The Zacks Analyst Blog Highlights: Skyworks Solutions, Verizon, AT&T, CACI International & Lionbridge Technologies - Press Re..

February 29 2012 - 3:30AM

Zacks

For Immediate Release

Chicago, IL – February 29, 2012 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Skyworks Solutions, Inc. ( SWKS),

Verizon ( VZ), AT&T ( T),

CACI International Inc. ( CACI) and

Lionbridge Technologies Inc. ( LIOX).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Tuesday’s Analyst

Blog:

Smartphones Drive Skyworks

Growth

Skyworks Solutions, Inc. ( SWKS) recently

announced that several of its front-end solutions are being

leveraged by the industry’s leading baseband providers for their

smartphone platforms which currently support world's leading mobile

broadband standards.

Skyworks continues to weather the turbulent economic conditions

well. The company has strategically positioned itself as a

diversified company. Skyworks continues to benefit from strong

underlying demand in the mobile Internet market driven by market

share gains and new product ramps. Skyworks saw a healthy holiday

season demand across all categories of mobile Internet devices,

including smartphones, e-readers and tablets.

According to Skyworks, several of its newest power amplifiers

and front-end modules deliver approximately 50% power added

efficiency with a 30% smaller footprint.

In particular, Skyworks’ solutions are compatible with the

world’s first fully integrated long-term evolution (LTE) modem

chipset which contains an integrated dual core application

processor for smartphones, tablets and other mobile devices.

As carriers like Verizon ( VZ)

and AT&T ( T) accelerate their LTE plans,

Skyworks expects a solid opportunity for growth in the coming years

with its broad product portfolio.

CACI Wins TSA Contract

Earning new contracts continues its interminable saga for

CACI International Inc. ( CACI) as it announced

the receipt of a $20 million five-year contract from the

Transportation Security Administration (TSA). The contract is to

provide Occupational Safety and Health (OSH) Support Services to

the TSA centres.

According to the contract, CACI International would implement

and maintain a comprehensive OSH program at the TSA’s headquarters,

five regional offices, 450 airports and other field operation

centres.

The company has had an ongoing relationship with the TSA in

providing its OSH services for over five years now. It is hence,

easy to aver that CACI International’s continuing support has

proved largely effective to the TSA as it has bolstered safety

improvement considerably for the latter.

Very recently, CACI International was awarded a contract worth

$41 million from the Department of Defense (DoD) to continue its

grand work as lead developer at the Defense Agencies Initiative

(DAI). This would directly cater to ameliorating the financial

management program of the DoD.

Needless to say, management is highly ebullient about its spate

of successes which seem to have transformed into an endless

phenomenon of contract awards. However, the company needs to be

wary of its formidable competitors who include big names such as

Lionbridge Technologies Inc. ( LIOX).

Our current Zacks Consensus Estimate projects an EPS of $1.42

per share and $5.89 per share in the third fiscal quarter and full

fiscal year 2012, respectively.

At present we have a Neutral recommendation on CACI

International Inc. The stock currently carries a Zacks #2 Rank,

which translates into a short-term rating of Buy.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

CACI INTL A (CACI): Free Stock Analysis Report

LIONBRIDGE TECH (LIOX): Free Stock Analysis Report

SKYWORKS SOLUTN (SWKS): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

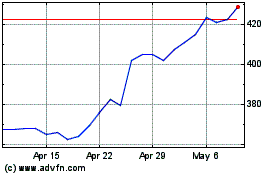

CACI (NYSE:CACI)

Historical Stock Chart

From Apr 2024 to May 2024

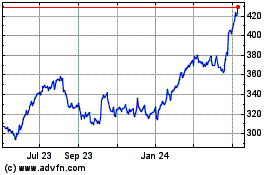

CACI (NYSE:CACI)

Historical Stock Chart

From May 2023 to May 2024