CACI International - Aggressive Growth

December 01 2011 - 7:00PM

Zacks

CACI International, Inc. (CACI) continues to post better

than expected earnings and estimates are up sharply. But shares

remain a great value as well as a growth story. This Zacks #1 Rank

(Strong Buy) is worth revisiting here.

Company Description

CACI offers professional and IT services for defense,

intelligence, homeland security, and IT modernization and

government transformation.

Another Surprise

Since being featured back in September, CACI has posted yet

another earnings surprise, putting the streak at 15 consecutive

quarters.

On Nov 2 the company showed an 11% increase in revenues for the

first fiscal quarter, to $924 million. Net income spiked 47% to

$42.1 million. Earnings per share came in at $1.40, well ahead of

the $1.11 analysts were expecting.

Business is Only Getting Better

The company went on to raise its full-year guidance in light of

the record quarter and the accelerating M&A activity.

Analysts polled by Zacks agreed in unison for fiscal 2012. This

year's consensus estimate jumped 57 cents, to $5.69. There was on

downward revision for fiscal 2013, compared to 13 upward. As a

result the consensus is up 53 cents, to $5.97 on the earnings

news.

Last year the company made $4.45, so the projected growth rates

are 28% for this year and 5% for next year.

And Shares are Cheap?

Right now the stock is trading at just 10 times this year's

estimates. That gives CACI a PEG of just 0.6. On top of that, the

P/S is only 0.4 and the P/B is just 1.3.

The Chart

CACI saw some ups and downs in the wake of the earnings news,

but right now it looks like shares are back on track. The MACD is

pointing to a shift in momentum and is about to produce a buy

signal.

Read the September 20th Feature Here

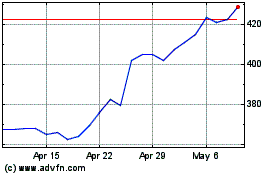

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

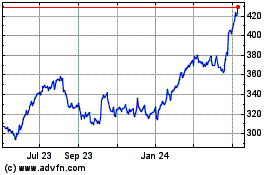

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024