Risk-Reward Balance Comerica - Analyst Blog

June 21 2011 - 12:43PM

Zacks

We have reiterated our

Neutral recommendation on Comerica Inc. (CMA). The reaffirmation follows a detailed

analysis of the company’s fundamentals following first quarter 2011

earnings, along with an evaluation of the current economic

environment, its strengths, opportunities, weaknesses and

acquisition efforts.

Comerica’s first quarter

net income of 57 cents per share outpaced the Zacks Consensus

Estimate of 48 cents and improved from the prior-quarter figure of

53 cents. The quarter’s earnings saw a striking year-over-year

improvement from a loss of 46 cents.

The year-over-year

improvement reflected an increase in non-interest income and net

interest margin, partially offset by higher non-interest expenses

and a lower net interest income. Furthermore, a significant

improvement in credit quality also acted as a positive

catalyst.

Concurrent with the fourth

quarter 2010 earnings release, Comerica announced that it would

acquire Sterling Bancshares Inc.

(SBIB) in a stock-for-stock transaction. The

strategic acquisition will augment Comerica's growth in Texas from

the current 95 banking centers to 152.

The takeover

will also give Comerica 65 banking centers in Houston, 63 in

Dallas/Fort Worth, 13 in San Antonio and 11 in Austin.

Additionally, the acquisition will add about $3.0 billion in loans

and $4.0 billion in deposits.

According to management,

Comerica continues to be on track to close its pending acquisition

of Sterling Bancshares in the second quarter, subject to customary

closing conditions. Management expects to complete the systems

conversion in the fourth quarter, and anticipates a smooth and

seamless transition.

Going forward, we expect

Comerica to enjoy business expansion not only from acquisitions but

also from an overall improvement in the economy. Moreover, its

business model positions it well to benefit from an eventual rise

in interest rates in the second half of 2011.

Comerica also boosted

investors’ confidence by doubling dividend and authorizing a share

repurchase in the fourth quarter of 2010. Management expects to

continue the share repurchase program, which coupled with dividend

payments would result in a payout of up to 50% of earnings for

full-year 2011.

Yet Comerica’s significant

exposure to the riskier areas, such as commercial real estate

markets, lack of meaningful loan growth and regulatory headwinds

are the downsides. We remain concerned about the company’s growth

prospects. Loan growth has clearly moderated over the past year,

and growth in fee income remains restricted.

Moreover, we expect the

recent regulatory moves and a sluggish economic recovery to

restrain fee income. These are also reflected in the guidance for

full-year 2011, which includes management’s assumption of a

single-digit decline in non-interest income from 2010.

Market-related fees are also expected to be lower as customers

remain cautious in a sluggish and still uncertain economic

environment.

Hence, the positive and

negative seem balanced for the stock and the Neutral recommendation

is retained. Additionally, shares of Comerica currently retain the

Zacks #3 Rank, which translates into a short-term Hold

rating.

COMERICA INC (CMA): Free Stock Analysis Report

STERLING BCS-TX (SBIB): Free Stock Analysis Report

Zacks Investment Research

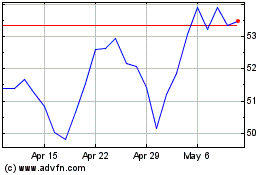

Comerica (NYSE:CMA)

Historical Stock Chart

From May 2024 to Jun 2024

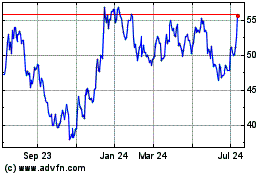

Comerica (NYSE:CMA)

Historical Stock Chart

From Jun 2023 to Jun 2024