WEAK MARKET CONDITIONS CONTINUE; COMPANY MAINTAINS FOCUS ON CASH

FLOW LAKE FOREST, Ill., April 30 /PRNewswire-FirstCall/ --

Brunswick Corporation (NYSE:BC) reported today results for the

first quarter of 2009: -- Total sales of $734.7 million were down

45 percent versus 2008, primarily the result of marine sales that

dropped by 52 percent from year-ago levels. -- A net loss of $184.2

million, or $2.08 per diluted share, which includes $39.6 million,

or $0.45 per diluted share, of restructuring charges and $0.40 per

diluted share of non-cash charges for special tax items. -- Cash on

hand at quarter's end was $359.1 million, up from the 2008 year-end

balance of $317.5 million. The revolving credit facility remained

undrawn throughout the quarter. -- Total restructuring charges for

2009 are estimated to be approximately $75 million, or $0.85 per

diluted share. -- The company expects to generate additional 2009

cost reductions of approximately $40 million, aggregating to

savings of $240 million for the year versus the $200 million of

savings previously announced. "Our businesses continued to be under

pressure from a variety of harsh economic factors that affected

both domestic and international demand for our products, especially

in our recreational marine markets," said Brunswick's Chairman and

Chief Executive Officer Dustan E. McCoy. "The year began as

expected with the continuation of unprecedented low levels of

demand experienced in the second half of 2008, especially during

the fourth quarter. Retail demand for marine products was impacted

in the first quarter of 2009 by declining consumer confidence and

the tightening of consumer credit terms by national lenders. As our

dealers work through this difficult economic climate, we continue

to reduce our wholesale shipments to reduce the number of boats and

engines on their showroom floors. Additionally, we experienced

lower equipment orders from our fitness and bowling products

customers," McCoy said. "Although these factors had a negative

effect on our revenues and earnings, we are successfully managing

our businesses for cash and maintained excellent levels of

liquidity throughout the quarter. This was demonstrated by the $359

million of cash on our balance sheet at the end of the quarter, a

$42 million increase from year-end levels," McCoy added. First

Quarter Results For the first quarter of 2009, the company reported

net sales of $734.7 million, down from $1,346.8 million a year

earlier. For the quarter, the company reported an operating loss of

$127.5 million, which included $39.6 million of restructuring

charges. In the first quarter of 2008, the company had operating

earnings of $10.3 million, which included $22.2 million of

restructuring charges. For the first quarter of 2009, Brunswick

reported a net loss of $184.2 million, or $2.08 per diluted share,

as compared with net earnings of $13.3 million, or $0.15 per

diluted share, for the first quarter of 2008. Diluted loss per

share for the first quarter of 2009 included restructuring charges

of $39.6 million, or $0.45 per diluted share, and a $0.40 per

diluted share charge for special tax items, primarily related to

increases in state and foreign deferred tax valuation allowances

resulting from cumulative losses reported by the company. Diluted

earnings per share, for the first quarter of 2008, included $22.2

million, or $0.16 per diluted share, of restructuring charges and

an investment sale gain of $0.10 per diluted share. Change in

Segment Reporting During the first quarter of 2009, the company

realigned the management of its marine service, parts and

accessories businesses. The Boat segment's parts and accessories

businesses of Attwood, Land 'N' Sea, Benrock, Inc., Kellogg Marine,

Inc. and Diversified Marine Products, L.P. are now being managed by

the Marine Engine segment's service and parts business leaders. As

a result, the marine service, parts and accessories operating

results previously reported in the Boat segment are now being

reported in the Marine Engine segment and the results for 2007 and

2008 have been restated (by quarter) to reflect this change and are

attached as an appendix to this news release. Marine Engine Segment

The Marine Engine segment, consisting of the Mercury Marine Group,

including the marine service, parts and accessories businesses,

reported net sales of $343.9 million in the first quarter of 2009,

down 45 percent from $628.6 million in the year-ago first quarter.

