Archer Daniels Misses, Revenues Rise - Analyst Blog

January 31 2012 - 3:58AM

Zacks

Leading food processing company Archer Daniels Midland

Company (ADM) reported disappointing second-quarter 2012

results in terms of earnings per share, significantly missing the

Zacks Consensus Estimate.

Archer Daniels’ adjusted earnings per share of 51 cents in the

quarter was below the Zacks Consensus Estimate of 77 cents and fell

short of the year-ago earnings of $1.20 per share. Earnings in the

quarter declined primarily due to ongoing weakness in global

oilseeds margins, lower results in corn and poor international

merchandising results.

On a reported basis, including a LIFO charge of 6 cents per

share and asset impairment costs of 33 cents per share, quarterly

earnings were down approximately 89% to 12 cents per share from the

prior-period earnings of $1.14 per share.

Quarterly Details

Archer Daniels' quarterly net sales surged 11.4% year over year

to $23,306 million, marginally beating the Zacks Consensus Estimate

of $23,077 million. The growth in net sales was mainly attributable

to a 28.5% rise in Oilseeds Processing revenues to $7,513 million

and 29.0% increase in Corn Processing revenues to $3,158 million,

offset by a 1.2% decline in Agricultural Services to $11,304

million.

Total segment operating profit, excluding the impact of the

PHA-related charges of $339 million, declined 52% to $648 million.

On a GAAP basis, segment operating profit was $309 million compared

with $1,362 million in the year-ago quarter.

GAAP operating profit for Agricultural Services segment declined

$268 million to $158.0 million due to poor international

merchandising results and lower U.S. export volumes.

Archer Daniels' Corn Processing segment's operating profit

(GAAP) reflected a drastic fall of $532 million, reporting an

operating loss of $133 million. The segment’s operating profit

included $339 million in asset impairment charges related to the

PHA renewable plastic production facility. The loss was also

attributed to high corn costs in the quarter, partly due to

economic hedge benefits recognized last year.

Archer Daniels' Oilseeds Processing segment recorded a quarterly

operating profit (GAAP) of $253 million compared with an operating

profit of $325 million in the year-ago period. The $72 million

decline was primarily due to the continued global weakness in

oilseeds processing margins.

Operating profit from the other business segment came in at $31

million, down $181 million from last year.

Archer Daniels, which competes with Bunge

Limited (BG) and Corn Products International

Inc. (CPO), currently has a Zacks #3 Rank, implying a

short-term Hold rating on the stock. The company retains a

long-term Underperform recommendation.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

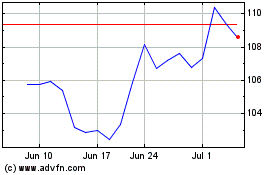

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

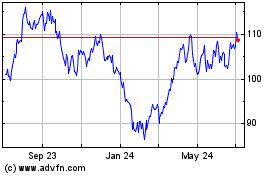

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024