0001140859false00011408592023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2023

_________________________________

Cencora, Inc.

(Exact name of registrant as specified in its charter)

_________________________________

Commission File Number: 1-6671

| | | | | | | | | | | | | | |

| Delaware | | 23-3079390 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | | |

| 1 West First Avenue | Conshohocken | PA | | 19428-1800 |

| (Address of principal executive offices) | | (Zip Code) |

(610) 727-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

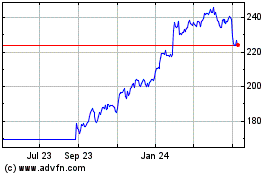

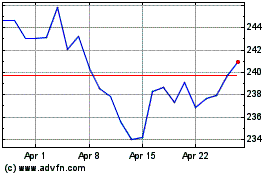

| Common stock | COR | New York Stock Exchange | (NYSE) |

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On November 2, 2023, Cencora, Inc. (the “Company”) issued a news release announcing the Company’s earnings for the fiscal quarter and year ended September 30, 2023. A copy of the news release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Current Report, including the exhibit attached hereto as Exhibit 99.1 and the information under Item 7.01 below, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On November 2, 2023, the Company is conducting a conference call and webcast scheduled to be held at 8:30 a.m. Eastern time regarding its results for the fiscal quarter and year ended September 30, 2023 and related matters.

A link to the conference call and slides prepared for the conference call are available on the Company's website at investor.cencora.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Cencora, Inc. |

| | | |

| Date: | November 2, 2023 | By: | /s/ James F. Cleary |

| | Name: | James F. Cleary |

| | Title: | Executive Vice President & Chief Financial Officer |

Exhibit 99.1

CENCORA REPORTS FISCAL 2023 FOURTH QUARTER AND YEAR END RESULTS

Revenue of $68.9 Billion for the Fourth Quarter, a 12.7 Percent Year-Over-Year Increase

Fourth Quarter GAAP Diluted EPS of $1.72 and Adjusted Diluted EPS of $2.86

Revenue of $262.2 Billion for Fiscal Year 2023, a 9.9 Percent Year-Over-Year Increase

Fiscal Year 2023 GAAP Diluted EPS of $8.53 and Adjusted Diluted EPS of $11.99

CONSHOHOCKEN, PA, November 2, 2023 - Cencora, Inc. (NYSE: COR), formerly AmerisourceBergen Corporation, today reported that in its fiscal year 2023 fourth quarter ended September 30, 2023, revenue increased 12.7 percent to $68.9 billion. Revenue increased 9.9 percent to $262.2 billion for the fiscal year. On the basis of U.S. generally accepted accounting principles (GAAP), diluted earnings per share (EPS) was $1.72 for the September quarter of fiscal 2023, compared to $1.40 in the prior year quarter. Adjusted diluted EPS, which is a non-GAAP measure that excludes items described below, increased 10.0 percent to $2.86 in the fiscal fourth quarter. For fiscal year 2023, diluted EPS increased 6.1 percent to $8.53. For fiscal year 2023, adjusted diluted EPS increased 8.7 percent to $11.99.

“Cencora delivered strong performance in fiscal 2023, which was a seminal year for our company as our purpose-driven teams took key steps to execute on our strategic imperatives and advance our position at the center of healthcare,” said Steven H. Collis, Chairman, President and Chief Executive Officer of Cencora.

“Coming together as a unified team under our new identity as Cencora, we are showcasing our impact across pharmaceutical care and our global footprint," Mr. Collis continued. "We move into fiscal 2024 with strong momentum and remain focused on continuing to enhance our position as a partner of choice for our customers and pharmaceutical manufacturers as we drive differentiated value-creation for all of our stakeholders."

Fourth Quarter Fiscal Year 2023 Summary Results

| | | | | | | | |

| GAAP | Adjusted (Non-GAAP) |

| Revenue | $68.9B | $68.9B |

| Gross Profit | $2.3B | $2.3B |

| Operating Expenses | $1.8B | $1.5B |

| Operating Income | $477M | $801M |

| Interest Expense, Net | $61M | $61M |

| Effective Tax Rate | 21.8% | 21.6% |

| Net Income Attributable to Cencora | $351M | $581M |

| Diluted Earnings Per Share | $1.72 | $2.86 |

| Diluted Shares Outstanding | 203.4M | 203.4M |

Below, Cencora presents descriptive summaries of the Company’s GAAP and adjusted (non-GAAP) quarterly and fiscal year results. In the tables that follow, GAAP results and GAAP to non-GAAP reconciliations are presented. For more information related to non-GAAP financial measures, including adjustments made in the periods presented, please refer to the Supplemental Information Regarding Non-GAAP Financial Measures following the tables.

Fourth Quarter GAAP Results

•Revenue: In the fourth quarter of fiscal 2023, revenue was $68.9 billion, up 12.7 percent compared to the same quarter in the previous fiscal year, reflecting a 13.0 percent increase in revenue within U.S. Healthcare Solutions and a 9.5 percent increase in revenue within International Healthcare Solutions.

•Gross Profit: Gross profit in the fiscal 2023 fourth quarter was $2.3 billion, a 13.5 percent increase compared to the same period in the previous fiscal year primarily due to increases in gross profit in both reportable segments and gains from antitrust litigation settlements in the current year quarter. Gross profit as a percentage of revenue was 3.27 percent, an increase of 2 basis points from the prior year quarter.

•Operating Expenses: In the fourth quarter of fiscal 2023, operating expenses were $1.8 billion, up 16.0 percent from the same period last fiscal year, primarily driven by increases in distribution, selling, and administrative expenses, and amortization expense compared to the prior year quarter. Operating expenses as a percentage of revenue in the fiscal 2023 fourth quarter were 2.58 percent compared to 2.50 percent for the same period in the previous fiscal year.

•Operating Income: In the fiscal 2023 fourth quarter, operating income was $476.9 million, up 4.9 percent compared to the same period in the previous fiscal year due to the increase in gross profit, offset in part by the increase in operating expenses. Operating income as a percentage of revenue was 0.69 percent in the fourth quarter of fiscal 2023 compared to 0.74 percent for the same period in the previous fiscal year.

•Interest Expense, Net: In the fiscal 2023 fourth quarter, net interest expense of $60.9 million increased 18.3 percent versus the prior year quarter primarily due to increases in intra-period variable-rate borrowings and associated interest rates, offset in part by an increase in interest income as a result of higher investment interest rates.

•Effective Tax Rate: The effective tax rate was 21.8 percent for the fourth quarter of fiscal 2023. This compares to 21.9 percent in the prior year quarter.

•Diluted Earnings Per Share: Diluted earnings per share was $1.72 in the fourth quarter of fiscal 2023, up 22.9 percent compared to the previous fiscal year fourth quarter.

•Diluted Shares Outstanding: Diluted weighted average shares outstanding for the fourth quarter of fiscal 2023 were 203.4 million, a decrease of 3.1 percent versus the prior fiscal year fourth quarter primarily as a result of share repurchases.

Fourth Quarter Adjusted (non-GAAP) Results

•Revenue: No adjustments were made to the GAAP presentation of revenue. In the fourth quarter of fiscal 2023, revenue was $68.9 billion, up 12.7 percent compared to the same quarter in the previous fiscal year, reflecting a 13.0 percent increase in revenue within U.S. Healthcare Solutions and a 9.5 percent increase in revenue within International Healthcare Solutions. On a constant currency basis, International Healthcare Solutions' revenue was up 10.1 percent.

•Adjusted Gross Profit: Adjusted gross profit in the fiscal 2023 fourth quarter was $2.3 billion, a 9.4 percent increase compared to the same period in the previous fiscal year due to an increase in gross profit in both reportable segments. Adjusted gross profit as a percentage of revenue was 3.34 percent in the fiscal 2023 fourth quarter, a decrease of 10 basis points when compared to the prior year quarter. The decrease was due to the decline of U.S. Healthcare Solutions' gross profit margin as a result of increased sales of products labeled for diabetes and/or weight loss in the GLP-1 class, which have lower gross profit margins, and lower sales of government-owned COVID-19 treatments, which have higher gross profit margins.

