Carlisle Companies Incorporated (NYSE:CSL) reported net sales

from continuing operations of $665.9 million for the third quarter

of 2010, a 10% increase from net sales of $604.2 million in the

third quarter of 2009. Organic sales increased by 7.9% from the

same quarter in the prior year. The Interconnect Technologies

segment’s acquisition of Jerrik and Electronic Cable Specialists

(ECS) and the Engineered Transportation Solutions segment’s

acquisition of Japan Power Brake contributed $14.0 million in

sales, or 2.3%, in the third quarter of 2010.

Income from continuing operations was $46.8 million, or $0.75

per diluted share, in the third quarter 2010 compared with $47.1

million, or $0.76 per diluted share, in the third quarter of 2009.

In the third quarter of 2010, income was positively impacted by a

reduction in the Company’s effective tax rate, higher sales

volumes, efficiencies from the Carlisle Operating System and

selling price increases. Offsetting these positive impacts were

higher raw material costs primarily in the Construction Materials

and Engineered Transportation Solutions segments.

Comment

David A. Roberts, Chairman, President and Chief Executive

Officer, said, “During the third quarter of 2010, all of our

business segments achieved organic growth, contributing to an

overall organic growth rate of 7.9%. Although still experiencing

higher raw material cost levels versus the prior year, EBIT

(Earnings Before Interest and Income Taxes) margins of 10% in the

third quarter of 2010 reflect continued emphasis on the Carlisle

Operating System and realization of pricing actions taken by our

businesses to address rising raw material costs.

“The consolidation of our US tire manufacturing operations into

our Jackson, Tennessee facility is expected to be substantially

complete by the end of 2010 and will provide a foundation for

margin growth in the Engineered Transportation Solutions segment in

2011. During the third quarter of 2010, we incurred costs of $3.4

million related to company-wide consolidation and plant closures.

We estimate an additional $6 million in related costs for the

fourth quarter of 2010. We expect to achieve company-wide savings

from our consolidation efforts of approximately $7 million in 2010,

with $3 million anticipated in the fourth quarter, and an

additional $14 million in 2011.”

Roberts continued, “We have recently taken several important

actions directed towards our long-term goals to reach $5 billion in

revenue, 15% EBIT margins, expand globally and produce strong free

cash flow. On October 4, 2010, we completed the sale of Trail King,

our non-core specialty trailer business, for proceeds of $35

million plus a $5 million earn-out potential. This divestiture

enables Carlisle management to focus on growing our core businesses

and provides additional capital which we intend to allocate to

investments that will generate greater returns for our

shareholders. Operating results for Trail King are now being

reported in Discontinued Operations.

“On October 15, 2010, we entered into a definitive agreement to

acquire Hawk Corporation, a leading global manufacturer of friction

materials for brakes, clutches and transmissions, for total

consideration of approximately $413 million. As indicated in our

related announcement, the acquisition of Hawk provides an excellent

growth opportunity in our industrial brake and friction product

line. We expect this acquisition to close by the end of 2010 and to

be accretive in 2011. We estimate costs associated with the

transaction and the change in control will be between $9 and $12

million during the fourth quarter of 2010.

“With a debt to capital ratio of 11% and available borrowings of

$469 million under our revolving credit facility, we are

well-positioned to carry out the Hawk acquisition and continue to

maintain our focus on growth through bolt-on acquisitions and new

product development.”

Roberts concluded by stating, “We continue to plan for revenue

growth for full year 2010 in our core operating segments but remain

cautious on our outlook for margin improvement for the remainder of

the year given current raw material cost levels and the general

economic environment. We will continue to respond with pricing

actions and pursuit of operating improvements through the Carlisle

Operating System.”

