false

0001494582

0001494582

2024-05-09

2024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 10, 2024 (May 9, 2024)

|

BOSTON OMAHA CORPORATION

|

|

(Exact name of registrant as specified in its Charter)

|

| |

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

| |

| |

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former name or address, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

Separation Agreement

On May 9, 2024, Boston Omaha Corporation (the “Company”), Alex B. Rozek, and certain other parties set forth therein, entered into a Separation and Stock Repurchase Agreement (the “Separation Agreement”) in connection with Mr. Rozek’s separation. The Company entered into the Separation Agreement at the direction and instruction of the Audit and Risk Committee of the Board of Directors of the Company, who oversaw the negotiations and approval of this matter pursuant to the governing documents of the Company.

Securities Repurchase

Pursuant to Section 2 of the Separation Agreement, the Company agreed to repurchase from Mr. Rozek and Boulderado Partners, LLC, an entity controlled by Mr. Rozek (“Boulderado,” together with Mr. Rozek, the “Selling Parties”), in the aggregate, 210,000 shares of Company Class A common stock, par value $0.001 per share, 527,780 shares of Company Class B common stock, par value $0.001 per share (“Class B common stock”) and 51,994 warrants to acquire 51,994 shares of Company Class B common stock. The aggregate purchase price payable to Mr. Rozek is $9,175,600, comprising (a) a cash payment of $8,800,480 and (b) 36,705 shares of Class A common stock, par value $0.0001 of Sky Harbour Group Corporation (“Sky Harbour” and such shares, the “SKYH Shares”). The aggregate purchase price payable to Boulderado is $9,951,113.62, comprising (a) a cash payment of $7,960,890.90 and (b) 194,738 SKYH Shares. The Company is obligated to pay such consideration to the Selling Parties within three business days after the Release Effective Date.

In connection with such repurchase, the Selling Parties provided the Company with customary representations and warranties with respect to the sale of the securities it held, as well as agreed to joint and several indemnification obligations to the Company with respect to such representations and warranties and the statements set forth in the instruments transferring such securities to the Company.

BOAM Matters

Pursuant to Section 2(e) of the Separation Agreement, effective as of May 9, 2024, among other things, Mr. Rozek (i) resigned as a manager of Boston Omaha Asset Management, LLC (“BOAM”), a subsidiary of the Company, and (ii) forfeited all of his Class C Units (as defined in the Amended and Restated Limited Liability Company Agreement of BOAM, dated January 6, 2023) to BOAM for no consideration.

Other Separation Provisions

The information set forth in Item 5.02 of this Current Report on Form 8-K is incorporated herein by reference.

The description of the Separation Agreement in this Item 1.01 and in Item 5.02 below of this Current Report on Form 8-K is not complete and is qualified in its entirety by reference to the complete text of the Separation Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

A&R Voting and Right of First Purchase Agreement

In connection with the entry into the Separation Agreement, Boulderado entered into an amendment (the “First Amendment”) with the Company and Magnolia Capital Fund, L.P. (“Magnolia”), to the Amended and Restated Voting and First Refusal Agreement, dated May 16, 2017, by and among the Company, Boulderado and Magnolia (the “Voting Agreement”). Pursuant to the First Amendment, the parties thereto agreed to remove Boulderado as a party to the Voting Agreement, with such rights and obligations terminated effective upon the consummation of the repurchases contemplated by the Separation Agreement.

The foregoing description of the First Amendment is not complete and is qualified in its entirety by reference to the complete text of First Amendment, a copy of which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS.

|

On May 9, 2024, the Board appointed Adam K. Peterson as the sole Chairman and sole Chief Executive Officer of the Company, succeeding Mr. Rozek, whose positions as Co-Chief Executive Officer and as Co-Chairperson and a member of the Board of Directors (the “Board”) of the Company ended effective May 9, 2024. Mr. Peterson has served as the Co-Chairperson and Co-Chief Executive Officer of the Company since February 2015, and has served as President since December 2017.

Mr. Rozek’s departure is not the result of a disagreement with the Company on any matter related to the Company’s operations, policies or practices.

In connection with Mr. Rozek’s departure, effective May 9, 2024, the Company and Mr. Rozek entered into the Separation Agreement as defined in Item 1.01 of this Current Report on Form 8-K.

Pursuant to the Separation Agreement, Mr. Rozek will receive the following separation payments and benefits: (a) 200,000 SKYH Shares as consideration for his efforts in connection with the successful launch of Sky Harbour, (b) severance of $960,000, payable in equal monthly installments over 18 months, (c) payment of $75,000 in lieu of employee benefits, payable in equal monthly installments over 18 months, and (d) a lump sum payment of $250,000 as consideration for certain non-competition covenants. As a result of Mr. Rozek’s departure, he is no longer eligible to participate in the Company’s management incentive bonus plan and such amounts have not otherwise been reallocated to officers of the Company.

In addition, the Company agreed, subject to certain conditions, to nominate and vote to appoint Mr. Rozek as the Company’s representative on the board of directors of Sky Harbour until December 31, 2026.

As a condition to the foregoing benefits and the Company’s obligations under the Separation Agreement, Mr. Rozek entered into a mutual general release of claims (the “General Release”) with the Company. The foregoing benefits will only be provided if Mr. Rozek signs and does not revoke the General Release.

On May 10, 2024, the Company issued a press release announcing the management and other changes described in Item 5.02 of this Form 8-K. A copy of the release is attached as Exhibit 99.1 to this Form 8-K and is incorporated by reference herein.

The information in this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

EXHIBIT INDEX

|

Exhibit Number

|

Exhibit Title

|

| |

|

|

10.1

|

|

|

10.2

|

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BOSTON OMAHA CORPORATION

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Joshua P. Weisenburger

|

|

| |

|

Joshua P. Weisenburger,

|

|

| |

|

Chief Financial Officer

|

|

Date: May 10, 2024

Exhibit 10.1

SEPARATION AND STOCK REPURCHASE AGREEMENT

THIS SEPARATION AND STOCK REPURCHASE AGREEMENT (this “Agreement” or “Separation Agreement”) is entered into as of May 9, 2024 by and between Boston Omaha Corporation, a Delaware corporation (the “Company”), Alex B. Rozek (“Executive”), solely for purposes of Section 2 and Section 10, Boulderado Partners, LLC, a Delaware limited liability company (“Boulderado”), solely for purposes of Section 6(c), the listed signatories hereto, and solely for purposes of Section 2(e), the listed signatories hereto.

WHEREAS, Executive currently serves as Co-Chairman of the Board and Co-Chief Executive Officer of the Company;

WHEREAS, Executive and the Company are parties to an Employment Agreement dated as of August 1, 2015, as amended on June 5, 2017 and February 27, 2018 (the “Employment Agreement”);

WHEREAS, Executive and Company agree that the terms of this Agreement have been the subject of negotiations and have reached material finalization only with the execution of this Agreement;

WHEREAS, Executive and the Company (each, a “Party” and together, the “Parties”) desire to set forth the terms of Executive’s separation from the Company; and

WHEREAS, Executive and Boulderado collectively hold 527,780 shares of Class B Common Stock, par value $0.0001 (“Class B Common Stock”) of the Company, which contain certain negative control rights, supermajority voting rights, and board designation rights, and each of Executive and Boulderado desire to sell and the Company desires to purchase such shares in connection with the Executive’s separation from the Company.

NOW, THEREFORE, in consideration of the premises, and the promises and agreements set forth below, the Parties, intending to be legally bound, agree as follows:

1. Separation Date.

(a) Except as provided herein, Executive departs from the Company and all of its direct and indirect subsidiaries and other related entities (other than Sky Harbour, as defined below, with which Executive may serve as described in Section 1(d) of this Agreement), effective as of the date Executive executes and returns this Agreement to the Company (the “Separation Date”).

