CASH POSITION and LIQUIDITY INCREASED; PIPELINE and COMPANY

INVENTORY REDUCED LAKE FOREST, Ill., Oct. 29 /PRNewswire-FirstCall/

-- Brunswick Corporation (NYSE:BC) reported today results for the

third quarter of 2009: -- Total sales of $665.8 million were down

36 percent versus 2008, primarily the result of marine sales that

dropped by 40 percent from year-ago levels. -- A net loss of $114.3

million, or $1.29 per diluted share, which includes $0.32 per

diluted share of restructuring charges, and $0.24 per diluted share

of benefits from special tax items. -- Cash totaled $624.1 million,

up from the 2008 year-end balance of $317.5 million. -- Pipeline

reduction and inventory management strategies led to lower dealer

inventory levels and company cash flow benefits, while having a

negative impact on the company's revenue and earnings. "We continue

to make great strides in improving our overall liquidity position,

reducing our marine dealer pipeline and executing our cost

reduction program," said Brunswick's Chairman and Chief Executive

Officer Dustan E. McCoy. "These significant accomplishments have

been achieved against a global marine market that has experienced

its lowest level of demand in more than 45 years. "Our overall

liquidity at the end of the third quarter was $740 million, $222

million higher than existed at the end of 2008. During the quarter,

we retired notes maturing in 2011, which eliminates any material

debt maturities over the next three years. "As we entered 2009, we

established as one of our top priorities an inventory management

and pipeline reduction strategy that was intended to assist our

dealers through this very difficult period. By producing fewer

units than we sold at wholesale, and selling lower amounts at

wholesale than our dealers are retailing, we have been able to

reduce the number of boats on dealers' showrooms as well as in our

factory yards to extremely low levels. This strategy of taking all

reasonable actions to maintain the health of our dealers has thus

far led to very manageable levels of dealer exits, and any related

Brunswick boat repurchase obligations. "The factors that affected

our revenues and earnings in the previous two quarters of 2009

continued into the third, including lower overall unit sales levels

across our entire company, combined with higher discounts and

incentives to facilitate retail boat sales, particularly of older

boat models. During the third quarter, the company continued to

experience reduced fixed-cost absorption and higher pension and bad

debt expenses. Offsetting these factors were cost savings generated

from our successful and ongoing fixed-cost reduction activities and

lower restructuring charges, along with the absence of large

impairment and tax charges incurred in the third quarter of last

year," McCoy said. Third Quarter Results For the third quarter of

2009, the company reported net sales of $665.8 million, down from

$1,038.8 million a year earlier. For the quarter, the company

reported an operating loss of $109.4 million, which included $28.8

million of restructuring charges. In the third quarter of 2008, the

company had an operating loss of $566.3 million, which included

$534.2 million of impairment and restructuring charges. For the

quarter, Brunswick reported a net loss of $114.3 million, or $1.29

per diluted share, as compared with a net loss of $729.1 million,

or $8.26 per diluted share, for the third quarter of 2008. The

diluted loss per share for the third quarter of 2009 included

restructuring charges of $0.32 per diluted share and a $0.24 per

diluted share benefit from special tax items. Diluted earnings per

share for the third quarter of 2008 included $4.59 per diluted

share of impairment and restructuring charges, and $3.34 per

diluted share of non-cash charges for special tax items. Review of

Cash Flow and Balance Sheet During the quarter, the company issued

$350 million of senior secured notes due in 2016. The net proceeds

from this financing of approximately $330 million were used to

retire $149 million of senior notes due in 2011, and $12 million of

senior notes due in 2013. Also in the quarter, the company reduced

