Earnings Preview: CACI International - Analyst Blog

August 15 2011 - 10:05AM

Zacks

CACI International Inc. (CACI) is scheduled to

announce its fourth quarter and fiscal 2011 results on Wednesday,

August 17, 2011.

The company has consistently exceeded expectations. On an

average, CACI has beaten the Zacks Consensus Estimate by 7.94% in

the last four quarters.

Third-Quarter Recap

CACI International posted earnings per share (EPS) of $1.16

compared with 87 cents in the year-earlier quarter, which easily beat the

Zacks Consensus Estimate of $1.03.

Revenues came in at $913.4

in the third quarter of fiscal 2011, up 16.5% year over year,

attributable to continued growth in Command, Control,

Communications, Computers, Intelligence, Surveillance and

Reconnaissance Integration Services and Business System Solutions

core competencies.

Agreement of

Estimate Revisions

Estimates for the fourth

quarter and fiscal 2011 have been largely static. Out of a total of

16 analysts covering the stock, two analysts changed their

estimates over the last 30 days (in the upward direction) while

others maintained their estimates.

The current Zacks Consensus

Estimate for fiscal 2011 is $4.34, representing an estimated 24.98%

year-over-year increase.

Magnitude of

Estimate Revisions

In the last thirty days,

the Zacks Consensus Estimate for 2011 was up by a penny. Estimate

for the fourth quarter of fiscal 2011 was also at $1.17 per share,

reflecting a year-over-year growth of 22.27%.

The company projected its

earnings per share estimate of $4.25 – $4.40 for fiscal 2011, up

from the previous estimate of $4.15 and $4.30.

For fiscal 2012, CACI

expects earnings per share between $4.60 and $4.80.

Our

Take

We believe that the

company’s recent acquisition of Paradigm Holdings Inc. will

strengthen its cybersecurity capabilities. The company is heading

toward providing integrated solutions for cyber operations and

enterprise IT/security engineering.

Furthermore, management is

also keen to increase shareholder wealth through share repurchases.

CACI International stepped up its share repurchase program by

approving a new $175 million repurchase program.

We believe that CACI’s

growth will be driven both organically and through acquisitions.

Moreover, we are confident about CACI’s recent acquisition

activities; new contract wins and share repurchase

programs.

Thus, we maintain our

long-term Outperform recommendation on the stock, supported by a

Zacks #2 Rank, which translates into a Buy rating.

CACI INTL A (CACI): Free Stock Analysis Report

Zacks Investment Research

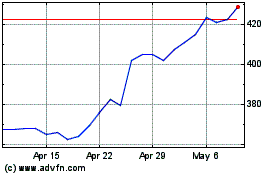

CACI (NYSE:CACI)

Historical Stock Chart

From May 2024 to Jun 2024

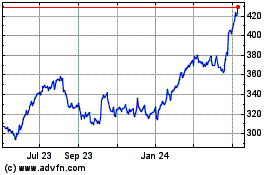

CACI (NYSE:CACI)

Historical Stock Chart

From Jun 2023 to Jun 2024