International sales, which represented 43 percent of total segment

sales (net of Marine eliminations) in the quarter, declined by 45

percent on a year-to-year basis. For the quarter, the Marine Engine

segment reported an operating loss of $50.6 million, including

restructuring charges of $11.7 million. This compares with

operating earnings of $33.6 million in the year-ago quarter,

including $1.5 million of restructuring charges. Sales were off

across all Marine Engine operations with sterndrive engines

experiencing a greater sales decline than outboard engines.

However, sales from the marine service, parts and accessories

businesses were down significantly less than our other marine

businesses. Mercury's manufacturing facilities continued to cut

production rates and take plant furloughs during the quarter in

response to lower retail demand and to reduce pipeline levels.

Lower sales and reduced fixed-cost absorption on lower production

had an adverse effect on operating earnings, which were partially

offset by reduced expenses. Boat Segment The Boat segment is

comprised of the Brunswick Boat Group and includes 17 boat brands.

The Boat segment reported net sales for the first quarter of 2009

of $205.3 million, down 64 percent compared with $565.6 million in

the first quarter of 2008. International sales, which represented

40 percent of total segment sales in the quarter, decreased by 59

percent during the period. For the first quarter of 2009, the Boat

segment reported an operating loss of $72.3 million, including

restructuring charges of $25.0 million. This compares with an

operating loss of $17.4 million, including restructuring charges of

$13.8 million in the first quarter of 2008. Boat manufacturing

facilities also continued to significantly cut production rates and

take plant furloughs during the quarter to address inventory levels

held throughout the pipeline. Lower sales and reduced fixed-cost

absorption on lower production had an adverse effect on operating

earnings, which were partially offset by reduced expenses. Fitness

Segment The Fitness segment is comprised of the Life Fitness

Division, which manufactures and sells Life Fitness and Hammer

Strength fitness equipment. Fitness segment sales in the first

quarter of 2009 totaled $118.6 million, down 21 percent from $149.2

million in the year-ago quarter. International sales, which

represented 45 percent of total segment sales in the quarter,

declined by 16 percent on a year-to-year basis. For the quarter,

the Fitness segment reported operating earnings of $0.3 million,

including $1.0 million of restructuring charges. This compares with

operating earnings of $8.1 million in the year-ago quarter.

Commercial equipment sales, which account for the largest

percentage of Fitness segment sales, declined in the quarter as gym

and fitness club operators remained cautious about ordering

equipment. Sales of consumer exercise equipment were down even more

year-over-year, reflecting the effects of the weak economy.

Operating earnings reflected the unfavorable effect of the reduced

sales, which was partially mitigated by reduced expenses. Bowling

& Billiards Segment The Bowling & Billiards segment is

comprised of Brunswick retail bowling centers; bowling equipment

and products; and billiards, Air Hockey and foosball tables.

Segment sales in the first quarter of 2009 totaled $99.9 million,

down 12 percent compared with $113.6 million in the year-ago

quarter. For the quarter, the segment reported operating earnings

of $10.6 million, including restructuring charges of $0.8 million.

This compares with operating earnings of $0.9 million, including

restructuring charges of $5.6 million in the first quarter of 2008.

Retail bowling revenues declined by mid-single digits during the

quarter. The bowling products and billiards businesses experienced

greater sales declines, as bowling center operators and billiards

retail customers remained cautious about purchases. Operating

earnings benefited from cost reductions and lower restructuring

charges in the segment, partially offset by lower revenue levels.

Outlook "We are not planning for any meaningful economic recovery

in 2009 and our near-term focus remains clear, which is to:

maintain strong liquidity without additional borrowings, take all

appropriate actions to maintain dealer health and position

ourselves to exit this global downturn as a stronger company,"

McCoy said. "Our plan requires that we continue to: (1) manage our

businesses for cash, with a focus on inventory reductions, (2)

produce and sell at wholesale below retail sales levels, (3)

evaluate our cost structure and take the appropriate actions

necessary to match the overall demand in the marketplace and (4)

execute against our core strategic platforms, which will enable us

to advance in our industries and maintain our leading brands and

market position. "Our full-year 2009 results will be negatively

affected by lower sales levels, reduced fixed-cost absorption, and

higher pension-related expenses when compared with 2008, as well as

by continuing restructuring charges. Partially offsetting these

factors will be approximately $240 million of 2009 cost reductions

resulting from the full-year effect of actions taken in 2008, as

well as further cost reduction activities initiated or planned in

2009. And although our 2009 earnings will be down significantly

compared with 2008 earnings before restructuring charges,

impairments, and special tax items, it remains our goal to exit

2009 with cash at or above the amount that we reported on our

balance sheet at year-end 2008, without increased borrowings. "As

each day passes and we successfully execute against these actions,

we become increasingly confident that we are well positioned to

benefit from an economic recovery," McCoy said. Conference Call

Scheduled Brunswick will host a conference call today at 10 a.m.