Segment Results

Construction Materials: Third quarter 2010 net sales of

$354.8 million increased by 4.3% from net sales of $340.1 million;

EBIT declined 10% to $54.1 million from $60.4 million for the same

period in 2009. The increase in sales primarily reflected higher

demand for re-roofing applications. The Company achieved an EBIT

margin of 15.2% for the third quarter 2010 partially attributable

to the realization of efficiency gains from the Carlisle Operating

System and other manufacturing improvements. This compared to

margin of 17.8% for prior year period, which reflected a period of

significantly lower raw material price levels. Selling prices

during the third quarter 2010 increased from the second quarter of

2010 but declined slightly when compared to the same quarter of the

prior year.

Engineered Transportation Solutions: Third quarter 2010

net sales of $186.0 million increased by 17% compared to net sales

of $158.3 million in the same prior year period. EBIT of $8.4

million increased by 11% compared to EBIT of $7.6 million for the

same period in 2009. Sales from the acquisition of Japan Power

Brake contributed $2.9 million to net sales in the third quarter of

2010. The segment achieved double digit organic sales growth in all

of its major product lines, most notably 48% in its industrial

brake and friction product line and, within its power sports

product line, ATV sales growth of 28%. During the third quarter of

2010, EBIT margin remained relatively flat at 4.5% when compared to

4.8% for the third quarter of 2009. EBIT was negatively impacted by

higher costs for natural and synthetic rubber and steel, which were

significantly offset by increased selling prices during the third

quarter. Plant restructuring expenses in the third quarter of 2010

of $3.3 million compared to restructuring expenses of $3.4 million

for the same period in 2009.

Interconnect Technologies: Third quarter 2010 net sales

of $61.4 million increased by 43% from net sales of $43.1 million,

and EBIT increased 67% to $8.2 million from $4.9 million for the

same period in 2009. The acquisition of Jerrik and ECS contributed

$11.1 million, or 26%, to net sales in the third quarter 2010.

Organic sales increased by 17% in the third quarter of 2010,

primarily due to growth within the aerospace and RF microwave

markets. EBIT margin increased to 13.4% in the third quarter of

2010 from 11.4% in the third quarter of 2009 as a result of organic

sales growth and cost efficiencies driven by the Carlisle Operating

System.

FoodService Products: Third quarter 2010 net sales

increased by 1.6% to $63.7 million compared to net sales of $62.7

million in the prior year period. EBIT declined 25% to $6.3 million

from $8.4 million for the same period in 2009. Despite continued

softness in restaurant traffic, sales demand in the foodservice

market was higher on increased inventory replenishment orders. This

increase was offset by lower demand in the healthcare foodservice

market. EBIT margin decreased to 9.9% in the third quarter of 2010

from 13.4% in the third quarter of 2009, due primarily to higher

transportation costs and higher raw material costs, which were

relatively level with the second quarter of 2010, but higher in

comparison to the prior year period.

Corporate Expense

Corporate expense increased from $7.3 million for the third

quarter of 2009 to $10.5 million for the third quarter of 2010. The

increase primarily reflects higher costs related to the ramp-up of

sales and sourcing support service in the Asia Pacific region,

which has seen increased sales of 81% during the first nine months

of 2010 versus the prior year period. Corporate expense was also

impacted by higher foreign currency exchange rate losses incurred

during the third quarter of 2010 as compared to the third quarter

of 2009.

Discontinued Operations

Income from discontinued operations of $3.7 million for the

third quarter of 2010 compared with a loss of $0.5 million for the

third quarter of 2009. Income from discontinued operations for the

third quarter of 2010 reflects higher operating earnings from the

specialty trailer business, Trail King, which was sold on October

4, 2010 and classified as held for sale in the balance sheet at

September 30, 2010. The specialty trailer business’ related results

of operations for all periods have been reclassified into

Discontinued Operations. During the third quarter 2009, the

specialty trailer business operated at a loss.

Net Income

Net income for the third quarter of 2010 was $50.5 million, or

$0.81 per diluted share, compared to net income of $46.6 million,

or $0.75 per diluted share, for the third quarter of 2009. Third

quarter 2010 net income was positively impacted by a reduction in

the effective tax rate, higher sales volumes, operating

improvements from the Carlisle Operating System and income from

Discontinued Operations. These positive impacts were partially

offset by higher raw material costs.

