Certain BlackRock closed-end funds (the “Funds”) announced

distributions today as detailed below.

January Monthly

Dividends

Taxable Funds:

Declaration- 12/21/2009 Ex-Date- 12/29/2009 Record-

12/31/2009 Payable- 1/11/2010 Fund

Ticker Dividend

Change FromPriorDividend

BlackRock Senior High Income Fund, Inc. ARK $0.025000 - BlackRock

Floating Rate Income Trust* BGT $0.067500 - BlackRock Strategic

Bond Trust BHD $0.069500 - BlackRock Core Bond Trust BHK $0.062000

- BlackRock Defined Opportunity Credit Trust BHL $0.054000 - The

BlackRock High Yield Trust BHY $0.043500 - The BlackRock Income

Trust, Inc. BKT $0.024000 - BlackRock Limited Duration Income Trust

BLW $0.070000 - BlackRock Income Opportunity Trust, Inc. BNA

$0.051000 - BlackRock Credit Allocation Income Trust III* BPP

$0.072500 - BlackRock Credit Allocation Income Trust IV* BTZ

$0.100000 - BlackRock Corporate High Yield Fund, Inc. COY $0.061000

- BlackRock Corporate High Yield Fund III, Inc. CYE $0.055000 -

BlackRock Debt Strategies Fund, Inc.* DSU $0.031000 - BlackRock

Diversified Income Strategies Fund, Inc. DVF $0.068500 - BlackRock

Enhanced Government Fund, Inc.* EGF $0.105000 - BlackRock Floating

Rate Income Strategies Fund, Inc. FRA $0.081500 - BlackRock

Floating Rate Income Strategies Fund II, Inc. FRB $0.075000 -

BlackRock High Income Shares HIS $0.013200 - BlackRock Corporate

High Yield Fund VI, Inc. HYT $0.087500 - BlackRock Corporate High

Yield Fund V, Inc. HYV $0.087500 - BlackRock Credit Allocation

Income Trust I, Inc.* PSW $0.060000 - BlackRock Credit Allocation

Income Trust II, Inc.* PSY $0.075000 -

Special Dividends

Declaration- 12/21/2009 Ex-Date- 12/29/2009 Record-

12/31/2009 Payable- 1/11/2010 Fund Ticker

OrdinaryIncome

BlackRock Strategic Bond Trust BHD $0.034000 BlackRock Core Bond

Trust BHK $0.226000 BlackRock Income Opportunity Trust, Inc. BNA

$0.175000 BlackRock High Income Shares HIS $0.004600

* In order to comply with the requirements of Section 19 of the

Investment Company Act of 1940, as amended, each of the Funds noted

above posted to the DTC bulletin board and sent to their

shareholders as of the applicable record date a Section 19 notice

with the previous dividend payment. The Section 19 notice

was provided not for tax reporting purposes but for informational

purposes only. This information can be found in the “Closed-End

Funds” section of www.blackrock.com. If applicable, the

final determination of the source and tax characteristics of all

distributions in 2009 will be made after the end of the year.

Among the Funds listed above, BlackRock Credit Allocation Income

Trust IV (NYSE:BTZ) and BlackRock Enhanced Government Fund, Inc.

(NYSE:EGF) (the “Trusts”) have each adopted a level distribution

plan (the “Plan”) and employ either a managed distribution or an

option over-write policy to support a level distribution of income,

capital gains and/or return of capital. The fixed amounts

distributed per share are subject to change at the discretion of

each Trust’s Board. Under its Plan, each Trust will distribute

all available investment income to its shareholders, consistent

with its primary investment objectives and as required by the

Internal Revenue Code of 1986, as amended (the “Code”). If

sufficient investment income is not available on a

quarterly/monthly basis, each Trust will distribute long-term

capital gains and or return capital to its shareholders in order to

maintain a level distribution.

