Brazil's Cosan, Shell To Boost Output At Raizen Ethanol Venture

February 14 2011 - 10:45AM

Dow Jones News

Brazilian sugar and ethanol group Cosan Industria e Comercio SA

(CSAN3.BR) and Royal Dutch Shell (RDSA.LN) disclosed more details

Monday about the $12 billion ethanol joint venture the companies

formed last year, which will be called Raizen.

"We are one of the most-competitive sustainable energy companies

in the world," said Raizen Chairman Rubens Ometto during a news

conference in Sao Paulo. "The organization was born big."

Despite still being in its infancy, the joint venture will

expand its production capacity over the next five years, Cosan and

Shell said. The added output aims to meet a growing demand for fuel

at the company's 4,500 service stations across Brazil.

Raizen will boost sugar-cane-crushing capacity to 100 million

metric tons a year, up from current output of 60 million tons,

Raizen Chief Executive Vasco Dias said. Ethanol production is

expected to more than double over the next five years to five

billion liters a year. Raizen now produces about 2.2 billion liters

annually.

"With our global reach and investments, our plan is to

consolidate sugar-cane ethanol into an international commodity,"

Dias said.

While the executives declined to put a value on the investments

needed to boost output to the expected levels, Chief Financial

Officer Luis Rapparini said that the company will sell bonds

overseas to fund the investments. The executive declined to give

any further details about the possible bond sales.

Raizen represents a huge step in the consolidation of Brazil's

fractured ethanol sector, where many of the sugar cane mills are

family owned. That's made the sector ripe for picking for foreign

investors flush with cash and a desire to enter Brazil's biofuels

segment.

Cosan and Shell's creation of Raizen was followed by two

separate deals made by Brazilian state-run energy giant Petroleo

Brasileiro (PBR, PETR4.BR), or Petrobras. In May 2010, Petrobras

invested nearly $1 billion for a 46% stake in local sugar group

Guarani, the country's fourth-largest sugar miller. Petrobras then

paid about $240 million for a 49% stake in Nova Fronteira

Bioenergia SA--a joint venture with local sugar producer Sao

Martinho SA (SMTO3.BR).

Previously, consolidation in the Brazilian biofuels sector had

been limited to smaller deals between rivals or investment funds.

U.S. company Bunge Ltd. (BG) in December 2009 acquired Usina Moema

Participacoes SA, which owns a Brazilian sugar-cane mill and has

ownership interests in five others. France's Louis Dreyfus

Commodities in October 2009 took control of giant sugar and ethanol

group SantelisaVale. Cosan snapped up local milling group

NovAmerica in early 2010.

-By Rogerio Jelmayer and Jeff Fick, Dow Jones Newswires;

55-21-2586-6085; jeff.fick@dowjones.com

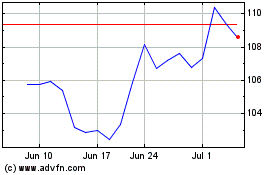

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

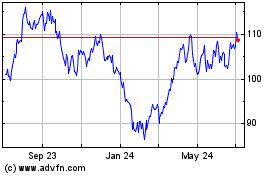

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024