•Adjusted Operating Expenses: In the fourth quarter of fiscal 2023, adjusted operating expenses were $1.5 billion, an increase of 10.2 percent compared to the same period in the previous fiscal year primarily due to an increase in distribution, selling, and administrative expenses compared to the prior year quarter. Adjusted operating expenses as a percentage of revenue in the fiscal 2023 fourth quarter was 2.18 percent, a decrease of 5 basis points when compared to the prior year quarter.

•Adjusted Operating Income: In the fiscal 2023 fourth quarter, adjusted operating income of $801.0 million increased 8.0 percent from the prior year quarter due to a 9.4 percent increase in U.S. Healthcare Solutions' operating income and a 3.1 percent increase in operating income within International Healthcare Solutions. On a constant currency basis, the Company’s adjusted operating income increased 8.2 percent compared to the prior year quarter. On a constant currency basis, International Healthcare Solutions segment operating income increased 4.0 percent. Adjusted operating income as a percentage of revenue was 1.16 percent in the fiscal 2023 fourth quarter, a decrease of 5 basis points when compared to the prior year quarter.

•Interest Expense, Net: No adjustments were made to the GAAP presentation of net interest expense. In the fiscal 2023 fourth quarter, net interest expense of $60.9 million increased 18.3 percent versus the prior year quarter primarily due to increases in intra-period variable-rate borrowings and associated interest rates, offset in part by an increase in interest income as a result of higher investment interest rates.

•Adjusted Effective Tax Rate: The adjusted effective tax rate was 21.6 percent for the fourth quarter of fiscal 2023 compared to 19.8 percent in the prior year quarter.

•Adjusted Diluted Earnings Per Share: Adjusted diluted earnings per share was up 10.0 percent to $2.86 in the fourth quarter of fiscal 2023 compared to $2.60 in the previous fiscal year fourth quarter.

•Diluted Shares Outstanding: No adjustments were made to the GAAP presentation of diluted shares outstanding. Diluted weighted average shares outstanding for the fourth quarter of fiscal 2023 were 203.4 million, a decrease of 3.1 percent versus the prior fiscal year fourth quarter primarily as a result of share repurchases.

Segment Discussion

The Company is organized geographically based upon the products and services it provides to its customers under two reportable segments: U.S. Healthcare Solutions and International Healthcare Solutions.

U.S. Healthcare Solutions Segment

U.S. Healthcare Solutions revenue was $61.9 billion, an increase of 13.0 percent compared to the same quarter in the prior fiscal year primarily due to overall market growth primarily driven by unit volume growth, including increased sales of products labeled for diabetes and/or weight loss in the GLP-1 class and increased sales of specialty products to physician practices and health systems. Segment operating income of $632.8 million in the fourth quarter of fiscal 2023 was up 9.4 percent compared to the same period in the previous fiscal year as a result of an increase in gross profit of 6.3%, offset in part by an increase in operating expenses of 4.1%.

International Healthcare Solutions

Revenue in International Healthcare Solutions was $7.0 billion in the fourth quarter of fiscal 2023, an increase of 9.5 percent compared to the same period in the prior fiscal year due to increased revenue across its businesses. Operating income within International Healthcare Solutions increased 3.1 percent to $168.2 million in the fourth quarter of fiscal 2023 due to growth at its global specialty logistics business and the January 2023 acquisition of PharmaLex, offset in part by a significant decline at its less-than-wholly-owned Alliance Healthcare subsidiary in Egypt. Cencora recently completed the divestiture of its stake in its subsidiary in Egypt and the results of the business will no longer be consolidated beginning in fiscal 2024. On a constant currency basis, International Healthcare Solutions revenue and operating income increased by 10.1 percent and 4.0 percent, respectively.

Fiscal Year 2023 Summary Results

| | | | | | | | |

| GAAP | Adjusted (non-GAAP) |

| Revenue | $262.2B | $262.2B |

| Gross Profit | $9.0B | $9.0B |

| Operating Expenses | $6.6B | $5.7B |

| Operating Income | $2.3B | $3.3B |

| Interest Expense, Net | $229M | $229M |

| Effective Tax Rate | 19.8% | 20.3% |

| Net Income Attributable to Cencora | $1.7B | $2.5B |

| Diluted Earnings Per Share | $8.53 | $11.99 |

| Diluted Shares Outstanding | 204.6M | 204.6M |

Summary Fiscal Year GAAP Results

In fiscal year 2023, GAAP diluted EPS was $8.53 compared to $8.04 in the prior fiscal year. Revenue increased 9.9 percent from last fiscal year to $262.2 billion. Gross profit increased 8.0 percent to $9.0 billion due to increases in gross profit in both reportable segments, and an increase in gains from antitrust litigation settlements, partially offset by an increase in LIFO expense in the current fiscal year. Operating expenses increased 11.6 percent primarily due to an increase in distribution, selling, and administrative expenses, amortization expense and restructuring and other expenses, offset in part by a litigation and opioid-related credit in the current fiscal year in comparison to an expense in the prior fiscal year and the prior fiscal year included a goodwill impairment. Operating income decreased 1.1 percent due to higher operating expenses, largely offset by higher gross profit. Diluted weighted average shares outstanding in fiscal 2023 were 204.6 million, down 3.1 percent from the prior fiscal year primarily due to share repurchases.

Summary Fiscal Year Adjusted (non-GAAP) Results

In fiscal year 2023, adjusted diluted EPS was $11.99 compared to $11.03 in the prior fiscal year. Revenue increased 9.9 percent to $262.2 billion. Adjusted gross profit increased 7.3 percent to $9.0 billion due to the increases in gross profit in both reportable segments. Adjusted operating expenses increased 9.2 percent to $5.7 billion primarily due to an increase in distribution, selling, and administrative expenses. Adjusted operating income increased 4.0 percent to $3.3 billion due to increases in gross profit in both reportable segments, offset in part by increased operating expenses. Adjusted operating income margin decreased by 8 basis points to 1.25 percent, primarily due to increased sales of sales of products labeled for diabetes and/or weight loss in the GLP-1 class, which have lower gross profit margins, and lower sales of government-owned COVID-19 treatments, which have higher gross profit margins, and a negative impact of foreign currency rates in comparison to the prior fiscal year. On a constant currency basis, revenue and adjusted operating income grew 10.9 percent and 6.0 percent, respectively.

Recent Company Highlights & Milestones

•Cencora completed its name change from AmerisourceBergen and began trading under the ticker symbol “COR” on the New York Stock Exchange on August 30, 2023. The new name underscores Cencora's experience and vision when it comes to connecting manufacturers, providers, pharmacies and patients, and ensuring the consistent, reliable flow of treatments to those who need them at a time of growing complexity.

•Good Neighbor Pharmacy, Cencora's national independent pharmacy network, convened nearly 5,000 independent pharmacy owners and other partners to celebrate its annual ThoughtSpot tradeshow and conference. The event

showcased the extraordinary collaboration, commitment and perseverance of the Good Neighbor Pharmacy network of pharmacists dedicated to improving community health.

Dividend Declaration

On November 1, 2023, the Company's Board of Directors declared a quarterly dividend of $0.51 per common share, an increase in its quarterly dividend rate from $0.485 per common share. The quarterly dividend of $0.51 per common share will be payable November 27, 2023, to stockholders of record at the close of business on November 13, 2023.

Fiscal Year 2024 Expectations

The Company does not provide forward-looking guidance on a GAAP basis as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. Please refer to the Supplemental Information Regarding Non-GAAP Financial Measures following the tables for additional information.

