Barnes Group Inc. Declares Increased Quarterly Dividend and Announces New Share Repurchase Program

October 20 2011 - 1:49PM

Business Wire

The Board of Directors of Barnes Group Inc. (NYSE: B) today

increased the Company’s quarterly cash dividend 25 percent to ten

cents ($0.10) per share of common stock. The dividend will be

payable December 9, 2011 to shareholders of record at the close of

business on November 30, 2011. On an annualized basis, the increase

raises the annual dividend from 32 cents ($0.32) per share to 40

cents ($0.40) per share.

“This increase in our dividend reflects Barnes Group’s ongoing

recovery in our businesses,” said Gregory F. Milzcik, President and

Chief Executive Officer, Barnes Group Inc. “We continue to deliver

improved financial performance and we remain confident in the

long-term growth prospects of the Company.”

Barnes Group Inc. and its predecessor companies have paid a cash

dividend to stockholders on a continuous basis since 1934.

In addition, the Board authorized the repurchase of up to five

million shares of the Barnes Group’s common stock. Under the

authorization, the Company from time to time would repurchase

shares in the open market or through privately negotiated

transactions depending on market conditions and other relevant

factors. Barnes Group recently completed the purchase of the

remaining shares under the Company’s 2008 Stock Repurchase

Authorization.

ABOUT BARNES GROUP

Founded in 1857, Barnes Group Inc. (NYSE:B) is a diversified

global manufacturer and logistical services company focused on

providing precision component manufacturing and operating service

support. The Barnes Group’s more than 4,800 dedicated employees, at

more than 60 locations worldwide, are committed to achieving

consistent and sustainable profitable growth. For more information,

visit www.BGInc.com. Barnes Group, the Critical Components

People.

Forward-Looking Statements

This release may contain certain forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are made based upon management's good

faith expectations and beliefs concerning future developments and

their potential effect upon the Company and can be identified by

the use of words such as "anticipated," "believe," "expect,"

"plans," "strategy," "estimate," "project," and other words of

similar meaning in connection with a discussion of future operating

or financial performance. These forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. The risks and uncertainties, including whether the

transaction proposed by Berner SE will be consummated and others

described in our periodic filings with the Securities and Exchange

Commission, include, among others, uncertainties arising from the

current or worsening disruptions in financial markets; future

financial performance of the industries or customers that we serve;

changes in market demand for our products and services; integration

of acquired businesses; restructuring costs or savings; the impact

of the proposed acquisition of the BDE businesses by Berner SE and

any other future strategic actions, including acquisitions, joint

ventures, divestitures, restructurings, or strategic business

realignments, and our ability to achieve the financial and

operational targets set in connection with any such actions;

introduction or development of new products or transfer of work;

changes in raw material or product prices and availability; foreign

currency exposure; our dependence upon revenues and earnings from a

small number of significant customers; a major loss of customers;

the outcome of pending and future claims or litigation or

governmental, regulatory proceedings, investigations, inquiries,

and audits; uninsured claims and litigation; outcome of

contingencies; future repurchases of common stock; future levels of

indebtedness; and numerous other matters of global, regional or

national scale, including those of a political, economic, business,

competitive, environmental, regulatory and public health nature.

The Company assumes no obligation to update our forward-looking

statements.

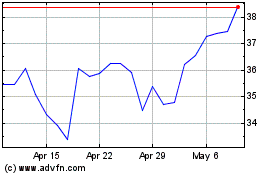

Barnes (NYSE:B)

Historical Stock Chart

From May 2024 to Jun 2024

Barnes (NYSE:B)

Historical Stock Chart

From Jun 2023 to Jun 2024