Carlisle Companies Incorporated (NYSE:CSL) reported income from

continuing operations of $54.6 million, or $1.76 per diluted share,

for the quarter ended June 30, 2006, an increase of 30% above $42.1

million, or $1.34 per diluted share, for the second quarter of

2005. Earnings before interest and income taxes ("EBIT") for the

second quarter of 2006 was $84.2 million or 12.2% expressed as a

percent of net sales. EBIT for the second quarter of 2005 was $66.0

million or 11.1% expressed as a percent of sales. Richmond

McKinnish, Carlisle President and CEO, commented, "The second

quarter of 2006 met our expectations. We continue to see strength

in many of our end markets; therefore, we are increasing our

guidance for income from continuing operations for the full year

2006 to the range of $5.25 to $5.45 per diluted share from the

previous range of $5.00 to $5.20 per diluted share." Net sales of

$692.7 million in the second quarter of 2006 were $101.1 million,

or an increase of 17%, as compared to net sales of $591.6 million

in the second quarter of 2005. Organic sales growth accounted for

$84.1 million, or 83%, of the improvement over the prior-year

quarter, primarily as a result of strong organic growth in the

Construction Materials segment and the Diversified Components

segment. The organic sales growth rate was 14.2% for the second

quarter of 2006 as compared to an organic growth rate of 9.6% for

the second quarter 2005. Acquisitions in the Diversified Components

segments accounted for $13.4 million, or 13%, of the growth over

the second quarter of 2005, while changes in foreign currency

exchange rates contributed $3.6 million, or 4%. Construction

Materials: Net sales of $292.9 million in the second quarter of

2006 were 29% above $227.9 million of net sales in the second

quarter of 2005 primarily related to higher volumes of TPO

(thermoplastic polyolefin) membrane and insulation reflecting

Carlisle's expanded geographic reach within the U.S. and focus on

total system sales. Second quarter 2006 EBIT of $46.6 million was

20% above second quarter 2005 EBIT of $38.8 million. Prior year

results included pre-tax gains of $1.3 million on the sale of

property and $1.3 million of insurance proceeds related to a fire

at a small coatings and waterproofing plant that occurred in 2002.

Segment EBIT for the second quarter of 2006 and 2005 included

earnings related to the Company's equity share of income at its

European roofing joint venture, Icopal, of $0.7 million and $0.6

million, respectively. Industrial Components: Net sales of $214.7

million for the three months ended June 30, 2006 represented a 3%

increase over net sales of $209.2 million for the same period in

2005. The tire and wheel business increased revenues on higher

commercial outdoor power equipment, ATV (all-terrain vehicles) and

high speed trailer tire sales as well as increased sales to the

replacement market. Improvement in the tire and wheel business was

slightly offset by lower sales in the power transmission belt

business driven by reduced volumes for the agricultural market.

EBIT of $23.4 million in the second quarter of 2006 was 18% above

EBIT of $19.8 million reported in the same quarter of 2005.

Earnings in the current-year quarter included a $5.6 million gain

resulting from the curtailment of certain retiree medical benefits

and $1.5 million of proceeds related to certain legal actions

initiated by the Company. Negatively impacting results in the

second quarter of 2006 were charges of $1.3 million related to a

lease termination and $1.2 million related to the impairment of

certain assets at the closed Red Wing, MN facility. Earnings in the

prior year included $3.6 million related to certain legal actions.