CDT, hosted by Dustan E. McCoy, chairman and chief executive

officer, Peter B. Hamilton, senior vice president and chief

financial officer, and Bruce J. Byots, vice president - corporate

and investor relations. The call will be broadcast over the

Internet at http://www.brunswick.com/. To listen to the call, go to

the Web site at least 15 minutes before the call to register,

download and install any needed audio software. Security analysts

and investors wishing to participate via telephone should call

(800) 857-1754 (passcode: Brunswick Q1). Callers outside North

America should call +1 (517) 308-9227 to be connected. These

numbers can be accessed 15 minutes before the call begins, as well

as during the call. A replay of the conference call will be

available through midnight CDT Thursday, May 7, 2009, by calling

(888) 445-8680 or (203) 369-3155. The replay will also be available

at http://www.brunswick.com/. Forward-Looking Statements Certain

statements in this news release are forward looking as defined in

the Private Securities Litigation Reform Act of 1995. These

statements involve certain risks and uncertainties that may cause

actual results to differ materially from expectations as of the

date of this news release. These risks include, but are not limited

to: the effect of (i) the amount of disposable income available to

consumers for discretionary purchases, and (ii) the level of

consumer confidence on the demand for marine, fitness, billiards

and bowling equipment, products and services; the ability to

successfully complete restructuring efforts in the timeframe and

cost anticipated; the ability to successfully complete the

disposition of non-core assets; the effect of higher product prices

due to technology changes and added product features and components

on consumer demand; the effect of competition from other leisure

pursuits on the level of participation in boating, fitness, bowling

and billiards activities; the effect of interest rates and fuel

prices on demand for marine products; the ability to successfully

manage pipeline inventories; the financial strength of dealers,

distributors and independent boat builders; the ability to maintain

mutually beneficial relationships with dealers, distributors and

independent boat builders; the ability to maintain effective

distribution and to develop alternative distribution channels

without disrupting incumbent distribution partners; the ability to

maintain market share, particularly in high-margin products; the

success of new product introductions; the ability to maintain

product quality and service standards expected by customers;

competitive pricing pressures; the ability to develop

cost-effective product technologies that comply with regulatory

requirements; the ability to transition and ramp up certain

manufacturing operations within time and budgets allowed; the

ability to successfully develop and distribute products

differentiated for the global marketplace; shifts in currency

exchange rates; adverse foreign economic conditions; the success of

global sourcing and supply chain initiatives; the ability to obtain

components and raw materials from suppliers; increased competition

from Asian competitors; competition from new technologies; the

ability to complete environmental remediation efforts and resolve

claims and litigation at the cost estimated; and the effect of

weather conditions on demand for marine products and retail bowling

center revenues. Additional factors are included in the company's

Annual Report on Form 10-K for 2008. About Brunswick Headquartered

in Lake Forest, Ill., Brunswick Corporation endeavors to instill

"Genuine Ingenuity"(TM) in all its leading consumer brands,

including Mercury and Mariner outboard engines; Mercury MerCruiser

sterndrives and inboard engines; MotorGuide trolling motors;

Teignbridge propellers; Arvor, Bayliner, Bermuda, Boston Whaler,

Cabo Yachts, Crestliner, Cypress Cay, Harris, Hatteras, Kayot,

Lowe, Lund, Maxum, Meridian, Ornvik, Princecraft, Quicksilver,

Rayglass, Sea Ray, Sealine, Triton, Trophy, Uttern and Valiant

boats; Attwood marine parts and accessories; Land 'N' Sea, Kellogg

Marine, Diversified Marine and Benrock parts and accessories

distributors; Life Fitness and Hammer Strength fitness equipment;