its borrowings under the Mercury Marine ABL facility by $74

million, and ended the period with no borrowings under this

facility. Cash and cash equivalents were $624 million at the end of

the third quarter, up $307 million from year-end 2008 levels. The

company's increased cash position resulted primarily from a change

in certain current assets and current liabilities, net financing

activities and net tax refunds, partially offset by net losses

experienced in the nine-month period and pension contributions. The

change in certain current assets and current liabilities was

largely the result of reductions of the company's inventory and

accounts and notes receivable, partially offset by decreased

accounts payable and lower accrued expenses. Net debt (defined as

total debt, less cash and cash equivalents) was $292 million, down

$122 million from year-end 2008 levels. The company's total

liquidity (defined as cash and cash equivalents, plus amounts

available under its asset-backed lending facilities) totaled $740

million, up $222 million from year-end 2008 levels. Marine Engine

Segment The Marine Engine segment, consisting of the Mercury Marine

Group, including the marine service, parts and accessories

businesses, reported net sales of $363.5 million in the third

quarter of 2009, down 29 percent from $515.2 million in the

year-ago third quarter. International sales, which represented 41

percent of total segment sales in the quarter, declined by 27

percent. For the quarter, the Marine Engine segment reported an

operating loss of $13.4 million, including restructuring charges of

$18.8 million. This compares with an operating loss of $9.7 million

in the year-ago quarter, which included $18.6 million of impairment

and restructuring charges. Sales were off across all Marine Engine

operations, with sterndrive engines experiencing a greater sales

decline than outboard engines. Sales from the segment's domestic

marine service, parts and accessories businesses, which represented

35 percent of total segment sales in the quarter, were down

mid-single digits, as boat usage and the purchase of parts and

accessories remained relatively stable. Mercury's manufacturing

facilities continued to cut production rates and take plant

furloughs during the quarter in response to lower retail demand and

to reduce pipeline levels. Lower sales, reduced fixed-cost

absorption on lower production and higher bad debt expense had an

adverse effect on operating earnings, which were partially offset

by Mercury Marine's expense reductions. Boat Segment The Boat

segment is comprised of the Brunswick Boat Group and includes 17

boat brands. The Boat segment reported net sales for the third

quarter of 2009 of $118.2 million, down 62 percent compared with

$314.2 million in the third quarter of 2008. International sales,

which represented 43 percent of total segment sales in the quarter,

decreased by 60 percent during the period. For the third quarter of

2009, the Boat segment reported an operating loss of $86.7 million,

including restructuring charges of $6.6 million. This compares with

an operating loss of $536.3 million, including impairment and

restructuring charges of $491.6 million, in the third quarter of

2008. Boat manufacturing facilities also continued to significantly

cut production rates and take plant furloughs during the quarter to

address inventory levels held by the company and its dealers. Lower

sales, reduced fixed-cost absorption on lower production volumes

and higher discounts and incentives to support retail sales by

dealers had an adverse effect on operating earnings, which were

partially offset by the Boat Group's expense reductions and the

absence of impairment charges incurred in the third quarter of

2008. Fitness Segment The Fitness segment is comprised of the Life

Fitness Division, which manufactures and sells Life Fitness and

Hammer Strength fitness equipment. Fitness segment sales in the

third quarter of 2009 totaled $126.8 million, down 22 percent from

$161.6 million in the year-ago quarter. International sales, which

represented 55 percent of total segment sales in the quarter,

declined by 15 percent. For the quarter, the Fitness segment