Fiscal Year 2024 Expectations on an Adjusted (non-GAAP) Basis

Cencora has introduced its fiscal year 2024 financial guidance. The Company continues to provide "ex-COVID" growth guidance to normalize for contributions related to exclusive COVID products, which are government-owned treatments. The Company does not expect a material contribution from exclusive COVID products beyond the fiscal 2024 first quarter. Commercial COVID products, including newly commercial COVID vaccines, are not excluded. The Company expects:

•Revenue growth to be in the range of 7 to 10 percent;

◦On a constant currency basis, revenue growth to be in the range of 7 to 10 percent;

◦U.S. Healthcare Solutions revenue growth to be in the range of 7 to 10 percent;

◦International Healthcare Solutions revenue growth to be in the range of 4 to 8 percent;

▪International Healthcare Solutions constant currency revenue growth to be in the range of 7 to 11 percent;

•Adjusted diluted earnings per share to be in the range of $12.70 to $13.00.

Additional expectations include:

•Adjusted operating income growth to be in the range of 4 to 6 percent;

◦On a constant currency basis, adjusted operating income growth to be in the range of 5 to 7 percent;

◦Excluding contributions related to COVID-19, adjusted operating income growth to be in the range of 7 to 9 percent;

▪On a constant currency basis, excluding contributions related to COVID-19, adjusted operating income growth to be in the range of 8 to 10 percent;

◦U.S. Healthcare Solutions segment operating income growth to be in the range of 4 to 7 percent;

▪Excluding contributions related to COVID-19, U.S. Healthcare Solutions segment operating income growth to be in the range of 7 to 10 percent;

◦International Healthcare Solutions segment operating income growth to be in the range of 1 to 4 percent;

▪On a constant currency basis, International Healthcare Solutions segment operating income growth to be in range of 5 to 8 percent;

▪Excluding contributions related to COVID-19, International Healthcare Solutions segment operating income growth to be in the range of 3 to 6 percent;

•On a constant currency basis, excluding contributions related to COVID-19, International Healthcare Solutions segment operating income growth to be in the range of 7 to 10 percent;

•Interest expense to be in the range of $210 million to $230 million;

•Adjusted effective tax rate to be approximately 20 percent to 21 percent;

•Adjusted free cash flow to be approximately $2.5 billion;

•Capital expenditures in the $500 million range; and

•Weighted average diluted shares outstanding are expected to be approximately 200 to 202 million for the fiscal year.

For additional details on EPS growth rate excluding COVID-19 contributions, please refer to our slide presentation for investors.

Conference Call & Slide Presentation

The Company will host a conference call to discuss the results at 8:30 a.m. ET on November 2, 2023. A slide presentation for investors has also been posted on the Company's website at investor.cencora.com. Participating in the conference call will be:

•Steven H. Collis, Chairman, President & Chief Executive Officer

•James F. Cleary, Executive Vice President & Chief Financial Officer

The dial-in number for the live call will be (833) 470-1428. From outside the United States and Canada, dial +1 (404) 975-4839. The access code for the call will be 016298. The live call will also be webcast via the Company’s website at investor.cencora.com. Users are encouraged to log on to the webcast approximately 10 minutes in advance of the scheduled start time of the call.

Replays of the call will be made available via telephone and webcast. A replay of the webcast will be posted on investor.cencora.com approximately one hour after the completion of the call and will remain available for one year. The telephone replay will also be available approximately one hour after the completion of the call and will remain available for seven days. To access the telephone replay from within the U.S. and Canada, dial (866) 813-9403. From outside the U.S. and Canada, dial +1 (929) 458-6194. The access code for the replay is 205780.

Upcoming Investor Events

Cencora management will be attending the following investor conference in the coming months:

•J.P. Morgan Healthcare Conference, January 8-11, 2024.

Please check the website for updates regarding the timing of the live presentation webcasts, if any, and for replay information.

About Cencora

Cencora is a leading global pharmaceutical solutions organization centered on improving the lives of people and animals around the world. We partner with pharmaceutical innovators across the value chain to facilitate and optimize market access to therapies. Care providers depend on us for the secure, reliable delivery of pharmaceuticals, healthcare products, and solutions. Our 46,000+ worldwide team members contribute to positive health outcomes through the power of our purpose: We are united in our responsibility to create healthier futures. Cencora is ranked #11 on the Fortune 500 and #24 on the Global Fortune 500 with more than $250 billion in annual revenue. Learn more at www.investor.cencora.com

Cencora’s Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this press release are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”). Words such as "aim," "anticipate," "believe," "can," "continue," "could," "estimate," "expect," "intend," "may," "might," "on track," "opportunity," "plan," "possible," "potential," "predict," "project,” "seek," "should," "strive," "sustain," "synergy," "target," "will," "would" and similar expressions are intended to identify such forward-looking statements, but the absence of these words does not mean the statement is not forward-looking. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances and speak only as of the date hereof. These statements are not guarantees of future performance and are based on assumptions and estimates that could prove incorrect or could cause actual results to vary materially from those indicated. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those indicated is included (i) in the "Risk Factors" and "Management's Discussion and Analysis" sections in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022 and elsewhere in that report as supplemented by the description of business risks described in Item 1A to our form 10-Q for the fiscal quarter ended March 31, 2023, to which mention is made herein and (ii) in other reports filed by the Company pursuant to the Securities Exchange Act. The Company undertakes no obligation to publicly update or revise any forward-looking statements, except as required by the federal securities laws.

CENCORA, INC.

FINANCIAL SUMMARY

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three

Months Ended

September 30, 2023 | | % of

Revenue | | Three

Months Ended

September 30, 2022 | | % of

Revenue | | %

Change |

Revenue | | $ | 68,922,331 | | | | | $ | 61,174,149 | | | | | 12.7% |

| | | | | | | | | | |

Cost of goods sold | | 66,668,879 | | | | | 59,188,590 | | | | | 12.6% |

| | | | | | | | | | |

Gross profit 1 | | 2,253,452 | | | 3.27% | | 1,985,559 | | | 3.25% | | 13.5% |

| | | | | | | | | | |

Operating expenses: | | | | | | | | | | |

| Distribution, selling, and administrative | | 1,393,828 | | | 2.02% | | 1,263,462 | | | 2.07% | | 10.3% |

| Depreciation and amortization | | 276,226 | | | 0.40% | | 170,562 | | | 0.28% | | 62.0% |

| Litigation and opioid-related expenses | | 13,890 | | | | | 15,024 | | | | | |

| Acquisition-related deal and integration expenses | | 40,291 | | | | | 49,851 | | | | | |

| Restructuring and other expenses | | 52,276 | | | | | 32,141 | | | | | |

Total operating expenses | | 1,776,511 | | | 2.58% | | 1,531,040 | | | 2.50% | | 16.0% |

| | | | | | | | | | |

| Operating income | | 476,941 | | | 0.69% | | 454,519 | | | 0.74% | | 4.9% |

| | | | | | | | | | |

Other (income) loss, net 2 | | (30,424) | | | | | 20,656 | | | | | |

Interest expense, net | | 60,942 | | | | | 51,523 | | | | | 18.3% |

| | | | | | | | | | |

| Income before income taxes | | 446,423 | | | 0.65% | | 382,340 | | | 0.63% | | 16.8% |

| | | | | | | | | | |

| Income tax expense | | 97,443 | | | | | 83,664 | | | | | |

| | | | | | | | | | |

| Net income | | 348,980 | | | 0.51% | | 298,676 | | | 0.49% | | 16.8% |

| | | | | | | | | | |

| Net loss (income) attributable to noncontrolling interests | | 1,585 | | | | | (3,939) | | | | | |

| | | | | | | | | | |

| Net income attributable to Cencora, Inc. | | $ | 350,565 | | | 0.51% | | $ | 294,737 | | | 0.48% | | 18.9% |

| | | | | | | | | | |

Earnings per share: | | | | | | | | | | |

Basic | | $ | 1.74 | | | | | $ | 1.42 | | | | | 22.5% |

Diluted | | $ | 1.72 | | | | | $ | 1.40 | | | | | 22.9% |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | 201,338 | | | | | 207,222 | | | | | (2.8)% |

Diluted | | 203,395 | | | | | 209,961 | | | | | (3.1)% |

________________________________________

1 Includes a $70.6 million gain from antitrust litigation settlements, a $90.3 million LIFO expense, and Turkey foreign currency remeasurement expense of $27.9 million in the three months ended September 30, 2023. Includes a $104.8 million LIFO expense and Turkey foreign currency remeasurement expense of $12.4 million in the three months ended September 30, 2022.