Brunswick bowling centers, equipment and consumer products;

Brunswick billiards tables; and Dynamo, Tornado and Valley pool

tables, Air Hockey and foosball tables. For more information, visit

http://www.brunswick.com/. Brunswick Corporation Comparative

Consolidated Statements of Operations (in millions, except per

share data) (unaudited) Three Months Ended ------------------ April

4, March 29, 2009 2008 % Change ---- ---- -------- Net sales $734.7

$1,346.8 -45% Cost of sales 643.5 1,077.3 -40% Selling, general and

administrative expense 155.2 203.1 -24% Research and development

expense 23.9 33.9 -29% Restructuring, exit and impairment charges

39.6 22.2 78% ---- ---- Operating earnings (loss) (127.5) 10.3 NM

Equity earnings (loss) (3.2) 4.8 NM Investment sale gain - 19.7 NM

Other income (expense), net (1.4) 1.1 NM ---- --- Earnings (loss)

before interest and income taxes (132.1) 35.9 NM Interest expense

(18.2) (11.5) -58% Interest income 0.5 1.4 -64% --- --- Earnings

(loss) before income taxes (149.8) 25.8 NM Income tax provision

34.4 12.5 ---- ---- Net earnings (loss) $(184.2) $13.3 NM =======

===== Earnings (loss) per common share: Basic $(2.08) $0.15 Diluted

$(2.08) $0.15 Weighted average shares used for computation of:

Basic earnings (loss) per common share 88.4 88.2 Diluted earnings

(loss) per common share 88.4 88.3 Effective tax rate (1) -23.0%

48.4% Supplemental Information ------------------------ Diluted net

earnings (loss) $(2.08) $0.15 Restructuring, exit and impairment

charges (2) 0.45 0.16 Investment sale gain, net of tax - (0.10)

Special tax items 0.40 - ---- --- Diluted net earnings (loss), as

adjusted $(1.23) $0.21 ====== ===== (1) The change in the effective

tax rate in the first quarter of 2009 was primarily due to

increases in state and foreign deferred tax valuation allowances

resulting from cumulative losses reported by the company. (2) The

2009 Restructuring, exit and impairment charges assume no tax

benefit, while the 2008 Restructuring, exit and impairment charges

include a tax benefit. Brunswick Corporation Selected Financial

Information (in millions) (unaudited) Segment Information (1) Three

Months Ended ------------------ Net Operating Operating Sales

Earnings (2) Margin ----- ------------ ---------- April 4, March

29, % April 4, March 29, % April 4, March 29, 2009 2008 Change 2009

2008 Change 2009 2008 ---- ---- ------ ---- ---- ------ ---- ----

Marine Engine $343.9 $628.6 -45% $(50.6) $33.6 NM -14.7% 5.3% Boat

205.3 565.6 -64% (72.3) (17.4) NM -35.2% -3.1% Marine Elimi-

nations (33.0) (110.2) - - ----- ------ --- --- Total Marine 516.2

1,084.0 -52% (122.9) 16.2 NM -23.8% 1.5% Fitness 118.6 149.2 -21%

0.3 8.1 -96% 0.3% 5.4% Bowling & Billiards 99.9 113.6 -12% 10.6

0.9 NM 10.6% 0.8% Corp/Other - - (15.5) (14.9) -4% --- --- -----

----- Total $734.7 $1,346.8 -45% $(127.5) $10.3 NM -17.4% 0.8%

====== ======== ======= ===== (1) During the first quarter of 2009,

the company realigned the management of its marine service, parts

and accessories businesses. The Boat segment's parts and

accessories businesses of Attwood, Land 'N' Sea, Benrock, Inc.,

Kellog Marine, Inc. and Diversified Marine Products, L.P. are now

being managed by the Marine Engine segment's service and parts

business leaders. As a result, the parts and accessories businesses

operating results previously reported in the Boat segment are now

being reported in the Marine Engine segment. Segment results have

been restated for all periods presented to reflect the change in

Brunswick's reported segments. (2) Operating earnings in the first

quarter of 2009 include $39.6 million of pretax restructuring, exit

and impairment charges. The $39.6 million charge consists of $11.7

million in the Marine Engine segment, $25.0 million in the Boat

segment, $1.0 million in the Fitness segment, $0.8 million in the

Bowling & Billiards segment and $1.1 million in Corp/Other.

Operating earnings in the first quarter of 2008 include $22.2

million of pretax restructuring, exit and impairment charges. The

$22.2 million charge consists of $1.5 million in the Marine Engine

segment, $13.8 million in the Boat segment, $5.6 million in the

Bowling & Billiards segment and $1.3 million in Corp/Other.

Brunswick Corporation Comparative Condensed Consolidated Balance

Sheets (in millions) April 4, December 31, March 29, 2009 2008 2008

---- ---- ---- (unaudited) (unaudited) Assets Current assets Cash

and cash equivalents $359.1 $317.5 $267.3 Accounts and notes

receivables, net 381.9 444.8 648.8 Inventories Finished goods 371.7

457.7 494.3 Work-in-process 232.6 248.2 346.0 Raw materials 97.0

105.8 143.9 ---- ----- ----- Net inventories 701.3 811.7 984.2

Deferred income taxes 13.3 103.2 241.9 Prepaid expenses and other

48.8 59.7 57.5 ---- ---- ---- Current assets 1,504.4 1,736.9

2,199.7 ------- ------- ------- Net property 875.8 917.6 1,034.4

----- ----- ------- Other assets Goodwill, net 287.8 290.9 678.4

Other intangibles, net 83.4 86.6 242.6 Investments 70.9 75.4 118.3

Other long-term assets 114.3 116.5 138.0 ----- ----- ----- Other

assets 556.4 569.4 1,177.3 ----- ----- ------- Total assets

$2,936.6 $3,223.9 $4,411.4 ======== ======== ======== Liabilities

and shareholders' equity Current liabilities Short-term debt $2.4

$3.2 $0.9 Accounts payable 238.2 301.3 488.0 Accrued expenses 653.7

696.7 832.2 ----- ----- ----- Current liabilities 894.3 1,001.2

1,321.1 Long-term debt 728.1 728.5 729.1 Other long-term

liabilities 766.9 764.3 444.2 Common shareholders' equity 547.3

729.9 1,917.0 ----- ----- ------- Total liabilities and

shareholders' equity $2,936.6 $3,223.9 $4,411.4 ======== ========

======== Supplemental Information ------------------------

Debt-to-capitalization rate 57.2% 50.1% 27.6% Brunswick Corporation

Comparative Condensed Consolidated Statements of Cash Flows (in

millions) (unaudited) Three Months Ended ------------------ April

4, March 29, 2009 2008 ---- ---- Cash flows from operating

activities Net earnings (loss) $(184.2) $13.3 Depreciation and

amortization 41.6 44.3 Deferred income taxes 35.0 9.4 Changes in

non-cash current assets and current liabilities 79.4 (136.6)

Impairment charges 4.0 8.4 Income taxes 69.1 (1.2) Other, net 5.6

(11.7) --- ----- Net cash provided by (used for) operating

activities 50.5 (74.1) ---- ----- Cash flows from investing

activities Capital expenditures (7.2) (28.3) Investments (1.4)

(4.1) Proceeds from investment sale - 40.4 Proceeds from sale of

property, plant and equipment 0.9 1.7 Other, net (0.2) 0.2 ---- ---

Net cash provided by (used for) investing activities (7.9) 9.9 ----

--- Cash flows from financing activities Net issuances (repayments)

of short-term debt (0.7) 0.3 Payments of long-term debt including

current maturities (0.3) (0.2) ---- ---- Net cash provided by (used

for) financing activities (1.0) 0.1 ---- --- Net increase

(decrease) in cash and cash equivalents 41.6 (64.1) Cash and cash

equivalents at beginning of period 317.5 331.4 ----- ----- Cash and

cash equivalents at end of period $359.1 $267.3 ====== ====== Free

Cash Flow Net cash provided by (used for) operating activities

$50.5 $(74.1) Net cash provided by (used for): Capital expenditures

(7.2) (28.3) Proceeds from investment sale - 40.4 Proceeds from

sale of property, plant and equipment 0.9 1.7 Other, net (0.2) 0.2

---- --- Total free cash flow $44.0 $(60.1) ===== ====== Brunswick

Corporation Appendix Segment Restatement 2007 - 2008 (in millions)

(unaudited) First Quarter - Year to Date

---------------------------- Net Sales Operating Earnings

Restructuring --------- ------------------ ------------- 2007 2008

2007 2008 2007 2008 ---- ---- ---- ---- ---- ---- Marine Engine

$635.9 $628.6 $39.4 $33.6 $3.4 $1.5 Boat 623.9 565.6 14.8 (17.4)

4.2 13.8 Marine eliminations (124.4) (110.2) - - - - ------ ------

--- --- --- --- Total Marine 1,135.4 1,084.0 54.2 16.2 7.6 15.3

Fitness 145.0 149.2 8.1 8.1 - - Bowling & Billiards 105.8 113.6

8.3 0.9 - 5.6 Eliminations (0.1) - - - - - Corporate/Other - -

(17.6) (14.9) - 1.3 -------- -------- ----- ----- --- --- Total

$1,386.1 $1,346.8 $53.0 $10.3 $7.6 $22.2 ======== ======== =====

===== ==== ===== Brunswick Corporation Appendix Segment Restatement

2007 - 2008 (in millions) (unaudited) Second Quarter - Year to Date

----------------------------- Net Sales Operating Earnings

Restructuring --------- ------------------ ------------- 2007 2008

2007 2008 2007 2008 ---- ---- ---- ---- ---- ---- Marine Engine

$1,397.6 $1,352.2 $128.2 $92.5 $3.4 $19.1 Boat 1,251.0 1,157.3 25.6

(59.6) 5.2 51.4 Marine eliminations (237.5) (207.2) - - - - ------

------ --- --- --- --- Total Marine 2,411.1 2,302.3 153.8 32.9 8.6

70.5 Fitness 289.0 306.1 15.5 16.3 - 1.3 Bowling & Billiards

209.0 224.0 5.6 (18.9) - 25.4 Eliminations (0.1) (0.2) - - - -

Corporate/Other - - (35.6) (37.2) 0.1 8.1 -------- -------- -----

----- --- --- Total $2,909.0 $2,832.2 $139.3 $(6.9) $8.7 $105.3

======== ======== ====== ===== ==== ====== Second Quarter - Quarter

to Date -------------------------------- Net Sales Operating

Earnings Restructuring --------- ------------------ -------------

2007 2008 2007 2008 2007 2008 ---- ---- ---- ---- ---- ---- Marine

Engine $761.7 $723.6 $88.8 $58.9 $- $17.6 Boat 627.1 591.7 10.8

(42.2) 1.0 37.6 Marine eliminations (113.1) (97.0) - - - - ------

----- --- --- --- --- Total Marine 1,275.7 1,218.3 99.6 16.7 1.0

55.2 Fitness 144.0 156.9 7.4 8.2 - 1.3 Bowling & Billiards

103.2 110.4 (2.7) (19.8) - 19.8 Eliminations - (0.2) - - - -

Corporate/Other - - (18.0) (22.3) 0.1 6.8 --- --- ----- ----- ---

--- Total $1,522.9 $1,485.4 $86.3 $(17.2) $1.1 $83.1 ========

======== ===== ====== ==== ===== Brunswick Corporation Appendix

Segment Restatement 2007 - 2008 (in millions) (unaudited) Third

Quarter - Year to Date ---------------------------- Net Sales

Operating Earnings Restructuring --------- ------------------

------------- 2007 2008 2007 2008 2007 2008 ---- ---- ---- ----

---- ---- Marine Engine $2,040.2 $1,867.4 $177.4 $82.8 $4.8 $37.7

Boat 1,780.2 1,471.5 (66.4) (595.9) 74.9 543.0 Marine eliminations

(347.8) (270.6) - - - - ------ ------ --- --- --- --- Total Marine

3,472.6 3,068.3 111.0 (513.1) 79.7 580.7 Fitness 439.2 467.7 27.3

26.6 - 2.1 Bowling & Billiards 323.6 335.1 5.4 (29.3) - 40.8

Eliminations (0.2) (0.1) - - - - Corporate/Other - - (50.7) (57.4)

0.1 15.9 -------- -------- ----- ----- --- ---- Total $4,235.2

$3,871.0 $93.0 $(573.2) $79.8 $639.5 ======== ======== =====

======= ===== ====== Third Quarter - Quarter to Date

------------------------------- Net Sales Operating Earnings

Restructuring --------- ------------------ ------------- 2007 2008

2007 2008 2007 2008 ---- ---- ---- ---- ---- ---- Marine Engine

$642.6 $515.2 $49.2 $(9.7) $1.4 $18.6 Boat 529.2 314.2 (92.0)

(536.3) 69.7 491.6 Marine eliminations (110.3) (63.4) - - - -

------ ----- --- --- --- --- Total Marine 1,061.5 766.0 (42.8)

(546.0) 71.1 510.2 Fitness 150.2 161.6 11.8 10.3 - 0.8 Bowling

& Billiards 114.6 111.1 (0.2) (10.4) - 15.4 Eliminations (0.1)

0.1 - - - - Corporate/Other - - (15.1) (20.2) - 7.8 --- --- -----

----- --- --- Total $1,326.2 $1,038.8 $(46.3) $(566.3) $71.1 $534.2

======== ======== ====== ======= ===== ====== Brunswick Corporation

Appendix Segment Restatement 2007 - 2008 (in millions) (unaudited)

Fourth Quarter - Year to Date ----------------------------- Net

Sales Operating Earnings Restructuring --------- ------------------

------------- 2007 2008 2007 2008 2007 2008 ---- ---- ---- ----

---- ---- Marine Engine $2,639.5 $2,207.6 $195.8 $69.9 $4.8 $36.9

Boat 2,367.5 1,719.5 (93.5) (655.3) 80.9 582.4 Marine eliminations

(436.2) (306.0) - - - - ----- ----- --- --- --- --- Total Marine

4,570.8 3,621.1 102.3 (585.4) 85.7 619.3 Fitness 653.7 639.5 59.7

52.2 - 3.3 Bowling & Billiards 446.9 448.3 16.5 (12.7) 2.8 44.6

Eliminations (0.2) (0.2) - - - - Corporate/Other - - (71.3) (65.7)

0.1 21.2 --- --- ---- ---- --- ---- Total $5,671.2 $4,708.7 $107.2

$(611.6) $88.6 $688.4 ======= ======= ===== ===== ==== ===== Fourth

Quarter - Quarter to Date -------------------------------- Net

Sales Operating Earnings Restructuring --------- ------------------

------------- 2007 2008 2007 2008 2007 2008 ---- ---- ---- ----

---- ---- Marine Engine $599.3 $340.2 $18.4 $(12.9) $- $(0.8) Boat

587.3 248.0 (27.1) (59.4) 6.0 39.4 Marine eliminations (88.4)

(35.4) - - - - ---- ---- --- --- --- --- Total Marine 1,098.2 552.8

(8.7) (72.3) 6.0 38.6 Fitness 214.5 171.8 32.4 25.6 - 1.2 Bowling

& Billiards 123.3 113.2 11.1 16.6 2.8 3.8 Eliminations - (0.1)

- - - - Corporate/Other - - (20.6) (8.3) - 5.3 --- --- ---- --- ---

--- Total $1,436.0 $837.7 $14.2 $(38.4) $8.8 $48.9 ======= =====

==== ==== === ==== DATASOURCE: Brunswick Corporation CONTACT: Bruce

Byots, Vice President - Corporate and Investor Relations,

+1-847-735-4612, or Daniel Kubera, Director - Media Relations and

Corporate Communications, +1-847-735-4617, Web Site:

http://www.brunswick.com/

Copyright

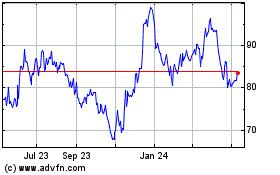

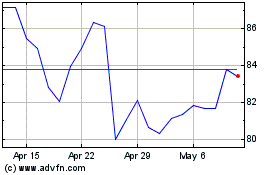

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brunswick (NYSE:BC)

Historical Stock Chart

From Jul 2023 to Jul 2024