CACI Beats, Raises Guidance - Analyst Blog

November 10 2011 - 8:44AM

Zacks

CACI International Inc. (CACI) reported

revenues of $924.4 million in the first quarter of fiscal 2012, up

10.8% from a year-ago and up 1.2% sequentially.

Organic revenues came in at $902.8 million, up 8.3% from a

year-ago. Contract funding orders in the quarter were $1.6 billion,

up 9.5% from the year-ago quarter. As of September 30, 2011, total

funded backlog was $2.52 billion, up 8.0% from the year-ago

quarter. Total backlog at September 30, 2011 was $7.95 billion, up

6.4% from a year-ago.

In terms of a customer mix, the Department of Defense accounted for

79.3% of total revenue. Federal Civilian Agencies accounted for

14.5% of total revenue. Commercial customers accounted for 5.7% of

total revenue and State and Local Governments accounted for 0.5% of

total revenue.

Operating margin came in at 8.2%, up from 6.2% in the year-ago

quarter and 6.8%, in the previous quarter. Net income jumped 47.1%

year over year to $42.1 million in the year-ago quarter.

Earnings per share (EPS) came in at $1.41, up from $0.92 per share

in the year-ago quarter and $1.16 in the previous quarter. This

easily beat the Zacks Consensus Estimate of $1.11.

The company ended the quarter with cash and equivalents of $28.6

million, down from $164.8 million at the end of the previous

quarter. Long-term debt was $528.4 million, up from $401.4 million

at the end of the previous quarter.

Cash flow continues to be strong. During the first quarter of

fiscal 2011, CACI International generated $56.1 million of cash

from operations and used $3.0 million for capital expenditure. The

company also repurchased shares for $209.7 million in the first

quarter.

CACI International also raised its guidance for FY12 driven by

stronger operating performance, completion of the Paradigm Holdings

and APG acquisitions and a large and a large commercial product

sale. The guidance also reflects the accelerated share repurchase

transaction. In August 2011, the company repurchased four million

shares of under an accelerated share repurchase program.

CACI International now expects revenues between $3,850 million and

$4,050 million in fiscal 2012, up from the previous guidance of

revenues $3,750 million – $3,950 million. Net income is projected

between $157 million and $163 million, up from the previous

estimate of $147 million – $153 million. EPS is forecasted between

$5.55 and $5.80, up from the previous guidance of $4.70 –

$4.90.

We continue to maintain an Outperform recommendation on CACI

International. Our recommendation is supported by Zacks #1 Rank,

which translates into a short-term rating of Buy.

CACI INTL A (CACI): Free Stock Analysis Report

Zacks Investment Research

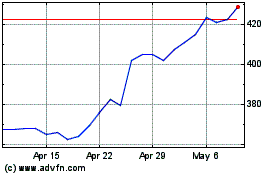

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

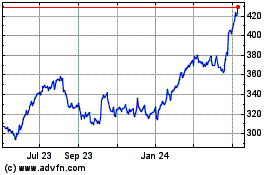

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024