2 Includes a $40.7 million gain on the divestiture of non-core businesses in the three months September 30, 2023.

CENCORA, INC.

FINANCIAL SUMMARY

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended

September 30, 2023 | | % of

Revenue | | Fiscal Year Ended

September 30, 2022 | | % of

Revenue | | %

Change |

Revenue | | $ | 262,173,411 | | | | | $ | 238,587,006 | | | | | 9.9% |

| | | | | | | | | | |

Cost of goods sold | | 253,213,918 | | | | | 230,290,639 | | | | | 10.0% |

| | | | | | | | | | |

Gross profit 1 | | 8,959,493 | | | 3.42% | | 8,296,367 | | | 3.48% | | 8.0% |

| | | | | | | | | | |

Operating expenses: | | | | | | | | | | |

| Distribution, selling, and administrative | | 5,309,984 | | | 2.03% | | 4,848,962 | | | 2.03% | | 9.5% |

| Depreciation and amortization | | 963,904 | | | 0.37% | | 693,895 | | | 0.29% | | 38.9% |

Litigation and opioid-related (credit) expenses 2 | | (24,693) | | | | | 123,191 | | | | | |

| Acquisition-related deal and integration expenses | | 139,683 | | | | | 119,561 | | | | | |

| Restructuring and other expenses | | 229,884 | | | | | 63,498 | | | | | |

| Impairment of assets | | — | | | | | 4,946 | | | | | |

Goodwill impairment 3 | | — | | | | | 75,936 | | | | | |

Total operating expenses | | 6,618,762 | | | 2.52% | | 5,929,989 | | | 2.49% | | 11.6% |

| | | | | | | | | | |

| Operating income | | 2,340,731 | | | 0.89% | | 2,366,378 | | | 0.99% | | (1.1)% |

| | | | | | | | | | |

Other income, net 4 | | (49,036) | | | | | (27,352) | | | | | |

Interest expense, net | | 228,931 | | | | | 210,673 | | | | | 8.7% |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income before income taxes | | 2,160,836 | | | 0.82% | | 2,183,057 | | | 0.91% | | (1.0)% |

| | | | | | | | | | |

| Income tax expense | | 428,260 | | | | | 516,517 | | | | | |

| | | | | | | | | | |

| Net income | | 1,732,576 | | | 0.66% | | 1,666,540 | | | 0.70% | | 4.0% |

| | | | | | | | | | |

| Net loss attributable to noncontrolling interests | | 12,717 | | | | | 32,280 | | | | | |

| | | | | | | | | | |

| Net income attributable to Cencora, Inc. | | $ | 1,745,293 | | | 0.67% | | $ | 1,698,820 | | | 0.71% | | 2.7% |

| | | | | | | | | | |

Earnings per share: | | | | | | | | | | |

Basic | | $ | 8.62 | | | | | $ | 8.15 | | | | | 5.8% |

Diluted | | $ | 8.53 | | | | | $ | 8.04 | | | | | 6.1% |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | 202,511 | | | | | 208,472 | | | | | (2.9)% |

Diluted | | 204,591 | | | | | 211,210 | | | | | (3.1)% |

________________________________________

1 Includes a $239.1 million gain from antitrust litigation settlements, a $204.6 million LIFO expense, and Turkey foreign currency remeasurement expense of $87.0 million in the fiscal year ended September 30, 2023. Includes a $1.8 million gain from antitrust litigation settlements, a $67.2 million LIFO expense, and Turkey foreign currency remeasurement expense of $40.0 million in the fiscal year ended September 30, 2022.

2 Includes the receipt of $83.4 million from the H.D. Smith opioid litigation indemnity escrow in the fiscal year ended September 30, 2023.

3 The goodwill impairment is related to the Company's less-than-wholly-owned subsidiary in Brazil in the fiscal year ended September 30, 2022.

4 Includes a $40.7 million gain on the divestiture of non-core businesses in the fiscal year ended September 30, 2023. Includes a 56.2 million gain on the divestiture of non-core businesses in the fiscal year ended September 30, 2022.

CENCORA, INC.

GAAP TO NON-GAAP RECONCILIATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 | |

| | Gross Profit | | Operating

Expenses | | Operating Income | | Income Before Income Taxes | | Income Tax Expense | | Net Income Attributable to Noncontrolling Interests | | Net Income Attributable

to Cencora | | Diluted

Earnings

Per Share | |

GAAP | | $ | 2,253,452 | | | $ | 1,776,511 | | | $ | 476,941 | | | $ | 446,423 | | | $ | 97,443 | | | $ | 1,585 | | | $ | 350,565 | | | $ | 1.72 | | |

| | | | | | | | | | | | | | | | | |

| Gains from antitrust litigation settlements | | (70,582) | | | — | | | (70,582) | | | (70,582) | | | (16,719) | | | — | | | (53,863) | | | (0.26) | | |

| | | | | | | | | | | | | | | | | |

| LIFO expense | | 90,323 | | | — | | | 90,323 | | | 90,323 | | | 21,264 | | | — | | | 69,056 | | | 0.34 | | |

| | | | | | | | | | | | | | | | | |

| Turkey highly inflationary impact | | 27,948 | | | — | | | 27,948 | | | 29,916 | | | — | | | — | | | 29,916 | | | 0.15 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related intangibles amortization | | — | | | (169,900) | | | 169,900 | | | 169,900 | | | 40,214 | | | (968) | | | 128,718 | | | 0.63 | | |

| | | | | | | | | | | | | | | | | |

| Litigation and opioid-related expenses | | — | | | (13,890) | | | 13,890 | | | 13,890 | | | 3,305 | | | — | | | 10,585 | | | 0.05 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related deal and integration expenses | | — | | | (40,291) | | | 40,291 | | | 40,291 | | | 9,548 | | | — | | | 30,743 | | | 0.15 | | |

| | | | | | | | | | | | | | | | | |

| Restructuring and other expenses | | — | | | (52,276) | | | 52,276 | | | 52,276 | | | 12,452 | | | — | | | 39,824 | | | 0.20 | | |

| | | | | | | | | | | | | | | | | |

| Gain on divestiture of non-core businesses | | — | | | — | | | — | | | (40,665) | | | 1,035 | | | — | | | (41,700) | | | (0.21) | | |

| | | | | | | | | | | | | | | | | |

| Other, net | | — | | | — | | | — | | | 4,310 | | | 781 | | | — | | | 3,529 | | | 0.02 | | |

| | | | | | | | | | | | | | | | | |

Tax reform 1 | | — | | | — | | | — | | | 4,824 | | | (8,931) | | | — | | | 13,755 | | | 0.07 | | |

| | | | | | | | | | | | | | | | | |

Adjusted Non-GAAP | | $ | 2,301,141 | | | $ | 1,500,154 | | | $ | 800,987 | | | $ | 740,906 | | | $ | 160,392 | | | $ | 617 | | | $ | 581,131 | | | $ | 2.86 | | |

| | | | | | | | | | | | | | | | | |

Adjusted Non-GAAP % change vs. prior year quarter | | 9.4% | | 10.2% | | 8.0% | | 8.6% | | 18.7% | | | | 6.5% | | 10.0% | |

| | | | | | | | | | | | | | |

| Percentages of Revenue: | | GAAP | | Adjusted Non-GAAP |

Gross profit | | 3.27% | | 3.34% |

Operating expenses | | 2.58% | | 2.18% |

| Operating income | | 0.69% | | 1.16% |

________________________________________

1 Includes tax expense relating to 2020 Swiss tax reform and a gain on the currency remeasurement of the related deferred tax assets, the latter of which is recorded within Other (Income) Loss, Net.