(b) On or after the Separation Date, the Company shall issue a press release announcing Executive’s departure from the Company. The tone of the press release shall be complimentary of Executive and to each of the Company and its officers and directors. At least 48 hours in advance of Company’s issuance of such press release, the Company shall provide a draft press release to Executive for Executive’s approval. Executive shall act reasonably and in good faith in connection with approving such press release for issuance and will withhold approval (or request modification to the press release) only for legitimate business reasons.

(c) Executive shall not be deemed to have been terminated without “Cause” or to have resigned for “Good Reason” for purposes of the Employment Agreement or any plan or agreement covering Executive.

(d) Absent a reason to remove Executive for “cause” pursuant to Section 3(g)(i) of the Sky Harbour Group Corporation (“Sky Harbour”) Stockholders’ Agreement dated January 25, 2022 (the “Sky Harbour Stockholders’ Agreement”) and absent a request from Sky Harbour for the Executive to no longer serve as the Sponsor Designee (defined below) to the board of directors of Sky Harbour, the Company shall, until December 31, 2026), (i) continue to nominate Executive to the board of directors of Sky Harbour as its “Sponsor Designee” (as defined in the Sky Harbour Stockholders’ Agreement) and (ii) vote its securities it holds in Sky Harbor to appoint the Executive as a member of the board of directors of Sky Harbour, in each case, pursuant to Section 3(e) of the Sky Harbour Stockholders’ Agreement; provided that the Company shall have no obligation to nominate or vote for the Executive as its Sponsor Designee at the 2026 annual shareholders’ meeting of Sky Harbour (the “2026 Meeting”) in the event that Sponsor Fall-Away Date (as defined in the Sky Harbour Stockholders’ Agreement) occurs prior to the 2026 Meeting. If Executive ceases to serve as the Company’s Sponsor Designee to the board of directors of Sky Harbour for any reason other than removal for cause or the Executive’s voluntary resignation, then Company shall pay Executive (at the time of such termination) $100,000 for each year until the 2026 Meeting that Executive does not so serve (pro rated as appropriate for any partial year).

2. Repurchase of Securities; BOAM Matters.

(a) Executive Repurchase. Executive has agreed to sell, and Company has agreed to purchase all of the shares of Class B Common Stock held by Executive upon the terms and conditions set forth on Exhibit A attached hereto.

(b) Boulderado Repurchase. Boulderado, an investment entity controlled by Executive, has agreed to sell, and Company has agreed to purchase (i) all of the shares of Class B Common Stock, (ii) all of the shares of Class A common stock, par value $0.001 per share (“Class A Common Stock”, together with the Class B Common Stock, “Common Stock”) of the Company and (iii) all of the warrants to purchase Class B Common Stock (“Class B Warrants”) of the Company, in each case, held by Boulderado upon the terms and conditions set forth on Exhibit B attached hereto.

(c) Form of Consideration. The purchase price to be paid pursuant to this Section 2 and Exhibits A and B shall be paid partially in cash and partially in shares of Class A Common Stock, par value $0.0001 of Sky Harbour (“SKYH Shares”) on the terms and conditions set out in Exhibits A and B attached hereto. It is understood and agreed that the ratio of cash to SKYH Shares shall be 80% cash and 20% SKYH Shares in each instance.

(d) Securities Powers/Effect of Sale. In connection with the repurchase of securities pursuant to Exhibits A and B, each of Executive and Boulderado, as applicable, shall deliver to Company on the date of execution of this Agreement a duly executed (i) irrevocable interest power evidencing the sale, transfer and assignment of each of the Class A Common Stock, Class B Common Stock and Class B Warrants in the form attached hereto as Exhibit C (the “Securities Power”, and collectively, the securities set forth thereunder, the “Securities”), (ii) amendment, in the form attached hereto as Exhibit D, to the Amended and Restated Voting and First Refusal Agreement (the “A&R Agreement”), dated May 26, 2017, by and among the Company, Boulderado and Magnolia Capital Fund, LP (“Magnolia”), and (iii) waiver agreement pursuant to the A&R Agreement, in the form attached hereto as Exhibit E, of that certain right of first refusal of Magnolia with respect to the sale of Class B Common Stock pursuant to this Section 2. Following the delivery of the duly executed documents contemplated by the immediately preceding sentence, (x) Executive and Boulderado shall have no further rights with respect to such Securities and (y) such Securities shall be automatically and immediately cancelled and retired by the Company.

(e) Representations and Warranties of Executive; Indemnification. Each of the Executive and Boulderado hereby makes the representations and warranties set forth on Exhibit F to the Company. The Executive and Boulderado shall, joint and severally, save, defend, indemnify and hold harmless Company and its affiliates (other than Executive and Boulderado) and the respective managers, officers, directors, representatives, successors and assigns of each of the foregoing from and against any and all losses, damages, liabilities, deficiencies, claims, diminution of value, interest, awards, judgments, penalties, costs and expenses (including attorneys’ fees, costs and other out-of-pocket expenses incurred in investigating, preparing or defending the foregoing), asserted against, incurred, sustained or suffered by any of the foregoing as a result of, arising out of or relating to any breach of any representation or warranty set forth on Exhibit F or the Securities Powers.

(f) Further Assurances. Each party hereto, as its sole cost and expense and without expense to the other party, shall from time to time do such further acts and execute and deliver such further documents regarding its obligations hereunder as may be required solely for the purpose of (a) accomplishing the purposes of this Agreement or (b) assuring and confirming unto the other party the validity of any documents of conveyance to be delivered in connection herewith.

(g) BOAM Resignation, Forfeiture and Withdrawal. Effective as of the date hereof, each of Executive, Brendan Keating, and Adam Peterson (the “Class C Holders”), (i) hereby resigns as a manager of Boston Omaha Asset Management, LLC (“BOAM”), (ii) forfeits all of his Class C Units (as defined in the BOAM LLCA) to BOAM for no consideration, and (iii) has delivered to BOAM a duly executed Form of Release (as defined in the BOAM LLCA) pursuant to Section 10.01(a) of the Amended and Restated Limited Liability Company Agreement of BOAM, dated January 6, 2023 (the “BOAM LLCA”). For the avoidance of doubt, this Agreement shall constitute a written resignation by each of the Class C Holders as a Manager (as defined in the BOAM LLC) pursuant to Section 3.03 of the BOAM LLCA.

3. Additional Sky Harbour Terms.

(a) The Company shall also provide Executive with a bonus for Executive’s efforts in connection with the successful launch of Sky Harbour, payable in the form of 200,000 SKYH Shares held indirectly by the Company, to be transferred within three (3) business days after the Release of Claims becomes irrevocable.

(b) For the avoidance of doubt, Executive shall retain the director cash compensation and equity grants previously received by Executive as a director of Sky Harbour and any future cash compensation and equity compensation grants received by the Executive as the Company’s Sponsor Designee on the board of directors of Sky Harbour for the time frame set forth in Section 1(d) of this Agreement.

4. Severance Pay. The Company shall provide Executive severance of $960,000, payable in equal monthly installments over 18 months in accordance with the Company’s standard payroll procedures, and commencing on the first payroll date after the Release Effective Date (as defined in Section 14 of the Release of Claims).

5. Employee Benefits. The Company shall pay Executive an additional $75,000, payable in equal monthly installments over 18 months, commencing on the first payroll date after the Release Effective Date (as defined in Section 14 of the Release of Claims). Such payments are intended to cover COBRA healthcare continuation coverage premiums and the value of other employee benefits (but, for the avoidance of doubt, whether Executive elects COBRA is in Executive’s discretion, and employee benefit coverage in connection with Executive’s termination of employment shall cease in accordance with applicable plan terms).

