Earnings Scorecard: CACI - Analyst Blog

August 29 2011 - 11:37AM

Zacks

CACI International Inc. (CACI) reported

earnings of $1.28 per share in the fourth quarter of fiscal 2011,

beating the Zacks Consensus Estimate of $1.17.

The company noted that the solid results were due to its growth

strategy, operational excellence, opportunities provided by

developing markets and new contract wins.

Fourth Quarter Earnings Highlights

The company reported revenues of $963.2 in the fourth quarter of

fiscal 2011, up 13.5% year over year. The year-over-year revenue

growth includes an organic revenue increase of 11.5%.

In terms of customer mix,

the Department of Defense accounted for 81.0% of total revenue and

Federal Civilian Agencies for 14.4% of total revenue. Commercial

customers are responsible for 4.2% of total revenue while State

Local Governments contributed 0.4% of total revenue.

Including one-time items, earnings per share (EPS) came in at $1.44

compared with $0.96 in the year-ago quarter.

Fiscal 2011

Highlights

Revenues improved 13.6%

from the previous year to $3.6 billion, driven by C4ISR Solutions

and Services core competency.

Excluding one-time items,

earnings per share were $4.41 compared with $3.43 in the previous

year.

Agreements of

Analysts

In the last 30 days, fiscal

2012 earnings estimates were raised by 14 analysts out of the 15

covering the stock, while 1 had lowered the same.

None of the analysts

changed his/her earnings estimate for fiscal 2012 over the last 7

days.

The current Zacks Consensus

Estimate for fiscal 2012 is $4.88, representing a year-over-year

increase of estimated 9.59%.

Magnitude of

Estimate Revisions

Earnings estimate for

fiscal 2012 increased 21 cents to $4.88, based on strong results

for the fourth quarter of fiscal 2011 and upgraded guidance for

fiscal 2012.

CACI International raised

its guidance for FY12; the improved guidance is attributed to the

expectation of stronger operating performance and the acquisition

of Pangia Technologies. Net income is expected around $147 million

and $153 million, up from the previous guidance of $144 million and

$150 million. Earnings per share are estimated between $4.70 and

$4.90, up from the initial forecast of $4.60 and $4.80.

Our

Take

We believe that CACI’s

long-term growth will be driven both organically and through

acquisitions. Furthermore, the company’s aggressive acquisition

strategy and new contract wins will expand its scale of

operations.

In an effort to strengthen

its cybersecurity capabilities, the company proposed to acquire

Paradigm Holdings Inc. The Pangia Technologies acquisition is

expected to open new growth opportunities for CACI and fortify its

technical offerings in the area of cybersecurity.

Management is also keen to

increase shareholder wealth through share repurchases. The company

recently replaced its $175 million share repurchase authorization

by a new repurchase authorization for 4 million shares.

We maintain our long-term

Outperform recommendation on the stock, supported by a Zacks #2

Rank, which translates into a Buy rating.

About Earnings Estimate Scorecard

Len Zacks, PhD in mathematics from MIT, proved over 30 years

ago that earnings estimate revisions are the most powerful force

impacting stock prices. He turned this ground breaking discovery

into two of the most celebrating stock rating systems in use today.

The Zacks Rank for stock trading in a 1 to 3 month time horizon and

the Zacks Recommendation for long-term investing (6+ months). These

“Earnings Estimate Scorecard” articles help analyze the important

aspects of estimate revisions for each stock after their quarterly

earnings announcements. Learn more about earnings estimates and our

proven stock ratings at http://www.zacks.com/education/

CACI INTL A (CACI): Free Stock Analysis Report

Zacks Investment Research

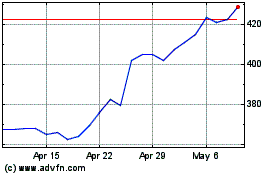

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

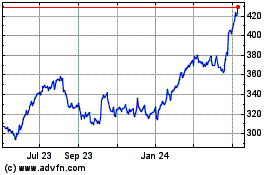

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024