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

GAAP TO NON-GAAP RECONCILIATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2022 | |

| | Gross Profit | | Operating

Expenses | | Operating Income | | Income Before Income Taxes | | Income Tax Expense | | Net Income Attributable to Noncontrolling Interests | | Net Income Attributable

to Cencora | | Diluted

Earnings

Per Share | |

GAAP | | $ | 1,985,559 | | | $ | 1,531,040 | | | $ | 454,519 | | | $ | 382,340 | | | $ | 83,664 | | | $ | (3,939) | | | $ | 294,737 | | | $ | 1.40 | | |

| | | | | | | | | | | | | | | | | |

| Gains from antitrust litigation settlements | | — | | | — | | | — | | | — | | | 79 | | | — | | | (79) | | | — | | |

| | | | | | | | | | | | | | | | | |

| LIFO expense | | 104,839 | | | — | | | 104,839 | | | 104,839 | | | 24,943 | | | — | | | 79,896 | | | 0.38 | | |

| | | | | | | | | | | | | | | | | |

| Turkey highly inflationary impact | | 12,415 | | | — | | | 12,415 | | | 18,543 | | | — | | | — | | | 18,543 | | | 0.09 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related intangibles amortization | | — | | | (72,685) | | | 72,685 | | | 72,685 | | | 6,194 | | | (1,127) | | | 65,364 | | | 0.31 | | |

| | | | | | | | | | | | | | | | | |

| Litigation and opioid-related expenses | | — | | | (15,024) | | | 15,024 | | | 15,024 | | | 5,106 | | | — | | | 9,918 | | | 0.05 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related deal and integration expenses | | — | | | (49,851) | | | 49,851 | | | 49,851 | | | 4,894 | | | — | | | 44,957 | | | 0.21 | |

| | | | | | | | | | | | | | | | | |

| Restructuring and other expenses | | — | | | (32,141) | | | 32,141 | | | 32,141 | | | 4,104 | | | — | | | 28,037 | | | 0.13 | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gain on remeasurement of equity investment | | — | | | — | | | — | | | (4,834) | | | — | | | — | | | (4,834) | | | (0.02) | | |

| | | | | | | | | | | | | | | | | |

| Loss on divestiture of non-core businesses | | — | | | — | | | — | | | 3,745 | | | 2,821 | | | 3,618 | | | 4,542 | | | 0.02 | | |

| | | | | | | | | | | | | | | | | |

| Certain discrete tax benefits | | — | | | — | | | — | | | — | | | 9,302 | | | — | | | (9,302) | | | (0.04) | | |

| | | | | | | | | | | | | | | | | |

Tax reform 1 | | — | | | — | | | — | | | 8,127 | | | (5,951) | | | — | | | 14,078 | | | 0.07 | | |

| | | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP | | $ | 2,102,813 | | | $ | 1,361,339 | | | $ | 741,474 | | | $ | 682,461 | | | $ | 135,156 | | | $ | (1,448) | | | $ | 545,857 | | | $ | 2.60 | |

|

| | | | | | | | | | | | | | |

| Percentages of Revenue: | | GAAP | | Adjusted Non-GAAP |

Gross profit | | 3.25% | | 3.44% |

Operating expenses | | 2.50% | | 2.23% |

| Operating income | | 0.74% | | 1.21% |

______________________________________

1 Includes tax expense relating to Swiss tax reform and a loss on the currency remeasurement of the related deferred tax assets, the latter of which is recorded within Other (Income) Loss, Net.

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

GAAP TO NON-GAAP RECONCILIATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended September 30, 2023 | |

| | Gross Profit | | Operating

Expenses | | Operating Income | | Income Before Income Taxes | | Income Tax Expense | | Net Loss Attributable to Noncontrolling Interests | | Net Income Attributable to Cencora | | Diluted

Earnings

Per Share | |

GAAP | | $ | 8,959,493 | | | $ | 6,618,762 | | | $ | 2,340,731 | | | $ | 2,160,836 | | | $ | 428,260 | | | $ | 12,717 | | | $ | 1,745,293 | | | $ | 8.53 | | |

| | | | | | | | | | | | | | | | | |

| Gains from antitrust litigation settlements | | (239,092) | | | — | | | (239,092) | | | (239,092) | | | (55,894) | | | — | | | (183,198) | | | (0.90) | | |

| | | | | | | | | | | | | | | | | |

| LIFO expense | | 204,595 | | | — | | | 204,595 | | | 204,595 | | | 47,830 | | | — | | | 156,765 | | | 0.77 | | |

| | | | | | | | | | | | | | | | | |

| Turkey highly inflationary impact | | 86,967 | | | — | | | 86,967 | | | 95,938 | | | — | | | — | | | 95,938 | | | 0.47 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related intangibles amortization | | — | | | (551,046) | | | 551,046 | | | 551,046 | | | 128,823 | | | (4,079) | | | 418,144 | | | 2.04 | | |

| | | | | | | | | | | | | | | | | |

Litigation and opioid-related credit, net 1 | | — | | | 24,693 | | | (24,693) | | | (24,693) | | | 13,717 | | | — | | | (38,410) | | | (0.19) | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related deal and integration expenses | | — | | | (139,683) | | | 139,683 | | | 139,683 | | | 32,655 | | | — | | | 107,028 | | | 0.52 | | |

| | | | | | | | | | | | | | | | | |

| Restructuring and other expenses | | — | | | (229,884) | | | 229,884 | | | 229,884 | | | 53,742 | | | — | | | 176,142 | | | 0.86 | | |

| | | | | | | | | | | | | | | | | |

| Gain on divestiture of non-core businesses | | — | | | — | | | — | | | (40,665) | | | 1,035 | | | — | | | (41,700) | | | (0.20) | | |

| | | | | | | | | | | | | | | | | |

| Other, net | | — | | | — | | | — | | | (5,501) | | | 781 | | | — | | | (6,282) | | | (0.03) | | |

| | | | | | | | | | | | | | | | | |

Tax reform 2 | | — | | | — | | | — | | | (6,638) | | | (29,287) | | | — | | | 22,649 | | | 0.11 | | |

| | | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP | | $ | 9,011,963 | | | $ | 5,722,842 | | | $ | 3,289,121 | | | $ | 3,065,393 | | | $ | 621,662 | | | $ | 8,638 | | | $ | 2,452,369 | | | $ | 11.99 | | 3 |

| | | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP % change vs. prior year | | 7.3% | | 9.2% | | 4.0% | | 4.1% | | 2.5% | | | | 5.3% | | 8.7% | |

| | | | | | | | | | | | | | |

| Percentages of Revenue: | | GAAP | | Adjusted Non-GAAP |

Gross profit | | 3.42% | | 3.44% |

Operating expenses | | 2.52% | | 2.18% |

| Operating income | | 0.89% | | 1.25% |

________________________________________

1 Includes the receipt of $83.4 million from the H.D. Smith opioid litigation indemnity escrow.

2 Tax expense relating to 2020 Swiss tax reform and a gain on the currency remeasurement of the related deferred tax assets, the latter of which is recorded within Other Income, Net.

