NCO & Delinquency a Mixed Bag - Analyst Blog

December 16 2011 - 12:08PM

Zacks

The regulatory filings by major credit card companies have

disclosed mixed results in credit card defaults and delinquency

rate for November 2011. According to these filings, three of the

nation's top six credit card companies reported a decline in card

defaults, while two of them recorded lower delinquency rates.

In comparison with the prior month,Bank of America

Corporation (BAC), JPMorgan Chase &

Co. (JPM), and Discover Financial

Services (DFS) recorded a fall in their respective credit

card defaults, where as Citigroup Inc. (C),

American Express Company (AXP) and Capital

One Financial Corp. (COF) reported a surge for the

same.

Card companies usually write off the loans that are 180 days

past due, assuming those as uncollectible. For BofA, on an

annualized basis, net charges-off (NCO) rate fell to 5.67% in

November 2011 as against 5.99% in October 2011 and 9.92% in

November 2010.

Similarly, JPMorgan reported a drop in NCO rate to 4.02% of its

total loan balance in November 2011 compared with 4.18% in October

2011 and 7.16% in November 2010.

However, on an annualized basis, Capital One’s NCO rate surged

from 3.96% in the prior month but decreased from 7.56% in the

prior-year month to 4.29% in November 2011.

In November 2011, the delinquency rate, indicating the future

rate of default, dropped for BofA and Discover Financial, whereas

it increased for JP Morgan and Citigroup; however, American Express

and Capital One witnessed no change in it since October 2011.

For BofA, delinquency rate for 30 days or more (on an annualized

basis) dropped from 3.97% in October 2011 and 5.47% in November

2010 to 3.96%. The delinquency rate for 30 days or more (on an

annualized basis) for Capital One was at par with October 2011 but

declined from 4.26% in November 2010 to 3.73% in November 2011.

Conversely, JPMorgan’s delinquency rate for 30 days or more (on

an annualized basis) increased slightly to 2.56%, compared with

2.55% in October 2011 and 3.68% in November 2010.

Conclusion

The decline in default rates is largely arising from the

inability of the defaulting card holders to get cards with large

credit limits. Besides, this waning default trend signifies the

card owners’ improving financial condition. As these card owners

are gradually recovering from the after-effects of recession, they

are trying their level best to reduce their credit card debts.

Additionally, various regulatory reforms undertaken by the

Federal Reserve, including limiting the fees that banks can charge

and constricting the pace at which they can raise their interest

rates, are also enabling the card owners to bring down their

balances.

However, the recent data from TransUnion shows that in the

September quarter, a significant number of cards were issued to

those customers who had some payment-related issues in the

past.

This indicates that once these customers start using their

cards, defaults may occur resulting into higher NCOs and

delinquencies. So, we remain concerned about this trend going

forward.

Currently, Capital One retains a Zacks #2 Rank, which translates

into a short-term Buy’ rating, while Discover Financial, JPMorgan,

American Express, Citigroup and BofA retain a Zacks #3 Rank, which

implies a short-term ‘Hold’ rating.

AMER EXPRESS CO (AXP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

CAPITAL ONE FIN (COF): Free Stock Analysis Report

DISCOVER FIN SV (DFS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

Zacks Investment Research

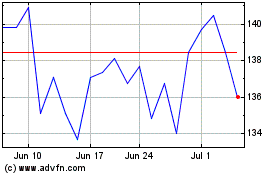

Capital One Financial (NYSE:COF)

Historical Stock Chart

From May 2024 to Jun 2024

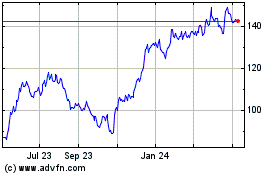

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2023 to Jun 2024