6. Post-Employment Covenants. Executive acknowledges and agrees that Executive will be bound by the following post-employment covenants and agreements (collectively, the “Covenants”). In entering into this Agreement, Executive acknowledges the effectiveness and enforceability of the Covenants, and Executive expressly affirms Executive’s commitment to abide by, and agrees that he will abide by, the terms of the Covenants as set forth below.

(a) Non-Solicitation. For a period of 18 months after the Separation Date, Executive shall not, directly or indirectly: (i) solicit any employee of the Company who was an employee as of the Separation Date (other than Cathy Vaughan, Eleanor Vaughan and Sydney Atkins (other than as a result of a general solicitation for employment); (ii) solicit, induce, encourage or attempt to influence any customer, service provider or supplier of the Company as of the Separation Date to cease to do business or terminate their relationship with the Company; or (iii) assist any other person or entity in doing or performing any of the acts that Executive is prohibited from doing under (i) or (ii) above.

(b) Non-Competition. For a period of 18 months after the Separation Date, Executive shall not, directly or indirectly, engage in any activities on behalf of, or be financially interested in, a Competitive Business (as an agent, consultant, officer, director, manager, employee, independent contractor, officer, owner, partner, stockholder, member, principal, service provider or otherwise). A “Competitive Business” means a business other than Mac Mountain, Boulderado, and KPR Series Investments (whether such business is conducted by an individual or entity, including Executive in self-employment) that is engaged in competition, directly or indirectly through any entity controlling, controlled by or under common control with such business, with any of the business activities (A) carried on by the Company or (B) being planned by the Company with Executive’s participation on the date hereof which are related to the Company’s billboard and the surety insurance lines of business, current operations in the broadband market, or with those entities in which the Company has a signed agreement or a letter of intent with respect to broadband (other than performance bonding for broadband projects). For the avoidance of doubt, notwithstanding anything in this Section 6(b), Mac Mountain and its affiliates shall be permitted to engage in any business in the broadband market and such operations shall not constitute a breach of this Section 6(b). This restriction shall apply in any geographic area in the United States in which the Company carries out business activities. Executive agrees that not specifying a more limited geographic area is reasonable in light of the broad geographic scope of the activities carried out by the Company in the United States. Nothing herein shall prevent Executive from owning for investment up to two percent (2%) of any class of equity security of an entity whose securities are traded on a national securities exchange or market or two percent (2%) of any private investment vehicle in which his only position is that of a limited partner. The Company will pay Executive a lump sum payment of $250,000 reflecting an additional bonus in consideration for Executive’s agreement with the terms of this Section 6(b), to be paid within three (3) business days after the Release Effective Date (as defined in Section 14 of the Release of Claims).

(c) Non-Disparagement. Executive agrees not to disparage the Company or Company’s executive officers or members of the Board. The Company’s current Chief Financial Officer, Co-Chief Executive Officer and current individual members of the Board agrees not to disparage Executive. The foregoing will not restrict or impede any person from exercising protected legal rights to the extent that such rights cannot be waived by agreement, from providing truthful statements in response to any governmental agency, rulemaking authority, subpoena power, legal process, required governmental testimony or filings, or from making statements in any judicial, administrative or arbitral proceeding (including, without limitation, depositions in connection with such proceedings) or from providing truthful information to any governmental agency. Nothing in this Agreement, including this Section 6(c), is intended to restrict or impede Executive from exercising protected rights to the extent such rights cannot be waived by Agreement, including the right to report possible securities law violations to any Governmental Authority, without notice to the Company, and rights under the National Labor Relations Act.

7. General Release of Claims. As a condition of the Company’s obligations under this Agreement, the Company and Executive have executed the General Release of All Claims and Potential Claims attached as Exhibit G (the “Release of Claims”). In order to receive any payments described in this Agreement to be made on or after the date hereof, Executive must not have revoked such execution within seven (7) days from the date of such execution. For the avoidance of doubt, the Company shall have no obligations under this Agreement unless the Executive executes and does not revoke this Agreement.

8. Cooperation. Executive shall cooperate with the Company and its counsel in connection with any ongoing or future investigations, inquiries, or legal, regulatory, or administrative proceedings which relate to or arise out of (i) Executive’s provision of services on behalf of the Company, (ii) any other matter that is or was within Executive’s knowledge or former responsibility, or (iii) actual or threatened litigation arising directly or indirectly from the transactions contemplated by this Agreement. Company shall cooperate with Executive and his counsel in connection with any ongoing or future litigation, investigations, inquiries, or legal, regulatory, or administrative proceedings which relate to or arise out of (i) Executive’s provision of services on behalf of the Company, (ii) Executive’s (or Boulderado’s) ownership of the Securities, or (iii) actual or threatened litigation arising directly or indirectly from the execution of this Agreement.

9. Return of Property. Executive is required to deliver to Company all security or access cards to the Company’s properties and Company credit cards and any other property in the possession or control of Executive which is owned by Company and specifically identified and requested by Company as of the date of execution of this Agreement. Company is responsible for all shipping costs and arranging for items outlined in this provision to be transported from Executive’s address.

10. Company Representations and Warranties; Indemnification. The Company hereby makes the representations and warranties set forth in this Section 10 to the Executive and Boulderado. The Company shall save, defend, indemnify and hold harmless Executive and Boulderado and the respective managers, officers, directors, representatives, successors and assigns of each of the foregoing (the “Seller Parties”) from and against any and all losses, damages, liabilities, deficiencies, claims, diminution of value, interest, awards, judgments, penalties, costs and expenses (including attorneys’ fees, costs and other out-of-pocket expenses incurred in investigating, preparing or defending the foregoing), asserted against, incurred, sustained or suffered by any of the foregoing as a result of, arising out of or relating to any breach of any representation or warranty set forth in this Section 10 (collectively, “Seller Losses”); provided that the Company shall have no obligation to indemnify the Seller Parties for any Seller Losses arising from or related to any payment made by the Company pursuant to Section 2. The Company hereby represents and warrants to the Executive (and the Direct Holders):

(a) Organization and Qualification. It is duly organized, validly existing and in good standing under the laws of its jurisdiction for formation or incorporation, as applicable.

(b) Authority. The Company has full power, capacity and authority to execute, deliver and perform its obligations under this Agreement. The execution, delivery and performance by the Company of this Agreement, and the consummation of the transactions contemplated hereby, have been duly and validly authorized by all necessary action on the part of the Company, including, but not limited to, the written consent and approval of the necessary holders of Class B Common Stock. This Agreement has been duly executed and delivered by the Company and is legal, valid, binding and enforceable upon and against the Company.

(c) No Conflict; Required Filings and Consents. The execution, delivery and performance by the Company of this Agreement and the consummation by the Company of the transactions contemplated hereby do not and will not (i) violate any provision of the governing documents of the Company; (ii) violate any federal, state or local statute, law, regulation, order, injunction or decree (“Law”) applicable to the Company; (iii) conflict with, result in a violation or breach of, or constitute a default under (or an event which would with or without notice or the lapse of time or both become a default), or give any third party the right to terminate, cancel or accelerate any obligation under any of the terms, conditions or provisions of, any material agreement or contract to which Company is a party or by which Company or its assets are bound; or (iv) require any consent or approval of, registration or filing (other than as a result of securities Laws) with, or notice to any federal, state or local governmental authority or any agency or instrumentality thereof (a “Governmental Authority”).

