UPDATE: Singapore's GIC Buys 5.0% Stake In Bunge; Market Value At Close To $500 Million

February 24 2012 - 12:59AM

Dow Jones News

Government of Singapore Investment Corp., GIC, has acquired a

5.0% stake in U.S. commodity trading company Bunge Ltd. (BG), with

a market value at close to US$500 million as the fund looks to

build up its exposure to the resources sector.

In a filing to the U.S. Securities and Exchange Commission,

dated Feb. 13 and posted on the company's website Thursday, Bunge

said that Singapore's sovereign wealth fund acquired 7.305 million

shares in the company. However, it didn't state the price at which

the shares were acquired.

Bunge shares closed in New York Thursday at US$67.83, valuing

GIC's stake at US$495.5 million.

A spokeswoman for GIC confirmed the stake purchase but didn't

provide further financial details or the reason for buying the

stake.

GIC, which had 3% exposure to natural resources as of March 31,

2011, has been looking to expand its portfolio in the sector, much

like other sovereign wealth funds such as China Investment Corp.

(CIC.YY), Abu Dhabi's Aabar Investments and Singapore's state-run

investment company Temasek Holdings Pte. Ltd.

In the middle of last year, GIC agreed to purchase US$400

million worth of shares in Glencore International PLC (GLEN.LN)'s

initial public offering, making it the second-biggest investor in

the IPO of the Swiss commodity trading giant.

In October last year, the Singaporean fund said it increased its

stake in blue-chip oil producer China Petroleum & Chemical

Corp. (0386.HK), or Sinopec, to 5.0%.

This latest investment in Bunge, which posted a 28.4% on-year

rise in revenue to US$58.7 billion last year, comes at a time when

global food demand and food price inflation are a hot topic for

governments.

New-York listed Bunge, a global agribusiness and food processing

company, has operations in over 30 countries and employs around

32,000 people.

According to GIC's website, the fund manages more than US$100

billion, but analysts say that the portfolio under management could

be as high as US$300 billion.

In GIC's last fiscal year ended March 31, 2011, GIC had said

that it had introduced more "flexibility" in its strategic

portfolio to respond more nimbly to "significant shocks and market

discontinuity."

-By Matthew Allen, Dow Jones Newswires; +65 64154 158;

matthew.allen@dowjones.com

-Chun Han Wong contributed to this article

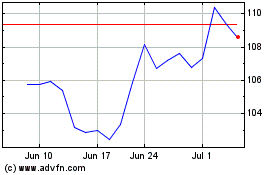

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

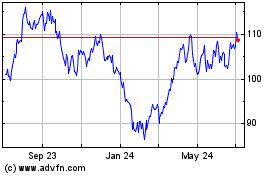

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024