ADM Remarkets Debt - Analyst Blog

April 01 2011 - 8:00AM

Zacks

Archer Daniels Midland

Company (ADM) announced the successful

remarketing in two parts of $1.75 billion of notes originally

issued as a component of its equity units in June 2008. The $70

million notes in the first part carry a coupon rate of 4.479% and

are due to mature on March 1, 2021. The $1 billion of notes in the

second part carry a coupon rate of 5.765% and are scheduled to

mature on March 1, 2041.

In June 2008, the company

had issued $1.75 billion of debentures as a component of equity

units. Equity units are a combination of debt and forward purchase

contract for the holder to purchase the company’s common stock.

The debentures were slated

to be remarketed in 2011. Each purchase contract obligated the

holder to purchase from the company, no later than June 1, 2011,

for a price of $50 in cash, a certain number of shares, ranging

from 1.0453 shares to 1.2544 shares, of the company’s common stock,

based on a formula established in the contract.

The remarketing is

scheduled to close on April 4, 2011, pursuant to customary closing

conditions. The remarketing is being carried out on behalf of

equity unit holders and Archer Daniels will not initially receive

any of the proceeds.

The proceeds will instead

be utilized toward the purchase of U.S. Treasury securities that

will be pledged to secure the stock purchase obligations of the

holders of the equity units. The U.S. Treasury securities will be

held by Archer Daniels’ collateral agent,

The

Bank of New York Mellon Corporation (BK).

On June 1, 2011, Archer

Daniels will receive approximately $1.75 billion from its

collateral agent and then issue shares under the forward stock

purchase contracts. This will mark the completion of the company’s

equity obligations under the original equity units. The issuance

proceeds will be utilized towards general corporate purposes,

including paying back short-term debt.

As a result of the

issuance, Archer Daniels’ number of outstanding shares will

increase by approximately 44 million and will dilute its fourth

quarter and fiscal 2011 earnings. The Zacks Consensus Estimate for

Archer Daniels is currently pegged at 89 cents for the fourth

quarter and $3.36 for fiscal 2011.

Based in Decatur, Illinois,

Archer Daniels Midland Company procures, transports, stores,

processes and merchandises agricultural commodities and products in

the United States and internationally.

In the United States,

Archer Daniels operates 191 elevators with an aggregate storage

capacity of more than 420 million bushels. It competes with

Bunge

Ltd.

(BG) and

Corn

Products International Inc. (CPO). We currently have a Zacks

#2 Rank (short-term Buy recommendation) on the stock.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

BANK OF NY MELL (BK): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

Zacks Investment Research

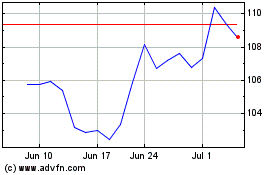

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

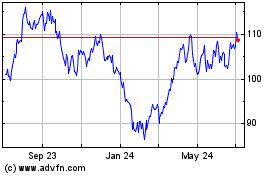

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024