reported operating earnings of $12.5 million, including $0.4

million of restructuring charges. This compares with operating

earnings of $10.3 million, including restructuring charges of $0.8

million, in the third quarter of 2008. Commercial equipment sales,

which account for the largest percentage of Fitness segment sales,

declined in the quarter as gym and fitness club operators remained

cautious about ordering equipment. Sales of consumer exercise

equipment were also down, although at lower rates than sales of

commercial equipment. Higher operating earnings in the third

quarter of 2009, when compared with 2008, reflect actions taken by

Life Fitness to reduce expenses, which were partially offset by the

unfavorable effect of lower sales. Bowling & Billiards Segment

The Bowling & Billiards segment is comprised of Brunswick

retail bowling centers; bowling equipment and products; and

billiards tables and accessories. Segment sales in the third

quarter of 2009 totaled $77.5 million, down 30 percent compared

with $111.1 million in the year-ago quarter. For the quarter, the

segment reported an operating loss of $3.8 million, including

restructuring charges of $0.8 million. This compares with an

operating loss of $10.4 million, including impairment and

restructuring charges of $15.4 million in the third quarter of

2008. For the quarter, retail bowling equivalent-center sales

declined by a high single-digit percentage. The bowling products

and billiards businesses experienced greater sales declines, as

bowling center operators and retail billiards customers remained

cautious about purchases. Operating losses reflected the

unfavorable effect of the reduced sales, which was partially offset

by Bowling & Billiards' cost reduction activities and the

absence of impairment charges incurred in the third quarter of

2008. Outlook "As we enter the fourth quarter of 2009 and begin

planning for 2010, our near-term operating and financial strategies

will continue to be focused on maintaining strong liquidity without

additional borrowing, taking all reasonable actions to protect our

dealer network, and positioning ourselves to take advantage of

improvements in economic conditions as they occur," McCoy said.

"Strategic actions pertaining to our inventory management and

pipeline reduction strategy will continue during the fourth

quarter, with a target to further reduce the number of boats in our

backyard and to minimize the seasonal growth in pipeline

inventories. These actions should continue to negatively affect our

sales and earnings as they have in the previous three quarters. "As

we enter 2010, the majority of our boat and engine manufacturing

facilities will begin to ramp up production. This is primarily the

result of dealer inventories being at historically low levels,

which means we will need to increase our wholesale shipments of

boats and engines to meet retail demand. Increased production

combined with higher wholesale shipments should provide improved

revenue and reduced losses throughout 2010. "In addition, the cash

generated from improving EBITDA, combined with continued tight

working capital management as well as a continued focus on our cost

management programs, should enable us to maintain strong levels of

liquidity throughout 2010. "During the third quarter, in our

continuing efforts to evaluate our manufacturing footprint, brands,

models, and cost and operating structures, we made a strategic

decision to consolidate Mercury Marine's two largest U.S.

manufacturing operations. The consolidation of manufacturing

operations in Fond du Lac, Wis., is expected to generate the

highest returns with the lowest execution risk. "As a result of

this decision, we will transition during the next 24 months our

manufacturing operations from Stillwater, Okla., to our facility in

Wisconsin. This consolidation, combined with the net fixed-cost

reductions achieved over the past two years, should help uniquely

position Brunswick for continued market leadership in our marine

and recreation businesses," McCoy concluded. Conference Call

Scheduled Brunswick will host a conference call today at 10 a.m.

