Form S-8 - Securities to be offered to employees in employee benefit plans

May 16 2024 - 4:01PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 16, 2024

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CONSTELLIUM SE

(Exact

name of registrant as specified in its charter)

|

|

|

| France |

|

Not Applicable |

| (State or other jurisdiction of

incorporation) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| Washington Plaza, |

|

300 East Lombard Street |

| 40-44 rue Washington |

|

Suite 1710 |

| 75008 Paris |

|

Baltimore, MD 21202 |

| France |

|

United States |

| (Head Office) |

|

|

(Address of principal executive offices) (Zip Code)

Constellium SE 2013 Equity Incentive Plan

(Full title of the Plan)

Corporation Service Company

80 State Street

Albany,

NY 12207-2543

(Name and address of agent for service)

(302) 636-5400

(Telephone number, including area code of agent for service)

Copies to:

|

|

|

|

|

| Jeremy Leach

Senior Vice President and Group General Counsel

40-44, rue Washington

75008 Paris, France |

|

Rina E. Teran

Chief Securities Counsel

300 East Lombard Street, Suite 1710

Baltimore, MD 21202 |

|

Andrew J. Nussbaum

Elina Tetelbaum Wachtell,

Lipton, Rosen & Katz 51 West 52nd Street

New York, NY 10019 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule

12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

REGISTRATION OF ADDITIONAL ORDINARY SHARES PURSUANT TO GENERAL INSTRUCTION E

This Registration Statement is being filed pursuant to General Instruction E to Form S-8 under the

Securities Act of 1933, as amended (the “Securities Act”). The contents of the Registration Statements on Form S-8 previously filed by Constellium SE (the “Registrant”) with the Securities

and Exchange Commission (the “Commission”) on October 25, 2013 (File No. 333-191905), December 19, 2014 (File No. 333-201141),

June 27, 2018 (File No. 333-225926), and May 14, 2021 (File No. 333-256148) (together, as amended, the “Prior Registration Statements”) are

incorporated by reference herein and made a part hereof. This Registration Statement on Form S-8 is filed by the Registrant to register an additional 6,000,000 shares of the Registrant’s ordinary shares,

nominal value €0.02 per share, which may be awarded under the Constellium SE 2013 Equity Incentive Plan (as amended, the “Plan”), which ordinary shares are additional securities of the same class as other securities issuable under the

Plan previously filed with the Commission with the Prior Registration Statements.

PART II

INFORMATION REQUIRED IN REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference |

The following documents previously filed or furnished by the Registrant with the Commission are incorporated by reference herein:

| |

(a) |

the Registrant’s annual report on Form

20-F for the fiscal year ended December 31, 2023, filed on March 18, 2024; |

| |

(b) |

all other reports filed or furnished by the Registrant pursuant to Section 13(a) or 15(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) since December 31, 2023 (other than information in such filings specifically not incorporated therein); |

| |

(c) |

the description of the Ordinary Shares, set forth in the Registrant’s Registration Statement on Form

F-3ASR, filed on March 20, 2024 (File No. 333-278097) and any amendments, reports or other filings filed with the Commission for the purpose of updating

that description; |

| |

(g) |

the Registrant’s registration statement on Form S-8 (File

No. 333-256148) filed on May 14, 2021. |

In addition to the foregoing, all documents subsequently filed by the Registrant pursuant to

Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, and all reports on Form 6-K subsequently filed or furnished by the Registrant which state that they are incorporated by reference herein, prior to the

filing of a post-effective amendment which indicates that all securities offered hereunder have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be part hereof from

the date of filing of such documents and reports.

Any statement contained in a document incorporated or deemed to be incorporated by

reference herein shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement herein, or in any subsequently filed document which also is or is deemed to be incorporated by reference,

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Articles of Association of Constellium SE, dated April

