Banco Latinoamericano de Comercio Exterior, S.A. - Value

March 12 2012 - 8:00PM

Zacks

Outside of the United States and Europe, there are plenty of

intriguing value bank stocks.

Banco Latinoamericano de Comercio

Exterior, S.A. (BLX) is one of those, as it doubled its net

income in 2011. But because of continued global banking fears, this

Zacks #1 Rank (Strong Buy) trades with a low forward P/E of just

8.9.

Banco Latinoamericano (aka Bladex) was created by

the Central Banks of Latin America and the Caribbean as a

supranational bank to support trade finance in the region.

Based in Panama, its shareholders include 23

Central Banks and state-owned entities in the region as well as

Latin American and international commercial banks.

Bladex Beat By 34% in Q4

On Feb 23, Bladex reported its fourth quarter and

full year 2011 results and surprised on the Zacks Consensus by 17

cents. Earnings were 67 cents compared to the consensus of just 50

cents.

Net income in the fourth quarter increased by 60%

from a year ago due to growth in the Commercial Division as well as

the Treasury Division and Asset Management Unit.

The Commercial Portfolio rose 20% to $5.4 billion

from a year ago.

ROE Continues to Rise

Bladex has ample capitalization and has been

increasing its Return on Equity (ROE) levels even as the European

and Chinese economies slow. ROE is a key indicator of strength in a

bank.

For the fourth quarter, ROE was 13.1%, up from 8.9%

in the fourth quarter of 2010.

In 2011, ROE was 11.4%, compared to just 6.2% in

2010.

"While Latin America is neither immune nor

indifferent to events affecting European Union financial

institutions, Bladex has effectively positioned its business in one

of the sweeter and more resilient spots of the global economy,

Latin America's growing trade flows," said Jaime Rivera, CEO.

2012 Zacks Consensus Estimate Rises

The analysts liked what they heard from the fourth

quarter report as the Zacks Consensus Estimate for 2012 rose to

$2.25 from $2.19 in the last 30 days.

That is essentially flat growth, however, compared

with 2011 as the bank also made $2.25 in 2011.

Shares Near Multi-Year High

Investors are finally discovering this hidden

banking gem. Shares have surged to a new 2-year high.

Yet, there is still plenty of value in the

stock.

In addition to a P/E of just 8.9, which is well

under the 15x cut-off I use for value, Bladex also has a

price-to-book ratio of 0.7.

A P/B ratio under 3.0 usually indicates value.

Juicy Dividend

Bladex also has been rewarding shareholders by

raising its quarterly dividend. It recently went to 25 cents from

20 cents. The dividend is currently yielding a not-too-shabby

5%.

This is the third time in the last 2 years that the

bank has raised the dividend.

Value investors looking for yield shouldn't totally

rule out the banks, especially those outside of the United States

and Europe. Bladex is a way to tap Latin America's strong

growth.

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor of the Turnaround Trader and

Insider Trader services. You can follow her on twitter at

@TraceyRyniec.

BANCO LATINOAME (BLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

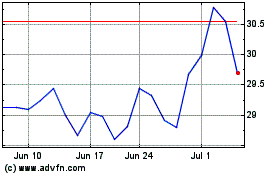

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2024 to Jul 2024

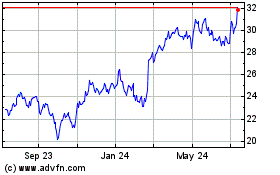

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2023 to Jul 2024