Seligman Premium Technology Growth Fund Announces Third Quarterly Distribution: 9.25% Annual Rate for IPO Investors

August 09 2010 - 11:50AM

Business Wire

On August 5, 2010, Seligman Premium Technology Growth Fund, Inc.

(NYSE: STK) (the Fund) declared the Fund’s third quarterly

distribution under its level rate distribution policy in the amount

of $0.4625 per share, which is equal to a quarterly rate of 2.3125%

(9.25% annualized) of the $20.00 offering price in the Fund's

initial public offering in November 2009.

The distribution will be paid on August 25, 2010 to Stockholders

of record on August 17, 2010. The ex-dividend date is August 13,

2010. It is anticipated that the Fund will make a subsequent

distribution under its level rate distribution policy in the month

of November.

The Fund is a closed-end investment company that trades on the

New York Stock Exchange.

Important Disclosures:

You should consider the investment objectives, risks,

charges, and expenses of the Fund carefully before investing. You

can obtain the Fund’s most recent periodic reports and other

regulatory filings by contacting your financial advisor or American

Stock Transfer & Trust Company, LLC at 800 937-5449. These

reports and other filings can also be found on the Securities and

Exchange Commission’s EDGAR database. You should read these reports

and other filings carefully before investing.

The Fund expects to receive all or some of its current income

and gains from the following sources: (i) dividends received by the

Fund that are paid on the equity and equity-related securities in

its portfolio; and (ii) capital gains (short-term and long-term)

from option premiums and the sale of portfolio securities. It is

possible that the Fund’s distributions will at times exceed the

earnings and profits of the Fund and therefore all or a portion of

such distributions may constitute a return of capital as described

below. A return of capital distribution does not necessarily

reflect the Fund’s investment performance and should not be

confused with “yield” or “income”. You should not draw any

conclusions about the Fund’s investment performance from the amount

of this distribution or from the Fund’s level distribution

policy.

A return of capital is not taxable, but it reduces a

stockholder’s tax basis in his or her shares, thus reducing any

loss or increasing any gain on a subsequent taxable disposition by

the stockholder of his or her shares. Distributions may be

variable, and the Fund’s distribution rate will depend on a number

of factors, including the net earnings on the Fund’s portfolio

investments and the rate at which such net earnings change as a

result of changes in the timing of, and rates at which, the Fund

receives income from the sources noted above. As portfolio and

market conditions change, the rate of dividends on the shares and

the Fund’s distribution policy could change.

The Fund should only be considered as one element of a complete

investment program. An investment in the Fund should be considered

speculative. The Fund's investment policy of investing in

technology and technology-related companies and writing call

options involves a high degree of risk.

There is no assurance that the Fund will meet its investment

objectives or that distributions will be made. You could lose some

or all of your investment. The net asset value of shares of a

closed-end fund may not always correspond to the market price of

such shares. Common stock of many closed-end funds frequently trade

at a discount from their net asset value, which may increase your

risk of loss. The Fund is subject to stock market risk, which is

the risk that stock prices overall will decline over short or long

periods, adversely affecting the value of an investment in the

Fund.

The market prices of technology and technology-related stocks

tend to exhibit a greater degree of market risk and price

volatility than other types of investments. These stocks may fall

in and out of favor with investors rapidly, which may cause sudden

selling and dramatically lower market prices. These stocks also may

be affected adversely by changes in technology, consumer and

business purchasing patterns, government regulation and/or obsolete

products or services. Technology and technology-related companies

are often smaller and less experienced companies and may be subject

to greater risks than larger companies, such as limited product

lines, markets and financial and managerial resources. These risks

may be heightened for technology companies in foreign markets.

This press release was prepared by Columbia Management

Investment Distributors, Inc., Member FINRA. Seligman Premium

Technology Growth Fund is managed by Columbia Management Investment

Advisers, LLC (formerly known as RiverSource Investments, LLC).

Columbia Management is part of Ameriprise Financial, Inc. Seligman

is an offering brand of Columbia Management.

© 2010 Columbia Management Investment Advisers, LLC. All rights

reserved.

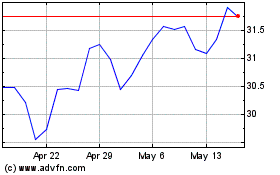

Columbia Seligman Premiu... (NYSE:STK)

Historical Stock Chart

From Jun 2024 to Jul 2024

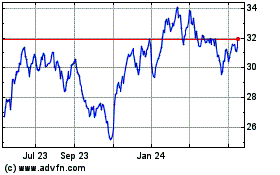

Columbia Seligman Premiu... (NYSE:STK)

Historical Stock Chart

From Jul 2023 to Jul 2024