10, 2023 (incorporated herein by reference to Exhibit 1.1 of Constellium SE’s Form 20-F filed on March 18, 2024) |

|

|

| 5.1 |

|

Opinion of Counsel* |

|

|

| 23.1 |

|

Consent of Counsel (included in Exhibit 5.1)* |

|

|

| 23.2 |

|

Consent of PricewaterhouseCoopers Audit, Independent Registered Public Accounting Firm* |

|

|

| 24.1 |

|

Power of Attorney (included on signature page)* |

|

|

| 99.1 |

|

Constellium SE 2013 Equity Incentive Plan (incorporated herein by reference to Exhibit 10.13 to Constellium SE’s Registration Statement

on Form F-1 (Registration No. 333-191863), filed on October 23, 2013) |

|

|

| 99.2 |

|

Amendment to the Constellium SE 2013 Equity Incentive Plan, effective as of May

24, 2018 (incorporated herein by reference to Exhibit 99.2 of Constellium SE’s Form S-8 furnished on June 27, 2018) |

|

|

| 99.3 |

|

Amendment No. 2 to the Constellium SE 2013 Equity Incentive Plan, effective as of June

28, 2019 (incorporated herein by reference to Exhibit 10.1 of Constellium SE’s Form 6-K furnished on June 28, 2019) |

|

|

| 99.4 |

|

Amendment No. 3 to the Constellium SE 2013 Equity Incentive Plan, effective as of December

12, 2019 (incorporated herein by reference to Exhibit 10.1 of Constellium SE’s Form 6-K furnished on December 12, 2019) |

|

|

| 99.5 |

|

Amendment No. 4 to the Constellium SE 2013 Equity Incentive Plan, effective as of May

14, 2021 (incorporated herein by reference to Exhibit 99.5 of Constellium SE’s Registration Statement on Form S-8 (Registration No.

333-256148), filed on May 14, 2021) |

|

|

| 99.6 |

|

Amendment No. 5 to the Constellium SE 2013 Equity Incentive Plan, effective as of May

16, 2023 (incorporated herein by reference to Exhibit 10.15.5 of Constellium SE’s Form 20-F filed on March 18, 2024) |

|

|

| 107 |

|

Filing Fee Table* |

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Baltimore, Maryland on May 16, 2024.

|

|

|

| Constellium SE |

|

|

| By: |

|

/s/ Jean-Marc Germain |

| Name: |

|

Jean-Marc Germain |

| Title: |

|

Chief Executive Officer |

Each person whose signature appears below hereby constitutes and appoints Jean-Marc Germain, Jack Guo

and Jeremy Leach, and each of them acting individually, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and re-substitution, to execute for him or her and in his or her name, place and stead, in any and all capacities, any and all amendments (including post-effective amendments) to this registration statement and any

registration statement for the same offering covered by this registration statement that is to be effective upon filing pursuant to Rule 462 promulgated under the Securities Act, as the

attorney-in-fact and to file the same, with all exhibits thereto and any other documents required in connection therewith with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents and their substitutes, and each of them, full power and authority to do and perform each and every act and thing

requisite and necessary to be done in connection therewith, as fully as he or she might or could do in person, hereby ratifying and confirming all that said

attorneys-in-fact and agents, or any of them, or their or his or her substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated:

|

|

|

|

|

| Name |

|

Title |

|

Date |

|

|

|

| /s/ Jean-Marc Germain |

|

Chief Executive Officer and Executive Director |

|

May 16, 2024 |

| Jean-Marc Germain |

|

(Principal Executive Officer) |

|

|

|

|

|

| /s/ Jack Guo |

|

Chief Financial Officer |

|

May 16, 2024 |

| Jack Guo |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

|

|

|

| /s/ Jean-Christophe Deslarzes |

|

Chairman |

|

May 16, 2024 |

| Jean-Christophe Deslarzes |

|

|

|

|

|

|

|

|

|

| /s/ Emmanuel Blot |

|

Director |

|

May 16, 2024 |

| Emmanuel Blot |

|

|

|

|

|

|

|

| /s/ Isabelle Boccon-Gibod |

|

Director |

|

May 16, 2024 |

| Isabelle Boccon-Gibod |

|

|

|

|

|

|

|

| /s/ Michiel Brandjes |

|

Director |

|

May 16, 2024 |

| Michiel Brandjes |

|

|

|

|

|

|

|

| /s/ Martha Brooks |

|

Director |

|

May 16, 2024 |

| Martha Brooks |

|

|

|

|

|

|

|

| /s/ John Ormerod |

|

Director |

|

May 16, 2024 |

| John Ormerod |

|

|

|

|

|

|

|

| /s/ Jean-Philippe Puig |

|

Director |

|

May 16, 2024 |

| Jean-Philippe Puig |

|

|

|

|

|

|

|

| /s/ Jean-François Verdier |

|

Director |

|

May 16, 2024 |

| Jean-François Verdier |

|

|

|

|

|

|

|

| /s/ Lori A. Walker |

|

Director |

|

May 16, 2024 |

| Lori A. Walker |

|

|

|

|

|

|

|

| /s/ Wiebke Weiler |

|

Director |

|

May 16, 2024 |

| Wiebke Weiler |

|

|

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act, the undersigned has caused this Registration Statement to be signed solely in the

capacity as the duly authorized representative of Constellium SE in the United States on May 16, 2024.