(d) SKYH Shares. The Company is the record and beneficial owner of the SKYH Shares. The SKYH Shares are free and clear of any charge, limitation, condition, mortgage, lien, security interest, adverse claim, encumbrance or restriction of any kind (collectively, “SKYH Encumbrances”), other than such SKYH Encumbrances set forth on any legend to the SKYH Shares held by the Company (as managed by Sky Harbour’s transfer agent) or SKYH Encumbrances arising as a result of any applicable securities Laws (collectively, “Permitted SKYH Encumbrances”). The Company has the right, authority and power to sell, convey, assign, transfer and deliver the SKYH Shares to the Executive and Boulderado. Upon delivery of the SKYH Shares, the Executive, or Boulderado as applicable, shall acquire good, valid and marketable title to the SKYH Shares, free and clear of any SKYH Encumbrance (other than Permitted SKYH Encumbrances).

(e) Compliance; Litigation. The Company has complied with its governing documents with respect to the ownership of the SKYH Shares. There is no claim, action, suit, proceeding, inquiry, investigation or arbitration by or before any governmental, regulatory, administrative, judicial or arbitral body (an “Action”) pending or threatened (a) affecting the Company (or its officers or directors in regards to their actions as such) with respect to the SKYH Shares or (b) to restrain or prevent the consummation of the transactions contemplated hereby, nor is there any basis for any of the foregoing.

(f) Disclosure. None of the representations or warranties of the Company contained herein contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements herein not misleading.

11. Indemnification. For the avoidance of doubt, Company shall comply with its obligations to indemnify, defend and hold harmless Executive pursuant to any and all existing rights to indemnification for actions, omissions and other circumstances occurring as a result of Executive’s role as a director and/or officer of the Company, its subsidiaries, or any predecessor thereto, whether those rights arise from the Employment Agreement, a separate indemnification agreement, statute, or the governing documents of the Company or its subsidiaries, or pursuant to any insurance policy or coverage provided or maintained by the Company or its subsidiaries on behalf of Executive. For the avoidance of doubt there shall be no obligation of the Company or any of its subsidiaries to indemnify Executive for any matter in which the Company seeks indemnification pursuant to Section 2(c).

12. Withholdings. Amounts payable hereunder are subject to all tax and other legally-required withholdings as determined by the Company in its discretion.

13. No Assignment. No right to receive payments and benefits under this Agreement shall be subject to set off, offset, anticipation, commutation, alienation, assignment, encumbrance, charge, pledge or hypothecation or to execution, attachment, levy, or similar process or assignment by operation of law, except as provided in this Agreement.

14. Entire Agreement. This Agreement, its Exhibits and the portions of the Employment Agreement (including the Agreement Regarding Assignment of Inventions, Confidentiality and Non-Solicitation by and between Executive and the Company (“the Employee NDA”) are incorporated herein represent the entire understanding and agreement between the Parties as to the subject matter hereof and supersede all prior agreements, arrangements and understandings between them concerning the subject matter hereof, and any subsequent written agreements shall be construed to change, amend, alter, repeal or invalidate this Agreement, only to the extent that this Agreement is specifically identified in and made subject to such other written agreements and is executed by both parties hereto.

15. Governing Law. This Agreement shall be governed by, construed and enforced in accordance with the internal laws of the State of Delaware without giving effect to the conflict of laws principles thereof.

16. Clawback Policy. For the avoidance of doubt, the Company’s Policy for the Recovery of Erroneously Awarded Compensation, as approved on November 10, 2023 (the “Clawback Policy”) continues to apply to any of Executive’s “Clawback Eligible Incentive Compensation” as defined in the Clawback Policy; provided, however, the payments made to Executive pursuant to this Agreement are not subject to the Clawback Policy. Notwithstanding the foregoing, Executive acknowledges that he is aware of the Clawback Policy, consents to it, and has returned to the Company a signed copy of the Attestation and Acknowledgement of Clawback Policy.

17. Resolution of Disputes. In the event of any dispute, controversy or claim arising out of or relating to this Agreement, any and all proceedings arising out of this Agreement shall be subject to resolution before a panel of three arbitrators of the American Arbitration Association, with all hearings to be held in Boston, Massachusetts; provided, however, that the Company retains the right and ability to pursue injunctive relief in court in the event of a breach or threatened breach of Section 6 of this Agreement.

18. Other Provisions. Sections 4.01, 4.09 and 4.11 of the Employment Agreement are incorporated into this Agreement, mutatis mutandis. The Company has no further obligation to reimburse Executive for any outstanding expenses under Section 2.02 of the Employment Agreement or any other Company plan or otherwise.

19. Amendment and Waiver. The provisions of this Agreement may be amended or terminated only with the prior written consent of the Company (as approved by the Board) and Executive and as memorialized in a writing specifically referencing the provisions being so amended or terminated. Any waiver of any provision of this Agreement shall be effective only if in writing, specifically referencing the provision being waived and signed by the person against whom enforcement of the waiver is being sought (which in the case of the Company shall require approval of the Board), and no course of conduct or course of dealing or failure or delay by any party hereto in enforcing or exercising any of the provisions of this Agreement shall affect the validity, binding effect or enforceability of this Agreement or be deemed to be an implied waiver of any provision of this Agreement.

20. No Strict Construction. The language used in this Agreement shall be deemed to be the language chosen by the Parties hereto to express their mutual intent, and no rule of strict construction shall be applied against any Party.

21. Interpretation. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision or any other jurisdiction, but this Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein.

22. Notices. Any notice, request or other communication given in connection with this Agreement shall be in writing and shall be deemed to have been given (i) when personally delivered to the recipient (provided written acknowledgement of receipt is obtained), (ii) two days after being sent by reputable overnight courier service or (iii) three days after being mailed by first class mail, return receipt requested, to the recipient at the address below indicated:

|

Notices to Executive or Boulderado:

Alex Rozek

c/o Scott Stokes, Esq.

Rich May, P.C.

176 Federal Street, 6th Floor

Boston, MA 02110

|

With a copy (which shall not constitute notice) to:

[___]

Notices to the Company:

Boston Omaha Corporation

1601 Dodge Street, Suite 3300

Omaha, NE 68102

Attn: Board of Directors

With a copy (which shall not constitute notice) to:

Greta B. Williams, Esq.

Gibson Dunn & Crutcher

1050 Connecticut Avenue, NW

Washington, D.C. 20036

or such other address or to the attention of such other person as the recipient party shall have specified by prior written notice to the sending party in accordance with this paragraph.

IN WITNESS WHEREOF, the Parties hereto have executed this Separation and Stock Repurchase Agreement as of the date first written above.

BOSTON OMAHA CORPORATION

By: /s/ Adam Peterson

Name: Adam Peterson

Title: Co-Chief Executive Officer

EXECUTIVE

/s/ Alex B. Rozek

Alex B. Rozek

[SIGNATURE PAGE TO SEPARATION AND STOCK REPURCHASE AGREEMENT]

With respect to Sections 2 and 10:

BOULDERADO PARTNERS, LLC

By its Managing Member

Boulderado Group, LLC, Manager

By: /s/ Alex B. Rozek

Name: Alex B. Rozek

Title: Manager

[SIGNATURE PAGE TO SEPARATION AND STOCK REPURCHASE AGREEMENT]

With respect to Section 2(e):

/s/ Adam Peterson

Adam Peterson

/s/ Brendan J. Keating

Brendan J. Keating

/s/ Alex B. Rozek

Alex B. Rozek

[SIGNATURE PAGE TO SEPARATION AND STOCK REPURCHASE AGREEMENT]

With respect to Section 6(c):

/s/ Adam Peterson

Adam Peterson

/s/ Joshua P. Weisenburger

Joshua P. Weisenburger

/s/ Brendan J. Keating

Brendan J. Keating

/s/ Bradford B. Briner

Bradford B. Briner

/s/ Frank H. Kenan II

Frank H. Kenan II

/s/ Vishnu Srinivasan

Vishnu Srinivasan

/s/ Jeffrey C. Royal

Jeffrey C. Royal

[SIGNATURE PAGE TO SEPARATION AND STOCK REPURCHASE AGREEMENT]