3 The sum of the components does not equal the total due to rounding.

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

GAAP TO NON-GAAP RECONCILIATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended September 30, 2022 | |

| | Gross Profit | | Operating

Expenses | | Operating Income | | Income Before Income Taxes | | Income Tax Expense | | Net Loss (Income) Attributable to Noncontrolling Interests | | Net Income Attributable

to Cencora | | Diluted

Earnings

Per Share | |

GAAP | | $ | 8,296,367 | | | $ | 5,929,989 | | | $ | 2,366,378 | | | $ | 2,183,057 | | | $ | 516,517 | | | $ | 32,280 | | | $ | 1,698,820 | | | $ | 8.04 | | |

| | | | | | | | | | | | | | | | | |

| Gains from antitrust litigation settlements | | (1,835) | | | — | | | (1,835) | | | (1,835) | | | (408) | | | — | | | (1,427) | | | (0.01) | | |

| | | | | | | | | | | | | | | | | |

| LIFO expense | | 67,171 | | | — | | | 67,171 | | | 67,171 | | | 14,943 | | | — | | | 52,228 | | | 0.25 | |

| | | | | | | | | | | | | | | | | |

| Turkey highly inflationary impact | | 40,033 | | | — | | | 40,033 | | | 51,966 | | | — | | | — | | | 51,966 | | | 0.25 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related intangibles amortization | | — | | | (304,551) | | | 304,551 | | | 304,551 | | | 67,749 | | | (5,219) | | | 231,583 | | | 1.10 | | |

| | | | | | | | | | | | | | | | | |

| Litigation and opioid-related expenses | | — | | | (123,191) | | | 123,191 | | | 123,191 | | | 24,111 | | | — | | | 99,080 | | | 0.47 | | |

| | | | | | | | | | | | | | | | | |

| Acquisition-related deal and integration expenses | | — | | | (119,561) | | | 119,561 | | | 119,561 | | | 23,401 | | | — | | | 96,160 | | | 0.46 | | |

| | | | | | | | | | | | | | | | | |

| Restructuring and other expenses | | — | | | (63,498) | | | 63,498 | | | 63,498 | | | 12,428 | | | — | | | 51,070 | | | 0.24 | | |

| | | | | | | | | | | | | | | | | |

| Gain on remeasurement of equity investment | | — | | | — | | | — | | | (4,834) | | | — | | | — | | | (4,834) | | | (0.02) | | |

| | | | | | | | | | | | | | | | | |

| Goodwill impairment | | — | | | (75,936) | | | 75,936 | | | 75,936 | | | — | | | (47,004) | | | 28,932 | | | 0.14 | | |

| | | | | | | | | | | | | | | | | |

| Impairment of assets | | — | | | (4,946) | | | 4,946 | | | 4,946 | | | — | | | — | | | 4,946 | | | 0.02 | | |

| | | | | | | | | | | | | | | | | |

| Gain on divestiture of non-core businesses | | — | | | — | | | — | | | (56,228) | | | (10,372) | | | 3,618 | | | (42,238) | | | (0.20) | | |

| | | | | | | | | | | | | | | | | |

| Certain discrete tax benefits | | — | | | — | | | — | | | — | | | (9,677) | | | 6,840 | | | 16,517 | | | 0.08 | | |

| | | | | | | | | | | | | | | | | |

Tax reform 1 | | — | | | — | | | — | | | 14,443 | | | (32,109) | | | — | | | 46,552 | | | 0.22 | | |

| | | | | | | | | | | | | | | | | |

Adjusted Non-GAAP | | $ | 8,401,736 | | | $ | 5,238,306 | | | $ | 3,163,430 | | | $ | 2,945,423 | | | $ | 606,583 | | | $ | (9,485) | | | $ | 2,329,355 | | | $ | 11.03 | | 2 |

| | | | | | | | | | | | | | |

| Percentages of Revenue: | | GAAP | | Adjusted Non-GAAP |

Gross profit | | 3.48% | | 3.52% |

Operating expenses | | 2.49% | | 2.20% |

| Operating income | | 0.99% | | 1.33% |

________________________________________

1 Includes tax expense relating to Swiss tax reform and a loss on the currency remeasurement of the related deferred tax assets, the latter of which is recorded within Other Income, Net.

2 The sum of the components does not equal the total due to rounding

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

SUMMARY SEGMENT INFORMATION

(dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| Revenue | | 2023 | | 2022 | | % Change |

| U.S. Healthcare Solutions | | $ | 61,928,984 | | | $ | 54,788,447 | | | 13.0% |

| International Healthcare Solutions | | 6,994,689 | | | 6,387,474 | | | 9.5% |

Intersegment eliminations | | (1,342) | | | (1,772) | | | |

| | | | | | |

Revenue | | $ | 68,922,331 | | | $ | 61,174,149 | | | 12.7% |

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| Operating income | | 2023 | | 2022 | | % Change |

| U.S. Healthcare Solutions | | $ | 632,830 | | | $ | 578,416 | | | 9.4% |

| International Healthcare Solutions | | 168,157 | | | 163,058 | | | 3.1% |

| | | | | | |

Total segment operating income | | 800,987 | | | 741,474 | | | 8.0% |

| | | | | | |

| Gains from antitrust litigation settlements | | 70,582 | | | — | | | |

| LIFO expense | | (90,323) | | | (104,839) | | | |

| Turkey highly inflationary impact | | (27,948) | | | (12,415) | | | |

| | | | | | |

| Acquisition-related intangibles amortization | | (169,900) | | | (72,685) | | | |

| Litigation and opioid-related expenses | | (13,890) | | | (15,024) | | | |

| Acquisition-related deal and integration expenses | | (40,291) | | | (49,851) | | | |

| Restructuring and other expenses | | (52,276) | | | (32,141) | | | |

| Operating income | | $ | 476,941 | | | $ | 454,519 | | | 4.9% |

| | | | | | |

Percentages of revenue: | | | | | | |

| | | | | | |

| U.S. Healthcare Solutions | | | | | | |

Gross profit | | 2.38% | | 2.53% | | |

Operating expenses | | 1.36% | | 1.47% | | |

Operating income | | 1.02% | | 1.06% | | |

| | | | | | |

| International Healthcare Solutions | | | | | | |

Gross profit | | 11.84% | | 11.22% | | |

Operating expenses | | 9.43% | | 8.67% | | |

Operating income | | 2.40% | | 2.55% | | |

| | | | | | |

| Cencora, Inc. (GAAP) | | | | | | |

Gross profit | | 3.27% | | 3.25% | | |

Operating expenses | | 2.58% | | 2.50% | | |

| Operating income | | 0.69% | | 0.74% | | |

| | | | | | |

| Cencora, Inc. (Non-GAAP) | | | | | | |

Adjusted gross profit | | 3.34% | | 3.44% | | |

Adjusted operating expenses | | 2.18% | | 2.23% | | |

Adjusted operating income | | 1.16% | | 1.21% | | |

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

SUMMARY SEGMENT INFORMATION

(dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended September 30, |

| Revenue | | 2023 | | 2022 | | % Change |

| U.S. Healthcare Solutions | | $ | 234,759,218 | | | $ | 212,100,202 | | | 10.7% |

| International Healthcare Solutions | | 27,418,679 | | | 26,491,673 | | | 3.5% |

Intersegment eliminations | | (4,486) | | | (4,869) | | | |

| | | | | | |

Revenue | | $ | 262,173,411 | | | $ | 238,587,006 | | | 9.9% |

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended September 30, |

| Operating income | | 2023 | | 2022 | | % Change |

| U.S. Healthcare Solutions | | $ | 2,596,559 | | | $ | 2,456,972 | | | 5.7% |

| International Healthcare Solutions | | 692,562 | | | 706,458 | | | (2.0)% |

Total segment operating income | | 3,289,121 | | | 3,163,430 | | | 4.0% |

| | | | | | |

| Gains from antitrust litigation settlements | | 239,092 | | | 1,835 | | | |

| LIFO expense | | (204,595) | | | (67,171) | | | |

| Turkey highly inflationary impact | | (86,967) | | | (40,033) | | | |

| | | | | | |

| Acquisition-related intangibles amortization | | (551,046) | | | (304,551) | | | |

| Litigation and opioid-related credit (expenses) | | 24,693 | | | (123,191) | | | |

| Acquisition-related deal and integration expenses | | (139,683) | | | (119,561) | | | |

| Restructuring and other expenses | | (229,884) | | | (63,498) | | | |

| Goodwill impairment | | — | | | (75,936) | | | |

| Impairment of assets | | — | | | (4,946) | | | |

| Operating income | | $ | 2,340,731 | | | $ | 2,366,378 | | | (1.1)% |

| | | | | | |

Percentages of revenue: | | | | | | |

| | | | | | |

| U.S. Healthcare Solutions | | | | | | |

Gross profit | | 2.48% | | 2.57% | | |

Operating expenses | | 1.37% | | 1.41% | | |

Operating income | | 1.11% | | 1.16% | | |

| | | | | | |

| International Healthcare Solutions | | | | | | |

Gross profit | | 11.64% | | 11.12% | | |

Operating expenses | | 9.11% | | 8.46% | | |

Operating income | | 2.53% | | 2.67% | | |

| | | | | | |

| Cencora, Inc. (GAAP) | | | | | | |

Gross profit | | 3.42% | | 3.48% | | |

Operating expenses | | 2.52% | | 2.49% | | |

| Operating income | | 0.89% | | 0.99% | | |

| | | | | | |

| Cencora, Inc. (Non-GAAP) | | | | | | |

Adjusted gross profit | | 3.44% | | 3.52% | | |

Adjusted operating expenses | | 2.18% | | 2.20% | | |

Adjusted operating income | | 1.25% | | 1.33% | | |

Note: For more information related to non-GAAP financial measures, refer to the section titled "Supplemental Information Regarding Non-GAAP Financial Measures" of this release.