|

|

|

| Constellium US Holdings I, LLC |

|

|

| By: |

|

/s/ Rina E. Teran |

| Name: |

|

Rina E. Teran |

| Title: |

|

Vice President & Secretary |

Exhibit 5.1

May 16, 2024

Constellium SE

Washington Plaza

40-44

rue Washington

75008 Paris

France

Constellium SE – Form S-8 Registration Statement – Exhibit 5.1 opinion

Ladies and Gentlemen,

We have acted as special French counsel

to Constellium SE, a Societas Europaea, with its corporate seat in Washington Plaza, 40-44 rue Washington, 75008 Paris, France (the “Issuer”), in connection with the filing under the

Securities Act of 1933, as amended (the “Securities Act”), of a registration statement on Form S-8 dated as of the date hereof (the “Form

S-8”). The Form S-8 is filed by the Issuer for the registration of up to 6,000,000 ordinary shares (with nominal value €0.02 per share) (the

“Shares”) that may be issued pursuant to the Constellium SE 2013 Equity Incentive Plan, as amended (the “Plan”), with the United States Securities and Exchange Commission (the “SEC”).

This opinion is furnished to you in order to be filed as an exhibit to the Form S-8 filed by you with the SEC.

| A. |

For the purpose of this opinion, we have exclusively examined and relied upon photocopies or copies received by

fax or by electronic means, or originals if so expressly stated, of the following documents: |

| |

c) |

a copy of the articles of association (statuts) of the Issuer last updated on April 10, 2023, as

certified as of May 15, 2024 (the “Articles”); |

| |

d) |

a copy of the resolutions (the “Resolutions”) of the general meeting of the Issuer held on

May 2, 2024 as certified as of May 15, 2024, relating, inter alia, to the authorization granted to the Board of Directors to freely allocate shares, to be issued or existing, under the Plan, for a

38-month period up to 6,000,000 Shares (the “Authorization”); |

| |

e) |

a K-bis extract (Extrait K-bis) of the Issuer issued on May 13, 2024, by the Registre du

Commerce et des Sociétés of Paris as of May 8, 2024 (the “Extract”); and |

| |

f) |

a certificate en matière de procédures collectives relating to the Issuer issued on

May 13, 2024, issued by the Registre du Commerce et des Sociétés of Paris as of May 12, 2024 (the “Certificate”). |

| B. |

In rendering this opinion, we have assumed: |

| |

a) |

the genuineness of all signatures on, and the authenticity and completeness of all documents submitted to us as

copies of drafts, originals or execution copies and the exact conformity to the originals of all documents submitted to us as photocopies or copies transmitted by facsimile or by electronic means and that all documents were at their date, and will

have remained, accurate and in full force and effect without modification; |

| |

b) |

that the Plan constitutes and will constitute a legal, valid and binding obligation of the participants in the

Plan and the Issuer, respectively, and is enforceable in accordance with its terms under all applicable laws; |

| |

c) |

that (a) the Authorization, as renewed from time to time, will be in full force and effect (i) as of

the date of granting any rights to subscribe for the Shares under the Plan or, as the case may be, (ii) as at the date of issuance of any Shares under the Plan, and (b) any rights to subscribe for the Shares under the Plan have been

validly granted; |

| |

d) |

that prior to the registration (immatriculation) of the Issuer with the Greffe of the Paris