Exhibit A

Repurchase of Class B Common Stock from Executive

| |

1.

|

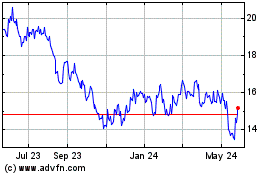

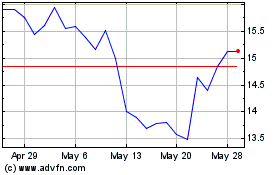

Number of Shares of Class B Common Stock/Purchase Price. Executive owns 120,000 shares of Class B Common Stock (the “Executive Shares”) As of the date hereof, Executive shall sell, transfer, and assign (or cause to be sold, transferred and assigned) all right, title and interest in the Executive Shares to the Company, and shall deliver (or cause to be delivered) to the Company an executed Securities Power. In consideration thereof, the Company shall pay to Executive an aggregate amount equal to $9,175,600 (the “Executive Shares Purchase Price”), representing (i) the number of Executive Shares multiplied by the 30-trading day volume-weighted average price of the Class A Common Stock for the 30 trading days ending two trading days prior to the execution of this Agreement plus (ii) a blocking/control premium of $7,300,000, which was determined using a valuation provided by The Brattle Group, a firm specializing in valuations of equity instruments.

|

| |

2.

|

Payment Terms. The Executive Shares Purchase Price shall be paid by the Company to Executive by: (A) a transfer of 36,705 SKYH Shares indirectly held by the Company (equal to $375,125.10 based on the 30-trading day volume-weighted average price of a SKYH Share for the 30 trading days ending two trading days prior to the execution of this Agreement) and (B) $8,800,480 in cash, in each case, to be transferred or paid (as applicable) within three (3) business days after the Release Effective Date (as defined in Section 14 of the Release of Claims).

|

| |

3.

|

Wire Instructions. The payment of cash and SKYH Share amounts to be paid pursuant to this Exhibit A shall be made by the Company in immediately available funds by wire transfer to the account set forth below.

|

|

Account Name

|

Wire Instructions

|

Wire/Share Amount

|

|

Alexander B. Rozek

|

[___]

|

$8,800,480.00

36,705 SKYH Shares

|

Exhibit B

Repurchase of Class A Common Stock, Class B Common Stock and Class B Warrants from Boulderado

| |

1.

|

Number of Shares of Class A Common Stock, Class B Common Stock and Class B Warrants/Purchase Price. Boulderado owns 210,000 shares of Class A Common Stock, 407,780 shares of Class B Common Stock and 51,994 Class B Warrants (the “Boulderado Shares”). As of the date hereof, Boulderado shall sell, transfer, and assign (or cause to be sold, transferred and assigned) all right, title and interest in the Boulderado Shares to the Company, and shall deliver (or cause to be delivered) to the Company an executed Securities Power. In consideration of the sale of the Class A Common Stock and Class B Common Stock, the Company shall pay to Boulderado an aggregate amount equal to $9,655,901.40, representing the number of shares of Class A Common Stock and Class B Common Stock owned by Boulderado multiplied by the 30-trading day volume-weighted average price of the Class A Common Stock for the 30 trading days ending two trading days prior to the execution of this Agreement (the “Boulderado Stock Price”). In consideration of the sale of the Class B Warrants, the Company shall pay to Boulderado an aggregate amount equal to $295,212.22, representing the number of shares of Class B Common Stock underlying the Class B Warrants multiplied by the 30-trading day volume-weighted average price of the Class A Common Stock for the 30 trading days ending two trading days prior to the execution of this Agreement, less the aggregate exercise price of such Class B Warrants (the “Boulderado Warrant Price”, and, together with the “Boulderado Stock Price”, the “Boulderado Securities Purchase Price”).

|

| |

2.

|

Payment Terms. The Boulderado Securities Purchase Price shall be paid by the Company to Boulderado by: (A) a transfer of 194,738 SKYH Shares indirectly held by the Company (equal to $1,990,222.36 based on the 30-trading day volume-weighted average price of a SKYH Share for the 30 trading days ending two trading days prior to the execution of this Agreement) and (B) $7,960,890.90 in cash, in each case, to be transferred or paid within three (3) business days after the Release Effective Date (as defined in Section 14 of the Release of Claims).

|

| |

3.

|

Wire Instructions. The payment of cash and SKYH Share amounts to be paid pursuant to this Exhibit B shall be made by the Company in immediately available funds by wire transfer to the account set forth below.

|

|

Account Name

|

Wire Instructions

|

Wire/Share Amount

|

|

Boulderado BOC SSL Margin

|

[___]

|

$2,563,320

|

|

Boulderado BOC

|

[___]

|

$62,520

|

|

Boulderado Partners

|

[___]

|

194,738 SKYH Shares

$5,335,050.90

|

Exhibit C

Form of Securities Power

IRREVOCABLE INTEREST POWER

May 9, 2024

FOR VALUE RECEIVED, and pursuant to that certain Separation Agreement, dated as of May 9, 2024 (“Separation Agreement”), by and Boston Omaha Corporation, a Delaware corporation (the “Company”), Alex B. Rozek, solely for purposes of Section 2 and Section 10 of the Separation Agreement, Boulderado Partners, LLC and certain other parties thereto, the undersigned hereby sells, assigns, transfers, conveys and delivers to the Company [●] [[shares of Class [A]/[B] Common Stock, par value $0.001 of the Company] / [warrants to acquire shares of Class B Common Stock, par value $0.001 of the Company] (the “Purchased Interests”), free and clear of all Encumbrances (as defined in Exhibit F to the Separation Agreement) other than Permitted Encumbrances (as defined in Exhibit F to the Separation Agreement), and does hereby irrevocably constitute and appoint any officer of the Company as attorney-in-fact to transfer the applicable Purchased Interests on the books of the Company, with full power of substitution in the premises. Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Separation Agreement.

This Irrevocable Interest Power may be executed in one or more counterparts, all of which shall be considered one and the same instrument. This Irrevocable Interest Power may be executed electronically (including by means of .pdf or similar graphic reproduction format or by means of digital signature software, e.g., DocuSign or Adobe Sign) and delivered by email or other similar means of electronic transmission, and ay electronic signature shall constitute an original for all purposes.

IN WITNESS WHEREOF, the undersigned have executed this Irrevocable Interest Power as of the date first written above.

[EXECUTIVE/BOULDERADO]

By: ________________________

Name:

Title:

Exhibit D

Amendment No. 1 to the Amended and Restated Voting and First Refusal Agreement

This Amendment No. 1 to the Amended and Restated Voting and First Refusal Agreement (the “Amendment”), is made and entered into as of May 9, 2024, by and among Boston Omaha Corporation (the “Company”), Boulderado Partners, LLC (“Boulderado”) and Magnolia Capital Fund, LP (“Magnolia”). Capitalized terms used, but not defined herein, shall have the same meaning as set forth in the A&R Agreement (as defined below).

RECITALS

WHEREAS, the Company, Boulderado and Magnolia entered into to the Amended and Restated Voting and First Refusal Agreement on May 26, 2017 (the “A&R Agreement”).

WHEREAS, as of the date hereof, each of Alex B. Rozek and Boulderado sold to the Company all of its Class B Common Stock and warrants to acquire shares of Class B Common Stock (the “Sale”).

WHEREAS, in connection with such Sale and pursuant to Section 10.5 of the A&R Agreement, the Parties hereto desire to, among other things, amend the A&R Agreement to reflect the Sale.