CENCORA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| September 30, |

| 2023 | | 2022 |

| ASSETS | | | |

| | | |

Current assets: | | | |

Cash and cash equivalents | $ | 2,592,051 | | | $ | 3,388,189 | |

Accounts receivable, net | 20,911,081 | | | 18,452,675 | |

Inventories | 17,454,768 | | | 15,556,394 | |

Right to recover asset | 1,314,857 | | | 1,532,061 | |

Prepaid expenses and other | 526,069 | | | 660,439 | |

Total current assets | 42,798,826 | | | 39,589,758 | |

| | | |

Property and equipment, net | 2,135,171 | | | 2,135,003 | |

Goodwill and other intangible assets | 14,005,900 | | | 12,836,623 | |

| Deferred income taxes | 200,667 | | | 237,571 | |

Other long-term assets | 3,418,182 | | | 1,761,661 | |

| | | |

Total assets | $ | 62,558,746 | | | $ | 56,560,616 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | |

Current liabilities: | | | |

Accounts payable | $ | 45,836,037 | | | $ | 40,192,890 | |

| Accrued expenses and other | 2,353,817 | | | 2,214,592 | |

Short-term debt | 641,344 | | | 1,070,473 | |

Total current liabilities | 48,831,198 | | | 43,477,955 | |

| | | |

Long-term debt | 4,146,113 | | | 4,632,360 | |

| | | |

Accrued income taxes | 310,676 | | | 320,274 | |

Deferred income taxes | 1,657,944 | | | 1,620,413 | |

| Accrued litigation liability | 5,061,795 | | | 5,461,758 | |

Other long-term liabilities | 1,884,733 | | | 976,583 | |

| | | |

| Total equity | 666,287 | | | 71,273 | |

| | | |

| Total liabilities and stockholders' equity | $ | 62,558,746 | | | $ | 56,560,616 | |

CENCORA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Fiscal Year Ended September 30, |

| 2023 | | 2022 |

| Operating Activities: | | | |

| Net income | $ | 1,732,576 | | | $ | 1,666,540 | |

| Adjustments to reconcile net income to net cash provided by operating activities | 1,304,216 | | | 1,176,210 | |

| Changes in operating assets and liabilities, excluding the effects of acquisitions and divestitures: | | | |

| Accounts receivable | (2,711,786) | | | (1,659,525) | |

| Inventories | (2,183,368) | | | (665,370) | |

| Accounts payable | 6,103,451 | | | 3,320,725 | |

| Other, net | (333,755) | | | (1,135,492) | |

| Net cash provided by operating activities | 3,911,334 | | | 2,703,088 | |

| | | |

| Investing Activities: | | | |

| Capital expenditures | (458,359) | | | (496,318) | |

Cost of acquired companies, net of cash acquired 1 | (1,409,835) | | | (133,814) | |

Cost of equity investments 2 | (743,275) | | | (18,491) | |

| Proceeds from the divestiture of businesses | — | | | 272,586 | |

| Other, net | 9,004 | | | 7,600 | |

| Net cash used in investing activities | (2,602,465) | | | (368,437) | |

| | | |

| Financing Activities: | | | |

| Net debt repayments | (623,258) | | | (923,103) | |

| | | |

Purchases of common stock 3 | (1,180,728) | | | (483,704) | |

| Exercises of stock options | 61,152 | | | 93,912 | |

| Cash dividends on common stock | (398,752) | | | (391,687) | |

| Employee tax withholdings related to restricted share vesting | (71,279) | | | (38,076) | |

| Other, net | (9,413) | | | (10,122) | |

| Net cash used in financing activities | (2,222,278) | | | (1,752,780) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 72,759 | | | (57,850) | |

| | | |

| (Decrease) increase in cash, cash equivalents, and restricted cash, including cash classified within assets held for sale | (840,650) | | | 524,021 | |

| Less: Increase in cash classified within assets held for sale | — | | | (610) | |

| (Decrease) increase in cash, cash equivalents, and restricted cash | (840,650) | | | 523,411 | |

| | | |

Cash, cash equivalents, and restricted cash at beginning of year 4 | 3,593,539 | | | 3,070,128 | |

| | | |

Cash, cash equivalents, and restricted cash at end of year 4 | $ | 2,752,889 | | | $ | 3,593,539 | |

________________________________________

1 Includes $1,406.5 million for the acquisition of PharmaLex.

2 Includes a $718.4 million investment in OneOncology.

3 Includes $28.4 million of purchases in September 2022 that cash settled in October 2022.

4 The following represents a reconciliation of cash and cash equivalents in the Condensed Consolidated Balance Sheets to cash, cash equivalents, and restricted cash used in the Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | | | | | | | | | | |

| | September 30, |

| (amounts in thousands) | | 2023 | | 2022 | | 2021 |

| Cash and cash equivalents | | $ | 2,592,051 | | | $ | 3,388,189 | | | $ | 2,547,142 | |

| Restricted cash (included in Prepaid Expenses and Other) | | 97,722 | | | 144,980 | | | 462,986 | |

| Restricted cash (included in Other Assets) | | 63,116 | | | 60,370 | | | 60,000 | |

| Cash, cash equivalents, and restricted cash | | $ | 2,752,889 | | | $ | 3,593,539 | | | $ | 3,070,128 | |

SUPPLEMENTAL INFORMATION REGARDING

NON-GAAP FINANCIAL MEASURES

To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses the non-GAAP financial measures described below. The non-GAAP financial measures should be viewed in addition to, and not in lieu of, financial measures calculated in accordance with GAAP. These supplemental measures may vary from, and may not be comparable to, similarly titled measures by other companies.

The non-GAAP financial measures are presented because management uses non-GAAP financial measures to evaluate the Company’s operating performance, to perform financial planning, and to determine incentive compensation. Therefore, the Company believes that the presentation of non-GAAP financial measures provides useful supplementary information to, and facilitates additional analysis by, investors. The presented non-GAAP financial measures exclude items that management does not believe reflect the Company’s core operating performance because such items are outside the control of the Company or are inherently unusual, non-operating, unpredictable, non-recurring, or non-cash. We have included the following non-GAAP earnings-related financial measures in this release:

•Adjusted gross profit and adjusted gross profit margin: Adjusted gross profit is a non-GAAP financial measure that excludes gains from antitrust litigation settlements, Turkey highly inflationary impact and LIFO expense (credit). Adjusted gross profit margin is the ratio of adjusted gross profit to total revenue. Management believes that these non-GAAP financial measures are useful to investors as a supplemental measure of the Company’s ongoing operating performance. Gains from antitrust litigation settlements, Turkey highly inflationary impact and LIFO expense (credit) are excluded because the Company cannot control the amounts recognized or timing of these items. Gains from antitrust litigation settlements relate to the settlement of lawsuits that have been filed against brand pharmaceutical manufacturers alleging that the manufacturer, by itself or in concert with others, took improper actions to delay or prevent generic drugs from entering the market. LIFO expense (credit) is affected by changes in inventory quantities, product mix, and manufacturer pricing practices, which may be impacted by market and other external influences.