Tribunal de commerce, the Issuer was duly established and validly existed as a Societas Europaea (SE) registered in The Netherlands with a capital divided into 137,867,418 ordinary shares with a nominal value of €0.02, each

validly issued, fully paid and non-assessable; |

| |

e) |

the Resolutions have been duly approved and have not been superseded, amended, annulled, revoked or rescinded

and are in full force and effect as at the date hereof; |

| |

f) |

that any and all authorizations and consents of, or other filings with or notifications to, any public

authority or other relevant body or person in or of any jurisdiction which may be required (including, without limitation, the laws of the French Republic) in respect of the Form S-8 have been or will be duly

obtained or made, as the case may be; and |

| |

g) |

that the information set forth in the Extract and the Certificate is on the date hereof complete and accurate.

|

| C. |

We are rendering this opinion in our capacity as Avocats au Barreau de Paris and this opinion is limited

to, and is to be construed in accordance with, the laws of the French Republic and relates to matters of French law exclusively. This opinion is given on the basis that it is to be governed by, and construed in accordance with, the laws of the

French Republic. In this opinion, references to French law or to the laws of the French Republic are to be read as references to the laws and regulations of France in full force and effect as of the date hereof, as interpreted by the Cour de

Cassation and the Conseil d’Etat (being the supreme courts of the French judiciary and administrative court systems, respectively) in their decisions reported in major legal publications. We express no opinion as to (i) any

matter of foreign law nor as to any matter of fact and, in particular, we express no opinion on European Community law as it affects any jurisdiction other than the Republic of France (ii) matters of competition law, and (iii) matters of

taxation. In addition, we have assumed that no foreign law affects the conclusions stated in this opinion and that the recognition by a French court pursuant to a treaty or otherwise of the effects in France of a foreign law does not affect the

conclusions stated in this opinion. |

This opinion is strictly limited to the matters specifically stated in Section D below and may not

be read as extending by implication to any matters not specifically referred to herein. In particular, nothing in this opinion should be taken as expressing an opinion on our part in respect of any representations and warranties of the parties or

any other facts, computations or information contained in the Form S-8 or in respect of any other agreement, instrument or document referred to in the Form S-8.

French law concepts used in this opinion and described in English may not have the same meaning under the laws of other jurisdictions and words appearing in

the French language have the meaning ascribed to them under French law and prevail over their translation into English. This opinion is given by GIDE LOYRETTE NOUEL A.A.R.P.I. (“Gide”) and may only be relied upon under the express

condition that (i) any issues of interpretation or liability arising hereunder will be governed by the laws of the French Republic and will be brought exclusively before a French court, and (ii) such liability, if any, shall be limited to

Gide only, to the exclusion of any of its directors, partners, employees, shareholders and advisors or its or their affiliates and, to the extent applicable, to the aggregate of the amount paid under Gide’s professional insurance in the

particular instance and any applicable deductible payable thereunder.

| D. |

Based upon and subject to the foregoing and to the further qualifications, limitations and exceptions set forth

herein, and subject to any factual matters not disclosed to us and inconsistent with the information revealed by the documents reviewed by us in the course of our examination referred to above, we are as at the date hereof of the opinion that

(a) the Issuer is duly incorporated (immatriculée), and is validly existing under the laws of the French Republic as a European limited-liability company (Societas Europaea) and (b) upon (i) adoption of all corporate

and other action required to be taken by the Issuer to issue Shares and (ii) payment in full of the Shares in accordance with the provisions of the Articles, such Shares will have been duly authorized, validly issued and fully paid up and will

be non-assessable. |

| E. |

Our opinions expressed above are subject to the following qualifications: |

| |

a) |

We have not investigated or verified the truth, accuracy or appropriateness of any representations of factual

nature made by the parties in the Form S-8, or of any information, opinion or statement of facts relating to the Issuer, or the Shares contained in the aforementioned document, nor have we been responsible for

ensuring that no material information has been omitted from it; and; |

| |

b) |

Our opinion in paragraph D.a) above is solely based on a review of the Articles, the Extract and the

Certificate, and the Extract and the Certificate are not conclusively capable of revealing whether or not: |

| |

• |

|

a winding-up has been made or a resolution passed for the dissolution (winding-up) of the Issuer, or the Issuer’s operations have terminated (cessation d’activité), or |

| |

• |

|

an order for the procédure de sauvegarde, sauvegarde accélérée, sauvegarde

financière accélérée, redressement judiciaire or liquidation judiciaire has been issued, |

as notice of these matters may not be filed immediately and, when filed, may not be entered on the records immediately. Also, a mandat ad

hoc or a conciliatory procedure (procédure de conciliation) will not appear in the Extract and the Certificate.