Year-to-Date

Net sales of $1.90 billion for the first nine months of 2010

increased 10% as compared with $1.73 billion for the same period in

2009. For the first nine months of 2010, organic sales increased by

6.6% from the prior year period, with organic growth generated by

all business segments with the exception of FoodService Products.

Acquisitions in the Interconnect Technologies and Engineered

Transportation Solutions segments contributed $45.9 million, or

2.6%, in sales in the first nine months of 2010 as compared to the

same period of 2009.

Income from continuing operations for the first nine months of

2010 of $108.7 million, or $1.75 per diluted share, decreased 9% as

compared with $119.2 million, or $1.93 per diluted share, for the

same period in 2009. 2010 EBIT year-to-date declined from 2009 due

to a gain of $27.0 million recorded in 2009 from fire insurance

recoveries, higher raw material costs experienced in 2010 and

reduction in selling prices, which have been increasing throughout

2010, but have declined on a year-over-year basis. Partially

offsetting these impacts were higher sales volumes and efficiencies

gained through the Carlisle Operating System. Plant and corporate

restructuring charges of $10.3 million in the first nine months of

2010 compared to charges of $14.7 million in the first nine months

of 2009.

Income from Discontinued Operations of $4.7 million in first

nine months of 2010 compared to a Loss from Discontinued Operations

of $10.5 million in the first nine months of 2009.

Net income for the first nine months of 2010 was $113.4 million,

or $1.83 per diluted share. Net income for the first nine months of

2009 was $108.7 million, or $1.76 per diluted share.

Cash flow provided by operating activities of $62.4 million for

the first nine months of 2010 compared with $333.4 million for the

same period in 2009. Cash used for working capital and other assets

and liabilities of $102.3 million for the first nine months of 2010

primarily reflected an increase in receivables and inventory due to

higher sales activity, as compared to cash provided by working

capital and other assets and liabilities of $178.3 million for the

first nine months of 2009. For the first nine months of 2010,

average working capital (defined as the average of the quarter end

balances of receivables, plus inventory less accounts payable) as a

percentage of annualized sales (defined as year-to-date net sales

calculated on an annualized basis) was 21.6%, as compared to a

percentage of 25.1% for the nine months ended September 30,

2009.

Capital expenditures were $46.8 million in the first nine months

of 2010 compared to capital expenditures of $34.9 million in the

first nine months of 2009. The increase in capital expenditures

primarily reflects the Company’s consolidation of its US tire

manufacturing operations into a new facility in Jackson, Tennessee,

expected to be substantially completed by the end of 2010.

Conference Call and

Webcast

The Company will discuss third quarter 2010 results on a

conference call at 10:00 a.m. ET today. The call may be accessed

live by going to the Investor Relations section of the Carlisle

website (http://www.carlisle.com/investors/conference_call.html),

or the taped call may be listened to shortly following the live

call at the same website location. A PowerPoint presentation will

accompany the call and can be found on the Carlisle website as

well.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are based on management's current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in global economic, business,

competitive, market and regulatory factors. More detailed

information about these factors is contained in the Company's

filings with the Securities and Exchange Commission. The Company

undertakes no duty to update forward-looking statements.

About Carlisle Companies

Carlisle is a diversified global manufacturing company

serving the construction materials, commercial roofing, specialty

tire and wheel, power transmission, heavy-duty brake and friction,

foodservice, commercial aerospace, defense and test and measurement

industries.