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, and certain other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree to amend the A&R Agreement in its entirety as follows:

TERMS

| |

1.

|

Amendments. The A&R Agreement is hereby amended to remove Boulderado as a party to the A&R Agreement. For the avoidance of doubt, the A&R Agreement shall be read to give effect to the Sale and termination of all rights and obligations of Boulderado and Alex B. Rozek under the A&R Agreement, including, but not limited to, removing all reference to (a) “Boulderado Partners, LLC” and “Boulderado” (including as a Class B Stockholder), (b) Alex B. Rozek, and (c) “Boulderado Class B Director”.

|

| |

2.

|

Ratification of Binding Provisions; Effect of Amendment. All the provisions of the A&R Agreement not amended by this Amendment shall remain in full force and effect as originally written. The Parties hereto agree and acknowledge that to the extent any terms and provisions of this Amendment are in any way inconsistent with or in conflict with any term or provision of the A&R Agreement, this Amendment will govern and control. Whenever the A&R Agreement is referred to in the A&R Agreement or in any other agreements, documents and instruments, such reference shall be deemed to be to the A&R Agreement as amended by this Amendment.

|

| |

3.

|

Miscellaneous. Sections 10.2 (Notices), 10.5 (Amendment and Waiver), 10.7 (Severability), 10.8 (Governing Law), 10.10 (Counterparts), and 10.12 (Further Assurances) of the A&R Agreement are incorporated herein by reference and shall apply to this Amendment, mutatis mutandis.

|

IN WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

| |

|

BOSTON OMAHA CORPORATION

|

| |

|

|

| |

By:

|

|

| |

|

Name:

|

| |

|

Title:

|

| |

|

|

| |

|

|

| |

|

BOULDERADO PARTNERS, LLC

|

| |

|

By its Managing Member

|

| |

|

Boulderado Group, LLC, Manager

|

| |

|

|

| |

By:

|

|

| |

|

Name:

|

| |

|

Title: Manager

|

| |

|

|

| |

|

MAGNOLIA CAPITAL FUND, LP

|

| |

|

By its General Partner

|

| |

|

The Magnolia Group, LLC

|

| |

|

|

| |

By:

|

|

| |

|

Name:

|

Exhibit E

Waiver Agreement

This Waiver Agreement (the “Waiver Agreement”), is made and entered into as of May 9, 2024, by and among Boston Omaha Corporation (the “Company”), Boulderado Partners, LLC (“Boulderado”) and Magnolia Capital Fund, LP (“Magnolia”). Capitalized terms used, but not defined herein, shall have the same meaning as set forth in the A&R Agreement (as defined below).

RECITALS

WHEREAS, the Company, Boulderado and Magnolia entered into to the Amended and Restated Voting and First Refusal Agreement on May 26, 2017 (the “A&R Agreement”);

WHEREAS, pursuant to Section 4 of the A&R Agreement, Magnolia has a right of first refusal with respect to any proposed Transfer of Class B Common Stock (the “ROFR Right”);

WHEREAS, Boulderado desires to distribute to Alex B. Rozek certain shares of Class B Common Stock (the “Transfer”);

WHEREAS, after giving effect to the Transfer, Alex B. Rozek and Boulderado desire to sell to the Company all of their shares of Class B Common Stock (the “Sale”); and

WHEREAS, in connection with such Transfer and Sale, Magnolia desires to waive its ROFR Right.

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, and certain other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

TERMS

| |

1.

|

Waiver. Effective as of the date of the Sale, and conditioned upon the consummation thereof, Magnolia hereby waives its ROFR Right with respect to the Transfer and the Sale.

|

| |

2.

|

Termination. This Waiver Agreement shall terminate and be of no further force and effect in the event that the Sale is not consummated. For the avoidance of doubt, the waiver set forth in Section 1 shall be void ab initio.

|

| |

3.

|

Miscellaneous. Sections 10.2 (Notices), 10.5 (Amendment and Waiver), 10.7 (Severability), 10.8 (Governing Law), 10.10 (Counterparts), and 10.12 (Further Assurances) of the A&R Agreement are incorporated herein by reference and shall apply to this Waiver Agreement, mutatis mutandis.

|

IN WITNESS WHEREOF, the parties have executed this Waiver Agreement as of the date first above written.

| |

|

BOSTON OMAHA CORPORATION

|

| |

|

|

| |

By:

|

|

| |

|

Name:

|

| |

|

Title:

|

| |

|

|

| |

|

|

| |

|

BOULDERADO PARTNERS, LLC

|

| |

|

By its Managing Member

|

| |

|

Boulderado Group, LLC, Manager

|

| |

|

|

| |

By:

|

|

| |

|

Name: Alex B. Rozek

|

| |

|

Title: Manager

|

| |

|

|

| |

|

MAGNOLIA CAPITAL FUND, LP

|

| |

|

By its General Partner

|

| |

|

The Magnolia Group, LLC

|

| |

|

|

| |

By:

|

|

| |

|

Name:

|

Exhibit F

Representations and Warranties of the Executive

The Executive, on behalf of itself and Boulderado, represents and warrants to the Company:

Section 1.1 Organization and Qualification. Boulderado is duly organized, validly existing and in good standing under the laws of its jurisdiction for formation or incorporation, as applicable.

Section 1.2 Authority. The Executive and Boulderado each have full power, capacity and authority to execute, deliver and perform its obligations under this Agreement. The execution, delivery and performance by the Executive of this Agreement and the execution and delivery of the Securities Powers by Executive and Boulderado, and the consummation of the transactions contemplated hereby, have been duly and validly authorized by all necessary action on the part of Boulderado as necessary. This Agreement has been duly executed and delivered by the Executive and is legal, valid, binding and enforceable upon and against the Executive. Each of the Securities Powers have been duly executed and delivered by Executive or Boulderado and are legal, valid, binding and enforceable upon and against Executive or Boulderado, as applicable.

Section 1.3 No Conflict; Required Filings and Consents. The (x) execution, delivery and performance by the Executive of this Agreement (and the execution and delivery of the Securities Powers by Executive and Boulderado), (y) the consummation by the Executive and Boulderado of the transactions contemplated hereby, and (z) the payments made to Executive and Boulderado pursuant to Section 2 of the Agreement, in each case do not and will not (a) violate any provision of the governing documents of Boulderado; (b) violate any Law applicable to the Executive or Boulderado; (c) conflict with, result in a violation or breach of, or constitute a default under (or an event which would with or without notice or the lapse of time or both become a default), or give any third party the right to terminate, cancel or accelerate any obligation under any of the terms, conditions or provisions of, any material agreement or contract to which Executive or Boulderado is a party or by which Executive’s or Boulderado’s assets are bound (including the creation of any Encumbrance (as defined below) upon the Securities); or (d) require any consent or approval of, registration or filing (other than as a result of securities Laws) with, or notice to any Governmental Authority.

Section 1.4 Securities. Executive and Boulderado, as applicable, are the record and beneficial owners of the Securities, free and clear of any charge, limitation, condition, mortgage, lien, security interest, adverse claim, encumbrance or restriction of any kind (collectively, “Encumbrances”) other than such Encumbrances arising as a result of securities Laws (“Permitted Encumbrances”). Except for the Securities, the Company has not issued or agreed to issue to the Executive or Boulderado (in each case, directly or indirectly) and Executive and Boulderado do not beneficially own or otherwise have the power to vote or control any (a) shares of capital stock or other equity, ownership or voting interests; (b) securities or instruments convertible into or exchangeable for shares of capital stock or other equity, ownership or voting interests; or (c) equity-equivalents, earnings, profits or revenue-based or equity-based rights. Executive and Boulderado each have the right, authority and power to sell, convey, assign, transfer and deliver the Securities to the Company. None of the Securities are certificated. Upon delivery of the Securities Powers, the Company shall acquire good, valid and marketable title to the Securities, free and clear of any Encumbrance (other than Permitted Encumbrances).