| |

c) |

Our opinions are subject to the effects of any applicable bankruptcy, insolvency, reorganization, moratorium or

similar laws affecting creditors’ rights generally including, without limitation, laws governing any judicial reorganization (redressement judiciaire), judicial liquidation (liquidation judiciaire), safeguard proceedings

(procédure de sauvegarde), accelerated safeguard proceedings (procédure de sauvegarde accélérée), accelerated financial safeguard proceedings (procédure de sauvegarde financière

accélérée), appointment of any conciliateur, or ad-hoc agent (mandataire ad-hoc) or judicial administrator (administrateur

provisoire), or any procedure in accordance with Livre Sixième of the French Code de commerce, or any similar proceedings in any jurisdiction other than France; and |

| |

d) |

The term “non-assessable”, which has no recognized meaning in

French law, for the purposes of this opinion means that no present or future holder of such Shares will be subject to personal liability, by reason of being such a holder, for additional payments or calls for further funds by the Issuer or any other

person. |

We assume no obligation to update this opinion or to inform any person of any changes of law or other matters coming to our

knowledge occurring after the date hereof which may affect this opinion in any respect. This opinion is given for the purposes of the Form S-8 only and may not be disclosed or quoted other than as an exhibit

to (and therefore together with) the Form S-8, without our prior written consent.

We hereby consent to the filing

of this opinion as an exhibit to the Form S-8 and to the use of our name under the heading “Legal Matters” in the prospectus forming a part thereof. In giving such consent, we do not hereby admit

that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the SEC promulgated thereunder.

Very truly yours,

/s/ Gide Loyrette Nouel A.A.R.P.I.

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of

Constellium SE of our report dated March 18, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Constellium

SE’s Annual Report on Form 20-F for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers Audit

Neuilly-sur-Seine, France

May 16, 2024

Exhibit 107

Calculation of Filing Fee Table

Form S-8

Constellium SE

Table 1: Newly

Registered Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Security Type |

|

Security

Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

Proposed

Maximum

Offering

Price Per Unit(2) |

|

Maximum

Aggregate Offering

Price |

|

Fee

Rate |

|

Amount of

Registration Fee(3) |

| |

|

|

|

|

|

|

|

| Equity |

|

Ordinary shares, nominal value €0.02, to be issued under the Constellium SE 2013 Equity Incentive Plan |

|

Other |

|

6,000,000 |

|

$20.09 |

|

$120,540,000 |

|

0.00014760 |

|

$17,791.70 |

| |

|

|

|

|

| Total Offering Amounts |

|

|

|

$120,540,000 |

|

|

|

$17,791.70 |

| |

|

|

|

|

| Total Fee Offset |

|

|

|

|

|

|

|

— |

| |

|

|

|

|

| Net Fee Due |

|

|

|

|

|

|

|

$17,791.70 |

| (1) |

The Ordinary Shares are being registered for issuance under the Constellium SE 2013 Equity Incentive Plan.

Pursuant to Rule 416(a) under the Securities Act of 1933 (the “Securities Act”), this Registration Statement shall also be deemed to cover any additional securities to be offered or issued in connection with the provisions of the

above-referenced plan, which provides for adjustments in the amount of securities to be offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar events. |

| (2) |

Estimated pursuant to Rule 457(c) and (h) under the Securities Act solely for the purpose of

calculating the registration fee on the basis of the average of the high and low selling price per share of the Ordinary Shares of Constellium SE, as reported on the New York Stock Exchange on May 15, 2024. |

| (3) |

Calculated at a rate of $147.60 per $1,000,000 of the proposed maximum aggregate offering price.

|

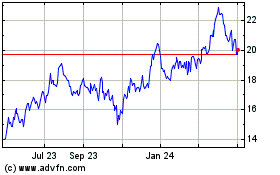

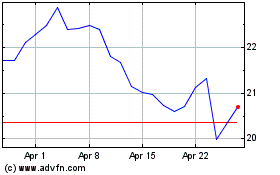

Constellium (NYSE:CSTM)

Historical Stock Chart

From May 2024 to Jun 2024

Constellium (NYSE:CSTM)

Historical Stock Chart

From Jun 2023 to Jun 2024