CARLISLE COMPANIES INCORPORATED Unaudited

Condensed Consolidated Statements of Earnings (In millions,

except share and per share amounts) Third

Quarter First Nine Months

2010 2009 % Change

2010 2009 % Change

Net sales

$ 665.9 $ 604.2 10 %

$ 1,900.8 $ 1,733.8 10 % Cost and expenses: Cost of

goods sold

522.3 460.1 14 %

1,501.6 1,355.7 11 %

Selling and administrative expenses

71.5 65.3 9 %

214.7 202.9 6 % Research and development expenses

6.0

3.9 54 %

16.8 12.3 37 % Gain related to fire settlement

- - NM

- (27.0 ) NM Other (income) expense, net

(0.4 ) 0.9 NM

(1.6 ) 5.6

NM Earnings before interest and income taxes

66.5 74.0 -10 %

169.3 184.3 -8 % Interest expense,

net

1.4 2.0 -30 %

5.1 7.0 -27 %

Earnings before income taxes

65.1 72.0 -10 %

164.2 177.3 -7 % Income tax expense

18.3

24.9 NM

55.5 58.1 NM

Income from continuing operations, net of tax

46.8 47.1 - %

108.7 119.2 -9 %

Income (loss) from discontinued operations, net of tax

3.7 (0.5 ) NM

4.7 (10.5 ) NM Net

income

$ 50.5 $ 46.6 8 %

$ 113.4 $ 108.7 4 %

Basic earnings

(loss) per share (1)

Continuing operations

$ 0.76 $ 0.77 -1 %

$

1.77 $ 1.95 -9 % Discontinued operations

0.06

(0.01 ) NM

0.08

(0.17 ) NM Basic earnings per

share

$ 0.82 $ 0.76 8 %

$ 1.85 $ 1.78 4 %

Diluted earnings

(loss) per share (1)

Continuing operations

$ 0.75 $ 0.76 -1 %

$

1.75 $ 1.93 -9 % Discontinued operations

0.06

(0.01 ) NM

0.08

(0.17 ) NM Diluted earnings per

share

$ 0.81 $ 0.75 8 %

$ 1.83 $ 1.76 4 %

Average shares outstanding - in thousands Basic

60,980 60,612

60,885 60,588 Diluted

61,527 61,237

61,639 61,153 Dividends

$ 10.4 $ 9.8 6 %

$

30.1 $ 28.8 5 % Dividends per

share

$ 0.17 $ 0.16 6 %

$ 0.49 $ 0.47 4 %

(1) Numerator for basic and diluted EPS calculated based on "two

class" method of computing earnings per share: Income from

continuing operations

$ 46.3 $ 46.6

$ 107.5 $ 117.9 Net

income

$ 50.0 $ 46.1

$

112.2 $ 107.4 NM = Not

Meaningful

* 2009 figures have been revised to

reflect the reclassification of Power Transmission from

discontinued operations to continuing operations and Johnson Truck

Bodies and specialty trailer businesses as discontinued

operations.

CARLISLE COMPANIES INCORPORATED Unaudited

Segment Financial Data (In millions)

Third Quarter First Nine Months

2010 2009 % Change

2010 2009 % Change

Net Sales Construction

Materials

$ 354.8 $ 340.1 4 %

$ 917.1 $

862.2 6 % Engineered Transportation Solutions

186.0 158.3 17

%

616.4 560.1 10 % Interconnect Technologies

61.4

43.1 43 %

185.6 126.1 47 % FoodService Products

63.7 62.7 2 %

181.7 185.4 -2 % Total Net Sales

$ 665.9 $ 604.2 10 %

$

1,900.8 $ 1,733.8 10 %

Earnings Before Interest and Income Taxes (EBIT)