Diversified Components: Net sales of $185.1 million in the second

quarter of 2006 were 20% higher than net sales of $154.5 million

for the same period of 2005 while EBIT in the second quarter of

2006 of $21.5 million was 41% higher than EBIT of $15.3 million in

the second quarter of 2005. Results for the current-year quarter

were negatively impacted by pre-tax charges of $2.5 million related

to an arbitration proceeding concerning the termination of a supply

agreement in the Company's high-performance wire and cable

business. Strong demand in the specialty trailer business and the

wire and cable business, as well as acquisitions in the two brake

businesses accounted for a significant portion of the increase in

net sales. The Company's refrigerated truck body business also

experienced favorable comparisons to the prior year, which was

negatively impacted by a labor dispute in 2005. Discontinued

Operations In the fourth quarter of 2005, the Company announced it

was exiting the businesses of Carlisle Systems & Equipment

which include Carlisle Process Systems and the Walker Group. On

April 10, 2006, Carlisle announced it had signed a definitive

agreement to sell Carlisle Process Systems to Tetra Pak, a division

of the Tetra Laval Group, a private industrial group headquartered

in Switzerland. The sale of the Carlisle Process Systems businesses

is subject to regulatory approvals as well as other customary

closing conditions. The Company is actively marketing the Walker

Group businesses. The sale of Carlisle Process Systems and the

Walker Group businesses are expected to be completed by December

31, 2006. Income from discontinued operations, net of tax, in the

second quarter of 2006 was $1.4 million as compared to losses from

discontinued operations in the second quarter of 2005 of $7.4

million. Net Income Net income for the second quarter ended June

30, 2006 of $56.0 million, or $1.80 per diluted share, was 61%

higher than net income in the second quarter ended June 30, 2005 of

$34.7 million, or $1.11 per diluted share. The increase in net

income for the second quarter 2006 was due primarily to the

improved income from continuing operations as well as the second

quarter 2005 including the aforementioned losses from discontinued

operations. Cash Flow Cash provided by continuing operations of

$55.7 million for the six months ended June 30, 2006 was

significantly stronger than $19.8 million provided in the first

half of 2005 due primarily to increased operating income and a

reduction in cash required to fund working capital levels. Cash

used in investing activities was $46.9 million in 2006 compared to

$46.1 million in 2005. Capital expenditures of $50.9 million in the

first half of 2006 were comparable to capital expenditures of $50.7

million in the first six months of 2005 with the Construction

Materials segment representing the majority of the expenditures for

both periods. Cash used in financing activities of $15.1 million in

the six months ended June 30, 2006 compared to cash provided by

financing activities of $41.9 million in the first half of 2005.

The year-over-year change in financing cash flow is due primarily

to a reduction in short-term borrowings in 2006 on stronger cash

flow from operating activities. Financing cash flows in 2005

included the use of $16.4 million to purchase 200,000 shares of

common stock. Backlog Backlog from continuing operations at June

30, 2006 of $269.9 million was below the backlog of $295.4 million

at March 31, 2006 and slightly higher than the backlog of $261.3

million at June 30, 2005. Increased backlog for the Construction

Materials segment was more than offset by decreased backlog in the

Industrial Components segment reflecting the seasonality of the

lawn and garden market. Conference Call and Webcast The Company

will discuss second quarter 2006 results on a conference call for

investors on Tuesday, July 25, 2006 at 11:00 a.m. Eastern. The call

may be accessed live at

http://www.carlisle.com/investors/conference_call.html, or the

taped call may be listened to shortly following the live call at

the same website location until August 8, 2006. A PowerPoint

presentation will also be available for viewing and/or printing at

the same website location. Forward-Looking Statements This news

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management's current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to changes in

