Credit-Card Delinquencies Fell For Large Issuers In February

March 15 2012 - 4:48PM

Dow Jones News

Late credit-card payments fell in February for several large

banks as consumers continued to pay off bills they built up during

the holiday shopping season.

Delinquencies were down for Capital One Financial Corp. (COF),

Discover Financial Services (DFS), Bank of America Corp. (BAC),

J.P. Morgan Chase & Co. (JPM) and Citigroup Inc. (C). American

Express Co. (AXP), the largest credit-card issuer by spending, said

its delinquency rate was flat for the second-straight month at

1.4%, the lowest of the six biggest card lenders.

Credit-card performance has surged over the last two years as

many customers abstained from amassing large balances following the

recession and instead focused on paying off their loans. That trend

has helped large banks cut their bad-debt expenses, but also has

made it difficult to increase revenue, which they largely derive

from charging interest on loan balances and various account

fees.

Net charge-offs, or loans lenders deem uncollectible, also fell

for several card issuers last month. But net charge-off rates

increased for American Express, Discover and Citi.

American Express's net charge-off rate rose to 2.4% from 2.2% in

January. The rate is still down from 3.8% a year earlier and

significantly lower than a few years ago, when the rate surpassed

10%.

Discover's net charge-off rate rose to 2.8% from 2.75% in

January but is still near a historic low.

Citi's net charge-off rate increased to 5.36% from 5.27% in

January.

Bank executives have said delinquencies and charge-offs are

likely to pick up this year as the industry pursues growth, though

analysts expect performance to continue to be strong going forward.

Banks' efforts to acquire new customers and boost overall loan

balances have become more important as the financial benefits banks

have enjoyed from cutting reserves for bad loans wane.

"The chapter is closing on reserve releases," Gordon Smith, the

head of J.P. Morgan's credit-card business, said last month at the

bank's investor day.

Many banks ramped up marketing last year in an effort to steal

market share, though in recent months they have taken a breather.

For example, the volume of credit-card offers sent to customers

fell in January to 266.3 million, an 18% decline from December and

a 30% decline from a year earlier, according to Mintel

Comperemedia, a market-research firm. It was the third-straight

month of a decrease in mailings.

"We are going to have to wait and see whether" credit-card

issuers are "sort of taking stock and are going to" resume mailings

again or if it is the "beginning of an ongoing trend," said Andrew

Davidson, senior vice president with Mintel Comperemedia.

The decline could be due to issuers feeling they "don't have to

mail so much to try to seek out these customers" as consumer debt

levels rise, Davidson said.

While delinquency rates have fallen for card lenders,

credit-card expert Odysseas Papadimitriou said there is still cause

for concern. When combining the amounts of new-card debt borrowers

built up last year with the amount of bad loans that issuers

charged off, the net result suggests consumers are leveraging up at

a troubling pace, said Papadimitriou, chief executive of

CardHub.com, a credit-card comparison website.

By CardHub.com's calculation, consumer credit-card debt rose by

$47.8 billion in 2011 when including charged-off loans. That

compares with an increase of $9.1 billion in 2010 and a decrease of

$10 billion in 2009.

-By Andrew R. Johnson, Dow Jones Newswires; 212-416-3214;

andrew.r.johnson@dowjones.com

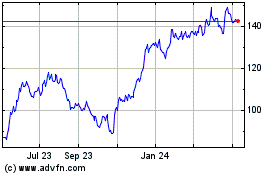

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

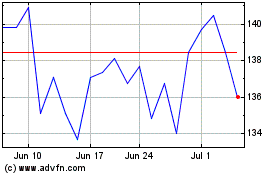

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024