Construction Materials

$ 54.1 $ 60.4 -10 %

$

124.8 $ 116.5 7 % Engineered Transportation Solutions

8.4 7.6 11 %

31.2 62.8 -50 % Interconnect

Technologies

8.2 4.9 67 %

22.0 11.7 88 % FoodService

Products

6.3 8.4 -25 %

19.0 18.4 3 % Segment

EBIT

77.0 81.3 -5 %

197.0 209.4 -6 % Corporate

(10.5 ) (7.3 ) -44 %

(27.7 ) (25.1 ) -10 % Total EBIT

$ 66.5 $ 74.0 -10 %

$

169.3 $ 184.3 -8 %

EBIT Margins Construction Materials

15.2

% 17.8 %

13.6 % 13.5 % Engineered

Transportation Solutions

4.5 % 4.8 %

5.1

% 11.2 % Interconnect Technologies

13.4 % 11.4

%

11.9 % 9.3 % FoodService Products

9.9

% 13.4 %

10.5 %

9.9 % Segment EBIT Margin

11.6 % 13.5 %

10.4 % 12.1 % Corporate

-1.6 %

-1.2 %

-1.5 % -1.4

% Total EBIT Margin

10.0 % 12.2

%

8.9 % 10.6 %

CARLISLE COMPANIES INCORPORATED Condensed Consolidated

Balance Sheet (In millions) September

30, December 31,

2010 2009

Assets

(Unaudited) Current Assets Cash and cash equivalents

$ 114.8 $ 96.3 Receivables

395.9 287.1

Inventories

382.5 338.3 Prepaid expenses and other

67.2 65.0 Current assets held for sale

23.5

13.1

Total current assets 983.9

799.8 Property, plant and equipment, net

455.8

460.9 Other assets

609.4 629.7 Non-current assets held for

sale

22.2 23.7

Total Assets

$ 2,071.3 $ 1,914.1

Liabilities and

Shareholders' Equity Current Liabilities Accounts

payable

$ 181.4 $ 132.6 Accrued expenses

168.4

160.9 Current liabilities associated with assets held for sale

9.7 7.6

Total current

liabilities 359.5 301.1 Long-term

debt

156.2 156.1 Other liabilities

236.9 238.3

Shareholders' equity

1,318.7 1,218.6

Total Liabilities and Shareholders' Equity $

2,071.3 $ 1,914.1

* 2009 figures have been revised to

reflect the classification of Trail King as held for sale

consistent with the current year presentation.

CARLISLE COMPANIES INCORPORATED Unaudited

Condensed Consolidated Statements of Cash Flows (In

millions) First Nine Months 2010

2009

Operating activities

Net income

$ 113.4 $ 108.7 Reconciliation of net

income to operating cash flows: Depreciation and amortization

53.8 50.8 Non-cash compensation

10.4 10.9 Gain on

insurance settlements related to property, plant and equipment

(24.3 ) Loss on writedown of assets

- 10.6 Deferred taxes

(5.6 ) 3.1 Gain on sale of investments, property and

equipment, net

(3.6 ) (1.4 ) Foreign exchange gain

(1.4 ) (1.5 ) Change in working capital and other

assets and liabilities

(102.3 ) 178.3 Other

(2.3 ) (1.8 )

Net cash (used in)

provided by operating activities 62.4

333.4

Investing activities Capital

expenditures

(46.8 ) (34.9 ) Proceeds from sale of

business

20.6 - Proceeds from investments and disposal of

property and equipment

5.7 6.7 Acquisitions, net of cash

acquired

- (33.0 ) Proceeds from insurance settlements

related to property, plant and equipment 30.0 Other

(0.2 ) 0.2

Net cash provided

by (used in) investing activities (20.7 )

(31.0 )

Financing activities Net change in

short-term debt and revolving credit lines

- (234.6 )

Dividends paid

(30.1 ) (28.8 ) Excess tax benefits on

share-based compensation

1.5 (0.2 ) Treasury shares and

stock options, net

5.1 (0.2 )

Net cash used in financing activities (23.5

) (263.8 )

Effect of exchange rate changes

on cash 0.3 (0.1 )

Change

in cash and cash equivalents 18.5 38.5

Cash and cash

equivalents Beginning of period

96.3

42.7 End of period

$ 114.8

$ 81.2

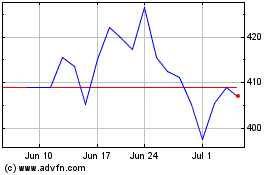

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From May 2024 to Jun 2024

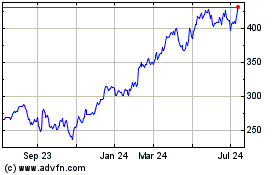

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Jun 2023 to Jun 2024