Section 1.5 Compliance; Litigation. Executive and Boulderado have complied with the governing documents of the Company with respect to the ownership of the Securities. There is no Action pending or threatened (a) affecting the Executive or Boulderado (or its officers or directors in regards to their actions as such) with respect to the Securities or (b) to restrain or prevent the consummation of the transactions contemplated hereby, nor is there any basis for any of the foregoing.

Section 1.6 Brokers. No broker, finder or agent will have any claim against the Company for any fees or commissions in connection with the transactions contemplated by this Agreement based on arrangements made by or on behalf of the Executive or Boulderado.

Section 1.7 Disclosure. None of the representations or warranties of the Executive contained in this Exhibit F or the Securities Powers contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements herein or therein not misleading.

Section 1.8 No Investment Advice; Independent Inquiry. Each of Executive and Boulderado have been provided an opportunity to ask questions of, and has received answers thereto satisfactory to it from, the Company and its representatives regarding the terms and conditions of the Agreement (including the sale of Securities to the Company), and each of Executive and Boulderado has obtained any and all additional information requested by Executive and Boulderado of the Company and its representatives to verify the accuracy of all information furnished to Executive and Boulderado. Executive and Boulderado has completed its own independent inquiry of the Company (including the financials thereof), and has relied only upon the advice of its own legal counsel, accountants, financial and other advisors in determining the legal, tax, financial and other consequences of the transactions contemplated by the Agreement (including the sale of Securities to the Company) and the suitability of such transactions for Executive and Boulderado and, except for the Company’s representations expressly set forth in the Agreement, each of Executive and Boulderado has not relied upon any representations, information, documents or due diligence information provided by or on behalf of the Company or any of its officers, directors, employees, members, managers, affiliates, advisors, agents or representatives (collectively, “Representatives”). Without limiting the generality of the foregoing, each of Executive and Boulderado represents and warrants that neither the Company nor any of its Representatives has provided any investment advice to Executive or Boulderado in connection with the transactions contemplated by the Agreement, including the sale of Securities to the Company.

Capitalized terms used, but not defined herein, shall have the same meaning as set forth in the Agreement.

Exhibit G

General Release of Claims

GENERAL RELEASE OF ALL CLAIMS AND POTENTIAL CLAIMS

1. This General Release of All Claims and Potential Claims (“General Release”) is entered into by and between Alex B. Rozek (“Executive”) and Boston Omaha Corporation (hereinafter the “Company”). Executive and the Company have entered into a Separation Agreement dated May 9, 2024 (with the Exhibits thereto, “Agreement” or “Separation Agreement”). In consideration of the promises made herein and the consideration due Executive under the Separation Agreement, this General Release is entered into between the parties. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Separation Agreement.

2. (a) The purpose of this General Release is to settle completely and release the Company, and in their capacities as such, its individual and/or collective officers, directors, stockholders, agents, parent companies, subsidiaries, affiliates, predecessors, successors, assigns, employees (including all former employees, officers, directors, stockholders and/or agents), attorneys, representatives and employee benefit programs (including the trustees, administrators, fiduciaries and insurers of such programs) (referred to collectively as “Company Releasees”) in a final and binding manner from every claim and potential claim for relief, cause of action and liability of any and every kind, nature and character whatsoever, known or unknown, that Executive has or may have against Company Releasees arising out of, relating to or resulting from any events occurring prior to the execution of this General Release, but excluding all rights and benefits to which Executive is entitled under the Separation Agreement and all rights to indemnifications and directors and officers liability insurance, all rights as an equity holder and in respect of Executive’s equity awards (other than such rights associated with the equity securities of the Company and BOAM, in each case, sold or forfeited (as applicable) pursuant to the Separation Agreement), and all vested benefits (other than such vested benefits associated with the equity securities of the Company and BOAM, in each case, sold or forfeited (as applicable) pursuant to the Separation Agreement).

(b) In addition, another purpose is to settle completely and release Executive and his spouse, heirs, successors, assigns, agents, representatives, executors and administrators, as well as Boulderado, members of Boulderado, and Mac Mountain (referred to collectively as “Executive Releasees”) in a final and binding manner from every claim and potential claim for relief, cause of action and liability of any and every kind, nature and character whatsoever, known or unknown, that the Company Releasees has or may have against Executive Releasees arising out of, relating to or resulting from any events occurring prior to the execution of this General Release but excluding all rights and benefits to which Company Releasees are entitled under the Separation Agreement and ancillary agreements thereto (including to all rights to indemnifications thereunder).

(c) This is a compromise settlement of all such claims and potential claims, known or unknown, and therefore this General Release does not constitute either an admission of liability on the part of Executive and the Company or an admission, directly or by implication, that Executive and/or the Company, its subsidiaries, affiliates or predecessors, have violated any law, rule, regulation, contractual right or any other duty or obligation. The parties hereto specifically deny that they have violated any law, rule, regulation, contractual right or any other duty or obligation.

(d) This General Release is entered into freely and voluntarily by Executive and the Company solely to avoid further costs, risks and hazards of litigation and to settle all claims and potential claims and disputes, known or unknown, in a final and binding manner.

3. For and in consideration of the promises and covenants made by Executive to the Company and the Company to Executive, contained herein, Executive and the Company have agreed and do agree as follows:

(a) Except for the exclusions noted in Section 2(a) of the General Release, Executive waives, releases and forever discharges Company Releasees, and the Company waives, releases and forever discharges the Executive Releasees, from any claims and potential claims for relief, causes of action and liabilities, known or unknown, that he or it has or may have against Company Releasees or the Executive Releasees, respectively, arising out of, relating to or resulting from any events occurring prior to the execution of this General Release but excluding any rights or benefits to which Executive is entitled under the Separation Agreement. In addition, this General Release does not cover, and nothing in this General Release shall be construed to cover, any claim that cannot be so released as a matter of applicable law.

(b) Executive and the Company agree that they will not directly or indirectly institute any legal proceedings against Company Releasees and the Executive Releasees, respectively, before any court, administrative agency, arbitrator or any other tribunal or forum whatsoever by reason of any claims and potential claims for relief, causes of action and liabilities of any and every kind, nature and character whatsoever, known or unknown, arising out of, relating to or resulting from any events occurring prior to the execution of this General Release, that is released herein.

(c) Executive is presently unaware of any injuries that he may have suffered as a result of working at the Company or its subsidiaries, affiliates or predecessors, and has no present intention of filing a workers’ compensation claim. Should any such claim arise in the future, Executive waives and releases any right to proceed against the Company or its subsidiaries, affiliates or predecessors, for such a claim. Executive also waives any right to bring any disability claim against the Company or its subsidiaries, affiliates or predecessors, or its or their carriers.

(d) Executive and the Company represent that they have not engaged in any fraud or other willful misconduct or engaged in any activities for which either party would not be entitled to indemnification under Delaware law.

4. Any dispute, claim or controversy of any kind or nature, including but not limited to the issue of arbitrability, arising out of or relating to this General Release, or the breach thereof, or any disputes which may arise in the future, shall be settled before a panel of three arbitrators of the American Arbitration Association, with all hearings to be held in Boston, Massachusetts.

5. It is further understood and agreed that Executive has not relied upon any advice whatsoever from the Company and/or its attorneys individually and/or collectively as to the taxability, whether pursuant to Federal, State or local income tax statutes or regulations, or otherwise, of the consideration transferred hereunder and that he will be solely liable for all of his tax obligations. Executive understands and agrees that the Company or its subsidiaries, affiliates or predecessors, may be required by law to report all or a portion of the amounts paid to him and/or his attorney in connection with this General Release to federal and state taxing authorities. Executive waives, releases, forever discharges and agrees to indemnify, defend and hold the Company harmless with respect to any actual or potential tax obligations imposed by law.

6. Executive acknowledges that he has read, understood and truthfully completed the Company’s Code of Business Conduct and Ethics Disclosure Statement.