CDT, hosted by Dustan E. McCoy, chairman and chief executive

officer, Peter B. Hamilton, senior vice president and chief

financial officer, and Bruce J. Byots, vice president - corporate

and investor relations. The call will be broadcast over the

Internet at http://www.brunswick.com/. To listen to the call, go to

the Web site at least 15 minutes before the call to register,

download and install any needed audio software. Security analysts

and investors wishing to participate via telephone should call

(800) 369-2064 (passcode: Brunswick Q3). Callers outside North

America should call +1 (517) 308-9313 to be connected. These

numbers can be accessed 15 minutes before the call begins, as well

as during the call. A replay of the conference call will be

available through 10:59 p.m. CST Thursday, Nov. 5, 2009, by calling

(800) 926-8540 or (203) 369-3852. The replay will also be available

at http://www.brunswick.com/. Forward-Looking Statements Certain

statements in this news release are forward-looking as defined in

the Private Securities Litigation Reform Act of 1995. Such

statements are based on current expectations, estimates and

projections about Brunswick's business. These statements are not

guarantees of future performance and involve certain risks and

uncertainties that may cause actual results to differ materially

from expectations as of the date of this news release. These risks

include, but are not limited to: the effect of the amount of

disposable income available to consumers for discretionary

purchases, and the level of consumer confidence on the demand for

marine, fitness, billiards and bowling equipment, products and

services; the ability to successfully complete restructuring

efforts in the timeframe and cost anticipated; the ability to

successfully complete the disposition of non-core assets; the

effect of higher product prices due to technology changes and added

product features and components on consumer demand; the effect of

competition from other leisure pursuits on the level of

participation in boating, fitness, bowling and billiards

activities; the effect of interest rates and fuel prices on demand

for marine products; the ability to successfully manage pipeline

inventories; the financial strength of dealers, distributors and

independent boat builders; the ability to maintain mutually

beneficial relationships with dealers, distributors and independent

boat builders; the ability to maintain effective distribution and

to develop alternative distribution channels without disrupting

incumbent distribution partners; the ability to maintain market

share, particularly in high-margin products; the success of new

product introductions; the ability to maintain product quality and

service standards expected by customers; competitive pricing

pressures; the ability to develop cost-effective product

technologies that comply with regulatory requirements; the ability

to transition and ramp up certain manufacturing operations within

time and budgets allowed; the ability to successfully develop and

distribute products differentiated for the global marketplace;

shifts in currency exchange rates; adverse foreign economic

conditions; the success of global sourcing and supply chain

initiatives; the ability to obtain components and raw materials

from suppliers; increased competition from Asian competitors;

competition from new technologies; the ability to complete

environmental remediation efforts and resolve claims and litigation

at the cost estimated; and the effect of weather conditions on

demand for marine products and retail bowling center revenues.

Additional factors are included in the company's Annual Report on

Form 10-K for 2008 and Quarterly Report on Form 10-Q for the

quarter ended July 4, 2009. Such forward-looking statements speak

only as of the date on which they are made and Brunswick does not

undertake any obligation to update any forward-looking statements

to reflect events or circumstances after the date of this news

release, or for changes made to this document by wire services or

Internet service providers. About Brunswick Headquartered in Lake

Forest, Ill., Brunswick Corporation endeavors to instill "Genuine

Ingenuity"(TM) in all its leading consumer brands, including

Mercury and Mariner outboard engines; Mercury MerCruiser

sterndrives and inboard engines; MotorGuide trolling motors;

Attwood marine parts and accessories; Land 'N' Sea, Kellogg Marine,

Diversified Marine and Benrock parts and accessories distributors;

Arvor, Bayliner, Bermuda, Boston Whaler, Cabo Yachts, Crestliner,

Cypress Cay, Harris, Hatteras, Kayot, Lowe, Lund, Maxum, Meridian,

Ornvik, Princecraft, Quicksilver, Rayglass, Sea Ray, Sealine,

Triton, Trophy, Uttern and Valiant boats; Life Fitness and Hammer

Strength fitness equipment; Brunswick bowling centers, equipment

and consumer products; Brunswick billiards tables. For more

information, visit http://www.brunswick.com/. Brunswick Corporation

Comparative Consolidated Statements of Operations (in millions,

except per share data) (unaudited) Three Months Ended

------------------ Oct. 3, Sept. 27, 2009 2008 % Change ---- ----

-------- Net sales $665.8 $1,038.8 -36% Cost of sales 590.2 862.3

-32% Selling, general and administrative expense 136.7 177.4 -23%

Research and development expense 19.5 31.2 -38% Goodwill impairment

charges - 374.0 NM Trade name impairment charges - 121.1 NM

Restructuring, exit and impairment charges 28.8 39.1 -26% ---- ----

Operating loss (109.4) (566.3) 81% Equity loss (3.8) (1.0) NM

Investment sale gain - 2.1 NM Other income (expense), net 0.3 (0.3)

NM --- ---- Loss before interest and income taxes (112.9) (565.5)

80% Interest expense (23.7) (12.7) -87% Interest income 0.7 2.5

-72% --- --- Loss before income taxes (135.9) (575.7) 76% Income

tax (benefit) provision (21.6) 153.4 ----- ----- Net loss $(114.3)

$(729.1) 84% ======= ======= Loss per common share: Basic $(1.29)

$(8.26) Diluted $(1.29) $(8.26) Weighted average shares used for

computation of: Basic loss per common share 88.4 88.3 Diluted loss

per common share 88.4 88.3 Effective tax rate 15.9% -26.7%

Supplemental Information ------------------------ Diluted net loss

$(1.29) $(8.26) Restructuring, exit and impairment charges (1) 0.32

0.28 Goodwill impairment - 3.37 Trade name impairment - 0.94

Special tax items (0.24) 3.34 ----- ---- Diluted net loss, as

adjusted $(1.21) $(0.33) ====== ====== (1) The 2009 Restructuring,

exit and impairment charges assume no tax benefit, while the 2008

Restructuring, exit and impairment charges include a tax benefit.

Brunswick Corporation Comparative Consolidated Statements of

Operations (in millions, except per share data) (unaudited) Nine

Months Ended ----------------- Oct. 3, Sept. 27, 2009 2008 % Change

---- ---- -------- Net sales $2,118.8 $3,871.0 -45% Cost of sales

1,878.0 3,121.5 -40% Selling, general and administrative expense

454.5 586.1 -22% Research and development expense 64.7 97.1 -33%

Goodwill impairment charges - 377.2 NM Trade name impairment

charges - 133.9 NM Restructuring, exit and impairment charges 103.9

128.4 -19% ----- ----- Operating loss (382.3) (573.2) 33% Equity

earnings (loss) (11.1) 10.1 NM Investment sale gain - 23.0 NM Other

income (expense), net (1.3) 1.6 NM ---- --- Loss before interest

and income taxes (394.7) (538.5) 27% Interest expense (60.2) (35.6)

-69% Interest income 2.2 5.4 -59% --- --- Loss before income taxes

(452.7) (568.7) 20% Income tax expense 9.5 153.1 --- ----- Net loss

$(462.2) $(721.8) 36% ======= ======= Loss per common share: Basic

$(5.23) $(8.18) Diluted $(5.23) $(8.18) Weighted average shares

used for computation of: Basic loss per common share 88.4 88.3

Diluted loss per common share 88.4 88.3 Effective tax rate -2.1%

-26.9% Supplemental Information ------------------------ Diluted

net loss $(5.23) $(8.18) Restructuring, exit and impairment charges

(1) 1.17 0.91 Goodwill impairment - 3.40 Trade name impairment -

1.03 Investment sale gain, net of tax - (0.11) Special tax items

0.12 3.31 ---- ---- Diluted net earnings (loss), as adjusted

$(3.94) $0.36 ====== ===== (1) The 2009 Restructuring, exit and

impairment charges assume no tax benefit, while the 2008

Restructuring, exit and impairment charges include a tax benefit.

Brunswick Corporation Selected Financial Information (in millions)

(unaudited) Segment Information (1) Three Months Ended

------------------ Operating Earnings Net Sales (Loss)(2) Operating

Margin ------------------------------------------------------- Oct.