The Trusts’ estimated sources of the distributions paid as of

December 18, 2009 and for its current fiscal year through December

18, 2009 are as follows:

Estimated Allocations as of December 18, 2009 Trust

Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital BTZ1 $0.100000 $0.0300 (30%)

$0.00 (0%) $0.00 (0%) $0.0700 (70%) EGF1,2

$0.272000 $0.0616 (23%) $0.00 (0%)

$0.1670 (61%) $0.0434 (16%)

Estimated Allocations for the fiscal year through

December 18, 2009 Trust Distribution

Net InvestmentIncome

Net RealizedShort-Term Gains

Net RealizedLong-Term Gains

Return of Capital BTZ1 $0.200000 $0.00777

(39%) $0.00 (0%) $0.00 (0%) $0.1223 (61%)

EGF1,2 $1.322000 $0.9467 (72%) $0.00 (0%)

$0.2968 (22%) $0.0785 (6%)

1 The Trust estimates that it has distributed more than their

income and capital gains in the current fiscal year; therefore, a

portion of your distribution may be a return of capital. A return

of capital may occur, for example, when some or all of the

shareholder’s investment is paid back to the shareholder. A return

of capital distribution does not necessarily reflect a Trust's

investment performance and should not be confused with ‘yield’ or

‘income’.

2 At December 14, 2009, and after giving effect to the

distribution, the sum of the Fund's accumulated net realized losses

and net unrealized depreciation of portfolio securities was

approximately $(13.5) million. The amount of the Fund's unrealized

depreciation of portfolio securities as of that date was $(13.6)

million.

The amounts and sources of distributions reported are only

estimates and are not provided for tax reporting purposes. The

actual amounts and sources of the amounts for tax reporting

purposes will depend upon each Trust’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. Each Trust will send you a Form 1099-DIV

for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

Trust Performance and Distribution Rate Information: Trust

Average annual total return (in relation to NAV) from

inception to November 30, 2009 Annualized current

distribution rate expressed as a percentage of NAV as of November

30, 2009 Cumulative total return (in relation to NAV) for

the fiscal year through November 30, 2009 Cumulative fiscal

year distributions as a percentage of NAV as of November 30, 2009

BTZ (8.70)% 9.40% 1.87% 1.57% EGF

4.71% 19.21% 12.85% 7.78%

Shareholders should not draw any conclusions about each

Trust’s investment performance from the amount of each Trust’s

current distributions or from the terms of each Trust’s

Plan.

About BlackRock

BlackRock is a leader in investment management, risk management

and advisory services for institutional and retail clients

worldwide. With approximately $3.2 trillion under management as of

September 30, 2009 (pro forma), BlackRock offers products that span

the risk spectrum to meet clients’ needs, including active,

enhanced and index strategies across markets and asset classes.

Products are offered in a variety of structures including separate

accounts, mutual funds, iShares® (exchange traded funds), and other

pooled investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock Solutions®.

Headquartered in New York City, the firm has over 8,500 employees

in 24 countries. For additional information, please visit

BlackRock’s website at www.blackrock.com.

Forward-Looking Statements

This press release, and other statements that BlackRock may

make, may contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified

by words or phrases such as “trend,” “potential,” “opportunity,”

“pipeline,” “believe,” “comfortable,” “expect,” “anticipate,”

“current,” “intention,” “estimate,” “position,” “assume,”

“outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,”

“achieve,” and similar expressions, or future or conditional verbs

such as “will,” “would,” “should,” “could,” “may” or similar

expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

With respect to each Fund, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes in political,

economic or industry conditions, the interest rate environment or

financial and capital markets, which could result in changes in the

Fund’s net asset value; (2) the performance of the Fund’s

investments; (3) the impact of increased competition; (4) the

extent and timing of any distributions or share repurchases; (5)

the impact of legislative and regulatory actions and reforms and

regulatory, supervisory or enforcement actions of government

agencies relating to the Fund or BlackRock, as applicable; and (6)

BlackRock’s ability to attract and retain highly talented

professionals.

The Annual and Semi-Annual Reports and other regulatory filings

of the Funds with the Securities and Exchange Commission (“SEC”)

are accessible on the SEC's website at www.sec.gov and on

BlackRock’s website at www.blackrock.com, and may discuss

these or other factors that affect the Funds. The information

contained on our website is not a part of this press release.

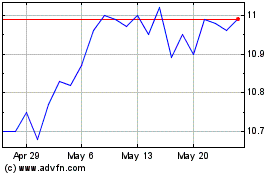

BlackRock Debt Strategies (NYSE:DSU)

Historical Stock Chart

From May 2024 to Jun 2024

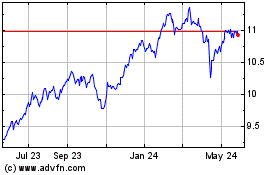

BlackRock Debt Strategies (NYSE:DSU)

Historical Stock Chart

From Jun 2023 to Jun 2024