7. It is further understood and agreed that Company Releasees and/or their attorneys shall not be further liable either jointly and/or severally to Executive and/or his attorneys individually or collectively for costs and/or attorney’s fees, including any provided for by statute, nor shall Executive and/or his attorneys be liable either jointly and/or severally to the Company and/or its attorneys individually and/or collectively for costs and/or attorneys’ fees, including any provided for by statute.

8. Executive and the Company understand and agree that if the facts with respect to which this General Release are based are found hereafter to be other than or different from the facts now believed by him to be true, they expressly accept and assume the risk of such possible difference in facts and agrees that this General Release shall be and remain effective notwithstanding such difference in facts.

9. Each party understands and agrees that if he or it hereafter commences any suit arising out of, based upon or relating to any of the claims and potential claims for relief, cause of action and liability of any and every kind, nature and character whatsoever, known or unknown, he or it has released herein, such party agrees to pay the Company Releasees or Executive Releasees, as applicable, and each of them, in addition to any other damages caused to Company Releasees or Executive Releasees, as applicable, all attorneys’ fees incurred by Company Releasees or Executive Releasees, as applicable in defending or otherwise responding to said suit.

10. It is further understood and agreed that this General Release shall be binding upon and will inure to the benefit of Executive’s spouse, heirs, successors, assigns, agents, employees, representatives, executors and administrators and shall be binding upon and will inure to the benefit of the individual and/or collective successors and assigns of Company Releasees and their successors, assigns, agents and/or representatives.

11. This General Release shall be construed in accordance with and governed for all purposes by the laws of the Commonwealth of Massachusetts without giving effect to the conflict of laws principles thereof.

12. Notwithstanding anything in this Agreement to the contrary, Executive does not waive, release or discharge any rights to indemnification for actions, omissions and other circumstances occurring through his affiliation with the Company or its subsidiaries, affiliates or predecessors, whether those rights arise from the Employment Agreement, a separate indemnification agreement, statute, corporate charter documents or any other source; nor does Executive waive, release or discharge any right Executive may have pursuant to any insurance policy or coverage provided or maintained by the Company or its subsidiaries, affiliates or predecessors.

13. If any part of this Agreement is found to be either invalid or unenforceable, the remaining portions of this Agreement will still be valid.

14. This Agreement is intended to release and discharge any claims of Executive under the Age Discrimination and Employment Act. To satisfy the requirements of the Older Workers’ Benefit Protection Act, 29 U.S.C. section 626(f), the parties agree as follows: (a) Executive acknowledges that he has read and understands the terms of this Agreement; (b) Executive acknowledges that he has been advised in writing to consult with an attorney, if desired, concerning this Agreement and has received all advice he deems necessary concerning this Agreement; (c) Executive acknowledges that he has been given twenty-one (21) days to consider whether or not to enter into this Agreement, has taken as much of this time as necessary to consider whether to enter into this Agreement, and has chosen to enter into this Agreement freely, knowingly and voluntarily; and (d) for a seven day period following the execution of this Agreement, Executive may revoke this Agreement by delivering a written revocation to the Company and this Agreement shall not become effective and enforceable until the revocation period has expired (the “Release Effective Date”).

15. Executive acknowledges that he has been encouraged to seek the advice of an attorney of his choice with regard to this General Release. Having read the foregoing, having understood and agreed to the terms of this General Release, and having had the opportunity to and having been advised by independent legal counsel, the parties hereby voluntarily affix their signatures.

16. This Agreement is to be interpreted without regard to the draftsperson. The terms and intent of the Agreement shall be interpreted and construed on the express assumption that all parties participated equally in its drafting.

17. This General Release constitutes a single integrated contract expressing the entire agreement of the parties hereto. Except for the Separation Agreement, which defines certain obligations on the part of both parties, and this General Release, there are no agreements, written or oral, express or implied, between the parties hereto, concerning the subject matter herein.

IN WITNESS WHEREOF, Executive and the Company have executed this General Release each as of the date indicated below.

EXECUTIVE

_____________________________

Alex B. Rozek

BOSTON OMAHA CORPORATION

By:_____________________________

Name:

Title:

Exhibit 10.2

Amendment No. 1 to the Amended and Restated Voting and First Refusal Agreement

This Amendment No. 1 to the Amended and Restated Voting and First Refusal Agreement (the “Amendment”), is made and entered into as of May 9, 2024, by and among Boston Omaha Corporation (the “Company”), Boulderado Partners, LLC (“Boulderado”) and Magnolia Capital Fund, LP (“Magnolia”). Capitalized terms used, but not defined herein, shall have the same meaning as set forth in the A&R Agreement (as defined below).

RECITALS

WHEREAS, the Company, Boulderado and Magnolia entered into to the Amended and Restated Voting and First Refusal Agreement on May 26, 2017 (the “A&R Agreement”).

WHEREAS, as of the date hereof, each of Alex B. Rozek and Boulderado sold to the Company all of its Class B Common Stock and warrants to acquire shares of Class B Common Stock (the “Sale”).

WHEREAS, in connection with such Sale and pursuant to Section 10.5 of the A&R Agreement, the Parties hereto desire to, among other things, amend the A&R Agreement to reflect the Sale.

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, and certain other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree to amend the A&R Agreement in its entirety as follows:

TERMS

| |

1.

|

Amendments. The A&R Agreement is hereby amended to remove Boulderado as a party to the A&R Agreement. For the avoidance of doubt, the A&R Agreement shall be read to give effect to the Sale and termination of all rights and obligations of Boulderado and Alex B. Rozek under the A&R Agreement, including, but not limited to, removing all reference to (a) “Boulderado Partners, LLC” and “Boulderado” (including as a Class B Stockholder), (b) Alex B. Rozek, and (c) “Boulderado Class B Director”.

|

| |

2.

|

Ratification of Binding Provisions; Effect of Amendment. All the provisions of the A&R Agreement not amended by this Amendment shall remain in full force and effect as originally written. The Parties hereto agree and acknowledge that to the extent any terms and provisions of this Amendment are in any way inconsistent with or in conflict with any term or provision of the A&R Agreement, this Amendment will govern and control. Whenever the A&R Agreement is referred to in the A&R Agreement or in any other agreements, documents and instruments, such reference shall be deemed to be to the A&R Agreement as amended by this Amendment.

|

| |

3.

|

Miscellaneous. Sections 10.2 (Notices), 10.5 (Amendment and Waiver), 10.7 (Severability), 10.8 (Governing Law), 10.10 (Counterparts), and 10.12 (Further Assurances) of the A&R Agreement are incorporated herein by reference and shall apply to this Amendment, mutatis mutandis.

|

IN WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

| |

|

BOSTON OMAHA CORPORATION

|

| |

|

|

| |

By:

|

/s/Adam Peterson

|

| |

|

Name: Adam Peterson

|

| |

|

Title: Co-Chief Executive Officer

|

| |

|

|

| |

|

|

| |

|

BOULDERADO PARTNERS, LLC

|

| |

|

By its Managing Member

|

| |

|

Boulderado Group, LLC, Manager

|

| |

|

|

| |

By:

|

/s/Alex B. Rozek

|

| |

|

Name: Alex B. Rozek

|

| |

|

Title: Manager

|

| |

|

|

| |

|

MAGNOLIA CAPITAL FUND, LP

|

| |

|

By its General Partner

|

| |

|

The Magnolia Group, LLC

|

| |

|

|

| |

By:

|

/s/Adam Peterson

|

| |

|

Name: Adam Peterson

|

Exhibit 99.1

BOSTON OMAHA ANNOUNCES DEPARTURE OF CO-CEO ALEX ROZEK AS ADAM PETERSON CONTINUES IN CHAIR AND CEO ROLES

Omaha, Nebraska

May 10, 2024