global economic, business, competitive, market and regulatory

factors. More detailed information about these factors is contained

in the Company's filings with the Securities and Exchange

Commission. The Company undertakes no duty to update

forward-looking statements. Carlisle is a diversified global

manufacturing company serving the construction materials,

commercial roofing, specialty tire and wheel, power transmission,

heavy-duty brake and friction, heavy-haul truck trailer,

foodservice, and data transmission industries. -0- *T CARLISLE

COMPANIES INCORPORATED Financial Results For the periods ended June

30 (In millions, except per share data) (Unaudited) Second Quarter

Six Months ------------------------- ---------------------------

2006 2005* % Change 2006 2005* % Change -------------------------

--------------------------- Net sales $692.7 $591.6 17% $1,313.8

$1,129.3 16% Income from continuing operations, net of tax $54.6

$42.1 30% $93.7 $70.8 32% Income (loss) from discontinued

operations, net of tax 1.4 (7.4) NM 3.5 (7.9) NM ----------------

------------------ Net income $56.0 $34.7 62% $97.2 $62.9 54%

================ ================== Basic earnings per share

Continuing operations $1.78 $1.36 31% $3.07 $2.29 34% Discontinued

operations 0.05 (0.24) NM 0.11 (0.26) NM ----------------

------------------ Net income $1.83 $1.12 63% $3.18 $2.03 57%

================ ================== Diluted earnings per share

Continuing operations $1.76 $1.34 31% $3.02 $2.26 34% Discontinued

operations 0.04 (0.23) NM 0.12 (0.25) NM ----------------

------------------ Net income $1.80 $1.11 62% $3.14 $2.01 56%

================ ================== SEGMENT FINANCIAL DATA

(Continuing Operations) (In millions) Second Quarter 2006 2005*

------------------------- --------------------------- Sales EBIT %

Sales Sales EBIT % Sales -------------------------

--------------------------- Construction Materials $292.9 $46.6

15.9% $227.9 $38.8 17.0% Industrial Components 214.7 23.4 10.9%

209.2 19.8 9.5% Diversified Components 185.1 21.5 11.6% 154.5 15.3

9.9% ---------------- ------------------ Subtotal 692.7 91.5 13.2%

591.6 73.9 12.5% Corporate - (7.3) - (8.0) ----------------

------------------ Total $692.7 $84.2 12.2% $591.6 $65.9 11.1%

================ ================== Six Months 2006 2005*

------------------------- --------------------------- Sales EBIT %

Sales Sales EBIT % Sales -------------------------

--------------------------- Construction Materials $520.8 $78.9

15.1% $399.4 $53.4 13.4% Industrial Components 438.8 45.2 10.3%

431.3 44.6 10.3% Diversified Components 354.2 39.2 11.1% 298.6 29.3

9.8% ---------------- ------------------ Subtotal 1,313.8 163.3

12.4% 1,129.3 127.3 11.3% Corporate - (16.5) - (15.1)

---------------- ------------------ Total $1,313.8 $146.8 11.2%

$1,129.3 $112.2 9.9% ================ ================== * 2005

figures have been revised to reflect discontinued operations and

conform with the 2006 segment presentation. NM = Not Meaningful

CARLISLE COMPANIES INCORPORATED Supplemental Financial Information

For the periods ended June 30 (Unaudited) Income from continuing

operations of $1.76 per diluted share for the second quarter of

2006 and $1.34 for the second quarter of 2005 included the

following items on a per diluted share basis: Second Second Quarter

Quarter 2006 2005 -------- -------- Consolidated: Tax benefit

related to U.S. federal tax audit $0.04 $- Construction Materials

segment: Gain on sale of property 0.03 Gain on insurance proceeds

0.03 Industrial Components: Curtailment gain on retiree medical

benefits 0.12 Award for arbitration proceedings concerning 0.03

0.08 termination of a supply agreement Lease termination costs

(0.03) Asset impairment charges on closed facility (0.03)

Diversified Components: Legal settlement on supply agreement (0.06)

-------- -------- $0.07 $0.14 ======== ======== CARLISLE COMPANIES

INCORPORATED Consolidated Statement of Earnings For the periods

ended June 30 (In thousands except per share data) (Unaudited)

Second Quarter ------------------------------- 2006 2005* % Change

--------- --------- --------- Net sales $692,704 $591,596 17.1%

--------- --------- --------- Cost and expenses: Cost of goods sold

545,908 470,469 16.0% Selling and administrative expenses 60,675

55,740 8.9% Research and development expenses 3,701 3,812 -2.9%

Other (income) expense, net (1,781) (4,393) NM --------- ---------

--------- Earnings before interest & income taxes 84,201 65,968

27.6% Interest expense, net 5,363 4,133 29.8% --------- ---------

--------- Earnings before income taxes 78,838 61,835 27.5% Income

taxes 24,190 19,753 22.5% --------- --------- --------- Income from

continuing operations, net of tax 54,648 42,082 29.9% ---------

--------- --------- Percent of net sales 7.9% 7.1% Income (loss)