•Adjusted operating expenses and adjusted operating expense margin: Adjusted operating expenses is a non-GAAP financial measure that excludes acquisition-related intangibles amortization; litigation and opioid-related expenses (credit); acquisition-related deal and integration expenses; restructuring and other expenses; impairment of assets; and goodwill impairment. Adjusted operating expense margin is the ratio of adjusted operating expenses to total revenue. Acquisition-related intangibles amortization is excluded because it is a non-cash item and does not reflect the operating performance of the acquired companies. We exclude acquisition-related deal and integration expenses and restructuring and other expenses that relate to unpredictable and/or non-recurring business activities. We exclude the amount of litigation and opioid-related expenses (credit), and the impairment of assets, including goodwill, that are unusual, non-operating, unpredictable, non-recurring or non-cash in nature because we believe these exclusions facilitate the analysis of our ongoing operational performance.

•Adjusted operating income and adjusted operating income margin: Adjusted operating income is a non-GAAP financial measure that excludes the same items that are described above and excluded from adjusted gross profit and adjusted operating expenses. Adjusted operating income margin is the ratio of adjusted operating income to total revenue. Management believes that these non-GAAP financial measures are useful to investors as a supplemental way to evaluate the Company’s performance because the adjustments are unusual, non-operating, unpredictable, non-recurring or non-cash in nature.

•Adjusted income before income taxes: Adjusted income before income taxes is a non-GAAP financial measure that excludes the same items that are described above and excluded from adjusted operating income. In addition, the gain (loss) on the currency remeasurement of the deferred tax asset relating to 2020 Swiss tax reform, the gain on the sale of non-core businesses, and the gain on the remeasurement of an equity investment are excluded from adjusted income before income taxes because these amounts are unusual, non-operating, and/or non-recurring. Management believes that this non-GAAP financial measure is useful to investors because it facilitates the calculation of the Company’s adjusted effective tax rate.

•Adjusted effective tax rate: Adjusted effective tax rate is a non-GAAP financial measure that is determined by dividing adjusted income tax expense by adjusted income before income taxes. Management believes that this non-GAAP financial measure is useful to investors because it presents an effective tax rate that does not reflect unusual, non-operating, unpredictable, non-recurring, or non-cash amounts or items that are outside the control of the Company.

•Adjusted income tax expense: Adjusted income tax expense is a non-GAAP financial measure that excludes the income tax expense associated with the same items that are described above and excluded from adjusted income before income taxes. Certain discrete tax benefits primarily attributable to foreign valuation allowance adjustments are also excluded from adjusted income tax expense. Further, certain expenses relating 2020 Swiss tax reform are excluded from adjusted income tax expense. Management believes that this non-GAAP financial measure is useful to investors as a supplemental way to evaluate the Company’s performance because the adjustments are unusual, non-operating, unpredictable, non-recurring or non-cash in nature.

•Adjusted net income/loss attributable to noncontrolling interest: Adjusted net income/loss attributable to noncontrolling interest excludes the non-controlling interest portion of the same items described above. Management believes that this non-GAAP financial measure is useful to investors because it facilitates the calculation of adjusted net income attributable to the Company.

•Adjusted net income attributable to the Company: Adjusted net income attributable to the Company is a non-GAAP financial measure that excludes the same items that are described above. Management believes that this non-GAAP financial measure is useful to investors as a supplemental way to evaluate the Company's performance because the adjustments are unusual, non-operating, unpredictable, non-recurring or non-cash in nature.

•Adjusted diluted earnings per share: Adjusted diluted earnings per share excludes the per share impact of adjustments including gains from antitrust litigation settlements; Turkey highly inflationary impact; LIFO expense (credit); acquisition-related intangibles amortization; litigation and opioid expenses (credit); acquisition-related deal and integration expenses; restructuring and other expenses; impairment of assets, including goodwill; the gain on the sale of non-core businesses; the gain (loss) on the currency remeasurement related to 2020 Swiss tax reform; and the gain on the remeasurement of an equity investment, in each case net of the tax effect calculated using the applicable effective tax rate for those items. In addition, the per share impact of certain discrete tax expense primarily attributable to foreign valuation adjustment allowance, and the per share impact of certain expenses related to 2020 Swiss tax reform are also excluded from adjusted diluted earnings per share. Management believes that this non-GAAP financial measure is useful to investors because it eliminates the per share impact of the items that are outside the control of the Company or that we consider to not be indicative of our ongoing operating performance due to their inherent unusual, non-operating, unpredictable, non-recurring, or non-cash nature.

•Adjusted Free Cash Flow: Adjusted free cash flow is a non-GAAP financial measure defined as net cash provided by operating activities, excluding significant unpredictable or non-recurring cash payments or receipts relating to legal settlements, minus capital expenditures. Adjusted free cash flow is used internally by management for measuring operating cash flow generation and setting performance targets and has historically been used as one of the means of providing guidance on possible future cash flows. For the fiscal year ended September 30, 2023, adjusted free cash flow of $3,130.5 million consisted of net cash provided by operating activities of $3,911.3 million, minus capital expenditures of $458.4 million, the gains from antitrust litigation settlements of $239.1 million, and the receipt of $83.4 million from the H.D. Smith opioid indemnity escrow. The Company does not provide forward looking guidance on a GAAP basis for free cash flow because the timing and amount of favorable and unfavorable settlements excluded from this metric, the probable significance of which cannot be determined, are unavailable and cannot be reasonably estimated.

The Company also presents revenue and operating income on a “constant currency” basis, which are non-GAAP financial measures. These amounts are calculated by translating current period GAAP results at the foreign currency exchange rates used in the comparable period in the prior year. The Company presents such constant currency financial information

because it has significant operations outside of the United States reporting in currencies other than the U.S. dollar and management believes that this presentation provides a framework to assess how its business performed excluding the impact of foreign currency exchange rate fluctuations. For the fourth quarter of fiscal 2023, (i) revenue of $68.9 billion was negatively impacted by foreign currency translation of $37.6 million, resulting in revenue on a constant currency basis of $69.0 billion, and (ii) operating income of $801.0 million was negatively impacted by foreign currency translation of $1.5 million, resulting in operating income on a constant currency basis of $802.5 million. For the fourth quarter of fiscal 2023 in the International Healthcare Solutions segment, (i) revenue of $6,994.7 million was negatively impacted by foreign currency translation of $37.6 million, resulting in revenue on a constant currency basis of $7,032.3 million, and (ii) operating income of $168.2 million was negatively impacted by foreign currency translation of $1.5 million, resulting in operating income on a constant currency basis of $169.6 million. For fiscal 2023, (i) revenue of $262.2 billion was negatively impacted by foreign currency translation of $2.4 billion, resulting in revenue on a constant currency basis of $264.5 billion, and (ii) operating income of $3,289.1 million was negatively impacted by foreign currency translation of $63.0 million, resulting in operating income on a constant currency basis of $3,352.1 million. For fiscal 2023 in the International Healthcare Solutions segment, (i) revenue of $27.4 billion was negatively impacted by foreign currency translation of $2.4 billion, resulting in revenue on a constant currency basis of $29.8 billion, and (ii) operating income of $692.6 million was negatively impacted by foreign currency translation of $63.0 million, resulting in operating income on a constant currency basis of $755.6 million.

In addition, the Company has provided non-GAAP fiscal year 2024 guidance for diluted earnings per share, operating income, effective income tax rate and free cash flow that excludes the same or similar items as those that are excluded from the historical non-GAAP financial measures, as well as significant items that are outside the control of the Company or inherently unusual, non-operating, unpredictable, non-recurring or non-cash in nature. The Company does not provide forward looking guidance on a GAAP basis for such metrics because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. For example, LIFO expense/credit is largely dependent upon the future inflation or deflation of brand and generic pharmaceuticals, which is out of the Company’s control, and acquisition-related intangibles amortization depends on the timing and amount of future acquisitions, which cannot be reasonably estimated. Similarly, the timing and amount of favorable and unfavorable settlements, the probable significance of which cannot be determined, are unavailable and cannot be reasonably estimated.

Contacts: Bennett S. Murphy

Senior Vice President, Head of Investor Relations and Treasury

610-727-3693

bennett.murphy@cencora.com

###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |