2nd UPDATE: Aon To Take Commissions Once Banned Under Spitzer

July 21 2010 - 3:03PM

Dow Jones News

Insurance broker Aon Corp. (AON) said Wednesday it will accept,

with some self-imposed restrictions, a form of compensation that

for a while was banned after former New York Attorney General Eliot

Spitzer mounted a campaign against the payments in 2004.

Aon joins rival Marsh & McLennan Cos. (MMC) in deciding to

accept contingent commissions, after New York's insurance regulator

allowed the practice earlier this year. The two firms, along with

smaller rival Willis Group Holdings PLC, had been banned from

accepting them for about five years.

Insurance brokers match the companies that buy insurance with

the sellers of the coverage; since the contingents were banned, the

three brokers have been paid only by the buyers for that service.

Smaller brokers such as Brown & Brown Inc. (BRO) have continued

to take the commissions from insurers, raising questions about

whether the ban created an uneven playing field for brokers. The

size of the commissions can be linked to factors including how

profitable the policy is for the insurance company.

Spitzer had argued the contingent payments amounted to secret

kickbacks, and the three companies agreed to stop accepting them in

2005 in a settlement with the New York Attorney General's office

that applied worldwide. Under an agreement reached with New York

regulators in February, the three leading brokers agreed to

disclose the fees to their clients as a condition for lifting of

the ban.

Marsh & McLennan said in March its large and middle-market

operations in the U.S. and Canada wouldn't take the payments, but

it would accept contingent commissions elsewhere.

Aon wasn't as specific in a statement released Wednesday.

"We have decided to accept various forms of compensation

available, which may include supplemental and/or contingent

commissions in the geographies and client segments globally where

appropriate and legally permissible," said Steve McGill, chairman

and chief executive of Aon Risk Solutions.

Willis has said the payments raise the question of whether the

broker is acting in the best interest of its clients, and launched

a website (clientsbeforecontingents.com) to argue against the

practice and promote the fact that its retail brokerage doesn't

take contingents.

The company issued a scathing statement after Aon's announcement

Wednesday, saying its rival was "retreating to a troublesome and

ambiguous position."

Aon's announcement "should come as a wake-up call to all risk

managers and buyers of insurance to re-evaluate whether their

broker really works for them, or the insurance carrier," Willis

said.

A brokerage that Willis acquired in 2008, Hilb Rogal &

Hobbs, was allowed, under an agreement with regulators at the time,

to accept the payments for three years. Willis spokesman Will

Thoretz said HRH was one year ahead of schedule in converting

clients to a different fee structure that compensates for the lost

contingent revenue.

In 2004, contingent commissions accounted for 2.5% of Aon's

revenue, compared with 9.7% for Marsh & McLennan and 3.1% for

Willis, according to data compiled by Citigroup analyst Keith

Walsh. Contingent revenue at Brown & Brown peaked at 6.3% in

2007 and dropped back to 4.9% last year, while contingents at

Willis were 1.5% of total revenue last year because of HRH.

-By Erik Holm, Dow Jones Newswires; 212-416-2892;

erik.holm@dowjones.com

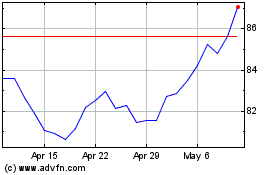

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2024 to Jun 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Jun 2023 to Jun 2024