 Other 32,517

32,416 30,146 28,906 29,358 ------ ------ ------ ------ ------

Total non- interest expense 122,972 120,090 120,040 114,150 113,567

------- ------- ------- ------- ------- Income before income taxes

70,139 75,491 76,063 79,417 82,029 Income taxes 21,174 22,944

23,283 24,717 25,566 ------ ------ ------ ------ ------ Net income

$48,965 $52,547 $52,780 $54,700 $56,463 ======= ======= =======

======= ======= PER SHARE DATA ---------- Net income - basic $0.83

$0.89 $0.90 $0.94 $0.97 Net income - diluted 0.82 0.89 0.89 0.93

0.95 Cash dividends 0.42 0.42 0.40 0.40 0.40 Book value at end of

quarter 27.16 26.11 26.85 25.18 23.74 OUTSTANDING SHARES

----------- Period-end shares 59,299 59,081 58,747 58,662 58,423

Weighted- average shares - basic 58,932 58,733 58,538 58,387 58,439

Dilutive effect of stock compensation 433 483 520 598 731 Weighted-

average shares - diluted 59,365 59,216 59,058 58,985 59,170

SELECTED ANNUALIZED RATIOS ----------- Return on average assets

1.44% 1.56% 1.59% 1.65% 1.72% Return on average equity 12.39 13.44

13.89 15.18 16.44 Net interest income to average earning assets(1)

4.74 4.68 4.67 4.70 4.69 (1) Taxable-equivalent basis assuming a

35% tax rate. Cullen/Frost Bankers, Inc. CONSOLIDATED FINANCIAL

SUMMARY (UNAUDITED) 2008 2007 -----------------------------

------------------- 3rd Qtr 2nd Qtr 1st Qtr 4th Qtr 3rd Qtr -------

------- ------- ------- ------- BALANCE SHEET SUMMARY --------- ($

in millions) Average Balance: Loans $8,434 $8,187 $7,918 $7,560

$7,436 Earning assets 11,712 11,717 11,605 11,422 11,340 Total

assets 13,486 13,518 13,382 13,169 13,026 Non-interest- bearing

demand deposits 3,605 3,531 3,518 3,483 3,567 Interest- bearing

deposits 6,797 6,885 6,876 6,765 6,685 Total deposits 10,402 10,416

10,394 10,248 10,252 Shareholders' equity 1,573 1,573 1,529 1,429

1,363 Period-End Balance: Loans $8,596 $8,354 $8,013 $7,769 $7,461

Earning assets 11,984 11,608 11,874 11,556 11,492 Goodwill and

intangible assets 553 554 556 558 560 Total assets 14,061 13,671

13,794 13,485 13,167 Total deposits 10,618 10,627 10,728 10,530

10,096 Shareholders' equity 1,611 1,542 1,577 1,477 1,387 Adjusted

shareholders' equity(1) 1,593 1,557 1,513 1,484 1,445 ASSET QUALITY

-------------- ($ in thousands) Allowance for possible loan losses

$107,109 $94,520 $92,498 $92,339 $92,263 as a percentage of

period-end loans 1.25% 1.13% 1.15% 1.19% 1.24% Net charge- offs

$6,351 $4,306 $3,846 $3,500 $9,592 Annualized as a percentage of

average loans 0.30% 0.21% 0.20% 0.18% 0.51% Non-performing assets:

Non-accrual loans $45,475 $40,485 $28,642 $24,443 $21,356

Foreclosed assets 9,683 9,146 7,944 5,406 5,023 ------- -------

------- ------- ------- Total $55,158 $49,631 $36,586 $29,849

$26,379 As a percentage of: Total loans and foreclosed assets 0.64%

0.59% 0.46% 0.38% 0.35% Total assets 0.39 0.36 0.27 0.22 0.20

CONSOLIDATED CAPITAL RATIOS ------------------- Tier 1 Risk- Based

Capital Ratio 10.33% 10.15% 9.98% 9.96% 10.07% Total Risk- Based

Capital Ratio 12.67 12.68 12.55 12.59 12.83 Leverage Ratio 9.04

8.69 8.51 8.37 8.01 Equity to Assets Ratio (period-end) 11.46 11.28

11.43 10.95 10.53 Equity to Assets Ratio (average) 11.66 11.63

11.42 10.85 10.46 (1) Shareholders' equity excluding accumulated

other comprehensive income (loss). Cullen/Frost Bankers, Inc.

CONSOLIDATED FINANCIAL SUMMARY (UNAUDITED) (In thousands, except

per share amounts) Nine Months Ended September 30,

----------------------- 2008 2007

-----------------------------------------------------------------------

CONDENSED INCOME STATEMENTS --------------------------- Net

interest income $395,944 $387,977 Net interest income(1) 410,647

398,926 Provision for possible loan losses 29,273 11,084

Non-interest income Trust fees 57,071 52,350 Service charges on

deposit accounts 63,869 59,674 Insurance commissions and fees

26,434 24,868 Other charges, commissions and fees 27,150 24,609 Net

gain (loss) on securities transactions (26) -- Other 43,626 40,347

------- ------- Total non-interest income 218,124 201,848

Non-interest expense Salaries and wages 167,475 155,913 Employee

benefits 36,702 37,150 Net occupancy 30,080 28,626 Furniture and

equipment 27,789 23,951 Intangible amortization 5,977 6,698 Other

95,079 95,958 ------- ------- Total non-interest expense 363,102

348,296 Income before income taxes 221,693 230,445 Income taxes

67,401 73,074 -------- -------- Net income $154,292 $157,371

-------- -------- PER SHARE DATA -------------- Net income - basic

$2.63 $2.66 Net income - diluted 2.61 2.62 Cash dividends 1.24 1.14

Book value at end of period 27.16 23.74 OUTSTANDING SHARES

------------------ Period-end shares 59,299 58,423 Weighted-average

shares - basic 58,736 59,142 Dilutive effect of stock compensation

483 820 Weighted-average shares - diluted 59,219 59,962 SELECTED

ANNUALIZED RATIOS -------------------------- Return on average

assets 1.53% 1.62% Return on average equity 13.23 15.21 Net

interest income to average earning assets(1) 4.69 4.69 (1)

Taxable-equivalent basis assuming a 35% tax rate. Cullen/Frost

Bankers, Inc. CONSOLIDATED FINANCIAL SUMMARY (UNAUDITED) As of or

for the Nine Months Ended September 30, -------------------- 2008

2007

-----------------------------------------------------------------------

BALANCE SHEET SUMMARY --------------------- ($ in millions) Average

Balance: Loans $8,181 $7,432 Earning assets 11,678 11,312 Total

assets 13,463 13,001 Non-interest-bearing demand deposits 3,551

3,538 Interest-bearing deposits 6,853 6,663 Total deposits 10,404

10,201 Shareholders' equity 1,558 1,383 Period-End Balance: Loans

$8,596 $7,461 Earning assets 11,984 11,492 Goodwill and intangible

assets 553 560 Total assets 14,061 13,167 Total deposits 10,618

10,096 Shareholders' equity 1,611 1,387 Adjusted shareholders'

equity(1) 1,593 1,445 ASSET QUALITY ------------- ($ in thousands)

Allowance for possible loan losses $107,109 $92,263 As a percentage

of period-end loans 1.25% 1.24% Net charge-offs: $14,503 $14,906

Annualized as a percentage of average loans 0.24% 0.27%

Non-performing assets: Non-accrual loans $45,475 $21,356 Foreclosed

assets 9,683 5,023 ------- ------- Total $55,158 $26,379 As a

percentage of: Total loans and foreclosed assets 0.64% 0.35% Total

assets 0.39 0.20 CONSOLIDATED CAPITAL RATIOS

--------------------------- Tier 1 Risk-Based Capital Ratio 10.33%

10.07% Total Risk-Based Capital Ratio 12.67 12.83 Leverage Ratio

9.04 8.01 Equity to Assets Ratio (period-end) 11.46 10.53 Equity to

Assets Ratio (average) 11.57 10.64 (1) Shareholders' equity

excluding accumulated other comprehensive income (loss).

DATASOURCE: Cullen/Frost Bankers, Inc. CONTACT: Greg Parker,

Investor Relations, +1-210-220-5632, or Renee Sabel, Media

Relations, +1-210-220-5416, both of Cullen/Frost Bankers, Inc. Web

site: http://www.frostbank.com/

Copyright

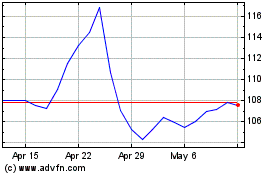

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From May 2024 to Jun 2024

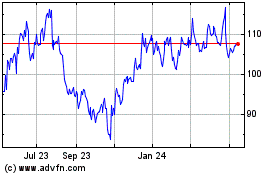

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jun 2023 to Jun 2024