3, Sept. 27, % Oct. 3, Sept. 27, % Oct. 3, Sept. 27, 2009 2008

Change 2009 2008 Change 2009 2008 ---- ---- ------ ---- ---- ------

---- ---- Marine Engine $363.5 $515.2 -29% $(13.4) $(9.7) -38%

-3.7% -1.9% Boat 118.2 314.2 -62% (86.7) (536.3) 84% -73.4% NM

Marine eliminations (20.1) (63.4) - - ----- ----- --- --- Total

Marine 461.6 766.0 -40% (100.1) (546.0) 82% -21.7% -71.3% Fitness

126.8 161.6 -22% 12.5 10.3 21% 9.9% 6.4% Bowling & Billiards

77.5 111.1 -30% (3.8) (10.4) 63% -4.9% -9.4% Eliminations (0.1) 0.1

- - Corp/Other - - (18.0) (20.2) 11% --- --- ----- ----- Total

$665.8 $1,038.8 -36% $(109.4) $(566.3) 81% -16.4% -54.5% ======

======== ======= ======= Nine Months Ended -----------------

Operating Earnings Net Sales (Loss) (3) Operating Margin

------------------------------------------------------- Oct. 3,

Sept. 27, % Oct. 3, Sept. 27, % Oct. 3, Sept. 27, 2009 2008 Change

2009 2008 Change 2009 2008 ---- ---- ------ ---- ---- ------ ----

---- Marine Engine $1,122.6 $1,867.4 -40% $(71.8) $82.8 NM -6.4%

4.4% Boat 462.3 1,471.5 -69% (266.9) (595.9) 55% -57.7% -40.5%

Marine eliminations (71.2) (270.6) - - ----- ------ --- --- Total

Marine 1,513.7 3,068.3 -51% (338.7) (513.1) 34% -22.4% -16.7%

Fitness 350.4 467.7 -25% 13.0 26.6 -51% 3.7% 5.7% Bowling &

Billiards 254.8 335.1 -24% 0.9 (29.3) NM 0.4% -8.7% Eliminations

(0.1) (0.1) - - Corp/Other - - (57.5) (57.4) 0% --- --- ----- -----

Total $2,118.8 $3,871.0 -45% $(382.3) $(573.2) 33% -18.0% -14.8%

======== ======== ======= ======= (1) During the first quarter of

2009, the company realigned the management of its marine service,

parts and accessories businesses. The Boat segment's parts and

accessories businesses of Attwood, Land 'N' Sea, Benrock, Inc.,

Kellogg Marine, Inc. and Diversified Marine Products, L.P. are now

being managed by the Marine Engine segment's service and parts

business leaders. As a result, the parts and accessories businesses

operating results previously reported in the Boat segment are now

being reported in the Marine Engine segment. Segment results have

been restated for all periods presented to reflect the change in

Brunswick's reported segments. (2) Operating earnings (loss) in the

third quarter of 2009 includes $28.8 million of pretax

restructuring, exit and impairment charges. The $28.8 million

charge consists of $18.8 million in the Marine Engine segment, $6.6

million in the Boat segment, $0.4 million in the Fitness segment,

$0.8 million in the Bowling & Billiards segment and $2.2

million in Corp/Other. Operating earnings (loss) in the third

quarter of 2008 includes $534.2 million of pretax restructuring,

exit and impairment charges. The $534.2 million charge consists of

$18.6 million in the Marine Engine segment, $491.6 million in the

Boat segment, $0.8 million in the Fitness segment, $15.4 million in

the Bowling & Billiards segment and $7.8 million in Corp/Other.

(3) Operating earnings (loss) in the first nine months of 2009

includes $103.9 million of pretax restructuring, exit and

impairment charges. The $103.9 million consists of $40.1 million in

the Marine Engine segment, $49.5 million in the Boat segment, $1.6

million in the Fitness segment, $4.8 million in the Bowling &

Billiards segment and $7.9 million in Corp/Other. Operating

earnings (loss) in the first nine months of 2008 includes $639.5

million of restructuring, exit and impairment charges. The $639.5

million consists of $37.7 million in the Marine Engine segment,

$543.0 million in the Boat segment, $2.1 million in the Fitness

segment, $40.8 million in the Bowling & Billiards segment and

$15.9 million in Corp/Other. Brunswick Corporation Comparative

Condensed Consolidated Balance Sheets (in millions) Oct. 3,

December 31, Sept. 27, 2009 2008 2008 ---- ---- ---- (unaudited)

(unaudited) Assets Current assets Cash and cash equivalents $624.1

$317.5 $342.9 Accounts and notes receivables, net 368.2 444.8 518.3

Inventories Finished goods 238.8 457.7 475.9 Work-in-process 182.9

248.2 291.1 Raw materials 81.5 105.8 131.1 ---- ----- ----- Net

inventories 503.2 811.7 898.1 Deferred income taxes 13.1 103.2 39.2

Prepaid expenses and other 34.6 59.7 75.2 ---- ---- ---- Current

assets 1,543.2 1,736.9 1,873.7 ------- ------- ------- Net property

798.4 917.6 970.3 ----- ----- ----- Other assets Goodwill, net

292.6 290.9 294.8 Other intangibles, net 78.5 86.6 89.9 Investments

57.8 75.4 81.6 Non-current deferred tax asset - - 14.8 Other

long-term assets 109.9 116.5 140.8 ----- ----- ----- Other assets

538.8 569.4 621.9 ----- ----- ----- Total assets $2,880.4 $3,223.9

$3,465.9 ======== ======== ======== Liabilities and shareholders'

