Barlcays and Angelo Gordon In Dispute Over Commercial-Mortgage Bonds

December 16 2011 - 12:58PM

Dow Jones News

Barclays PLC (BCS, BARC.LN) and big-name hedge fund Angelo

Gordon & Co. are battling over whether some $600 million in

outstanding commercial-mortgage backed securities have

defaulted.

The fight, which also involves an argument from MBIA Inc. (MBI),

pits the two big names against each other to such an extent that

the trustee for the bonds, U.S. Bancorp (USB), has sought a judge's

help.

In essence, Barclays as an investor in the notes claims the

bonds have defaulted because there should have been some $8.5

million paid to investors. Barclays argues the misallocation of

those funds caused a material default and that the investors are

now owed the entire remaining principal and all interest.

Angelo Gordon, a hedge fund with $22 billion in assets under

management and a growing force in the real-estate investing world,

is the collateral manager for the bonds. It disputes there were any

errors and also disputes that specific error would cause a default,

refusing to hand over the collateral or let the deal be

liquidated.

Meanwhile, MBIA, another investor in the bonds, also disputes

there would be a default if Barclays was correct on the

mistake.

U.S. Bancorp said it could not determine in its capacity as

trustee whether there had been a mistake. In the court filing in

federal court in Manhattan it says it hired an independent expert,

at the request of Barclays, and that expert did determine a default

was made and it was prepared to liquidate the funds before MBIA

refuted the claims. It has placed nearly $2.3 million in interest

payments in an escrow account until the matter is settled.

Barclays couldn't immediately comment and Angelo Gordon couldn't

immediately be reached for comment.

-By David Benoit, Dow Jones Newswires; 212-416-2458;

david.benoit@dowjones.com

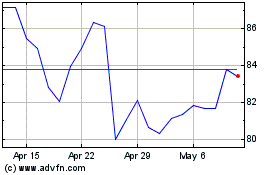

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2024 to Jul 2024

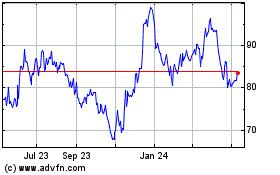

Brunswick (NYSE:BC)

Historical Stock Chart

From Jul 2023 to Jul 2024