Earnings Preview: Archer Daniels - Analyst Blog

August 01 2011 - 11:45AM

Zacks

Archer Daniels Midland Company (ADM), one of

the leading food processing companies in the world, is scheduled to

report its fourth-quarter 2011 financial results before the opening

bell on August 2, 2011.

The current Zacks Consensus Estimates for the quarter is

earnings of 84 cents a share. For the quarter under review, revenue

is expected at $20,484.0 million, according to the Zacks Consensus

Estimate.

Third-Quarter 2011 Summary

Archer Daniels reported robust third-quarter 2011 results. Net

income for the reported quarter was $578.0 million or 86 cents per

share compared with $421.0 million or 65 cents per share in the

year-ago quarter. Quarterly earnings also outpaced the Zacks

Consensus Estimate by a penny.

The robust quarterly result was primarily attributable to

increased segmental profit, partially offset by negative

discrepancy from changes in Last-In-First-Out (LIFO) inventory

valuations caused by higher agricultural commodity prices.

ADM's quarterly net sales climbed 32.6% year over year to

$20,077.0 million, beating the Zacks Consensus Estimate of

$17,279.0 million. The growth in net sales was mainly attributable

to a robust jump of 37.6% in Agricultural Services to $9,340.0

million, a rise of 30.6% in Oilseeds Processing revenues to

$6,642.0 million and an increase of 28.2% in Corn Processing

revenues to $2,513.0 million.

Fourth-Quarter 2011 Zacks Consensus

The analyst covered by Zacks expects Archer Daniels Midland to

post fourth-quarter 2011 earnings of 84 cents a share, which is

higher than earnings of 69 cents delivered in the prior-year

quarter. The current Zacks Consensus Estimate ranges between

earnings of 74 cents and $1.00 a share.

Zacks Agreement & Magnitude

Of the 12 analysts following the stock, only one analyst

revisited and downgraded its estimate, over the last 7 days for the

fourth quarter of fiscal 2011. Two out of 3 analysts revisiting

their estimates have downgraded and only one has upgraded it over

the last 30 days.

Mixed Earnings Surprise History

With respect to earnings surprises, ADM has thrice topped the

Zacks Consensus Estimate over the last four quarters in the range

of approximately negative 28.0% to positive 48.1%. The average

remained at approximately 14.8%. This suggests that ADM has beaten

the Zacks Consensus Estimate by an average of 14.8% in the trailing

four quarters.

Our View

Archer Daniels Midland is in the midst of a brisk expansion

strategy, which includes expanding crushing capacities in North

America, and fertilizer blending and biodiesel capacities in South

America. Moreover, in Europe, the company has acquired processing

facilities in Czech Republic and Germany.

These initiatives offer a strong upside potential to the

company. Moreover, the world is facing tight supply of

milling-quality wheat resulting from continued reductions in the

production of Australian wheat crop and depletion in supply from

Europe.

The U.S. is becoming the best source for milling quality wheat

due to a variety of buyers in North Africa and Middle East. ADM is

expected to benefit from this as it has a substantial quantity of

milling wheat in storage.

In addition, Archer Daniels Midland is one of the leading

players in the global food processing industry and commands a

massive network of more than 560 processing and sourcing facilities

and 27,000 vehicles operating across the Americas, Europe and Asia

for transportation of agricultural commodities. This provides a

strong competitive advantage to the company and strengthens its

well-established position in the market.

However, ADM's operating performance is based on the

availability and price of agricultural commodities, which in turn,

is dependent on factors, such as weather, plantings, government

programs and policies, changes in global demand and standards of

living. Therefore, the company is prone to significant risks from

adverse fluctuations due to these factors.

Furthermore, agricultural commodity-based business is a

capital-intensive business and hence requires sufficient liquidity

and financial flexibility to fund the operating and capital

requirements. For this, ADM relies on cash generated from

operations and external financing. Limitations on access to

external financing could negatively affect the company's operating

results.

Archer Daniels Midland, which competes with Bunge

Limited (BG) and Corn Products International

Inc. (CPO), currently has a Zacks #4 Rank, implying a

short-term Sell rating on the stock. Besides, the company retains a

long-term Neutral recommendation.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

Zacks Investment Research

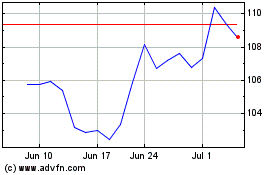

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

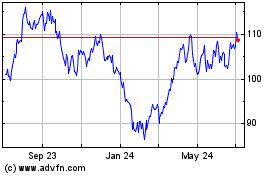

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024