Archer Daniels Dissolves Metabolix JV - Analyst Blog

January 13 2012 - 11:32AM

Zacks

ADM Polymer Corporation, a unit of Archer Daniels

Midland Company (ADM), has decided to part its

biodegradeable plastics joint venture with Metabolix Inc., called

Telles LLC, effective February 8, 2012. The joint venture was

formed in July 2006.

The joint venture, Telles, produces bio-based plastics, called

Mirel, using Metabolix’s fermentation technology at Archer Daniels’

integrated corn processing complex facility in Clinton, Iowa. The

Mirel plastics produced are used in plastic utensils and lids, as

approved by Food and Drug Administration (FDA).

Archer Daniels’ decision to exit the commercial alliance came

after an analysis of its business portfolio, which resulted in

identifying uncertainty on projected capital and production costs,

as well as the rate of market adoption for its bio-plastics

business with Metabolix. The company said this uncertainty would in

turn lead to uncertain returns for ADM.

Archer Daniels said it will carry out the dissolution in

accordance with the terms established in the commercial alliance

agreement with Metabolix. Per the terms, ADM Polymer is entitled to

provide PHA fermentation services for Metabolix during a three-year

period following termination.

Following the break-up, Metabolix will get back the ownership of

all the technology used in the joint venture, while Archer Daniels

will retain the ownership of the Clinton facility in Iowa where

Mirel is produced. The company continues to evaluate alternate

commercially viable uses for the fermentation assets in

Clinton.

Archer Daniels said its second quarter results will record a

one-time pre-tax charge of $300-$360 million due to its decision to

exit the joint venture. The company expects the cash portion of the

charge to not exceed $5 million.

The company is also focused on evaluating the impact of its

decision on its employees involved in the joint venture. The

company currently has 90 full-time employees working at the Clinton

polymer plant and a small group of people supporting the Telles

sales and marketing efforts in Europe.

Illinois-based Archer Daniels, one of the leading food

processing companies in the world, processes oilseeds, corn, wheat,

cocoa, and other foodstuffs, and is a leading manufacturer of

vegetable oil, protein meal, corn sweeteners, flour, biodiesel,

ethanol, and other value-added food and feed ingredients.

Archer Daniels, which competes with Bunge

Limited (BG) and Corn Products International

Inc. (CPO), currently has a Zacks #2 Rank, implying a

short-term Buy rating on the stock. However, the company retains a

long-term Underperform recommendation.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

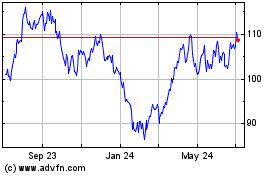

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

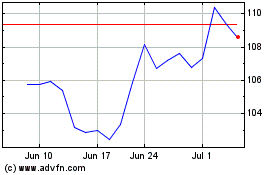

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024