from discontinued operations, net of tax 1,400 (7,406) NM ---------

--------- --------- Net income $56,048 $34,676 61.6% =========

========= ========= Basic earnings per share

------------------------ Continuing operations $1.78 $1.36 30.9%

Discontinued operations 0.05 (0.24) NM --------- ---------

--------- Basic earnings per share $1.83 $1.12 63.4% =========

========= ========= Diluted earnings per share

-------------------------- Continuing operations $1.76 $1.34 31.3%

Discontinued operations 0.04 (0.23) NM --------- ---------

--------- Diluted earnings per share $1.80 $1.11 62.2% =========

========= ========= Average shares outstanding (000's) - basic

30,640 30,977 --------- --------- Average shares outstanding

(000's) - diluted 31,059 31,335 --------- --------- Dividends

$7,704 $7,163 --------- --------- --------- Dividends per share

$0.250 $0.230 8.7% --------- --------- --------- * 2005 figures

have been revised to reflect discontinued operations. NM = Not

Meaningful Consolidated Statement of Earnings For the periods ended

June 30 (In thousands except per share data) (Unaudited) Six Months

---------------------------------- 2006 2005* % Change

---------------------------------- Net sales $1,313,809 $1,129,334

16.3% ---------------------------------- Cost and expenses: Cost of

goods sold 1,039,633 898,040 15.8% Selling and administrative

expenses 122,034 110,755 10.2% Research and development expenses

7,585 7,733 -1.9% Other (income) expense, net (2,236) 654 NM

------------------------------- Earnings before interest &

income taxes 146,793 112,152 30.9% Interest expense, net 9,619

8,038 19.7% ------------------------------- Earnings before income

taxes 137,174 104,114 31.8% Income taxes 43,442 33,277 30.5%

------------------------------- Income from continuing operations,

net of tax 93,732 70,837 32.3% -------------------------------

Percent of net sales 7.1% 6.3% Income (loss) from discontinued

operations, net of tax 3,492 (7,908) NM

------------------------------- Net income $97,224 $62,929 54.5%

=============================== Basic earnings per share

------------------------ Continuing operations $3.07 $2.29 34.1%

Discontinued operations 0.11 (0.26) NM

------------------------------- Basic earnings per share $3.18

$2.03 56.7% =============================== Diluted earnings per

share -------------------------- Continuing operations $3.02 $2.26

33.6% Discontinued operations 0.12 (0.25) NM

------------------------------- Diluted earnings per share $3.14

$2.01 56.2% =============================== Average shares

outstanding (000's) - basic 30,543 30,960 -------------------

Average shares outstanding (000's) - diluted 31,010 31,340

------------------- Dividends $15,360 $14,304

---------------------------- Dividends per share $0.500 $0.460 8.7%

---------------------------- * 2005 figures have been revised to

reflect discontinued operations. NM = Not Meaningful CARLISLE

COMPANIES INCORPORATED Comparative Condensed Consolidated Balance

Sheet (In thousands) (Unaudited) June 30, December 31, 2006 2005

----------- ----------- Assets Current Assets Cash and cash

equivalents $30,273 $38,745 Receivables 265,067 163,277 Inventories

359,456 336,090 Prepaid expenses and other 54,607 57,272 Current

assets held for sale 57,156 65,788 ----------- ----------- Total

current assets 766,559 661,172 ----------- ----------- Property,

plant and equipment, net 453,173 432,749 Other assets 437,727

426,381 Non-current assets held for sale 44,115 42,955 -----------

----------- $1,701,574 $1,563,257 =========== ===========

Liabilities and Shareholders' Equity Current Liabilities Short-term

debt, including current maturities $42,468 $57,993 Accounts payable

160,793 127,698 Accrued expenses 143,331 145,375 Current

liabilities associated with assets held for sale 43,656 41,645

----------- ----------- Total current liabilities 390,248 372,711

----------- ----------- Long-term debt 282,004 282,426 Other

liabilities 185,956 176,911 Non-current liabilities associated with

assets held for sale 161 970 Shareholders' equity 843,205 730,239

----------- ----------- $1,701,574 $1,563,257 ===========

=========== CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Statement of Cash Flows For the Six Months Ended June

30 (In thousands) (Unaudited) 2006 2005* -------- --------

Operating activities Net income $97,224 $62,929 Reconciliation of

net earnings to cash flows: (Income) loss from discontinued

operations, net of tax (3,492) 7,908 Depreciation and amortization

28,351 26,848 Non-cash compensation 3,902 911 Loss on equity

investments 2,269 3,141 Loss on writedown of assets 1,245 - Foreign

exchange loss 551 418 Deferred taxes 2,574 (1,540) Loss (gain) on

investments, property and equipment, net 1,195 (1,860) Receivables

under securitization program (4,900) - Working capital (71,948)

(77,909) Other (1,226) (1,015) -------- -------- Net cash provided

by operating activities 55,745 19,831 -------- -------- Investing

activities Capital expenditures (50,892) (50,704) Proceeds from

investments, property and equipment 3,052 3,959 Other 922 608

-------- -------- Net cash used in investing activities (46,918)

(46,137) -------- -------- Financing activities Net change in

short-term debt and revolving credit lines (15,062) 68,147

Reductions of long-term debt - (260) Dividends (15,360) (14,304)

Purchase of common shares - (16,428) Treasury shares and stock

options, net 15,335 4,699 -------- -------- Net cash (used in)

provided by financing activities (15,087) 41,854 -------- --------

Net cash used in discontinued operations (1,304) (3,583) --------

-------- Effect of exchange rate changes on cash (908) (86)

-------- -------- Change in cash and cash equivalents (8,472)

11,879 Cash and cash equivalents Beginning of period 38,745 25,018

-------- -------- End of period $30,273 $36,897 -------- -------- *

2005 figures have been revised to reflect discontinued operations.

*T

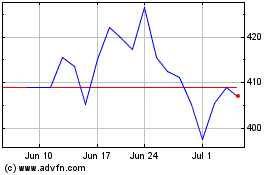

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From May 2024 to Jun 2024

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Jun 2023 to Jun 2024