UPDATE:New York:Broker Contingent Commissions Likely Early 2010

December 09 2009 - 2:56PM

Dow Jones News

The New York Insurance Department has taken a major step toward

lifting a ban on some insurer-paid commissions for the three

biggest insurance brokers, which could boost their earnings.

The insurance department's proposed Producer Compensation

Transparency regulation imposes transparency rules that require

insurance brokers to tell their customers whether they accept

payments from insurers and if the payments are based on

profitability or business volume, so-called contingent

commissions.

Several state attorneys general and other regulators have signed

agreements with the largest brokers--Aon Corp. (AON), Marsh &

McLennan Cos. (MMC) and Willis Group Holdings Ltd. (WSH)--that bans

them from taking contingent commissions, but the officials are

widely expected to reconsider lifting those bans once the new

compensation regulation goes into affect.

As a last step toward adopting the proposed regulation, which

spells out disclosure rules for brokers, the N.Y. insurance

regulator published the proposed language Dec. 2, which means it

will likely go into effect 45 days later, in January.

Matthew Gaul, special counsel at the insurance department, said

the office has gone through an extensive comment and revision

process for nearly 18 months, and that the required 45-day period

for public comment is likely the last step before the regulation is

adopted, perhaps with some minor changes.

"We plan to move quickly once we have the authority," he said

Wednesday. He said some broker groups are opposed to the regulation

on the grounds that it will be difficult to implement, but other

broker groups have come to accept it, though are requesting some

minor changes.

Connecticut Attorney General Richard Blumenthal said in a

September interview he was in discussions with the brokers to bring

back a "level playing field," on compensation rules.

Blumenthal did not immediately return a phone call asking about

the current state of discussions. A spokesman for the New York

Attorney General's office did not immediately return a phone call

asking for comment.

Terry Fleming, a board member of the Risk and Insurance

Management Society, which has criticized the commissions, said

recently he expects attorneys general in key states to consider

allowing the commissions for the biggest brokers once the

regulation is adopted.

Keith F. Walsh, an analyst with Citigroup, called the likely

change a "reversing of Spitzer's regulatory regime," referring to

former New York Attorney General Eliot Spitzer, whose investigation

into insurer-paid commissions led to the ban.

Walsh estimated in a note Wednesday that a return of the

commissions could boost earnings per share by as much as 10% for

Aon, Marsh and Willis.

Willis Group Chief Executive Joseph Plumeri has said the broker

will not accept contingent commissions. Plumeri has said the

commissions set up a conflict of interest for brokers, who serve as

advocates for policyholders, but stand to receive an insurer-paid

commission if the policy is more profitable.

Shares of Aon recently fell 2 cents to $37.86, Marsh was off 1

cent to $21.53 and Willis were down 8 cents to $26.72.

-By Lavonne Kuykendall, Dow Jones Newswires; 312-750-4141;

lavonne.kuykendall@dowjones.com

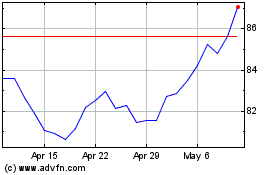

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2024 to May 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2023 to May 2024