CACI's Record 2Q, Guidance Raised - Analyst Blog

February 06 2012 - 6:15AM

Zacks

CACI International

Inc. (CACI) reported pro forma net income of $41.1

million or $1.51 per diluted share in its second quarter financial

results of fiscal 2012, compared to $32.9 million or $1.06 per

diluted share in the previous year period. This comprehensively

beat the Zacks Consensus Estimate of $1.39 per share.

Revenues

Pro forma revenues came in at

$973.2 million, up 12.2% year over year and 5.3% sequentially.

Contract funding orders in the quarter were $605 million, rising

17% year over year but falling 62.2% sequentially.

As of December 31, 2011, total

funded backlog was $2.19 billion, up 0.5% year over year but down

13.1% sequentially. Total backlog amounted to $8.0 billion at the

end of December 31, 2011, rising 7.4% annually.

In terms of a customer mix, the

Department of Defense accounted for 79.0% of total revenue. Federal

Civilian Agencies contributed about 16.3% of total revenue.

Commercial customers accounted for 4.3% of total revenue and State

and Local Governments added 0.4% to total revenue.

Margins

Pro forma operating margin came in

at 7.7%, up from 6.8% in the year-ago quarter and 8.2%, in the

previous quarter. This was directly attributable to the 26.8%

annual rise in operating income coming in at $74.7 million,

evolving from direct labor growth and production efficiencies

attained.

Balance Sheet and Cash

Flows

The company ended the quarter with

cash and cash equivalents of $24 million, down from $28.6 million

at the end of the previous quarter. Net long-term debt amounted to

approximately $590 million, rising from $528 million at the end of

the previous quarter.

Net cash provided for operating

activities during the first six months of fiscal 2012 ameliorated

to $85.3 million versus $68.5 million during the first six months

of fiscal 2011. During this time, cash used for capital

expenditures was $7.1 million rising from $5.8 million during the

first six months of fiscal 2011. Cash used for share repurchases

amounted to $209.7 million during the first six months of fiscal

2012.

Outlook

The strong quarterly and overall

six months’ performance of the company induced CACI to raise its

2012 guidance on the whole. The company now expects net income

between $162 million - $168 million, up from the previous estimate

of $157 million - $163 million.

Diluted EPS is projected to fall

between $5.72 and $5.94, up from the previous guidance range of

$5.55 and $5.80. Effective corporate tax rate is expected to

diminish to 39.8% from its prior projection of 39.9% and overall

revenue estimates have been reiterated to fall between $3,850

million and $4,050 million in fiscal 2012.

CACI INTL A (CACI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

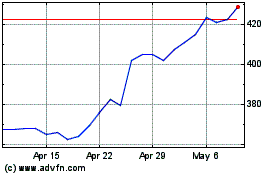

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

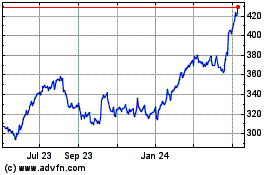

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024