2nd UPDATE: Bunge 4Q Net Falls 16% On Higher Costs; Revenue Beats Views

February 09 2012 - 1:43PM

Dow Jones News

Bunge Ltd. (BG) reported a drop in fourth-quarter earnings but

outperformed peers among the big global grain traders, buoyed by an

expanding sugar business and the contribution of a recently

acquired shipping facility in the Ukraine.

Rivals Archer Daniels Midland Co. (ADM) and Cargill Inc. have in

recent weeks reported sharp falls in earnings and job cuts as

volatile markets and excess oilseed processing capacity hit

margins.

Bunge's positioning in the key Black Sea region helped mitigate

what the U.S. company viewed as a still-volatile global grain

market and continuing problems in the domestic oilseed sector.

The fourth-quarter performance beat analysts' expectations, and

its shares were recently up 5.3% to $62.90.

Bunge sounded a cautiously optimistic note for 2012, saying that

large global crops will help grain merchandising volumes and that

it will see full-year contributions from new export terminals,

including one in the Ukraine and one in Washington state. It

expects full-year profits to exceed those in 2011.

"We expect to produce good results in 2012, but recognize that

the year will be challenging," said Drew Burke, Bunge's chief

financial officer.

Bunge was "very, very cautious" in its grain trading in 2011,

and could remain so in 2012, Chief Executive Alberto Weisser told

analysts on a conference call. He said earnings in its agribusiness

segment, which fell 46% in the fourth quarter, could improve this

year, but that it was too soon to say for sure. Large grain

merchandisers such as Bunge have struggled in recent months to

navigate volatile grain markets that have at times been driven by

worries about broader macroeconomic problems rather than supply and

demand fundamentals.

Increased grain merchandising volumes stemming from the

company's 2011 purchase of an export terminal in the Ukraine, where

exports have boomed recently, helped limit the drop in earnings.

Weisser also said that North America oilseed processing margins

show signs of improving.

The company is counting on continued improvement in its sugar

and bioenergy business, as efforts to plant more sugarcane to feed

two new mills in Brazil start to pay off. Bunge said it expected to

harvest 17 million to 19 million metric tons of sugar cane this

year to feed its mills, up from 14 million last year, and that it

would be able to fill the mills' 21-million ton capacity in

2013.

The company's sugar and bioenergy segment swung to a profit of

$3 million in the fourth quarter after losing $56 million the prior

year.

Bunge's grain export business in the Ukraine could suffer

depending on how badly crops are damaged by extreme winter weather,

but Weisser said he's "not yet worried."

He added that drought in South America, which has damaged corn

and soybean crops there, could have a positive impact on the

company, as crops are small enough to boost demand for North

America grain but big enough to maintain South America volumes.

Bunge reported a profit of $254 million, or $1.65 a share, down

from $301 million, or $1.95, a year earlier. Excluding items such

as impairment charges, earnings were $1.99 a share in the

year-earlier quarter. Sales jumped 29% to $16.4 billion as total

volume grew 22%.

Analysts polled by Thomson Reuters had most recently forecast

earnings of $1.57 on revenue of $13.73 billion.

-By Ian Berry, Dow Jones Newswires; 312-750-4072;

ian.berry@dowjones.com

--Melodie Warner contributed to this article.

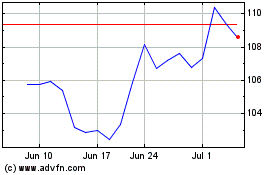

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

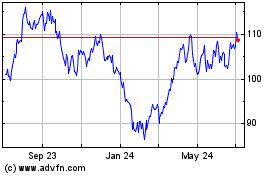

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024