Mexico Lower House Passes Bill To Regulate Bank Fees, Rates

February 12 2010 - 5:25PM

Dow Jones News

Mexico's lower house of Congress has approved legislation that

gives the central bank greater authority to regulate the interest

rates and commissions that lenders charge, as well as boost

competition in the payment processing industry.

The long-delayed bill, which awaits the signature of President

Felipe Calderon after it was passed Thursday, says the Bank of

Mexico should make sure loans are made under "accessible and

reasonable" conditions.

Measures include giving the Bank of Mexico the power to

establish the interest rates banks pay on deposits and charge on

loans, banning some types of fees altogether, and requiring lenders

to offer a basic credit card with a credit limit of no more than

11,500 pesos ($889).

The bill was passed by the Senate in April, but failed to make

it to the house floor for a vote last year owing to a heavy

legislative backlog.

The Bank of Mexico already enjoys broad powers to regulate the

financial system. The central bank last year banned several

commissions with a view to boosting competition by giving banks a

greater incentive to generate revenue from lending rather than

passively collecting commission and fee income.

"We continue to believe and insist that the best way to obtain a

reduction in commissions ... is through competition," Enrique

Zorrilla, chief executive of Mexico's No. 2 bank Banamex, said at a

press conference Friday.

Fees and commissions of close to MXN56.3 billion accounted for

about 27% of the banking industry's operating income in 2008.

Banks have attracted congressional scrutiny in recent years due

to public outrage over fees and a surge in bad credit-card loans

during 2008 and early 2009 as the result of poor lending standards

and a recession.

Mexico's economy likely contracted close to 7% last year, its

worst downturn since the 1995 peso crisis as the global crisis

dried up international trade, especially with the U.S., its largest

trading partner.

The recession and spike in unemployment made it harder for

businesses and families to pay back their debts, forcing most of

the country's largest banks, with prodding from regulators, to

restructure the credit card loans of many heavily indebted

consumers.

Five of Mexico's top seven banks are foreign-owned. Banco Bilbao

Vizcaya Argentaria SA (BBV) and Banco Santander SA (STD) of Spain,

Citigroup Inc. (C), HSBC Holdings PLC (HBC) of the U.K., and

Canada's Bank of Nova Scotia (BNS) control nearly 70% of loans and

deposits.

Another key provision in the bill seeks to bring greater

competition to Mexico's electronic payment processing industry,

which is controlled by two bank-owned networks, Prosa and

e-Global.

The legislation will require all payment networks to request

operating approval from the Bank of Mexico and force competing

networks to connect with each other free of charge. The central

bank will also be tasked with lowering entrance barriers to

investors who want to open new processing networks.

Mexico's banks have spent millions of dollars in recent years to

provide card payment terminals to businesses of all sizes in a bid

to get consumers to make purchases with credit and debit cards

instead of cash.

According to data from the Bank of Mexico, the number of card

payment terminals rose to 441,107 in the third quarter of 2009 from

just 117,787 in the first quarter of 2002.

During the same period, the number of credit cards in

circulation rose more than threefold to 22.3 million, while debit

cards nearly doubled to 62.5 million.

-By Ken Parks, Dow Jones Newswires; 52-55-5980-5177;

ken.parks@dowjones.com

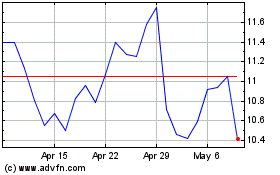

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

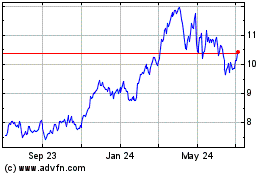

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Jul 2023 to Jul 2024