equity Current liabilities Short-term debt $11.5 $3.2 $0.3 Accounts

payable 232.6 301.3 346.8 Accrued expenses 628.4 696.7 791.7 -----

----- ----- Current liabilities 872.5 1,001.2 1,138.8 Long-term

debt 904.8 728.5 726.4 Other long-term liabilities 767.3 764.3

422.1 Shareholders' equity 335.8 729.9 1,178.6 ----- ----- -------

Total liabilities and shareholders' equity $2,880.4 $3,223.9

$3,465.9 ======== ======== ======== Supplemental Information

------------------------ Debt-to-capitalization rate 73.2% 50.1%

38.1% Brunswick Corporation Comparative Condensed Consolidated

Statements of Cash Flows (in millions) (unaudited) Nine Months

Ended ----------------- October 3, September 27, 2009 2008 ----

---- Cash flows from operating activities Net loss $(462.2)

$(721.8) Depreciation and amortization 119.8 133.1 Pension 58.7 4.8

Deferred income taxes 9.9 0.1 Provision for doubtful accounts 33.1

18.8 Goodwill, trade name, and other long-lived asset impairment

charges 18.0 561.1 Changes in non-cash current assets and current

liabilities 314.3 (113.9) Change due to repurchase of accounts

receivable (84.2) - Income taxes 90.6 159.9 Other, net 32.1 (21.9)

---- ----- Net cash provided by operating activities 130.1 20.2

----- ---- Cash flows from investing activities Capital

expenditures (20.2) (84.8) Investments 7.5 21.1 Proceeds from

investment sale - 45.5 Proceeds from sale of property, plant and

equipment 11.7 9.6 Other, net 1.9 0.2 --- --- Net cash provided by

(used for) investing activities 0.9 (8.4) --- ---- Cash flows from

financing activities Net issuances of short-term debt 8.3 -

Proceeds from asset-based lending facility 81.1 - Payments of

asset-based lending facility (81.1) - Net proceeds from issuance of

long-term debt 329.9 250.4 Payments of long-term debt including

current maturities (162.6) (250.7) ------ ------ Net cash provided

by (used for) financing activities 175.6 (0.3) ----- ---- Net

increase in cash and cash equivalents 306.6 11.5 Cash and cash

equivalents at beginning of period 317.5 331.4 ----- ----- Cash and

cash equivalents at end of period $624.1 $342.9 ====== ====== Free

Cash Flow Net cash provided by operating activities $130.1 $20.2

Net cash provided by (used for): Capital expenditures (20.2) (84.8)

Proceeds from investment sale - 45.5 Proceeds from sale of

property, plant and equipment 11.7 9.6 Other, net 1.9 0.2 --- ---

Total free cash flow $123.5 $(9.3) ====== ===== DATASOURCE:

Brunswick Corporation CONTACT: Bruce Byots, Vice President -

Corporate and Investor Relations, +1-847-735-4612, or Daniel Kubera

, Director - Media Relations and Corporate Communications,

+1-847-735-4617, , both of Brunswick Corporation Web Site:

http://www.brunswick.com/

Copyright

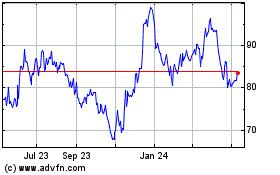

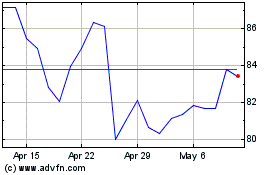

Brunswick (NYSE:BC)

Historical Stock Chart

From May 2024 to Jun 2024

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2023 to Jun 2024